Economy

Federal government’s environmental policies will do more harm than good

From the Fraser Institute

By Matthew Lau

The study covered grocery bags, food packaging, soft drink containers, furniture, t-shirts and other plastic products. In most cases, replacing plastics with alternatives causes greenhouse gas emissions to rise by 35 to 700 per cent.

Through a variety of regulatory and spending initiatives, the Trudeau government is expanding its control over our lives, often in the name of climate change or other environmental objectives. For example, the government plans to force consumers to buy electric vehicles instead of conventional cars and has proposed or implemented plastics restrictions on consumers and businesses—everything from plastic drinking straws and plastic utensils to clothing material and food packages.

However, while evidence of the high costs to consumers continues to mount, evidence of the environmental benefits is notably absent. Indeed, many recent studies provide evidence that Ottawa’s restrictions on consumers may well cause net environmental harm. One reason is that the plastic products the federal government is so intent on restricting are more environmentally efficient than alternatives.

A study published earlier this year in the journal Environmental Science & Technology concludes, “15 of the 16 applications a plastic product incurs fewer greenhouse gas emissions than their alternatives.” The study covered grocery bags, food packaging, soft drink containers, furniture, t-shirts and other plastic products. In most cases, replacing plastics with alternatives causes greenhouse gas emissions to rise by 35 to 700 per cent.

Why? Because plastic generally takes less energy to manufacture and transport than the alternatives. In fact, many plastic products that are more environmentally friendly than non-plastic alternatives (according to the study) are products the Trudeau government wants to ban or curtail through regulation.

Other evidence shows plastic bans of the type imposed in Canada cause environmental ruin, contrary to the predictions of politicians. For example, research in New Jersey found after single-use plastic bags were banned in 2022, shoppers switched to the heavier reusable bags. “Owing to the larger carbon footprint of the heavier, non-woven polypropylene bags,” reported the Wall Street Journal, “greenhouse gas emissions rose 500%.”

Similarly, the New York Times reported that while California banned single-use plastic bags almost a decade ago, in 2023 “Californians threw away more plastic bags, by weight, than when the law first passed, according to figures from CalRecycle, California’s recycling agency.”

Also from the Wall Street Journal, analyses suggest electric vehicles often emit more particulate pollution (dust, dirt and soot) than conventional vehicles. That’s because most particulate pollution these days is not from the tailpipe but from tire wear. EVs are much heavier than conventional vehicles so their tires wear out faster, increasing particulate pollution. The firm Emissions Analytics compared a plug-in electric to a hybrid vehicle and found the plug-in electric, which weighed more, emitted about one-quarter more particulate matter than the hybrid as a result of tire wear.

Last year, the chair of the U.S. National Transportation Safety Board noted that EVs manufactured by Ford, Volvo and Toyota were all about 33 per cent heavier than conventionally powered versions of those same vehicles. That’s a problem not only for the environment but also for driver safety—and yet more evidence that the Trudeau government’s EV mandates will harm Canadians.

When it comes to vehicles, plastic products and many other things, the Trudeau government should begin reducing its control over consumers. The harm to consumers is evident; the compensating benefits to the environment—if any—are not.

Author:

Economy

The True Cost of Mark Carney’s Ineffective Green Energy Sinkhole

From Energy Now

By Ron Wallace

The Carney government has continued to express an openness to new oil export pipelines while maintaining its commitment to long-standing clean energy ambitions associated with emissions reductions. Hence their assertions that any potential revival of projects such as Keystone XL would have to be accompanied by the production of “decarbonized” oil. Reflecting this stance, Energy and Natural Resources Minister Tim Hodgson recently reaffirmed his governments’ position that Canada is seeking to be a leader in the production of “affordable, low-carbon energy” by introducing a new $3.4 million investment into carbon dioxide removal (CDR) ventures to support Canada’s low-carbon energy goals.

However, on the vital issue of a proposed emissions cap for Canadian oil and gas production, it is regrettable that Prime Minister Carney’s stance remains unclear despite significant evidence that the policy would have material negative effects on the Canadian, particularly the western, economy. Notably, the House Environment Committee that has recently reviewed the issue appear to be in favour of the policy despite reports that warn of the cap’s material economic impact.

Along with its 2030 Emissions Reduction Plan, and the expected release of its climate competitiveness strategy along with the federal budget, it may be timely to review Canada’s historical progress for emissions targets and importantly to assess what these policies have cost Canadians.

