Automotive

Federal government EV mandates destined to fail

From the Fraser Institute

By Julio Mejía, Elmira Aliakbari, and Jason Clemens

According to reports, the Trudeau government will soon unveil regulations meant to phaseout the sale of new internal combustion vehicles and compel Canadians to buy zero-emission vehicles. The Biden administration is also mandating a similar shift. But these initiatives overlook two realities—consumer preferences are not easily swayed by top-down government directives, and the unrealistic timeline for minerals crucial for electric vehicles (EV) raises serious doubts about the likelihood of success.

Specifically, according to the Trudeau government’s new regulations, all new passenger vehicles and light trucks sold in Canada must be electric zero-emission vehicles by 2035, with interim targets of 20 per cent by 2026 and 60 per cent by 2030. And the Biden administration has mandated that two-thirds of new vehicles sold in the United States must be electric by 2032.

And yet, despite multibillion-dollar subsidies and governmental efforts to promote EV adoption, consumers are not embracing them. In Canada, only 6.5 per cent (98,589) of the 1.5 million new vehicles sold in 2022 were electric, according to Statistics Canada. Achieving the Trudeau government’s 2026 target would require a rapid increase in EV sales to more than 300,000 in coming years and more than 900,000 in 2030 (assuming no change in total vehicle sales). Such rapid growth in a short timeframe is at best questionable.

South of the border, data from the U.S. Department of Energy indicates that, out of 283.5 million registered vehicles in 2022, EVs comprised a mere 0.9 per cent of total vehicle registrations. In response, automakers are making strategic business decisions. Ford, for example, is delaying the construction of $12 billion worth of EV production facilities, citing a lack of consumer demand. Similarly, General Motors is abandoning the goal of producing 400,000 EVs by mid-2024 due to lower-than-expected sales.

But even in the unlikely scenario of sudden shift in consumer preferences, production-side barriers loom large. For example, the extraction (i.e. mining) of lithium, nickel, manganese, cadmium, graphite, zinc and other rare-earth elements necessary for EVs requires a rapid and marked expansion.

According to a recent study, to meet international EV adoption mandates (including mandates in Canada and the U.S.) by 2030 the world would need 50 new lithium mines, 60 new nickel mines, 17 new cobalt mines, 50 new mines for cathode production, 40 new mines for anode materials, 90 new mines for battery cells, and 81 new mines for EV bodies and motors, for a total of 388 new mines worldwide. For context, in 2021 there were only 340 metal mines operating in Canada and the U.S.

And historically, the development of mining and refining facilities has been slow. Production timelines range from six to nine years for lithium and 13 to 18 years for nickel—two elements critical for EV batteries. The aggressive government timelines for EV adoption clash with historically sluggish metal and mineral production, raising the risk of EV manufacturers falling short of needed minerals.

Not only are consumers resistant to top-down regulations, but the ambitious short-term EV adoption mandates in Canada and the U.S. are on a collision course with the reality of metal and mineral production capacity. Simply put, it’s not at all clear that sufficient capacities will be available to produce enough EVs to achieve the mandates being imposed on Canadians and Americans, nor is it clear consumers in either country are willing to spend their own money to purchase them.

Authors:

Automotive

Canadians’ Interest in Buying an EV Falls for Third Year in a Row

From Energy Now

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index

Fewer Canadians are considering buying an electric vehicle, marking the third year in a row interest has dropped despite lower EV prices, a survey from AutoTrader shows.

Forty-two per cent of survey respondents say they’re considering an EV as their next vehicle, down from 46 per cent last year. In 2022, 68 per cent said they would consider buying an EV.

Meanwhile, 29 per cent of respondents say they would exclusively consider buying an EV — a significant drop from 40 per cent last year.

The report, which surveyed 1,801 people on the AutoTrader website, shows drivers are concerned about reduced government incentives, a lack of infrastructure and long-term costs despite falling prices.

Electric vehicle prices fell 7.8 per cent in the last quarter of 2024 year-over-year, according to the AutoTader price index.

The survey, conducted between Feb. 13 and March 12, shows 68 per cent of non-EV owners say government incentives could influence their decision, while a little over half say incentives increase their confidence in buying an EV.

Automotive

Hyundai moves SUV production to U.S.

MxM News

MxM News

Quick Hit:

Hyundai is responding swiftly to 47th President Donald Trump’s newly implemented auto tariffs by shifting key vehicle production from Mexico to the U.S. The automaker, heavily reliant on the American market, has formed a specialized task force and committed billions to American manufacturing, highlighting how Trump’s America First economic policies are already impacting global business decisions.

Key Details:

-

Hyundai has created a tariffs task force and is relocating Tucson SUV production from Mexico to Alabama.

