Business

ESG Puppeteers

From Heartland Daily News

By Paul Mueller

The Environmental, Social, and Governance (ESG) framework allows a small group of corporate executives, financiers, government officials, and other elites, the ESG “puppeteers,” to force everyone to serve their interests. The policies they want to impose on society — renewable energy mandates, DEI programs, restricting emissions, or costly regulatory and compliance disclosures — increase everyone’s cost of living. But the puppeteers do not worry about that since they stand to gain financially from the “climate transition.”

Consider Mark Carney. After a successful career on Wall Street, he was a governor at two different central banks. Now he serves as the UN Special Envoy on Climate Action and Finance for the United Nations, which means it is his job to persuade, cajole, or bully large financial institutions to sign onto the net-zero agenda.

But Carney also has a position at one of the biggest investment firms pushing the energy transition agenda: Brookfield Asset Management. He has little reason to be concerned about the unintended consequences of his climate agenda, such as higher energy and food prices. Nor will he feel the burden his agenda imposes on hundreds of millions of people around the world.

And he is certainly not the only one. Al Gore, John Kerry, Klaus Schwab, Larry Fink, and thousands of other leaders on ESG and climate activism will weather higher prices just fine. There would be little to object to if these folks merely invested their own resources, and the resources of voluntary investors, in their climate agenda projects. But instead, they use other people’s resources, usually without their knowledge or consent, to advance their personal goals.

Even worse, they regularly use government coercion to push their agenda, which — incidentally? — redounds to their economic benefit. Brookfield Asset Management, where Mark Carney runs his own $5 billion climate fund, invests in renewable energy and climate transition projects, the demand for which is largely driven by government mandates.

For example, the National Conference of State Legislatures has long advocated “Renewable Portfolio Standards” that require state utilities to generate a certain percentage of electricity from renewable sources. The Clean Energy States Alliance tracks which states have committed to moving to 100 percent renewable energy, currently 23 states, the District of Columbia, and Puerto Rico. And then there are thousands of “State Incentives for Renewables and Efficiency.”

Behemoth hedge fund and asset manager BlackRock announced that it is acquiring a large infrastructure company, as a chance to participate in climate transition and benefit its clients financially. BlackRock leadership expects government-fueled demand for their projects, and billions of taxpayer dollars to fund the infrastructure necessary for the “climate transition.”

CEO Larry Fink has admitted, “We believe the expansion of both physical and digital infrastructure will continue to accelerate, as governments prioritize self-sufficiency and security through increased domestic industrial capacity, energy independence, and onshoring or near-shoring of critical sectors. Policymakers are only just beginning to implement once-in-a-generation financial incentives for new infrastructure technologies and projects.” [Emphasis added.]

Carney, Fink, and other climate financiers are not capitalists. They are corporatists who think the government should direct private industry. They want to work with government officials to benefit themselves and hamstring their competition. Capitalists engage in private voluntary association and exchange. They compete with other capitalists in the marketplace for consumer dollars. Success or failure falls squarely on their shoulders and the shoulders of their investors. They are subject to the desires of consumers and are rewarded for making their customers’ lives better.

Corporatists, on the other hand, are like puppeteers. Their donations influence government officials, and, in return, their funding comes out of coerced tax dollars, not voluntary exchange. Their success arises not from improving customers’ lives, but from manipulating the system. They put on a show of creating value rather than really creating value for people. In corporatism, the “public” goals of corporations matter more than the wellbeing of citizens.

But the corporatist ESG advocates are facing serious backlash too. The Texas Permanent School Fund withdrew $8.5 billion from Blackrock last week. They join almost a dozen state pensions that have withdrawn money from Blackrock management over the past few years. And last week Alabama passed legislation defunding public DEI programs. They follow in the footsteps of Florida, Texas, North Carolina, Utah, Tennessee, and others.

State attorneys general have been applying significant pressure on companies that signed on to the “net zero” pledges championed by Carney, Fink, and other ESG advocates. JPMorgan and State Street both withdrew from Climate Action 100+ in February. Major insurance companies started withdrawing from the Net-Zero Insurance Alliance in 2023.

Still, most Americans either don’t know much about ESG and its potential negative consequences on their lives or, worse, actually favour letting ESG distort the market. This must change. It’s time the ESG puppeteers found out that the “puppets” have ideas, goals, and plans of their own. Investors, taxpayers, and voters should not be manipulated and used to climate activists’ ends.

They must keep pulling back on the strings or, better yet, cut them altogether.

Paul Mueller is a Senior Research Fellow at the American Institute for Economic Research. He received his PhD in economics from George Mason University. Previously, Dr. Mueller taught at The King’s College in New York City.

Originally posted at the American Institute for Economic Research, reposted with permission.

