Business

Federal government should tackle Canada’s productivity crisis in upcoming budget

From the Fraser Institute

In late-2014, per-person gross domestic product (GDP), a common indicator of living standards, stood at $58,162 (adjusted for inflation). By the end of 2023 it was actually slightly lower. This means Canadian living standards haven’t increased in a decade.

In a recent speech, the Bank of Canada’s senior deputy governor highlighted the risk posed by chronically sluggish productivity growth to the country’s living standards. She also noted that stalled productivity makes it harder to reduce inflation and keep it at (or close to) the Bank’s 2 per cent target.

Productivity is conventionally defined as the value of economic output per hour of work. Over time, it’s the most important determinant of overall economic growth. In a mainly market-based economy such as Canada’s, particular attention should be paid to the productivity performance of the business sector.

Unfortunately, here the news isn’t good.

Business sector productivity has flatlined in Canada, with the level of output per hour worked essentially unchanged from seven years ago. This pattern of productivity stagnation, in turn, is the principal reason why the value of economic output per person has stalled in Canada. In late-2014, per-person gross domestic product (GDP), a common indicator of living standards, stood at $58,162 (adjusted for inflation). By the end of 2023 it was actually slightly lower. This means Canadian living standards haven’t increased in a decade. That’s not a picture any Canadian citizen or policymaker should be happy about.

For many people, GDP is an abstract concept that doesn’t easily map to their lived experience. But the level and rate of growth of GDP clearly matter to the wellbeing of citizens. Academic studies confirm that worker wages are based in part on the productivity level of their employers. Put simply, the most productive businesses generally pay higher wages, salaries and benefits.

Moreover, over time individual and household incomes can only grow if the economy itself generates more output per hour of work and per person. When per-person GDP increases by 2 per cent a year (after inflation), average income doubles within 35 years. With 1 per cent annual growth in per-person GDP, it takes 70 years. At 0.5 per cent growth in per-person GDP, 139 years must pass before the average income will double. In Canada, per-person GDP has been declining outright, an alarming and unusual trend.

Addressing Canada’s productivity crisis should be job one for the federal government’s 2024 budget, which the Trudeau government will table on April 16. In the early 1980s, Canada was roughly 88 per cent as productive as the United States, measured by the value of output per hour of work across the economy. By 2022, that figure had dropped to 71 per cent, and it’s continued to decline since then.

What can be done? So far, the Trudeau government has relied on population growth fuelled by high levels of immigration to drive economic growth. That strategy has manifestly failed, as the government itself recently (if sheepishly) acknowledged by dialing back the numbers of non-permanent immigrants who will be admitted to the country.

A smarter approach is to boost investment in the things that make businesses and workers more productive—machinery, equipment, digital tools and technologies, intellectual property, up-to-date transportation and communications infrastructure, and research and development focused on bringing innovative products and ideas to market, rather than keeping them in the lab or in academic institutions. Canada’s record is poor in most of these areas, as evidenced by the fact we trail far behind the U.S. and many European countries in the level of business investment per employee.

That will need to change if we hope to up our game on productivity and lay the foundations for a more prosperous Canada.

Author:

Business

China, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

Sam Cooper

Sam Cooper

The U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) has identified $1.4 billion in fentanyl-linked suspicious transactions, naming China, Mexico, Canada, and India as key foreign touchpoints in the global production and laundering network. The analysis, based on 1,246 Bank Secrecy Act filings submitted in 2024, tracks financial activity spanning chemical purchases, trafficking logistics, and international money laundering operations.

The data reveals that Mexico and the People’s Republic of China were the two most frequently named foreign jurisdictions in financial intelligence gathered by FinCEN. Most of the flagged transactions originated in U.S. cities, the report notes, due to the “domestic nature” of Bank Secrecy Act data collection. Among foreign jurisdictions, Mexico, China, Hong Kong, and Canada were cited most often in fentanyl-related financial activity.

The FinCEN report points to Mexico as the epicenter of illicit fentanyl production, with Mexican cartels importing precursor chemicals from China and laundering proceeds through complex financial routes involving U.S., Canadian, and Hong Kong-based actors.

The findings also align with testimony from U.S. and Canadian law enforcement veterans who have told The Bureau that Chinese state-linked actors sit atop a decentralized but industrialized global fentanyl economy—supplying precursors, pill presses, and financing tools that rely on trade-based money laundering and professional money brokers operating across North America.

“Filers also identified PRC-based subjects in reported money laundering activity, including suspected trade-based money laundering schemes that leveraged the Chinese export sector,” the report says.

A point emphasized by Canadian and U.S. experts—including former U.S. State Department investigator Dr. David Asher—that professional Chinese money laundering networks operating in North America are significantly commanded by Chinese Communist Party–linked Triad bosses based in Ontario and British Columbia—is not explored in detail in this particular FinCEN report.¹

Chinese chemical manufacturers—primarily based in Guangdong, Zhejiang, and Hebei provinces—were repeatedly cited for selling fentanyl precursors via wire transfers and money service businesses. These sales were often facilitated through e-commerce platforms, suggesting that China’s global retail footprint conceals a lethal underground market—one that ultimately fuels a North American public health crisis. In many cases, the logistics were sophisticated: some Chinese companies even offered delivery guarantees and customs clearance for precursor shipments, raising red flags for enforcement officials.