-

Despite a 25% tariff on car imports that began April 3, Hyundai reported a 2% gain in Q1 operating profit and maintained earnings guidance.

-

Hyundai and Kia derive one-third of their global sales from the U.S., where two-thirds of their vehicles are imported.

Diving Deeper:

In a direct response to President Trump’s decisive new tariffs on imported automobiles, Hyundai announced Thursday it has mobilized a specialized task force to mitigate the financial impact of the new trade policy and confirmed production shifts of one of its top-selling models to the United States. The move underscores the gravity of the new 25% import tax and the economic leverage wielded by a White House that is now unambiguously prioritizing American industry.

Starting with its popular Tucson SUV, Hyundai is transitioning some manufacturing from Mexico to its Alabama facility. Additional consideration is being given to relocating production away from Seoul for other U.S.-bound vehicles, signaling that the company is bracing for the long-term implications of Trump’s tariffs.

This move comes as the 25% import tax on vehicles went into effect April 3, with a matching tariff on auto parts scheduled to hit May 3. Hyundai, which generates a full third of its global revenue from American consumers, knows it can’t afford to delay action. Notably, U.S. retail sales for Hyundai jumped 11% last quarter, as car buyers rushed to purchase vehicles before prices inevitably climb due to the tariff.

Despite the trade policy, Hyundai reported a 2% uptick in first-quarter operating profit and reaffirmed its earnings projections, indicating confidence in its ability to adapt. Yet the company isn’t taking chances. Ahead of the tariffs, Hyundai stockpiled over three months of inventory in U.S. markets, hoping to blunt the initial shock of the increased import costs.

In a significant show of good faith and commitment to U.S. manufacturing, Hyundai last month pledged a massive $21 billion investment into its new Georgia plant. That announcement was made during a visit to the White House, just days before President Trump unveiled the auto tariff policy — a strategic alignment with a pro-growth, pro-America agenda.

Still, the challenges are substantial. The global auto industry depends on complex, multi-country supply chains, and analysts warn that tariffs will force production costs higher. Hyundai is holding the line on pricing for now, promising to keep current model prices stable through June 2. After that, however, price adjustments are on the table, potentially passing the burden to consumers.

South Korea, which remains one of the largest exporters of automobiles to the U.S., is not standing idle. A South Korean delegation is scheduled to meet with U.S. trade officials in Washington Thursday, marking the start of negotiations that could redefine the two nations’ trade dynamics.

President Trump’s actions represent a sharp pivot from the era of global corporatism that defined trade under the Obama-Biden administration. Hyundai’s swift response proves that when the U.S. government puts its market power to work, foreign companies will move mountains — or at least entire assembly lines — to stay in the game.

-

Business2 days ago

Business2 days agoIs Government Inflation Reporting Accurate?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s Hidden Climate Finance Agenda

-

2025 Federal Election2 days ago

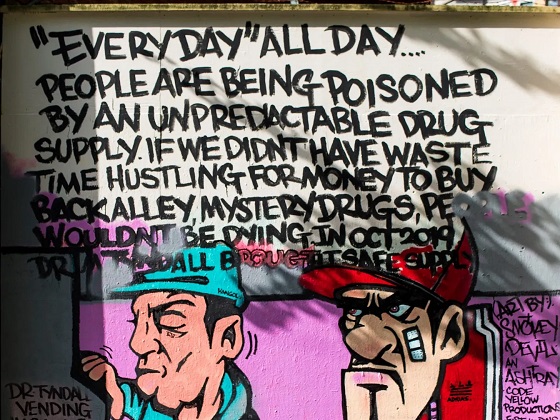

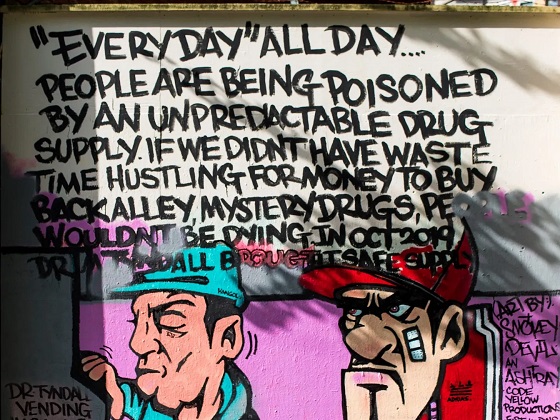

2025 Federal Election2 days agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoWhen it comes to pipelines, Carney’s words flow both ways

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPolls say Canadians will give Trump what he wants, a Carney victory.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCarney Liberals pledge to follow ‘gender-based goals analysis’ in all government policy

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre’s Conservatives promise to repeal policy allowing male criminals in female jails

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoTrump Has Driven Canadians Crazy. This Is How Crazy.