In 2015 the Trudeau Liberal government agreed to adopt targets under the Kyoto Protocol that committed Canada to reducing total emissions to 5 per cent below 1990 levels. However, a recent audit from the Commissioner of the Environment’s Office indicates that the federal government is set to miss its 2030 target to cut carbon emissions by 40 per cent below 2005 levels by 2030. That 2025 report concluded that in the past 20 years the only significant drops in emissions came during the 2008 financial crisis and the COVID-19 pandemic. Obviously, those events did not reflect any effects of Canadian emissions reduction policies.

In appearing before the House of Commons Standing Committee on Environment and Sustainable Development (ENVI) Commissioner DeMarco concluded that while Canada’s emissions in 2023 were 694 mega tonnes, or 8.5% lower than 2005, they were still 14% higher than 1990. Clearly, Canada is not on track to meet its 2030 target to reduce emissions by 40–45% below 2005. In short, Canada has never met a single national emissions target set since 1992.

While Carney’s vision is for Canada to become an “energy superpower” Alberta Premier Danielle Smith has maintained that changes are needed to a suite of federal legislation that has effectively blocked private sector investment. Those concerns have been validated by the actions of major crude oil pipeline operators like Enbridge Inc. as they re-direct significant investment away from Canada and into the United States.

The policies that the Carney government has inherited include legislative initiatives such as Bill C-69 designed to restructure environmental assessments and “modernize” the National Energy Board (now the Canada Energy Regulator- CER), Bill C-48 that banned oil tankers off B.C.’s northwest coast, proposed regulations for targeted emissions caps, fuel standards and unattainable mandates for zero-emission vehicles by 2035.

Canadians might be right to ask about the cost of these policies. In a recent report, the Fraser Institute assessed the costs of successive Liberal governments efforts to pivot to green industrial policies to control emissions through massive spending programs, along with changes to regulatory standards designed to constrain traditional energy sources. The inescapable conclusion is that the Federal government’s “green shift” by which the federal government has sought to shape industrial outcomes has not only imposed high, unrecoverable costs but has delivered minimal economic payoff while failing to meet even the minimal objectives to reduce emissions.

The Fraser Institute noted that while Federal spending on the green economy surged from $600 million in 2014/15 to $23 billion in 2024/25, a nearly 40-fold increase, the green economy’s share of GDP rose only marginally from 3.1% in 2014 to 3.6% in 2023, according to Statistics Canada. Moreover, promised “green jobs” have not materialized at scale while traditional energy sectors vital to the Canadian GDP have been actively constrained.

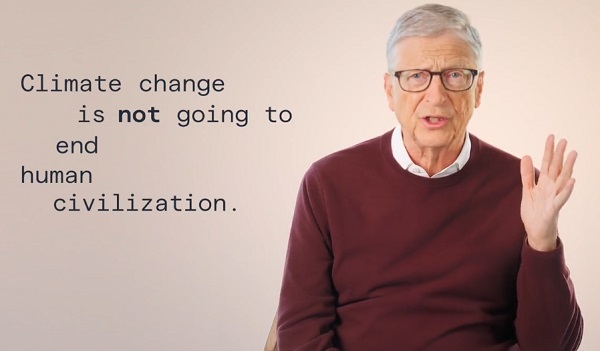

Amidst these dismal facts, released immediately prior to yet another COP30 Climate Conference to be held in Belém, Brazil, Bill Gates has delivered an essay “A New Approach For the World’s Climate Strategy,” that asserted that the “doomsday view of climate change” is “wrong” noting that such predictions that “cataclysmic climate change will decimate civilization” are misplaced. Gates asserts that climate activists have placed too much focus “on near-term emissions goals” and that this effort is “diverting resources from the most effective things we should be doing to improve life in a warming world.” Noted critic Roger Pielke commented that Gates’ essay is “a welcome contribution to a growing chorus of climate realism and energy pragmatism”.

These developments indicate that the Canadian government is not only out of touch with understanding the disastrous economic consequences of its climate policies but reflects a growing consensus that these policies have not, and will not, achieve their intended aims.

If Canada is to achieve energy superpower status it must acknowledge that while material changes to simplify and make more predictable Canadian regulatory project approval processes are necessary, they alone will ultimately be insufficient. What is needed is a complete re-assessment of climate policies and emissions strategies that accept “energy pragmatism” in ways that focus on adaptation. Carney’s One Canadian Economy Act has been designed to circumvent Canada’s regulatory bottlenecks with determinations of the “national interest” made in Ottawa as vetted by a new Major Projects Office. It won’t work.

