Economy

Five Canadian premiers demand Trudeau scrap carbon tax for all provinces and not just a few

From LifeSiteNews

By ‘singling out Atlantic Canadians with this relief, it has caused divisions across the country. All Canadians are equally valued and should be equally respected,’ the premiers wrote

Five Canadian premiers from coast to coast banded together to demand Prime Minister Justin Trudeau drop the carbon tax on home heating bills for all provinces, saying his policy of giving one region a tax break over another has caused “divisions.”

“It is of vital importance that federal policies and programs are made available to all Canadians in a fair and equitable way,” reads a letter dated November 10 and signed by Premiers Tim Houston of Nova Scotia, Blaine Higgs of New Brunswick, Doug Ford of Ontario, Danielle Smith of Alberta, and Scott Moe of Saskatchewan.

The premiers wrote that by “singling out Atlantic Canadians with this relief, it has caused divisions across the country. All Canadians are equally valued and should be equally respected.”

In the letter, the premiers demanded a meeting with Trudeau to discuss the matter and “urge the federal government to remove the carbon tax on all forms of home heating across Canada immediately.”

“We are calling on the federal government to do the right thing and treat all Canadians fairly by removing the federal carbon tax from all forms of home heating. This would help address the significant affordability concerns faced by families from coast to coast to coast,” the premiers wrote.

“Given the vast impacts of carbon pricing, we are asking for a meeting to discuss this issue.”

Trudeau recently announced he was pausing the collection of the carbon tax on home heating oil for three years, but only for Atlantic Canadian provinces. The current cost of the carbon tax on home heating fuel is 17 cents per litre. Most Canadians, however, heat their homes with clean-burning natural gas, a fuel that will not be exempted from the carbon tax.

Trudeau’s announcement came amid dismal polling numbers showing his government will be defeated in a landslide by the Conservative Party come the next election.

Indeed, a recent poll even shows the Green Party outperforming the Liberals in Atlantic Canada.

The premiers’ letter was signed by two Atlantic provinces that benefit from the carbon tax pause but whose leaders do not think it is fair they get special treatment over the others.

The premiers warned Trudeau that with winter coming most Canadians will be hit with high heating bills thanks to the carbon tax.

“Many Canadian households do not use home heating oil and instead use all forms of heating to heat their homes. Winter is coming and these people also deserve a break. It is of vital importance that federal policies and programs are made available to all Canadians in a fair and equitable way,” the letter reads.

“The federal government was elected by voters across this country. This is an opportunity to show them that they won’t be penalized for their choice of home heating source.”

The Conservative Party of Canada (CPC) under leader Pierre Poilievre firmly opposes the carbon tax. Poilievre recently dared Trudeau to call a “carbon tax” election so Canadians can decide for themselves if they want a government for or against a tax that has caused home heating bills to double in some provinces.

A recent CPC motion calling for the carbon tax to be paused for all Canadians failed to pass after the Liberal and Bloc Quebecois MPs voted against it. This motion interestingly had support from the New Democratic Party (NDP), which means its passage is likely.

85 percent of small businesses now opposed to Trudeau’s carbon tax

Opposition to Trudeau’s carbon tax is strong and growing, notably among small business owners. Indeed, a recent poll shows that 85% of small businesses reject the federal carbon tax.

The poll, conducted by the Canadian Federation of Independent Business (CFIB), shows that opposition to the carbon tax has nearly doubled in only a year. Last year, about 52% of businesses opposed a carbon tax.

CFIB president Dan Kelly noted that “the entire federal carbon tax structure is beginning to look like a shell game.”

When it comes to small businesses, Kelly said that they pay “about 40% of the costs of the carbon tax, but the federal government has promised to return only 10% to small businesses.”

LifeSiteNews reported last month how Trudeau’s carbon tax is costing Canadians hundreds of dollars annually, as the rebates given out by the federal government are not enough to compensate for the increased fuel costs.

The Trudeau government’s current environmental goals – in lockstep with the United Nations’ “2030 Agenda for Sustainable Development” – include phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of the use of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum (WEF) – the globalist group behind the socialist “Great Reset” agenda – an organization in which Trudeau and some of his cabinet are involved.

2025 Federal Election

Canada drops retaliatory tariffs on automakers, pauses other tariffs

MxM News

MxM News

Quick Hit:

Canada has announced it will roll back retaliatory tariffs on automakers and pause several other tariff measures aimed at the United States. The move, unveiled by Finance Minister François-Philippe Champagne, is designed to give Canadian manufacturers breathing room to adjust their supply chains and reduce reliance on American imports.

Key Details:

- Canada will suspend 25% tariffs on U.S. vehicles for automakers that maintain production, employment, and investment in Canada.

- A broader six-month pause on tariffs for other U.S. imports is intended to help Canadian sectors transition to domestic sourcing.

- A new loan facility will support large Canadian companies that were financially stable before the tariffs but are now struggling.