Business

Elon Musk, DOGE officials reveal ‘astonishing’ government waste, fraud in viral interview

From LifeSiteNews

Elon Musk said that ‘the sheer amount of waste and fraud’ in federal agencies, is ‘astonishing’ and that DOGE is cutting ‘$4 billion a day’ in misused taxpayer funds.

In a remarkable Fox News interview, Department of Government Efficiency (DOGE) founder Elon Musk and top officials of the DOGE team offered stunning, often infuriating, insights into how the federal government functions.

The interview, which has garnered well over 10 million online views on X in less than 24 hours, provided one extreme example after another of government mismanagement, excess, waste, and fraud while simultaneously promising a future where the D.C. Leviathan is tamed and restored to its proper, efficient role.

The new Deputy Director of the Office of Management and Budget (OMB), former U.S. House Rep. Dan Bishop, averred that the DOGE A-Team interview was the “most amazing and significant half-hour in TV history.”

Musk was joined by DOGE team members Steve Davis, Joe Gebbia, Aram Moghaddassi, Brad Smith, Anthony Armstrong, Tom Krause, and Tyler Hassen – all successful businessmen and entrepreneurs in their own rights – to describe the widespread systemic weaknesses and failures at the Internal Revenue Service (IRS), the National Institutes of Health (NIH), the Department of Health and Human Services (HHS), the Social Security Administration (SSA), and more.

Fox host Bret Baier described the group as “Silicon Valley colliding with government.”

“This is a revolution. And I think it might be the biggest revolution in government since the original revolution,” said Musk during the discussion.

“But at the end of the day, America’s going to be in much better shape,” he promised.

“America will be solvent. The critical programs that people depend upon will work, and it’s going to be a fantastic future.”

My interview with the @elonmusk and the @DOGE team tonight on #SpecialReport pic.twitter.com/KKpxEPtu1Z

— Bret Baier (@BretBaier) March 27, 2025

“The government is not efficient, and there’s a lot of waste and fraud. So we feel confident that a 15% reduction can be done without affecting any of the critical government services,” began Musk, founder and CEO of both Tesla and SpaceX and owner of X.

Musk said that the most stunning thing he’s discovered during the early phases of DOGE is “the sheer amount of waste and fraud in government. It is astonishing. It’s mind-blowing.”

Musk cited the example of a simple 10-question National Park online survey for which the government was charged nearly $1 billion and which in the end served no purpose.

“I think we will accomplish most of the work required to reduce the deficit by a trillion dollars within [130 days],” he predicted. “Our goal is to reduce the waste and fraud by $4 billion a day, every day, seven days a week. And so far, we are succeeding.”

Billionaire Airbnb co-founder Joe Gebbia, is working to digitize the retirement process for government employees, which is currently stuck using 1950s technology, housed in a Pennsylvania cave.

“It’s an injustice to civil servants who are subjected to these processes that are older than the age of half the people watching the show tonight,” said Gebbia. “We really believe that the government can have an Apple store-like experience, beautifully designed, great user experience, modern systems.”

“The retirement process is all by paper, literally, with people carrying paper and manila envelopes into this gigantic mine,” added Musk, limiting the number of federal employees who can retire to no more than 8,000 per month.

Gebbia expects to have the antiquated system updated and overhauled in a matter of months.

“The two improvements that we’re trying to make to Social Security are helping people that legitimately get benefits protect them from fraud that they experience every day on a routine basis and also make the experience better,” said DOGE software engineer Aram Moghaddassi.

He offered an amazing statistic: “When you want to change your (direct deposit) bank account, you can call Social Security. We learned 40% of the phone calls that they get are from fraudsters” who are attempting to commandeer retired seniors’ benefit payments.

“What we’re doing will help their benefits,” assured Musk. “As a result of the work of DOGE, legitimate recipients of social security will receive more money, not less money.”

“There are over 15 million people that are over the age of 120 that are marked as alive in the Social Security system,” said Steve Davis, who has previously worked alongside Musk at SpaceX, the Boring Company, and X

He explained that despite this being discovered by hardworking personnel at the SSA back in 2008, nothing was done. As a result, 15-20 million social security numbers that were clearly fraudulent were just floating around, susceptible to being used for “bad intentions.”

Health care entrepreneur Brad Smith, who has taken charge of auditing HHS and NIH, also cited stunning, troubling statistics displaying the extreme inefficiencies of the nation’s top federal health organizations.

Smith said that at NIH, “Today they have 27 different centers” created by Congress over the years and there are “700 different IT systems,” each using their own IT software.

“They have 27 different CIOs (Chief Information Officers),” added Smith, “so when you think about making great medical discoveries, you have to connect the data.”

Those discoveries are likely severely hampered by NIH’s communications disconnect.