Dr. Ron Wallace is a retired former member of the National Energy Board.

Economy

Welcome to the Energy Humanist Club! Bill Gates breaks the moral monopoly against fossil fuels

Bill Gates’s humanist challenge to the anti-fossil-fuel climate establishment was only possible because the “moral monopoly” against fossil fuels has been breaking. Now it will break even faster.

Bill Gates brings human-centric thinking to international climate politics

Early last week, Bill Gates released a viral memo about rising GHG levels, “Three tough truths about climate,” purporting to be a “new way to look at the problem,” ahead of the influential COP (Conference of the Parties) climate conference.

The core of the memo, the supposed “new way to look at the problem,” will be very familiar to those who have read my work or that of other “energy humanists,” such as Bjorn Lomborg, Steve Koonin, and Michael Shellenberger.

“We should measure success by our impact on human welfare more than our impact on the global temperature,” which means we should reject “climate policies” where “human welfare takes a backseat to lowering emissions, with bad consequences.”

On the basis of this human-centric “new way to look at the problem,” Gates challenges the two most sacredly held tenets of the global anti-fossil-fuel movement:

- Climate catastrophism: “Although climate change will have serious consequences…it will not lead to humanity’s demise. People will be able to live and thrive in most places on Earth for the foreseeable future.”

- Net-zero by 2050 (to limit temperatures from rising to 1.5 or 2 degrees C above pre-industrial levels): “refocus on the metric that should count even more than emissions and temperature change: improving lives.”

While neither Gates’s human-centrism nor his challenges to the anti-fossil-fuel movement are new to the expert conversation about climate, what is new is that one of the biggest thought-and-action leaders in international climate politics would take this position.

This has generated great excitement in the energy humanist community and in the broader pro-human and pro-freedom communities, since the world of international politics listens when Gates—the world’s largest philanthropist and a huge influencer of government aid—speaks.

Gates’s mind didn’t change, his incentives changed—which is even more fortuitous

I think there’s even more cause for excitement than one might think, because what’s happening is far more significant than what it appears to be, which is one very (very) influential person publicly changing his mind.

What’s actually happening is not that Gates has changed his mind—there is ample evidence he’s long held the key tenets of his new memo. What’s happening is that the intellectual, economic, and political environment has changed so much and so quickly that Bill Gates, one of the shrewdest, most calculating people on Earth, after authoring a conventional climate catastrophist book just a few years ago, feels incentivized to challenge the global anti-fossil-fuel movement’s anti-humanism, catastrophism, and ruinous net-zero obsession.

If we understand how this happened, which I will argue is through the mechanism of “breaking a moral monopoly,” we can achieve even more rapid progress in the near future.

The leverage of breaking a “moral monopoly”

In “Reframing the Conversation,” the final chapter of Fossil Future—which was written between 2018 and 2021—I made the case that the anti-fossil-fuel movement could be stopped, despite the fact (at the time) “that today’s world is starting to head in the deadly direction of fossil fuel elimination—and that support for that direction is so overwhelmingly massive.”

How could I make that case, at a time when every major government, corporation, financial investor, and cultural institution seemed confidently united in support of rapidly eliminating fossil fuels? Because I believed that the seemingly insurmountable anti-fossil-fuel movement was based on an easy-to-refute set of anti-human and false ideas—which I call “the anti-impact framework”—that seemed powerful only because it had a “moral monopoly.”

The fossil fuel elimination movement is an incredibly fragile creature. It is based on the indefensible anti-impact framework, which has an anti-human goal (eliminating human impact in general and CO2 emissions in particular), a false and anti-human view of the planet (the delicate nurturer assumption), and a thoroughly irrational method of evaluation (ignoring benefits and catastrophizing side-effects).

The fossil fuel elimination movement is powerful only because it has a moral monopoly, meaning that it is widely considered the only moral position. Anything with a moral monopoly ends up attracting huge numbers of opportunistic people seeking status (and money) by associating with something uncontroversially good. But if that monopoly is broken, these opportunistic followers scatter.

Once one understands the power and fragility of an undeserved moral monopoly, an inspiring implication emerges: “To change the trajectory of the culture we don’t need to try to change everyone’s mind on this issue. What we really need to do is something much easier: we need to break the moral monopoly of the moral case for eliminating fossil fuels.”

I was optimistic that the moral monopoly of the anti-fossil-fuel movement could be broken for two reasons: 1) the reality of anti-fossil-fuel policies would be far more negative than people expected, and 2) the power of “reframing” the energy/climate conversation from a humanistic perspective was far more powerful than people imagined.

