Business

Fed executive pay rises $571 million since 2015

From the Canadian Taxpayers Federation

Author: Ryan Thorpe

Executive compensation in the federal government spiked by more than half-a-billion dollars since 2015, according to access-to-information records obtained by the Canadian Taxpayers Federation.

From 2015 to 2022, executive compensation across federal departments and agencies rose from $1.38 billion to $1.95 billion – an increase of 41 per cent. Meanwhile, the number of federal executives grew from 7,138 to 9,371 – an increase of 31 per cent.

Inflation increased by 19.4 per cent between 2015 and 2022, according to Statistics Canada data.

The average annual compensation among federal executives also rose from $193,600 to $208,480 during that period.

“Taxpayers need help with the rising cost of living, not higher taxes to pay for more highly paid paper-pushers,” said Franco Terrazzano, CTF Federal Director. “It’s a safe bet that most Canadians struggling with grocery bills, heating bills and mortgage payments aren’t losing sleep worrying that government executives aren’t paid enough, so why is the government ballooning its c-suite?”

Table: Federal executive compensation, 2015 to 2022

|

Year (as of March) |

Number of executives |

Executive compensation |

|

2015 |

7,138 |

$1,381,987,936 |

|

2016 |

7,181 |

$1,406,613,900 |

|

2017 |

7,209 |

$1,410,973,156 |

|

2018 |

7,438 |

$1,460,468,760 |

|

2019 |

7,863 |

$1,555,972,489 |

|

2020 |

8,202 |

$1,692,682,269 |

|

2021 |

8,837 |

$1,836,893,134 |

|

2022 |

9,371 |

$1,953,667,640 |

The spike in federal c-suite pay follows years of underwhelming performance results across departments and agencies.

In 2022-23, federal departments hit just 50 per cent of their performance targets, according to data from the Treasury Board of Canada Secretariat. Each year from 2018 through 2021, federal departments met less than half of their performance targets.

“Less than 50 per cent of performance targets are consistently met within the same year,” according to a 2023 report from the Parliamentary Budget Officer, the government’s independent budget watchdog.

About 90 per cent of federal executives get a bonus each year, according to records obtained by the CTF. The feds handed out $202 million in bonuses in 2022, with the average bonus among executives being $18,252.

The feds handed out $1.3 billion in bonuses since 2015. The annual cost to taxpayers for federal bonuses has risen by 46 per cent during that time.

The number of employees receiving a six-figure annual salary has more than doubled under Prime Minister Justin Trudeau.

A total of 102,761 federal bureaucrats received a six-figure salary in 2022, according to access-to-information records obtained by the CTF. When Trudeau came to power in 2015, 43,424 federal bureaucrats were collecting a six-figure salary.

The feds also handed out more than 800,000 raises between 2020 and 2022. With the feds employing about 400,000 bureaucrats, that means multiple employees received more than one raise in recent years.

Under the Trudeau government, the size of the federal bureaucracy has spiked by about 40 per cent, with more than 98,000 new hires.

“In the last couple years, taxpayers have paid for tens of thousands of new bureaucrats, hundreds of thousands of pay raises and hundreds of millions in bonuses, and we’re still getting poor performance from the bureaucracy,” Terrazzano said. “Trudeau needs to take air out of the ballooning bureaucracy, and he should start by reining in the c-suite.”

2025 Federal Election

POLL: Canadians want spending cuts

By Gage Haubrich

By Gage Haubrich

The Canadian Taxpayers Federation released Leger polling showing Canadians want the federal government to cut spending and shrink the size and cost of the bureaucracy.

“The poll shows most Canadians want the federal government to cut spending,” said Gage Haubrich, CTF Prairie Director. “Canadians know they pay too much tax because the government wastes too much money.”