While China’s industrial base dominates the global fentanyl supply chain, Mexican cartels are the next most prominent state-like actors in the ecosystem—but the report emphasizes that Canada and India are rising contributors.

“Subjects in other foreign countries—including Canada, the Dominican Republic, and India—highlight the presence of alternative suppliers of precursor chemicals and fentanyl,” the report says.

“Canada-based subjects were primarily identified by Bank Secrecy Act filers due to their suspected involvement in drug trafficking organizations allegedly sourcing fentanyl and other drugs from traditional drug source countries, such as Mexico,” it explains, adding that banking intelligence “identified activity indicative of Canada-based individuals and companies purchasing precursor chemicals and laboratory equipment that may be related to the synthesis of fentanyl in Canada. Canada-based subjects were primarily reported with addresses in the provinces of British Columbia and Ontario.”

FinCEN also flagged activity from Hong Kong-based shell companies—often subsidiaries or intermediaries for Chinese chemical exporters. These entities were used to obscure the PRC’s role in transactions and to move funds through U.S.-linked bank corridors.

Breaking down the fascinating and deadly world of Chinese underground banking used to move fentanyl profits from American cities back to producers, the report explains how Chinese nationals in North America are quietly enlisted to move large volumes of cash across borders—without ever triggering traditional wire transfers.

These networks, formally known as Chinese Money Laundering Organizations (CMLOs), operate within a global underground banking system that uses “mirror transfers.” In this system, a Chinese citizen with renminbi in China pays a local broker, while the U.S. dollar equivalent is handed over—often in cash—to a recipient in cities like Los Angeles or New York who may have no connection to the original Chinese depositor aside from their role in the laundering network. The renminbi, meanwhile, is used inside China to purchase goods such as electronics, which are then exported to Mexico and delivered to cartel-linked recipients.

FinCEN reports that US-based money couriers—often Chinese visa holders—were observed depositing large amounts of cash into bank accounts linked to everyday storefront businesses, including nail salons and restaurants. Some of the cash was then used to purchase cashier’s checks, a common method used to obscure the origin and destination of the funds. To banks, the activity might initially appear consistent with a legitimate business. However, modern AI-powered transaction monitoring systems are increasingly capable of flagging unusual patterns—such as small businesses conducting large or repetitive transfers that appear disproportionate to their stated operations.

On the Mexican side, nearly one-third of reports named subjects located in Sinaloa and Jalisco, regions long controlled by the Sinaloa Cartel and Cartel Jalisco Nueva Generación. Individuals in these states were often cited as recipients of wire transfers from U.S.-based senders suspected of repatriating drug proceeds. Others were flagged as originators of payments to Chinese chemical suppliers, raising alarms about front companies and brokers operating under false pretenses.

The report outlines multiple cases where Mexican chemical brokers used generic payment descriptions such as “goods” or “services” to mask wire transfers to China. Some of these transactions passed through U.S.-based intermediaries, including firms owned by Chinese nationals. These shell companies were often registered in unrelated sectors—like marketing, construction, or hardware—and exhibited red flags such as long dormancy followed by sudden spikes in large transactions.

Within the United States, California, Florida, and New York were most commonly identified in fentanyl-related financial filings. These locations serve as key hubs for distribution and as collection points for laundering proceeds. Cash deposits and peer-to-peer payment platforms were the most cited methods for fentanyl-linked transactions, appearing in 54 percent and 51 percent of filings, respectively.

A significant number of flagged transactions included slang terms and emojis—such as “blues,” “ills,” or blue dots—in memo fields. Structured cash deposits were commonly made across multiple branches or ATMs, often linked to otherwise legitimate businesses such as restaurants, salons, and trucking firms.

FinCEN also tracked a growing number of trade-based laundering schemes, in which proceeds from fentanyl sales were used to buy electronics and vaping devices. In one case, U.S.-based companies owned by Chinese nationals made outbound payments to Chinese manufacturers, using funds pooled from retail accounts and shell companies. These goods were then shipped to Mexico, closing the laundering loop.

Another key laundering method involved cryptocurrency. Nearly 10 percent of all fentanyl-related reports involved virtual currency, with Bitcoin the most commonly cited, followed by Ethereum and Litecoin. FinCEN flagged twenty darknet marketplaces as suspected hubs for fentanyl distribution and cited failures by some digital asset platforms to catch red-flag activity.

Overall, FinCEN warns that fentanyl-linked funds continue to enter the U.S. financial system through loosely regulated or poorly monitored channels, even as law enforcement ramps up enforcement. The Drug Enforcement Administration reported seizures of over 55 million counterfeit fentanyl pills in 2024 alone.