Reality was always a threat to the moral monopoly against fossil fuels

On the reality of anti-fossil-fuel policies being negative, I wrote:

One factor that will contribute to breaking the moral monopoly against fossil fuels is reality.

Already we are seeing clear evidence that there’s something wrong with the policies of the anti-fossil fuel movement. As I’ve been writing this book, my adopted home state, California, has been besieged by blackouts due to overreliance on unreliable solar and wind.

Around the world there are popular movements against the higher energy prices brought about by “green” policies…

At the same time, countries that take energy seriously, like China and India, are using and will continue to use more fossil fuels, exposing the lie that green energy will rapidly replace fossil fuels.

Soon enough, events will reveal more and more glaringly that being anti-fossil fuel is a truly destructive position.

One aspect of energy reality I highlighted in Fossil Future was the “effectively unlimited” need for energy to power AI / machine learning:

There are two features of the machine-learning revolution that are crucial to recognize when it comes to energy: it is extremely energy intensive—involving rapidly growing numbers of power-hungry computers—and the need for it is effectively unlimited. While we are going to want only so much energy to produce our food, there is no limit to the amount of life-improving computation we want…

While all of the above predictions have come true, it has turned out that AI’s effectively unlimited need for energy was the part of reality that has most broken the moral monopoly against fossil fuels.

The reason is that AI quickly generated a rapid increase in (highly influential) tech giants’ need for energy, specifically reliable electricity. This need quickly turned climate catastrophism and fossil fuel elimination from wealth-and-status benefiters for tech giants to wealth-and-status destroyers.

As I documented in Tech giants’ self-made AI energy crisis, “For years tech giants have been helping climate catastrophists shut down reliable fossil fuel electricity, falsely claiming they can be replaced by solar/wind. Now the grid they’ve helped gut can’t supply their growing AI needs.”

Just a few years ago, Meta, Google, Microsoft, and other tech giants were promoting climate catastrophism and calling for “net zero” (i.e., fossil fuel elimination) by 2050.

This helped their wealth and status. They could appear “green,” get international praise, and look good to potential customers by going along with the trends and (most damagingly) using their wealth and influence to continue the anti-fossil-fuel trends.

Of course these companies needed massive amounts of fossil fuels, but that need could be disguised by 1) having coal-dominated China produce a lot of the needed infrastructure for digital tech and 2) lying about their electricity usage being “100% renewable” and/or “net zero” through the use of fraudulent-but-legal “energy credits” that allow them to take credit for others’ solar and wind electricity use and blame others for their (massive) fossil fuel electricity use.

Tech giants’ anti-fossil-fuel stance could only last as long as US electricity demand remained stagnant. As soon as AI projections revealed that huge amounts of additional, reliable electricity were needed, tech giants’ interest in electricity necessarily shifted from fraudulently relabeling portions of a stagnant electricity supply in their favor to actually securing a lot more reliable electricity. And most of that electricity needed to come from fossil fuels—specifically natural gas (in large part because the government had so thoroughly gutted the ability to develop new coal power).

Once new fossil fuel electricity was clearly needed for AI success, tech giants’ wealth-and-status calculation shifted from being anti-fossil-fuel to pro-fossil-fuel, and their public positions and private actions changed with impressive rapidity given how much and how recently they said they were worried about a fossil fueled climate catastrophe.

Perhaps the most revealing shift was from Larry Fink, head of BlackRock, which owns huge shares of the public tech giants as well as countless other big public companies. In the early 2020s, Fink was called “the emperor” for his influential ESG pronouncements that everyone had to go net-zero or else, which were backed by a seeming conviction in avoiding a fossil-fueled climate catastrophe by a rapid “energy transition” that would somehow rapidly replace fossil fuels with unreliable solar and wind.

But once AI’s massive, reliable electricity demand became clear, Fink, at of all places the World Economic Forum (close to ground zero for corporate anti-fossil-fuel views), declared, “The world is going to be short power. To power these data companies you cannot have just this intermittent power like wind and solar, you need dispatchable power, cause you can’t turn off and on these data centers.”

While changing energy realities provided crucial raw material for breaking the anti-fossil-fuel moral monopoly, events by themselves without the required framing and arguments do not cause major intellectual shifts, because the monopoly side usually warps events (e.g., advocates of subsidized unreliable power have absolved themselves of blame for the Texas blackouts, rising electricity prices, and Europe’s dangerous dependence on Russian gas.) In Fossil Future I argued that in order for that monopoly to break, enough of us need to “reframe” the conversation: “As events unfold, if enough of us are reframing the conversation…there will be rapid uptake of the truth.”