Between 2019 and 2024, federal government spending increased 26 per cent even after accounting for inflation. Leger asked Canadians what they think should happen to federal government spending in the next five years. Results of the poll show:

- 43 per cent say reduce spending

- 20 per cent say increase spending

- 16 per cent say maintain spending

- 20 per cent don’t know

The federal government added 108,000 bureaucrats and increased the cost of the bureaucracy 73 per cent since 2016. Leger asked Canadians what they think should happen to the size and cost of the federal bureaucracy. Results of the poll show:

- 53 per cent say reduce

- 24 per cent say maintain

- 4 per cent say increase

- 19 per cent don’t know

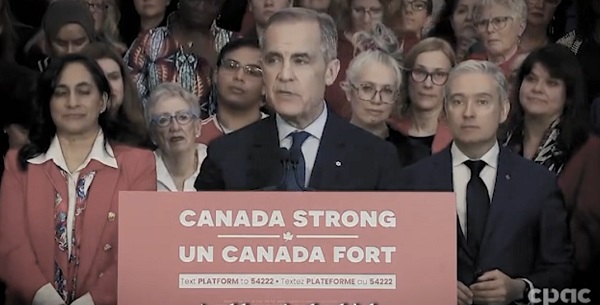

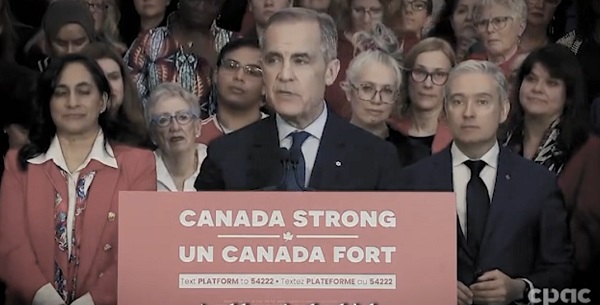

Liberal Leader Mark Carney promised to “balance the operating budget in three years.” Leger asked Canadians if they believed Carney’s promise to balance the budget. Results of the poll show:

- 58 per cent are skeptical

- 32 per cent are confident

- 10 per cent don’t know

“Any politician that wants to fix the budget and cut taxes will need to shrink the size and cost of Ottawa’s bloated bureaucracy,” Haubrich said. “The polls show Canadians want to put the federal government on a diet and they won’t trust promises about balancing the budget unless politicians present credible plans.”

2025 Federal Election

Carney’s budget means more debt than Trudeau’s

The Canadian Taxpayers Federation is criticizing Liberal Party Leader Mark Carney’s budget plan for adding another $225 billion to the debt.

“Carney plans to borrow even more money than the Trudeau government planned to borrow,” said Franco Terrazzano, CTF Federal Director. “Carney claims he’s not like Trudeau and when it comes to the debt, here’s the truth: Carney’s plan is billions of dollars worse than Trudeau’s plan.”

Today, Carney released the Liberal Party’s “fiscal and costing plan.” Carney’s plan projects the debt to increase consistently.

Here is the breakdown of Carney’s annual budget deficits:

- 2025-26: $62 billion

- 2026-27: $60 billion

- 2027-28: $55 billion

- 2028-29: $48 billion

Over the next four years, Carney plans to add an extra $225 billion to the debt. For comparison, the Trudeau government planned on increasing the debt by $131 billion over those years, according to the most recent Fall Economic Statement.

Carney’s additional debt means he will waste an extra $5.6 billion on debt interest charges over the next four years. Debt interest charges already cost taxpayers $54 billion every year – more than $1 billion every week.

“Carney’s debt binge means he will waste $1 billion more every year on debt interest charges,” Terrazzano said. “Carney’s plan isn’t credible and it’s even more irresponsible than the Trudeau plan.

“After years of runaway spending Canadians need a government that will cut spending and stop wasting so much money on debt interest charges.”

-

Alberta2 days ago

Alberta2 days agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNo Matter The Winner – My Canada Is Gone

-

Health2 days ago

Health2 days agoHorrific and Deadly Effects of Antidepressants

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCampaign 2025 : The Liberal Costed Platform – Taxpayer Funded Fiction

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoA Perfect Storm of Corruption, Foreign Interference, and National Security Failures