Anthony Armstrong, a Morgan Stanley banker now working for DOGE at the Office of Personnel Management (OPM) talked about “duplicative functions” and “overstaffing” at government agencies. He said that money is “sloshing out the door.”

As an example, he cited the IRS, which has 1,400 employees whose only job is to provision laptops and cell phones to IRS workers.

“As an ex-CFO of a big public tech company, really what we’re doing is, we’re applying public company standards to the federal government, and it is alarming how the financial operations and financial management is set up today,” said Tom Krause, CEO of Cloud Software Group.

He explained that there is virtually no accountability or verification protections when it comes to the Treasury Department disbursing funds to various government agencies.

A 94-year-old grandmother is no longer “going to be robbed by forces like she’s getting robbed today, and the solvency of the federal government will ensure that she continues to receive those social security checks,” added Musk.

“The reason we’re doing this is because if we don’t do it, America is going to go insolvent and go bankrupt, and nobody’s going to get anything,” said Musk.

Tyler Hassen, a former oil executive working at the Interior Department for DOGE alleged that there was no departmental oversight at the Interior Department “whatsoever” under the Biden administration.

Steve Davis talked about the out-of-control issuance and use of federal credit cards.

“There are in the federal government around 4.6 million credit cards for around 2.3 to 2.4 million employees. This doesn’t make sense. So, one of the things all of the teams have worked on is we’ve worked for the agencies and said, ‘Do you need all of these credit cards? Are they being used? Can you tell us physically where they are?’” recounted Davis.

“Clearly there should not be more credit cards than there are people,” interjected Musk.

Musk later described how the Small Business Administration (SBA) has given out $300 million in loans to people “under the age of 11.” An additional $300 million in loans has been handed out to people “over the age of 120.”

Musk said that these government loans are clearly “fraudulent.”

“Terrible things are being done,” he exclaimed. “We’re stopping it.”

Business

Americans rallying behind Trump’s tariffs

The Trump administration’s new tariffs are working:

The European Union will delay tariffs on U.S. exports into the trading bloc in response to the imposition of tariffs on European aluminum and steal, a measure announced in February by the White House as a part of an overhaul of the U.S. trade policies.

Instead of taking effect March 12, these tariffs will not apply until “mid-April”, according to a European official interviewed by The Hill.

This is not the first time the EU has responded this way to U.S. tariff measures. It happened already last time Trump was in office. One of the reasons why Brussels is so accommodative is that the European Parliament emphasized negotiations already back in February. Furthermore, as Forbes notes,

The U.S. economy is the largest in the world, and many countries rely on American consumers to buy their goods. By import tariffs, the U.S. can pressure trading partners into more favorable deals and protect domestic industries from unfair competition.

More on unfair competition in a moment. First, it is important to note that Trump did not start this trade skirmish. Please note what IndustryWeek reported back in 2018:

Trump points to U.S. auto exports to Europe, saying they are taxed at a higher rate than European exports to the United States. Here, facts do offer Trump some support: U.S. autos face duties of 10% while European cars are subject to dugies of only 2.5% in the United States.

They also noted some nuances, e.g., that the United States applies a higher tariff on light trucks, presumably to defend the most profitable vehicles rolling out of U.S. based manufacturing plants. Nevertheless, the story that most media outlets do not tell is that Europe has a history of putting tariffs on U.S. exports to a greater extent than tariffs are applied in the opposite direction.

Larson’s Political Economy is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Facts notwithstanding, this trade war has caught media attention and is reaching ridiculous proportions. According to CNBC,

Auto stocks are digesting President Donald Trump’s annoncement that he would place 25% tariffs on “all cars that are not made in the United Sates,” as well as certain automobile parts. … Shares of the “Detroit Three” all fell.

They also explain that GM took a particularly hard beating, and that Ferrari is going to use the tariffs as a reason to raise prices by ten percent. This sounds dramatic, but keep in mind that stocks fly up and down with impressive amplitude; what was lost yesterday can come back with a bonus tomorrow. As for Ferrari, a ten-percent price hike is basically meaningless since these cars are often sold in highly customized, individual negotiations before they are even produced.

Despite the media hype, these tariffs will not last the year. One reason is the retaliatory nature in President Trump’s tariffs, which—again—has already caught the attention of the Europeans and brought them to the negotiation table. We can debate whether or not his tactics are the best in order to create more fair trade terms between the United States and our trading partners, but there is no question that Trump’s methods have caught the attention of the powers that be (which include Mexico and Canada).

There is another reason why I do not see this tariffs tit-for-tat continuing for much longer. The European economy is in bad shape, especially compared to the U.S. economy. With European corporations already signaling increased direct investment in the U.S. economy, Europe is holding the short end of this stick.