Why “reframing” is the key to breaking the moral monopoly against fossil fuels

“Reframing” the energy/climate conversation from a humanistic perspective has been the core of my work on this issue for 18 years. I highly recommend (re)reading the final chapter of Fossil Future for a full account of the mechanics of reframing. But the basic idea is to, instead of adopting the basic way of thinking the establishment anti-fossil-fuel movement does (e.g., our number one goal should be emissions reduction) then quibbling about details, explicitly advocate for thinking about energy and climate in a different way:

-

a pro-human vs. anti-human way: our ultimate goal and standard is advancing human flourishing on Earth, not eliminating human impact on Earth

-

an evenhanded vs. biased way: we evaluate fossil fuels and any other technology by carefully weighing benefits and side-effects (negative and positive), not by ignoring benefits and “catastrophizing” side-effects

In Fossil Future, I highlighted the persuasive success that I and other energy humanists, such as Bjorn Lomborg, Matt Ridley, Robert Bryce, and Michael Shellenberger had had in arguing for the morality of fossil fuel use as an enormous net-benefit to humans (including making our naturally dangerous climate far safer)—a direct and powerful challenge to the anti-fossil-fuel moral monopoly.

I specifically highlighted our success challenging the “false monopoly on science” the anti-fossil-fuel movement (undeservedly) claims while smearing fossil fuel supporters as “climate science deniers.” Energy humanists properly embrace real climate science by integrating it into an overall humanistic analysis “in which one considers the issue of fossil fuels’ impact on climate in its full context from a human flourishing perspective—and even though fossil fuels do impact climate, that’s not necessarily even negative, and even if it is negative it can be possible that fossil fuels’ positives far outweigh it.”

I predicted: “As I and other energy humanists rise in prominence and continue to reframe the conversation…No longer will it be possible to smear fossil fuel advocates as ‘climate change deniers’” and the anti-fossil-fuel movement’s “false monopoly on science…will start to break.”

As I had hoped, the reality of how bad anti-fossil-fuel policies were for human life and progress, combined with a growing army of energy humanists and arguments reframing energy and climate developments, energized more public energy humanists (e.g., Lucy Biggers, Matthew Wielicki, Chris Martz, Jusper Machogu), more energy humanist arguments, and more people hearing those arguments (e.g., Joe Rogan, Jordan Peterson, Lex Fridman).

In late 2024, another development took the energy humanist challenge to the anti-fossil-fuel monopoly to a new level: a new US administration steeped in energy humanism and alarmed about the energy reality caused by anti-fossil-fuel policies.

How reality and reframing have helped the second Trump administration break the anti-fossil-fuel moral monopoly

As I discussed recently on Fox News’s Will Cain Show, the second Trump administration has obviously been a big source of political, economic, and cultural pressure against climate catastrophism and for the unleashing of fossil fuels (along with all other forms of cost-effective energy).

In an era where tech executives need to work very closely with the government to reach their AI goals, the second Trump administration compared to the preceding Biden administration is obviously one that would make Bill Gates far more comfortable speaking up and encouraging the international “climate change” (anti-fossil-fuel) movement to reject climate catastrophism, net-zero policies, and, most importantly, anti-human thinking.

But it would be a mistake to attribute this to just a combination of emerging energy realities plus Donald Trump and his long-standing support of fossil fuels and opposition to climate catastrophism. The new Trump administration has itself been hugely influenced, by not just reality but reframing.

Note that, notwithstanding the first Trump administration doing many good things on energy, the second Trump administration is on a completely different level in terms of making unleashing energy—including opposing climate catastrophism—a central, overarching, and intransigent focus.

For example, on the climate catastrophism issue, the first Trump administration chose not to take on the EPA “endangerment” finding at the root of much of US anti-fossil-fuel policy, while the second Trump administration made it an immediate priority.

The first Trump administration was significantly influenced by figures sympathetic to climate catastrophism, such as David Banks, a Republican “climate hawk” who advocated participation in the Paris climate framework. The second Trump administration, by contrast, is consistently at war against climate catastrophism and obsessed with unleashing American energy, above all American fossil fuel energy.

Reality certainly plays a big role here. This administration’s energy leaders, like many of us, have seen the destructive consequences of the Biden energy policies and their more consistent equivalents in Europe. They saw Europe deindustrializing and dangerously dependent on Russian natural gas. They saw catastrophic blackouts in California and Texas. And above all they saw AI emerging and our grid, handicapped by two decades of anti-fossil-fuel policies, totally unequipped to handle it.

