Business

ESG will impose considerable harm on Canadian workers, doesn’t reflect the reality of how markets actually work

From the Fraser Institute

By Steven Globerman, Jack Mintz, and Bryce Tingle

The ESG movement—which calls for public companies and investors in public companies to identify and voluntarily implement environmental, social, and governance initiatives—will cause substantial harm to the economy and

workers, finds two new essays by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Investor support for ESG is starting to wane, which isn’t surprising as the considerable harms ESG mandates pose come to light,” said Steven Globerman, resident scholar at the Fraser Institute and author of It’s Time to Move on from ESG.

The essay summarizes the arguments against imposing top-down ESG mandates. In particular, evidence shows that (1) ESG-branded investment funds do not perform better than conventional investment funds, (2) companies that proclaim to pursue ESG-related activities are not more profitable than companies that do not, and (3) mandating ESG-related corporate disclosures imposes additional costs on public companies and diverts resources away from productivity-enhancing investments, harming workers.

A separate new essay in the Institute’s series on ESG, Putting Economics Back into ESG written by Jack Mintz and Bryce Tingle of the University of Calgary, highlights how the current concept of ESG mandates being pursued in Canada are incompatible with basic economic theory and fail to understand how markets actually work. As a result, ESG mandates will (1) discourage new businesses from locating in Canada, (2) investors will be reluctant to invest in Canada, (3) Canadian companies will be less competitive than their international peers, (4) capital will leave Canada for jurisdictions without restrictive ESG mandates, and (5) economic growth will slow and workers will suffer as a result.

But these harms can be minimized if the definition of what constitutes ESG is expanded, securities commissions are not tasked with regulating ESG, but instead focus on ensuring market integrity, and if governments prosecute fraud in ESG branded funds, and likewise, governments impose liability for the use of ESG ratings, which have been found to be invalid and unreliable.

Crucially, both essays conclude that public policy objectives, such as those addressed by ESG initiatives, should be decided by and acted on by democratically elected governments, not private sector actors.

“There is no reason to believe that managers and business executives enjoy any comparative advantage in identifying and implementing broad environmental and social policies compared to politicians and regulators,” said Globerman.

“The evidence is clear—the private sector best serves the interests of society when it focuses on maximizing shareholder wealth within the confines of the established laws, not complying with top-down imposed ESG mandates that will harm the economy and ultimately Canadian workers.”

- The ESG movement calls for public companies and investors in public companies to identify and voluntarily implement environmental, social, and governance initiatives—ostensibly in the public interest.

- One school of thought supporting ESG is that doing so will make companies more profitable and thereby increase the wealth of their shareholders.

- However, academic research to date has failed to identify a consistent and statistically significant positive relationship between corporate ESG ratings and the stock market performance of companies.

- In fact, research instead suggests that adopting an ESG-intensive model might compromise the efficient production and distribution of goods and services and thereby slow the overall rate of real economic growth. Slower real economic growth means societies will be less able to afford investments to address environmental and other ESG-related priorities.

- The second school of thought is that companies, their senior managers, and their boards have an ethical obligation to implement ESG initiatives that go beyond simply complying with existing laws and regulations, even if it means reduced profitability. However, corporate managers and board members cannot and should not be expected to determine public policy priorities. The latter should be identified by democratic means and not by unelected private sector managers or investors.

- Given that there are indications that investor support for ESG is waning, it is apparent that the time has come for corporate leaders and politicians to acknowledge that it’s time to move on from ESG.

Authors:

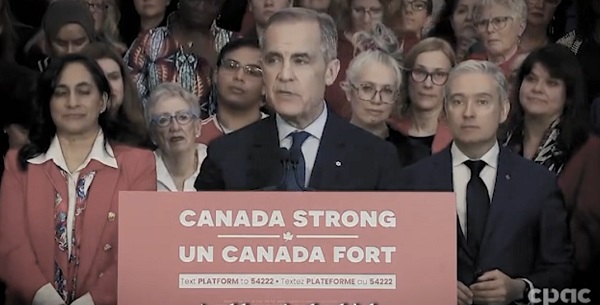

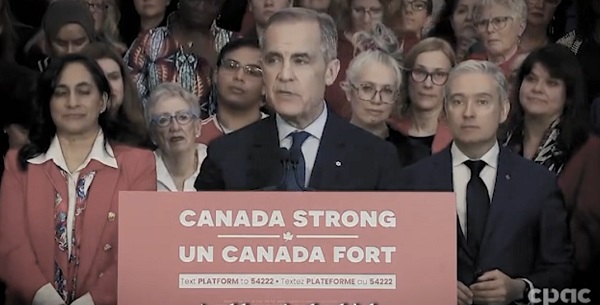

2025 Federal Election

Carney’s budget means more debt than Trudeau’s

The Canadian Taxpayers Federation is criticizing Liberal Party Leader Mark Carney’s budget plan for adding another $225 billion to the debt.

