Alberta

Ford and Trudeau are playing checkers. Trump and Smith are playing chess

By Dan McTeague

Ford’s calls for national unity – “We need to stand united as Canadians!” – in context feels like an endorsement of fellow Electric Vehicle fanatic Trudeau. And you do wonder if that issue has something to do with it. After all, the two have worked together to pump billions in taxpayer dollars into the EV industry.

There’s no doubt about it: Donald Trump’s threat of a blanket 25% tariff on Canadian goods (to be established if the Canadian government fails to take sufficient action to combat drug trafficking and illegal crossings over our southern border) would be catastrophic for our nation’s economy. More than $3 billion in goods move between the U.S. and Canada on a daily basis. If enacted, the Trump tariff would likely result in a full-blown recession.

It falls upon Canada’s leaders to prevent that from happening. That’s why Justin Trudeau flew to Florida two weeks ago to point out to the president-elect that the trade relationship between our countries is mutually beneficial.

This is true, but Trudeau isn’t the best person to make that case to Trump, since he has been trashing the once and future president, and his supporters, both in public and private, for years. He did so again at an appearance just the other day, in which he implied that American voters were sexist for once again failing to elect the nation’s first female president, and said that Trump’s election amounted to an assault on women’s rights.

Consequently, the meeting with Trump didn’t go well.

But Trudeau isn’t Canada’s only politician, and in recent days we’ve seen some contrasting approaches to this serious matter from our provincial leaders.

First up was Doug Ford, who followed up a phone call with Trudeau earlier this week by saying that Canadians have to prepare for a trade war. “Folks, this is coming, it’s not ‘if,’ it is — it’s coming… and we need to be prepared.”

Ford said that he’s working with Liberal Finance Minister Chrystia Freeland to put together a retaliatory tariff list. Spokesmen for his government floated the idea of banning the LCBO from buying American alcohol, and restricting the export of critical minerals needed for electric vehicle batteries (I’m sure Trump is terrified about that last one).

But Ford’s most dramatic threat was his announcement that Ontario is prepared to shut down energy exports to the U.S., specifically to Michigan, New York, Wisconsin, and Minnesota, if Trump follows through with his plan. “We’re sending a message to the U.S. You come and attack Ontario, you attack the livelihoods of Ontario and Canadians, we’re going to use every tool in our toolbox to defend Ontarians and Canadians across the border,” Ford said.

Now, unfortunately, all of this chest-thumping rings hollow. Ontario does almost $500 billion per year in trade with the U.S., and the province’s supply chains are highly integrated with America’s. The idea of just cutting off the power, as if you could just flip a switch, is actually impossible. It’s a bluff, and Trump has already called him on it. When told about Ford’s threat by a reporter this week, Trump replied “That’s okay if he does that. That’s fine.”

And Ford’s calls for national unity – “We need to stand united as Canadians!” – in context feels like an endorsement of fellow Electric Vehicle fanatic Trudeau. And you do wonder if that issue has something to do with it. After all, the two have worked together to pump billions in taxpayer dollars into the EV industry. Just over the past year Ford and Trudeau have been seen side by side announcing their $5 billion commitment to Honda, or their $28.2 billion in subsidies for new Stellantis and Volkswagen electric vehicle battery plants.

Their assumption was that the U.S. would be a major market for Canadian EVs. Remember that “vehicles are the second largest Canadian export by value, at $51 billion in 2023 of which 93% was exported to the U.S.,”according to the Canadian Vehicle Manufacturers Association, and “Auto is Ontario’s top export at 28.9% of all exports (2023).”

But Trump ran on abolishing the Biden administration’s de facto EV mandate. Now that he’s back in the White House, the market for those EVs that Trudeau and Ford invested in so heavily is going to be much softer. Perhaps they’d like to be able to blame Trump’s tariffs for the coming downturn rather than their own misjudgment.

In any event, Ford’s tactic stands in stark contrast to the response from Alberta, Canada’s true energy superpower. Premier Danielle Smith made it clear that her province “will not support cutting off our Alberta energy exports to the U.S., nor will we support a tariff war with our largest trading partner and closest ally.”

Smith spoke about this topic at length at an event announcing a new $29-million border patrol team charged with combatting drug trafficking, at which said that Trudeau’s criticisms of the president-elect were, “not helpful.” Her deputy premier Mike Ellis was quoted as saying, “The concerns that president-elect Trump has expressed regarding fentanyl are, quite frankly, the same concerns that I and the premier have had.” Smith and Ellis also criticized Ottawa’s progressively lenient approach to drug crimes.

(For what it’s worth, a recent Léger poll found that “Just 29 per cent of [Canadians] believe Trump’s concerns about illegal immigration and drug trafficking from Canada to the U.S. are unwarranted.” Perhaps that’s why some recent polls have found that Trudeau is currently less popular in Canada than Trump at the moment.)

Smith said that Trudeau’s criticisms of the president-elect were, “not helpful.” And on X/Twitter she said, “Now is the time to… reach out to our friends and allies in the U.S. to remind them just how much Americans and Canadians mutually benefit from our trade relationship – and what we can do to grow that partnership further,” adding, “Tariffs just hurt Americans and Canadians on both sides of the border. Let’s make sure they don’t happen.”

