Alberta

Finance Minister Nate Horner says Alberta on track to $2.4 billion surplus

Q1 update: Continued fiscal growth

Alberta’s strong fiscal management continues to secure Alberta’s future.

Alberta is on course to record a $2.4-billion surplus at the end of 2023-24, despite an unprecedented wildfire season and ongoing economic volatility. This is $94 million higher than forecast in Budget 2023.

Strong and prudent fiscal management will help Alberta remain the economic engine of Canada. The government’s new fiscal framework requires the government to use at least half of available surplus cash to pay down debt, freeing up money that can support the needs of Alberta families now and for decades to come. Based on the first quarter update, Alberta plans to eliminate $2.6 billion in taxpayer-supported debt this fiscal year.

“Alberta’s finances remain strong, and thanks to our new fiscal framework, Alberta’s fiscal position is poised to become even stronger. Our continued priorities of paying down debt and saving for the future will ensure we have the capacity to meet Albertans’ needs both today and well into the future.”

After the required 50 per cent of projected available surplus cash is used to pay off maturing debt, remaining surplus cash will be allocated to the Alberta Fund, where it can be used for additional debt repayment, contributions to the Alberta Heritage Savings Trust Fund and one-time initiatives that do not lead to a permanent increase in government spending. A projected $2.6 billion will be set aside in the Alberta Fund in 2023-24.

Revenue

Revenue for 2023-24 is forecast at $71.1 billion, a $491-million increase from Budget 2023.

Alberta’s robust business environment is attracting investment and people from around the country, driving a projected $1.5-billion increase in corporate and personal income tax revenue.

The corporate income tax revenue forecast has increased by $889 million, following a record-high year in 2022-23. At eight per cent, Alberta’s general corporate income tax rate is the lowest in the country. Alberta’s low taxes remain one reason investors choose Alberta.

Keeping life affordable is a key priority for Alberta’s government, which is why it paused the provincial fuel tax on gasoline and diesel in January. Extending the pause to the end of 2023 will save Albertans and Alberta businesses 13 cents per litre on gasoline and diesel for the rest of the calendar year. As a result, fuel tax revenue is forecast to be reduced by $532 million – money that is going directly back into the pockets of Albertans every time they fill up their vehicle.

Between April 1 and June 30, the price of West Texas Intermediate (WTI) oil averaged US$74 per barrel. It is now forecast to average $US75 per barrel over the course of the fiscal year, $4 lower than the Budget 2023 forecast. The resulting impact on Alberta’s revenue is being offset by a narrower light-heavy oil price differential, which is now forecast to average US$15 per barrel, $5 narrower than at budget.

Bitumen royalties are projected to increase by $515 million in 2023-24; however, overall resource revenue is projected to decrease by $694 million from the budget forecast. Lower natural gas royalties account for most of the projected decrease due to weaker prices, robust North American production and the impact of wildfires on production in Alberta.

Expense

Expense for 2023-24 is forecast at $68.7 billion, a $397-million increase from Budget 2023. The expense increase before the forecast contingency allocation is $1.6 billion. Of this, $397 million is funded by dedicated revenue and $1.2 billion is set aside as a preliminary allocation from the contingency, leaving $323 million unallocated.

The unprecedented wildfire season in the province prompted Alberta’s government to act swiftly and responsibly to ensure the safety of Albertans in affected areas. To date, the government has allocated $750 million for fighting wildfires in the province this year, along with $175 million for uninsurable losses, $75 million of which is expected to be covered by the federal government, and $55 million, mainly for emergency evacuation payments. Alberta’s government will continue to support Albertans during difficult situations like natural disasters.

The operating expense forecast has increased by $179 million, mainly due to a $214-million increase in Health funding that is being fully offset by federal bilateral agreement revenue. Capital grant increases of $170 million are mainly for re-profiling projects from the 2022-23 fiscal year.

Debt servicing costs are forecast to increase $245 million from budget, mainly due to higher interest rates – reiterating the importance of government’s commitment to paying down debt.

Alberta Heritage Savings Trust Fund

The Alberta Heritage Savings Trust Fund is Alberta’s long-term savings account, and the government remains committed to growing it. The fund performed well during the 2023-24 first quarter, earning a two per cent return with a net investment income of $739 million. Its fair value of net assets on June 30 was $21.6 billion, an increase from the $21.2 billion recorded at the end of the previous fiscal year.

Over five years, the fund returned 6.4 per cent, which is 0.6 per cent above the return of its passive benchmark.

Economic outlook

By continuing to grow and diversify Alberta’s economy, Alberta’s government is continuing to exceed expectations. Alberta’s real gross domestic product is now expected to rise three per cent in 2023, up 0.2 percentage points from Budget 2023. Projections by private forecasters show the province is expected to lead the country in economic growth this year.

Robust population growth is supporting Alberta’s labour market and generating demand and activity in Alberta’s economy, ultimately boosting the province’s economic outlook. Although risks and uncertainty persist due to rising interest rates, high consumer prices and other factors, Alberta’s economy remains well-positioned to withstand any challenges that arise.

