Opinion

Escape Room 2 – The NEW Real Estate Owner Tax Game – High Stakes Edition

By Cory G. Litzenberger, CPA, CMA, CFP, C.Mgr – CEO | Director of CGL Tax

Justin time for Tax Season, we have a new version of our most popular game, but this time you are now trying to convert your Real Estate to tax-Freeland.

No those are not typos.

In 2017, we released Escape Room – The NEW Small Business Tax Game – Family Edition after then Federal Liberal Finance Minister, Bill Morneau, finally released the new version of

the Tax on Split Income (“TOSI”) or the so-called “income sprinkling” rules.

This time, in this game, there are fewer unconditional exits, and the stakes are higher.

So just like I said in December 2017:

“These rules are written like a bad “escape room” game. The way these rules are written, everyone is caught… unless you can escape… and the exits are not clearly marked.”

The talking points in the media have been that the Underused Housing Tax (UHT) Act would only apply to non-resident and foreign owners.

However, what they failed to mention is that many Canadians will be caught by the filing requirement and will have to file or face penalties, even if they won’t owe any tax.

This ain’t your Daddy’s failure to file penalty.

Failing to file a UHT return faces a minimum penalty of $5,000 per individual, per property and $10,000 if you are a corporation.

This makes the failure to file a T1135 Foreign Property form look like pocket change.

So while you may not have to pay any UHT, you still might have to pay even more if you didn’t know you had to file it already this tax season because:

- the Underused Housing Tax Act is not part of the Income Tax Act;

- there are requirements to file even if you don’t owe;

- it is due on April 30 irrespective of your ordinary income tax filing deadline

- the filing is entirely separate from any other tax filing; and

- at the time of this article’s publication, it cannot be e-filed – it must be filled out and sent manually.

The prescribed Form UHT-2900 only came out on January 31, 2023, and applies to 2022.

As a result, you will need to figure out if you must file it by April 30 this year or face a minimum $5,000 penalty, per person, per property, for failure to file.

As this is new legislation with large penalty amounts, some practitioners are unaware if their errors and omissions insurance even includes coverage for these returns. This means you can expect to see extremely high fees for preparing these forms.

Can you think of a better way to navigate the messy rules than by playing a game for you to play this Tax Season?

Escape Room 2 – Rules of the Game

IMPORTANT RULES OF THE GAME: This is not an all-inclusive list. The below information is a high-level summary of the more common areas of concern. You should seek specialist advice on your specific circumstances and how the new rules will apply to you.

1) Were you the legal owner (a person/entity registered on title), jointly or otherwise, of a residential property in Canada as of December 31?

If yes, you are still trapped and get to keep playing.

If not, Congrats! You escaped! You can go back to paying rent or sleeping in your vehicle without having to worry about the UHT.

2) Are you a publicly-traded Trust or Corporation that is incorporated under the laws of Canada or a province and listed on a Canadian Stock Exchange?

If yes, Congrats! You escaped! You may continue working on your Securities filings for your upcoming AGM.

If not, you’re still trapped – keep playing.

3) Are you a Registered Charity, Cooperative Housing Corporation, Municipality, Indigenous Governing Body, Government of Canada, Provincial Government, University, Public College, School Authority or Hospital Authority?

If yes, Congrats! You escaped! You may continue dealing with your annual audit of financial statements.

If not, you’re still trapped – keep playing.

4) Are you an individually wealthy person that does not like to share with others?

For example, you own one or more multiple residential properties – but every single one of them is only in your personal name. No spouse, no corporation, no trust, no partnerships, no friends, no one!

If yes, Congrats! You escaped! You may go back to swimming alone in your pool of wealth.

If not, you’re still trapped – keep playing.

5) Is the only reason you are on the land title because you are currently the executor or administrator of someone’s estate?

If yes, Congrats! You escaped! You may continue to grieve and fill out the mountains of government paperwork while everyone else asks you “where’s my inheritance?”