But crucially, they’ve seen these developments through the frame of energy humanism, which has given them a level of intransigence that would otherwise be impossible.

Energy humanism in this administration is most obvious with the Secretary of Energy, Chris Wright, himself one of the top 10 energy humanist intellectuals in the world (we debated some climate catastrophists together back in 2015). Wright courageously challenged anti-fossil-fuel ESG thinking at its peak of popularity and countering cowardly “sustainability” ESG reports with his own pro-fossil-fuel “Bettering Human Lives” report that focused on all the good his and other fossil fuel companies did.

It’s not just Chris Wright, though. The new Administration is permeated by energy humanists. Doug Burgum, who is both Secretary of the Interior and Chairman of the National Energy Dominance Council, has long adopted the energy humanist approach as a very pro-energy Governor of North Dakota.

When I spoke at a North Dakota event in 2023, Burgum introduced me and specifically highlighted philosophy and ideology: “This guy gets it. He’s a philosopher. He’s helping leaders to set policy, to understand the words that work to help describe and push back against this ideology that’s trying to basically undermine our grid, undermine our economics, and undermine our national security.”

Beyond Burgum and Wright, there are literally hundreds of people in the Administration and Congress that I know for a fact have been significantly influenced by energy humanism.

Thanks to energy humanism permeating the Trump administration and Congress, a confident, pro-human advocacy of fossil fuels and a disdain for climate catastrophism emanates from DC and makes it a lot easier for new people to speak up from the same perspective. This, along with the reality of the anti-fossil-fuel movement’s energy failures and the overall growth of energy humanism, is the context in which Bill Gates wrote his memo.

The Gates memo is a major new ratcheting of the energy humanist position breaking the anti-fossil-fuel moral monopoly

Much commentary on the Gates memo describes it as Gates changing his mind on energy and climate issues.

But, having closely followed Gates’s thinking for quite some time, I don’t think Gates’s mind has meaningfully changed about the truth of how to think about, and make policy on, fossil fuels and climate. In fact, I think he’s long disagreed with climate catastrophism and believed in humanism to a greater extent than even his recent memo conveys.

What is notable about Gates’s memo isn’t a mind change but an incentive change. The intellectual, political, and economic environment has changed a lot, to the point where Bill Gates now considers it acceptable and even advantageous to tell more of the truth about his views.

Make no mistake, Bill Gates is an incredibly calculating person. It has been a big cause of his business success and it’s the reason why his public comments about energy and climate shift with the winds.

E.g., in 2016, before peak “net zero”, he was willing to be critical of solar and wind’s deficiencies but during peak “net zero” he warned of looming climate disaster and chose to publish a book “How to Avoid a Climate Disaster.” He funded The Guardian, a leading source of anti-fossil-fuel propaganda and climate catastrophism. And he participated in the whole international anti-fossil-fuel “climate change” movement financially and intellectually with little criticism of its anti-human and ultimately murderous quest to rapidly eliminate fossil fuels in a world that needs far more energy.

But now that we’re in an AI era where Gates’s business interests require a lot more fossil fuels—and everyone else’s in his orbit do, too—and the administration loves fossil fuels and hates climate catastrophism—and energy humanism has become a more acceptable position—Gates feels comfortable explicitly advocating a humanistic perspective and opposing climate catastrophism.

Here’s the great thing about that: Because of Gates’s status, above all in the international climate world where energy humanism has least taken hold, Gates’s memo will make it far easier for some key people to tell the truth.

What’s happening here is a major ratcheting in energy humanism breaking the anti-fossil-fuel moral monopoly.

Moral monopolies don’t get broken all at once, even if there is sufficient understanding among influential people to break them because many of those who understand are so disincentivized from speaking up. The more absolute the moral monopoly, the higher cost there is to challenging it.

The early challengers will be ignored, marginalized, or, if they can manage to get a hearing, demonized. But the early challengers, if persuasive and at all popular, make it just a little easier for the next round of challengers to speak up. And once the next round speaks up, it’s a little easier for the next round. And so on.

If the moral monopoly is invalid and the challenger is valid, as is the case for anti-fossil-fuels vs. energy humanism, each successive wave of prominent challengers has a ratcheting effect—it sticks in a way that can’t be pushed back, because the once-suppressed basic truths, now seen, can’t be unseen. The only direction to go is forward.