“Carney plans to borrow even more money than the Trudeau government planned to borrow,” said Franco Terrazzano, CTF Federal Director. “Carney claims he’s not like Trudeau and when it comes to the debt, here’s the truth: Carney’s plan is billions of dollars worse than Trudeau’s plan.”

Today, Carney released the Liberal Party’s “fiscal and costing plan.” Carney’s plan projects the debt to increase consistently.

Here is the breakdown of Carney’s annual budget deficits:

- 2025-26: $62 billion

- 2026-27: $60 billion

- 2027-28: $55 billion

- 2028-29: $48 billion

Over the next four years, Carney plans to add an extra $225 billion to the debt. For comparison, the Trudeau government planned on increasing the debt by $131 billion over those years, according to the most recent Fall Economic Statement.

Carney’s additional debt means he will waste an extra $5.6 billion on debt interest charges over the next four years. Debt interest charges already cost taxpayers $54 billion every year – more than $1 billion every week.

“Carney’s debt binge means he will waste $1 billion more every year on debt interest charges,” Terrazzano said. “Carney’s plan isn’t credible and it’s even more irresponsible than the Trudeau plan.

“After years of runaway spending Canadians need a government that will cut spending and stop wasting so much money on debt interest charges.”

Business

Canada Urgently Needs A Watchdog For Government Waste

From the Frontier Centre for Public Policy

By Ian Madsen

From overstaffed departments to subsidy giveaways, Canadians are paying a high price for government excess

Not all the Trump administration’s policies are dubious. One is very good, in theory at least: the Department of Government Efficiency. While that term could be an oxymoron, like ‘political wisdom,’ if DOGE is useful, so may be a Canadian version.

DOGE aims to identify wasteful, duplicative, unnecessary or destructive government programs and replace outdated data systems. It also seeks to lower overall costs and ensure mechanisms are in place to evaluate proposed programs for effectiveness and value for money. This can, and usually does, involve eliminating some departments and, eventually, thousands of jobs. Some new roles within DOGE may need to become permanent.

The goal in the U.S. is to lower annual operating costs and ensure that the growth in government spending is lower than in revenues. Washington’s spending has exploded in recent years. The U.S. federal deficit exceeds six per cent of gross domestic product. According to the U.S. Treasury Department, annual debt service cost is escalating unsustainably.

Canada’s latest budget deficit of $61.9 billion in fiscal 2023–24 is about two per cent of GDP, which seems minor compared to our neighbour. However, it adds to the federal debt of $1.236 trillion, about 41 per cent of our approximate $3 trillion GDP. Ottawa’s public accounts show that expenses are 17.8 per cent of GDP, up from about 14 per cent just eight years ago. Interest on the escalating debt were 10.2 per cent of revenues in the most recent fiscal year, up from just five per cent a mere two years ago.

The Canadian Taxpayers Federation (CTF) continually identifies dubious or frivolous spending and outright waste or extravagance: “$30 billion in subsidies to multinational corporations like Honda, Volkswagen, Stellantis and Northvolt. Federal corporate subsidies totalled $11.2 billion in 2022 alone. Shutting down the federal government’s seven regional development agencies would save taxpayers an estimated $1.5 billion annually.”

The CTF also noted that Ottawa hired 108,000 more staff in the past eight years at an average annual cost of over $125,000. Hiring in line with population growth would have added only 35,500, saving about $9 billion annually. The scale of waste is staggering. Canada Post, the CBC and Via Rail lose, in total, over $5 billion a year. For reference, $1 billion would buy Toyota RAV4s for over 25,600 families.

Ottawa also duplicates provincial government functions, intruding on their constitutional authority. Shifting those programs to the provinces, in health, education, environment and welfare, could save many more billions of dollars per year. Bad infrastructure decisions lead to failures such as the $33.4 billion squandered on what should have been a relatively inexpensive expansion of the Trans Mountain pipeline—a case where hiring better staff could have saved money. Terrible federal IT systems, exemplified by the $4 billion Phoenix payroll horror, are another failure. The Green Slush Fund misallocated nearly $900 million.

Ominously, the fast-growing Old Age Supplement and Guaranteed Income Security programs are unfunded, unlike the Canada Pension Plan. Their costs are already roughly equal to the deficit and could become unsustainable.

Canada is sleepwalking toward financial perdition. A Canadian version of DOGE—Canada Accountability, Efficiency and Transparency Team, or CAETT—is vital. The Auditor General Office admirably identifies waste and bad performance, but is not proactive, nor does it have enforcement powers. There is currently no mechanism to evaluate or end unnecessary programs to ensure Canadians will have a prosperous and secure future. CAETT could fill that role.

Ian Madsen is the Senior Policy Analyst at the Frontier Centre for Public Policy.

-

Alberta2 days ago

Alberta2 days agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNo Matter The Winner – My Canada Is Gone

-

Health2 days ago

Health2 days agoHorrific and Deadly Effects of Antidepressants

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCampaign 2025 : The Liberal Costed Platform – Taxpayer Funded Fiction

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoA Perfect Storm of Corruption, Foreign Interference, and National Security Failures