Diving Deeper:

Ottawa is shifting its approach to the escalating trade war with Washington, softening its economic blows in a calculated effort to stabilize domestic manufacturing. On Tuesday, Finance Minister François-Philippe Champagne outlined a new set of trade policies that provide conditional relief from retaliatory tariffs that have been in place since March. Automakers, the hardest-hit sector, will now be eligible to import U.S. vehicles duty-free—provided they continue to meet criteria that include ongoing production and investment in Canada.

“From day one, the government has reacted with strength and determination to the unjust tariffs imposed by the United States on Canadian goods,” Champagne stated. “We’re giving Canadian companies and entities more time to adjust their supply chains and become less dependent on U.S. suppliers.”

The tariff battle, which escalated in April with Canada slapping a 25% tax on U.S.-imported vehicles, had caused severe anxiety within Canada’s auto industry. John D’Agnolo, president of Unifor Local 200, which represents Ford employees in Windsor, warned the BBC the situation “has created havoc” and could trigger a recession.

Speculation about a possible Honda factory relocation to the U.S. only added to the unrest. But Ontario Premier Doug Ford and federal officials were quick to tamp down the rumors. Honda Canada affirmed its commitment to Canadian operations, saying its Alliston facility “will operate at full capacity for the foreseeable future.”

Prime Minister Mark Carney reinforced the message that the relief isn’t unconditional. “Our counter-tariffs won’t apply if they (automakers) continue to produce, continue to employ, continue to invest in Canada,” he said during a campaign event. “If they don’t, they will get 25% tariffs on what they are importing into Canada.”

Beyond the auto sector, Champagne introduced a six-month tariff reprieve on other U.S. imports, granting time for industries to explore domestic alternatives. He also rolled out a “Large Enterprise Tariff Loan Facility” to support big businesses that were financially sound prior to the tariff regime but have since been strained.

While Canada has shown willingness to ease its retaliatory measures, there’s no indication yet that the U.S. under President Donald Trump will reciprocate. Nevertheless, Ottawa signaled its openness to further steps to protect Canadian businesses and workers, noting that “additional measures will be brought forward, as needed.”

Business

DOGE Is Ending The ‘Eternal Life’ Of Government

From the Daily Caller News Foundation

By David Bossie

In his 1964 “A Time For Choosing” speech, Ronald Reagan famously said, “a government bureau is the nearest thing to eternal life we’ll ever see on this earth.” And for more than 60 years, President Reagan’s words have proven to be true. However, with the historic re-election of President Donald Trump and the creation of the Department of Government Efficiency (DOGE) under the leadership of Elon Musk, the Gipper’s contention is finally being challenged – and not a moment too soon.

The Trump Administration inherited a horribly bloated federal government in dire need of common sense streamlining from top to bottom. For decades, the executive branch has expanded at an incomprehensible rate and along with it, so has waste, fraud, and abuse. Presidents on both sides of the aisle have made promises to tighten the government’s belt, shrink the bureaucracy, and return power to the people where it belongs. Those efforts for the most part – however well-intentioned – never got off the ground. The reality is that when politicians have been forced to choose between a legislative priority and cutting government spending, cuts are always the first casualty. But currently, with our $36 trillion national debt spiraling out of control, reining in the size and scope of government is no longer a choice, but a necessity.

President Trump is the perfect leader for these trying times. He’s battletested and fears nothing – and no challenge is too large. Whether it’s securing the border, growing the economy, forging peace in Ukraine and the Middle East, or negotiating fair trade deals, this president is on a mission to save America. And if any chief executive is going to have success at deconstructing the administrative state, it’s Trump the steel-spined change agent. The shadowy deep state doesn’t scare him, the biased liberal media can’t intimidate him, and this time there are no phony partisan investigations aiming to sidetrack him. Trump made a promise to bring fiscal responsibility back to governing, and along with Musk and DOGE, they’re finally conducting the “audit with teeth” that the American people have been waiting for, and their hard work is turning out to be infectious.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here. Thank you!

With each passing day, a different member of the cabinet is announcing a new cut, discovering a duplicative program, or updating an antiquated system to steer us away from the fiscal cliff that’s rapidly approaching. When the president also happens to be a highly successful businessman, making the business operate more smoothly and for less money is the name of the game. Trump has brought this mindset to the White House and according to recent polling 77 percent favor a full review of government spending.

President Trump is going back to the basics that have become taboo in Washington, like asking fundamental questions about whether an agency has been successful in its mission or if a program is still necessary. In the case of the Education Department, Trump sees an emergency and is not willing to kick the can down the road any longer. The president believes that education excellence for our children is essential so America can compete for generations to come. Drastic reform is long overdue and that means moving education decisions back to state and local officials – and parents. That’s why President Trump is taking the steps to confront the failed status quo and close the underperforming department so we can turnaround lackluster public schools and low-test scores.

