From The Center Square

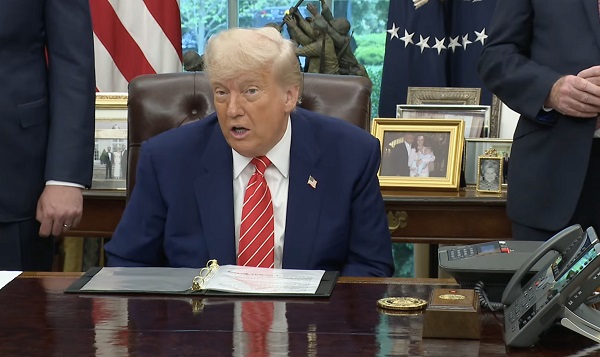

Seeking to reorder global trade with America at the center, President Donald Trump announced the framework of a trade deal with the United Kingdom on Thursday.

Prime Minister Keir Starmer, since 2024 leader of a nation that maintains a special relationship with the U.S. including a more even trade balance than with other countries, spoke with the president by phone during an Oval Office meeting Thursday morning.

“This is turning out to be a great deal for both countries,” Trump said.

The 78-year-old second-term Republican president said the deal would improve market access for U.S. products in the United Kingdom, and improve the relationship between the two countries. Trump said it was the first of many deals from his trade team.

The 62-year-old leader of the Labour Party said the deal would create new jobs in both nations.

“We can finishing ironing out some of the details, but there’s a fantastic platform here,” Starmer said, calling the deal “historic.”

Commerce Secretary Howard Lutnick said the U.S. has balanced trade with the United Kingdom. Lutnick said it would add $5 billion in market access to the U.S. Lutnick said the United Kingdom would get a 10% tariff on 100,000 automobile imports to the U.S., lower than the 25% tariff on foreign autos for other nations.

Lutnick said the lower tariff would protect jobs in the UK.

On social media, Trump wrote, “Today is an incredible day for America as we deliver our first Fair, Open, and Reciprocal Trade Deal – Something our past Presidents never cared about. Together with our strong Ally, the United Kingdom, we have reached the first, historic Trade Deal since Liberation Day. As part of this Deal, America will raise $6 BILLION DOLLARS in External Revenue from 10% Tariffs, $5 BILLION DOLLARS in new Export Opportunities for our Great Ranchers, Farmers, and Producers, and enhance the National Security of both the U.S. and the UK through the creation of an Aluminum and Steel Trading Zone, and a secure Pharmaceutical Supply Chain. This Deal shows that if you respect America, and bring serious proposals to the table, America is OPEN FOR BUSINESS. Many more to come — STAY TUNED!”

Trump announced a slate of higher tariffs on foreign nations on April 2, which he dubbed “Liberation Day” for American trade. On April 9, Trump paused those higher rates for 90 days to give his trade team time to make deals with other countries.

When Trump temporarily suspended the higher tariffs on April 9, he kept a 10% baseline tariff in place along with a 25% import duty on foreign autos and auto parts. He also kept 25% tariffs on foreign steel and aluminum.

Trump also imposed 145% tariffs on China, which retaliated with 125% tariffs on U.S. goods. Those tariffs remain in place, although the two nations are set to begin talks this weekend.

Economists, businesses and many publicly-traded companies have warned that tariffs could raise prices on a wide range of consumer products.

Trump has said he wants to use tariffs to restore manufacturing jobs lost to lower-wage countries in decades past, shift the tax burden away from American families, and pay down the national debt.

A tariff is a tax on imported goods. The importer pays the tax and can either absorb the loss or pass the cost on to consumers through higher prices