This is exactly the right approach. Smith knows there is a lot at stake in this fight, and is not willing to step into the ring in a fight that Canada simply can’t win, and will cause a great deal of hardship for all involved along the way.

While Trudeau indulges in virtue signaling and Ford in sabre rattling, Danielle Smith is engaging in true statesmanship. That’s something that is in short supply in our country these days.

As I’ve written before, Trump is playing chess while Justin Trudeau and Doug Ford are playing checkers. They should take note of Smith’s strategy. Honey will attract more than vinegar, and if the long history of our two countries tell us anything, it’s that diplomacy is more effective than idle threats.

Dan McTeague is President of Canadians for Affordable Energy.

2025 Federal Election

Next federal government should recognize Alberta’s important role in the federation

From the Fraser Institute

By Tegan Hill

With the tariff war continuing and the federal election underway, Canadians should understand what the last federal government seemingly did not—a strong Alberta makes for a stronger Canada.

And yet, current federal policies disproportionately and negatively impact the province. The list includes Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off British Columbia’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

Meanwhile, Albertans contribute significantly more to federal revenues and national programs than they receive back in spending on transfers and programs including the Canada Pension Plan (CPP) because Alberta has relatively high rates of employment, higher average incomes and a younger population.

For instance, since 1976 Alberta’s employment rate (the number of employed people as a share of the population 15 years of age and over) has averaged 67.4 per cent compared to 59.7 per cent in the rest of Canada, and annual market income (including employment and investment income) has exceeded that in the other provinces by $10,918 (on average).

As a result, Alberta’s total net contribution to federal finances (total federal taxes and payments paid by Albertans minus federal money spent or transferred to Albertans) was $244.6 billion from 2007 to 2022—more than five times as much as the net contribution from British Columbians or Ontarians. That’s a massive outsized contribution given Alberta’s population, which is smaller than B.C. and much smaller than Ontario.

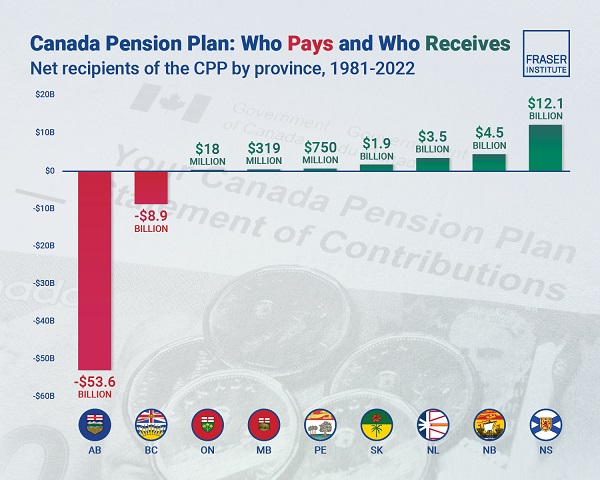

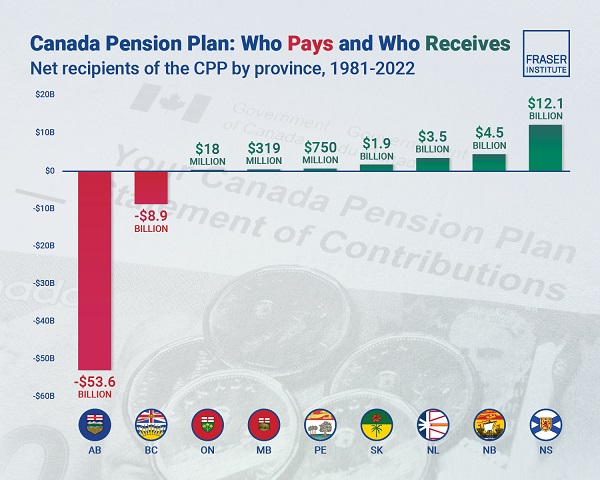

Albertans’ net contribution to the CPP is particularly significant. From 1981 to 2022, Alberta workers contributed 14.4 per cent (on average) of total CPP payments paid to retirees in Canada while retirees in the province received only 10.0 per cent of the payments. Albertans made a cumulative net contribution to the CPP (the difference between total CPP contributions made by Albertans and CPP benefits paid to retirees in Alberta) of $53.6 billion over the period—approximately six times greater than the net contribution of B.C., the only other net contributing province to the CPP. Indeed, only two of the nine provinces that participate in the CPP contribute more in payroll taxes to the program than their residents receive back in benefits.

So what would happen if Alberta withdrew from the CPP?

For starters, the basic CPP contribution rate of 9.9 per cent (typically deducted from our paycheques) for Canadians outside Alberta (excluding Quebec) would have to increase for the program to remain sustainable. For a new standalone plan in Alberta, the rate would likely be lower, with estimates ranging from 5.85 per cent to 8.2 per cent. In other words, based on these estimates, if Alberta withdrew from the CPP, Alberta workers could receive the same retirement benefits but at a lower cost (i.e. lower payroll tax) than other Canadians while the payroll tax would have to increase for the rest of the country while the benefits remained the same.