Quick facts

- The amount of surplus cash available for debt repayment and the Alberta Fund is calculated after several necessary cash adjustments are made.

- In 2023-24, the total amount available for allocation is forecast at $5.2 billion, which includes $5.1 billion carried over from the 2022-23 final results.

Alberta

Red Deer Justice Centre Grand Opening: Building access to justice for Albertans

The new Red Deer Justice Centre will help Albertans resolve their legal matters faster.

Albertans deserve to have access to a fair, accessible and transparent justice system. Modernizing Alberta’s courthouse infrastructure will help make sure Alberta’s justice system runs efficiently and meets the needs of the province’s growing population.

Alberta’s government has invested $191 million to build the new Red Deer Justice Centre, increasing the number of courtrooms from eight to 12, allowing more cases to be heard at one time.

“Modern, accessible courthouses and streamlined services not only strengthen our justice

system – they build safer, stronger communities across the province. Investing in the new Red Deer Justice Centre is vital to helping our justice system operate more efficiently, and will give people in Red Deer and across central Alberta better access to justice.”

Government of Alberta and Judiciary representatives with special guests at the Red Deer Justice Centre plaque unveiling event April 22, 2025.

On March 3, all court services in Red Deer began operating out of the new justice centre. The new justice centre has 12 courtrooms fully built and equipped with video-conference equipment to allow witnesses to attend remotely if they cannot travel, and vulnerable witnesses to testify from outside the courtroom.

The new justice centre also has spaces for people taking alternative approaches to the traditional courtroom trial process, with the three new suites for judicial dispute resolution services, a specific suite for other dispute resolution services, such as family mediation and civil mediation, and a new Indigenous courtroom with dedicated venting for smudging purposes.

“We are very excited about this new courthouse for central Alberta. Investing in the places where people seek justice shows respect for the rights of all Albertans. The Red Deer Justice Centre fills a significant infrastructure need for this rapidly growing part of the province. It is also an important symbol of the rule of law, meaning that none of us are above the law, and there is an independent judiciary to decide disputes. This is essential for a healthy functioning democracy.”

“Public safety and access to justice go hand in hand. With this investment in the new Red Deer Justice Centre, Alberta’s government is ensuring that communities are safer, legal matters are resolved more efficiently and all Albertans get the support they need.”

“This state-of-the-art facility will serve the people of Red Deer and surrounding communities for generations. Our team at Infrastructure is incredibly proud of the work done to plan, design and build this project. I want to thank everyone, at all levels, who helped make this project a reality.”

Budget 2025 is meeting the challenge faced by Alberta with continued investments in education and health, lower taxes for families and a focus on the economy.

Quick facts

- The new Red Deer Justice Centre is 312,000 sq ft (29,000 m2). (The old courthouse is 98,780 sq ft (9,177 m2)).

- The approved project funding for the Red Deer Justice Centre is about $191 million.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

-

Business2 days ago

Business2 days agoChinese firm unveils palm-based biometric ID payments, sparking fresh privacy concerns

-

COVID-192 days ago

COVID-192 days agoRFK Jr. Launches Long-Awaited Offensive Against COVID-19 mRNA Shots

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoConservatives promise to ban firing of Canadian federal workers based on COVID jab status

-

Business1 day ago

Business1 day agoIs Government Inflation Reporting Accurate?

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCarney’s Hidden Climate Finance Agenda

-

Environment1 day ago

Environment1 day agoExperiments to dim sunlight will soon be approved by UK government: report

-

2025 Federal Election1 day ago

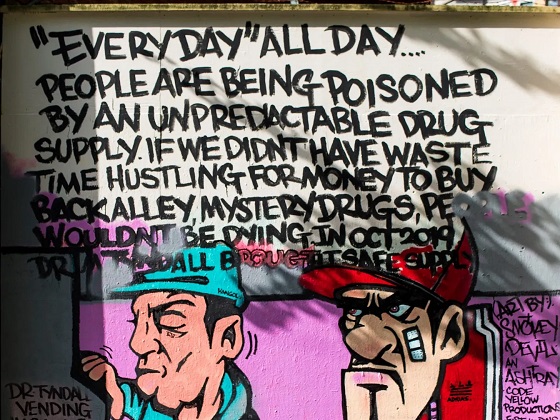

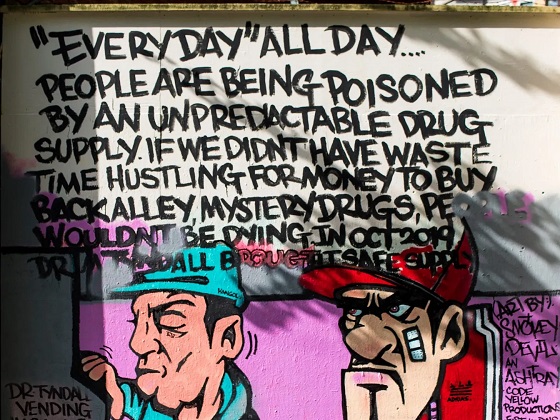

2025 Federal Election1 day agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoIs free speech over in the UK? Government censorship reaches frightening new levels