But the bad news for the Europeans does not stop there. They are at an intrinsic disadvantage going into a tariffs-based trade war. The EU has a “tariff” of sorts that we do not have, namely the value-added tax, VAT. Shiphub.co has a succinct summary of how the VAT affects trade:

When importing (into the European Union), VAT should be taken into account. … VAT is calculated based on the customs value (the good’s value and transport costs … ) plus the due duty amount.

The term “duty” here, of course, refers to trade tariffs. This means that when tariffs go up, the VAT surcharge goes up as well. Aside from creating a tax-on-tax problem, this also means that the inflationary effect from U.S. imports is significantly stronger than it is on EU imports to the United States—even when tariffs are equal.

If the U.S. government wanted to, they could include the tax-on-tax effect of the VAT when assessing the effective EU tariffs on imports from the United States. This would quickly expand the tit-for-tat tariff war, with Europe at an escalating disadvantage.

For these reasons, I do not see how this “trade war” will continue beyond the summer, but even that is a pessimistic outlook.

Before I close this tariff topic and declare it a weekend, let me also mention that the use of tariffs in trade war is neither a new nor an unusual tactic. Check out this little brochure from the Directorate-General for Trade under the European Commission’:

Trade defence instruments, such as anti-dumping or anti-subsidy duties, are ways of protecting European production against international trade distortions.

What they refer to as “defence instruments” are primarily tariffs on imports. In a separate report the Directorate lists no fewer than 63 trade-war cases where the EU imposes tariffs to punish a country for unfair trade tactics.

Trade what, and what countries, you wonder? Sweet corn from Thailand, fused alumina from China, biodiesel from Argentina and Indonesia, malleable tube fittings from China and Thailand, epoxy resins from China, South Korea, Taiwan, and Thailand… and lots and lots of tableware from China.

Like most people, I would prefer a world without taxes and tariffs, and the closer we can get to zero on either of those, the better. But until we get there, we should take a deep breath in the face of the media hype and trust our president on this one.

Larson’s Political Economy is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

-

Alberta2 days ago

Alberta2 days agoAlberta Institute urging Premier Smith to follow Saskatchewan and drop Industrial Carbon Tax

-

Addictions1 day ago

Addictions1 day agoShould fentanyl dealers face manslaughter charges for fatal overdoses?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFool Me Once: The Cost of Carney–Trudeau Tax Games

-

Alberta1 day ago

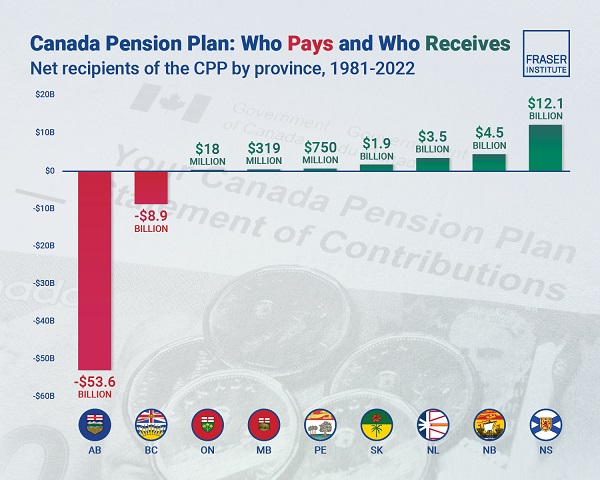

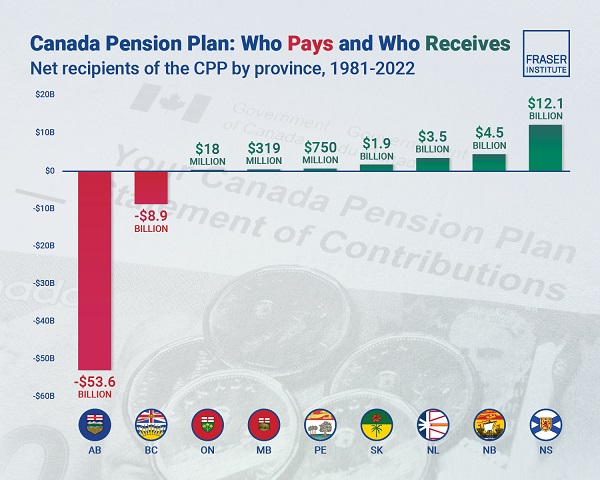

Alberta1 day agoAlbertans have contributed $53.6 billion to the retirement of Canadians in other provinces

-

Automotive2 days ago

Automotive2 days agoTrump announces 25% tariff on foreign automobiles as reciprocal tariffs loom

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoChinese Gangs Dominate Canada: Why Will Voters Give Liberals Another Term?

-

Also Interesting23 hours ago

Also Interesting23 hours agoThe bizarre story of Taro Tsujimoto

-

Energy1 day ago

Energy1 day agoEnergy, climate, and economics — A smarter path for Canada