Finally, despite any claims to the contrary, according to Statistics Canada, Alberta’s demographic advantage, which fuels its outsized contribution to the CPP, will only widen in the years ahead. Alberta will likely maintain relatively high employment rates and continue to welcome workers from across Canada and around the world. And considering Alberta recorded the highest average inflation-adjusted economic growth in Canada since 1981, with Albertans’ inflation-adjusted market income exceeding the average of the other provinces every year since 1971, Albertans will likely continue to pay an outsized portion for the CPP. Of course, the idea for Alberta to withdraw from the CPP and create its own provincial plan isn’t new. In 2001, several notable public figures, including Stephen Harper, wrote the famous Alberta “firewall” letter suggesting the province should take control of its future after being marginalized by the federal government.

The next federal government—whoever that may be—should understand Alberta’s crucial role in the federation. For a stronger Canada, especially during uncertain times, Ottawa should support a strong Alberta including its energy industry.

Alberta

Province announces plans for nine new ‘urgent care centres’ – redirecting 200,000 hospital visits

Expanding urgent care across Alberta

If passed, Budget 2025 includes $17 million in planning funds to support the development of urgent care facilities across the province.

As Alberta’s population grows, so does the demand for health care. In response, the government is making significant investments to ensure every Albertan has access to high-quality care close to home. Currently, more than 35 per cent of emergency department visits are for non-life-threatening conditions that could be treated at urgent care centres. By expanding these centres, Alberta’s government is enhancing the health care system and improving access to timely care.

If passed, Budget 2025 includes $15 million to support plans for eight new urgent care centres and an additional $2 million in planning funds for an integrated primary and urgent care facility in Airdrie. These investments will help redirect up to 200,000 lower-acuity emergency department visits annually, freeing up capacity for life-threatening cases, reducing wait times and improving access to care for Albertans.

“More people are choosing to call Alberta home, which is why we are taking action to build capacity across the health care system. Urgent care centres help bridge the gap between primary care and emergency departments, providing timely care for non-life-threatening conditions.”

“Our team at Infrastructure is fully committed to leading the important task of planning these eight new urgent care facilities across the province. Investments into facilities like these help strengthen our communities by alleviating strains on emergency departments and enhance access to care. I am looking forward to the important work ahead.”

The locations for the eight new urgent care centres were selected based on current and projected increases in demand for lower-acuity care at emergency departments. The new facilities will be in west Edmonton, south Edmonton, Westview (Stony Plain/Spruce Grove), east Calgary, Lethbridge, Medicine Hat, Cold Lake and Fort McMurray.

“Too many Albertans, especially those living in rural communities, are travelling significant distances to receive care. Advancing plans for new urgent care centres will build capacity across the health care system.”

“Additional urgent care centres across Alberta will give Albertans more options for accessing the right level of care when it’s needed. This is a necessary and substantial investment that will eventually ease some of the pressures on our emergency departments.”

The remaining $2 million will support planning for One Health Airdrie’s integrated primary and urgent care facility. The operating model, approved last fall, will see One Health Airdrie as the primary care operator, while urgent care services will be publicly funded and operated by a provider selected through a competitive process.

“Our new Airdrie facility, offering integrated primary and urgent care, will provide same-day access to approximately 30,000 primary care patients and increase urgent care capacity by around 200 per cent, benefiting the entire community and surrounding areas. We are very excited.”

Alberta’s government will continue to make smart, strategic investments in health facilities to support the delivery of publicly funded health programs and services to ensure Albertans have access to the care they need, when and where they need it.

Budget 2025 is meeting the challenge faced by Alberta with continued investments in education and health, lower taxes for families and a focus on the economy.

Quick facts

- The $2 million in planning funds for One Health Airdrie are part of a total $24-million investment to advance planning on several health capital initiatives across the province through Budget 2025.

- Alberta’s population is growing, and visits to emergency departments are projected to increase by 27 per cent by 2038.

- Last year, Alberta’s government provided $8.4 million for renovations to the existing Airdrie Community Health Centre.

Related information

-

Alberta2 days ago

Alberta2 days agoAlberta Institute urging Premier Smith to follow Saskatchewan and drop Industrial Carbon Tax

-

Addictions2 days ago

Addictions2 days agoShould fentanyl dealers face manslaughter charges for fatal overdoses?

-

Also Interesting1 day ago

Also Interesting1 day agoThe bizarre story of Taro Tsujimoto

-

Alberta2 days ago

Alberta2 days agoAlbertans have contributed $53.6 billion to the retirement of Canadians in other provinces

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChinese Gangs Dominate Canada: Why Will Voters Give Liberals Another Term?

-

Energy2 days ago

Energy2 days agoEnergy, climate, and economics — A smarter path for Canada

-

Health1 day ago

Health1 day agoRFK Jr. Drops Stunning Vaccine Announcement

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoSoaked, Angry, and Awake: What We Saw at Pierre Poilievre’s Surrey Rally