The broader pattern is unmistakable: precursor chemicals flow from China, manufacturing occurs in Mexico, Canada plays an increasing role in chemical acquisition and potential synthesis, and drugs and proceeds flood into the United States, supported by global financial tools and trade structures. The same infrastructure that enables lawful commerce is being manipulated to sustain the deadliest synthetic drug crisis in modern history.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

2025 Federal Election

Canada drops retaliatory tariffs on automakers, pauses other tariffs

MxM News

MxM News

Quick Hit:

Canada has announced it will roll back retaliatory tariffs on automakers and pause several other tariff measures aimed at the United States. The move, unveiled by Finance Minister François-Philippe Champagne, is designed to give Canadian manufacturers breathing room to adjust their supply chains and reduce reliance on American imports.

Key Details:

- Canada will suspend 25% tariffs on U.S. vehicles for automakers that maintain production, employment, and investment in Canada.

- A broader six-month pause on tariffs for other U.S. imports is intended to help Canadian sectors transition to domestic sourcing.

- A new loan facility will support large Canadian companies that were financially stable before the tariffs but are now struggling.

Diving Deeper:

Ottawa is shifting its approach to the escalating trade war with Washington, softening its economic blows in a calculated effort to stabilize domestic manufacturing. On Tuesday, Finance Minister François-Philippe Champagne outlined a new set of trade policies that provide conditional relief from retaliatory tariffs that have been in place since March. Automakers, the hardest-hit sector, will now be eligible to import U.S. vehicles duty-free—provided they continue to meet criteria that include ongoing production and investment in Canada.

“From day one, the government has reacted with strength and determination to the unjust tariffs imposed by the United States on Canadian goods,” Champagne stated. “We’re giving Canadian companies and entities more time to adjust their supply chains and become less dependent on U.S. suppliers.”

The tariff battle, which escalated in April with Canada slapping a 25% tax on U.S.-imported vehicles, had caused severe anxiety within Canada’s auto industry. John D’Agnolo, president of Unifor Local 200, which represents Ford employees in Windsor, warned the BBC the situation “has created havoc” and could trigger a recession.

Speculation about a possible Honda factory relocation to the U.S. only added to the unrest. But Ontario Premier Doug Ford and federal officials were quick to tamp down the rumors. Honda Canada affirmed its commitment to Canadian operations, saying its Alliston facility “will operate at full capacity for the foreseeable future.”

Prime Minister Mark Carney reinforced the message that the relief isn’t unconditional. “Our counter-tariffs won’t apply if they (automakers) continue to produce, continue to employ, continue to invest in Canada,” he said during a campaign event. “If they don’t, they will get 25% tariffs on what they are importing into Canada.”

Beyond the auto sector, Champagne introduced a six-month tariff reprieve on other U.S. imports, granting time for industries to explore domestic alternatives. He also rolled out a “Large Enterprise Tariff Loan Facility” to support big businesses that were financially sound prior to the tariff regime but have since been strained.

While Canada has shown willingness to ease its retaliatory measures, there’s no indication yet that the U.S. under President Donald Trump will reciprocate. Nevertheless, Ottawa signaled its openness to further steps to protect Canadian businesses and workers, noting that “additional measures will be brought forward, as needed.”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

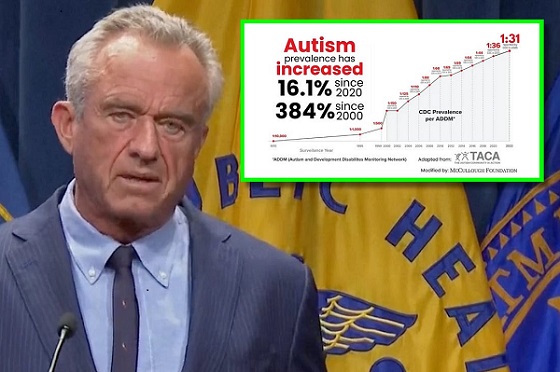

Autism2 days ago

Autism2 days agoAutism Rates Reach Unprecedented Highs: 1 in 12 Boys at Age 4 in California, 1 in 31 Nationally

-

Health2 days ago

Health2 days agoTrump admin directs NIH to study ‘regret and detransition’ after chemical, surgical gender transitioning

-

Also Interesting2 days ago

Also Interesting2 days agoBetFury Review: Is It the Best Crypto Casino?

-

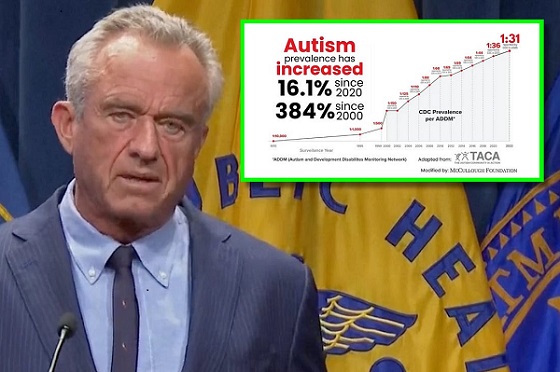

Autism1 day ago

Autism1 day agoRFK Jr. Exposes a Chilling New Autism Reality

-

COVID-191 day ago

COVID-191 day agoCanadian student denied religious exemption for COVID jab takes tech school to court

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBureau Exclusive: Chinese Election Interference Network Tied to Senate Breach Investigation

-

International1 day ago

International1 day agoUK Supreme Court rules ‘woman’ means biological female