Bill Gates speaking up for a human-centered approach to GHG emissions is a major ratchet. He’s said something explicit that is very hard to argue with: “We should measure success by our impact on human welfare more than our impact on the global temperature,” which means we should reject “climate policies” where “human welfare takes a backseat to lowering emissions, with bad consequences.”

Even if/when certain parts of the incentive environment change (e.g., a new Administration) it’s hard to imagine Gates reversing his position.

But it’s very easy to imagine, even inevitable, that Gates’s new stance will make it easier—much easier—for the next influencers to challenge and help break the anti-fossil-fuel moral monopoly.

In the tech world, legendary software engineer and entrepreneur “DHH”—David Heinemeier Hansson”—showcased this by responding to a commentary about the Gates memo by energy humanist Lucy Biggers (who I’m proud to share has credited Fossil Future for heavily influencing her thinking) with far better comments than Gates’s.

“Europe would do well to follow Gates on this pivot. The EU is responsible for just 6% of global emissions, but still thinks it’s saving the planet by sorting and washing trash by hand, forgoing AC, or deleting emails (lol). Climate doomerism is degrowth nonsense in a nutshell.”

When asked, “If the West doesn’t lead by example, do we think the rest of the world will follow?” DHH answered:

“There’s no example to lead for. The Eurobrain is focused on degrowth, limiting energy use, and virtue-signaling trash sorting. None of that is worth imitating. We should be focused on abundant energy, economic expansion, and embracing technology (like trash sorting robots).”

As far as I can tell, DDH has long held these views, but only started voicing them this year with the Gates memo unleashing a new level of directness. I am looking forward to more tech leaders making such comments. But what I’m looking forward to most of all is what happens in international goal-setting and policy-making.

Energy humanist ratcheting in international climate politics

The core of our energy problems is the international anti-fossil-fuel movement, led by the UN.

As I’ve argued over the years, this is a deeply anti-human and irrational movement that legitimatizes itself by engaging with a lot of good climate science (in addition to bad) under the auspices of the Intergovernmental Panel on Climate Change (IPCC).

Of all the parts of what I call “the knowledge system,” international climate politics has proven the most immune to energy humanism—in my view due to how entrenched its leaders’ statuses are based on climate catastrophism and the fact that from its founding it has attracted power-lusting anti-humanists (the current UN Secretary General is a good example).

It’s hard to imagine many people who could directly break this part of the anti-fossil-fuel moral monopoly with energy humanism. But Bill Gates, as the world’s leading philanthropist, who both gives huge amounts of money and influences many other billionaires, is in a unique position to disrupt things.

As evidence, him writing a long blog post just totally overtook international media and will surely be a central topic at the upcoming COP 30 climate conference in Brazil.

In my view the enduring effect of Gates’s memo will not primarily be its conclusions (which, while better than the anti-fossil-fuel movement’s, are very flawed and based on very sloppy analysis), but its reframing of the energy and climate conversation around the goal and standard of increasing human welfare.

“…our climate strategies need to prioritize human welfare. This may seem obvious—who could be against improving people’s lives?—but sometimes human welfare takes a backseat to lowering emissions, with bad consequences.”

In Fossil Future I discuss my “thrilling discovery” of the power of reframing: “I could do something relatively easy”—getting agreement with an idea that’s common sense but not common practice in a given discussion—“that would then frame the conversation in a way that would make it far easier for the other person to understand and agree with my evaluation of fossil fuels.”

For example, when discussions of energy and climate issues are explicitly reframed in terms of is overall best for “human welfare” (or the term I prefer, “human flourishing”) listeners are far more likely to actually look at the pros and cons of fossil fuels for human life vs. just treat their climate side-effects as an infinite evil to be eliminated at all costs.

Bill Gates is now doing this reframing in the belly of the beast, international climate politics—the most influential and anti-human part of the moral monopoly against fossil fuels.

What will happen now that human-centered framing is explicitly part of international climate politics?

It’ll be positive no matter what, but as computer legend Alan Kay said, “The best way to predict the future is to invent it.” Here’s what I think we need to do next to make the future better.

Be very happy—but don’t be or act remotely satisfied

A common response I saw to the Gates memo was some kind of declaration of victory or at least satisfaction because of the degree of Gates’s public shift away from climate catastrophism.

But note that Gates is still quite anti-fossil-fuels. And in any case, the deadly anti-fossil-fuel movement still dominates leading institutions around the world.

I believe being satisfied when so much more progress is needed is a big mistake that comes from what I call “the moral outcast posture.”