Similarly, with the decision to end USAID and slash foreign aid, Trump and DOGE are simply putting America first. America is handing out billions upon billions in taxpayer dollars around the globe on programs that should be spent on fixing our own domestic problems. The plan to decentralize and modernize the Agriculture Department is another great example of thinking outside the box. The American people understand the rationale that downtown Washington, D.C. is the last place decisions about farming should be made. Relocating the department to various hubs around the heartland is common sense.

Additionally, the announcement that the Department of Health and Human Services will cut 20,000 full-time employees is part of President Trump’s vision to “right-size the federal government and unleash the private sector again” in the words of Treasury Secretary Scott Bessent. And word that the Trump Administration is planning to work with Congress to finally defund National Public Radio and the Public Broadcasting Service is welcome news to millions of Americans who believe sending taxpayer funds to biased news outlets is wrong.

DOGE is also doing courageous work at the Social Security Administration (SSA). The amazing efforts to identify individuals who are either deceased, in the country illegally, or otherwise ineligible will help stave off the program’s insolvency, which experts predict is only ten years away. When a DOGE official disclosed that 40 percent of the calls made to SSA are from would-be fraudsters trying to exploit the system, it’s become all too obvious that new safeguards must be adopted.

When it comes to the question of how much money DOGE will ultimately end up saving taxpayers, in the context of our $36 trillion debt crisis, the more the better. However, the overall change in mindset – forcing government to operate efficiently and responsibly like businesses and families – and passing that mindset onto future administrations is perhaps the most critical shift that can be made. In fact, in an ideal scenario, every state, county, and city would have its very own DOGE operation. We must get serious about cutting government waste now or we’ll go bankrupt. That’s just the reality of the situation and President Trump knows it.

David Bossie is the president of Citizens United and served as a senior adviser to the Trump-Pence 2020 campaign. In 2016, Bossie served as deputy campaign manager for Donald J. Trump for President and deputy executive director for the Trump-Pence Transition Team.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNeil Young + Carney / Freedom Bros

-

Business1 day ago

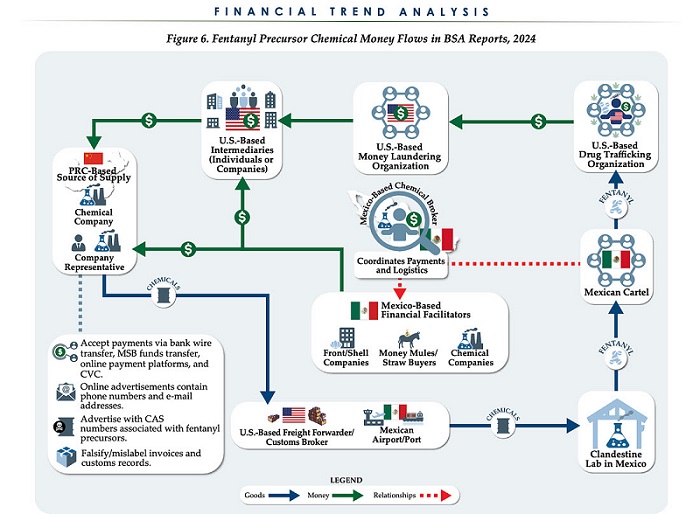

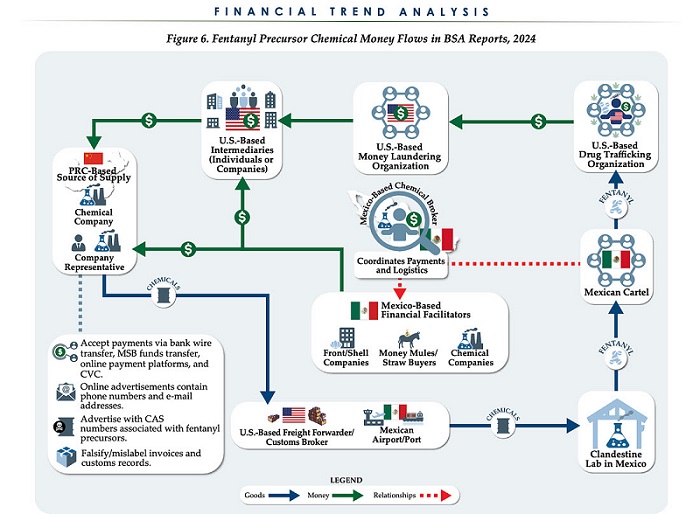

Business1 day agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoTucker Carlson Interviews Maxime Bernier: Trump’s Tariffs, Mass Immigration, and the Oncoming Canadian Revolution

-

espionage1 day ago

espionage1 day agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target

-

Business2 days ago

Business2 days agoDOGE Is Ending The ‘Eternal Life’ Of Government

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanada drops retaliatory tariffs on automakers, pauses other tariffs

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBREAKING from THE BUREAU: Pro-Beijing Group That Pushed Erin O’Toole’s Exit Warns Chinese Canadians to “Vote Carefully”

-

Daily Caller1 day ago

Daily Caller1 day agoDOJ Releases Dossier Of Deported Maryland Man’s Alleged MS-13 Gang Ties