Those of us who have been against the anti-fossil-fuel moral monopoly have been frequently treated as outcasts—“climate change deniers,” “delayers,” etc. And people in the fossil fuel industry were for a long time treated similarly when they interacted with those outside the industry.

When one gets treated this badly, it’s easy to internalize the idea that one is somehow naturally an outcast. This manifests in a “moral outcast posture” wherein one acts like their mistreatment by others is somehow okay and deserved, and where better treatment is met with gratitude and satisfaction.

The outcast posture is particularly understandable among people who are pro-fossil-fuels but don’t know inside-out how anti-human and irrational the anti-fossil-fuel position is. (Many in the industry fit this description.)

Since I’ve been fortunate enough to spend 18 years thinking honestly about energy issues, I have been able to avoid the moral outcast posture. I think I’ve felt about being pro-fossil-fuels the way abolitionists felt about supporting freedom from slavery in the early 1800s. Even though so many disagree with me on fossil fuels, I believe deeply that it’s a product of them being locked in a false and anti-human framework that will one day be rightly seen as wrong.

When the mainstream makes a concession in the direction I believe is true, I’m happy for the progress. But I’m not satisfied—because the mainstream is still really wrong.

That’s how I feel about Bill Gates’s memo in particular and the state of energy and climate politics in general. It’s still really, really bad—for example, ignoring most of fossil fuels’ benefits, including climate-related benefits—and energy humanism is really, really good.

I believe that this intransigent support of energy humanism in general and fossil fuels in particular is what has gotten the ratcheting I am happy about now, and saying it going forward will be crucial for future ratcheting.

It’s people like Chris Wright, Bjorn Lomborg (evidence shows he’s the most influential energy humanist on Gates), and, yes, me. It’s people who said there was a moral case for fossil fuels and a fossil future, not the people who said, “Fossil fuels aren’t quite as bad as they used to be” or “Fossil fuels aren’t quite as bad as you think.”

Now that we are winning, we need to keep fighting harder. Ratcheting becomes easier over time, because there’s a lower and lower penalty for speaking the truth, so now is the time to step on the gas.

Personally, I will soon systematically refute all the bad things in the Gates memo and argue that while its basic moral framework is rightly humanistic, its analysis is biased, sloppy, and gives a lot of bad guidance. I will continue to call on COP to fundamentally change (or disband), not just shift a little bit—and encourage political and cultural leaders to do the same.

I encourage you to share these and other resources widely while we benefit from not just the Gates ratcheting (which should endure) but media momentum (which doesn’t last long). And, crucially, when you’re sharing good resources make clear that you agree with Bill Gates’s framing that we need to think about energy and climate issues from the perspective of advancing human flourishing on Earth, not minimizing human impact on Earth.

Here are some talking points to get started with.

- The irrefutable case for a Fossil Future

- Every “net zero by 2050” myth, refuted

- Energy Sound Bites on Fossil Fuels, parts 1, 2, and 3

So, fellow energy humanists. Let’s be very happy with the victories we’ve won. But let’s not be satisfied until the world consistently thinks and acts in a pro-human way toward energy: the industry that powers every other industry, the technology that powers every other technology, and a fundamental requirement of global human flourishing.

Questions about this article? Ask AlexAI, my chatbot for energy and climate answers:

Popular links

- EnergyTalkingPoints.com: Hundreds of concise, powerful, well-referenced talking points on energy, environmental, and climate issues.

- My new book Fossil Future: Why Global Human Flourishing Requires More Oil, Coal, and Natural Gas—Not Less.

- Speaking and media inquiries

“Energy Talking Points by Alex Epstein” is my free Substack newsletter designed to give as many people as possible access to concise, powerful, well-referenced talking points on the latest energy, environmental, and climate issues from a pro-human, pro-energy perspective.

-

Crime2 days ago

Crime2 days agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Business1 day ago

Business1 day agoCarney government should retire misleading ‘G7’ talking point on economic growth

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoB.C. government laid groundwork for turning private property into Aboriginal land

-

Alberta1 day ago

Alberta1 day agoCanada’s heavy oil finds new fans as global demand rises

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoPro-freedom group warns Liberal bill could secretly cut off Canadians’ internet access

-

Brownstone Institute20 hours ago

Brownstone Institute20 hours agoBizarre Decisions about Nicotine Pouches Lead to the Wrong Products on Shelves

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoA Story So Good Not Even The Elbows Up Crew Could Ruin It

-

Justice2 days ago

Justice2 days agoA Justice System That Hates Punishment Can’t Protect the Innocent