If not, you’re still trapped – keep playing.

6) Are you an individual Canadian Citizen or Permanent Resident of Canada (under the Immigration and Refugee Protection Act) that does not have a business, farm, or rental property owned with another person that could possibly be viewed as a partnership?

If yes, Congrats! You escaped! You may continue to live in your home, paycheque to paycheque, while your cost of payroll deductions and mortgage interest continue to rise and eat away at it.

If not, you’re still trapped – keep playing.

7) Does your business, farm, or rental property co-owned with another person have a residential dwelling on it?

For example, is your home on the same land title as your farmland or business?

If yes, Congrats! … haha – fooled you! You’re still trapped, and now you get to play the UHT Escape Room Game – Advanced Edition

If not, Congrats! You just made it out – lucky number 7!

Welcome to UHT Escape Room Game – Advanced Edition

In this Edition, everyone must file or face a minimum $5,000 penalty per person on each property.

For example, husband/wife partnership with three residential properties = 2 x 3 x $5,000 = $30,000 penalty if you don’t file!

8) Are you a Specified Canadian Corporation where at least 90% of the ownership and control (direct and indirect) are held by other Specified Canadian Corporations, Canadian Citizens, or Permanent Residents of Canada?

If yes, you have to file but you won’t have to pay. Don’t forget to file by April 30 no matter what your fiscal year-end date is!

If not, you’re still trapped – keep playing.

9) Are you a Specified Canadian Partnership where every member of the partnership is either a Specified Canadian Corporation, or would not have to file if we ignored the whole “partner of a partnership” thing?

If yes, Congrats! You have to file but won’t have to pay.

If not, You’re still trapped – keep playing.

10) Are you a Specified Canadian Trust where every beneficiary of the trust is either a Specified Canadian Corporation, or would have escaped from filing if they were the owner themselves?

If yes, Congrats! You have to file but won’t have to pay.

If not, You’re still trapped – keep playing.

11) In this filing year or last year, were you an owner of a property when another co-owner that owned 25% or more died?

If yes, Congrats! It’s sure a good thing they died! You have to file but won’t have to pay

If not, you’re still trapped – keep playing.

12) Did you die this year or last year (or are you the executor for someone that did and you were not on the land title before they died)?

If yes, then UHT definitely puts the FUN in FUNeral! You have to file, but won’t have to pay – don’t forget to play again next year!

If not, you’re still trapped (but alive) – keep playing.

13) Did you buy the property this year and never owned or had your name on it before in the past decade?

If yes, Congrats on becoming a home-owner, on your first… or second… or third… or… well it doesn’t matter how many homes you have, just as long as you bought it this year. You have to file but don’t have to pay – play again next year!

If not, you’re still trapped – keep playing.

14) Was the property still under construction before April Fools’ Day of the filing year?

If yes, Congrats – this isn’t an April Fools’ prank. You have to file, but don’t have to pay!

If not, You’re still trapped – keep playing.

15) Was the property finished before April Fools’ Day of the filing year, offered up for sale to the public, but never sold or occupied by an individual as a place of residence or lodging during the year?

If yes, Congrats! Isn’t it fun making mortgage payments on a home no one wants? You have to file but don’t have to pay.

If not, you’re still trapped – keep playing.

16) Was the property unable to be lived in for at least 120 consecutive days because of renovations undertaken that occurred in a timely fashion?

If yes, Congrats! As long as you haven’t used this escape door in the last decade, you can now use it. You have to file but don’t have to pay – otherwise, it’s still locked and you keep playing.

If not, you’re still trapped – keep playing.

17) Was the property unable to be lived in for at least 60 consecutive days in the year because of disaster or hazardous conditions caused by circumstances outside the reasonable control of an owner?

If yes, Congrats! As long as you haven’t used this escape door more than once before for the same disaster or hazardous condition on the property you have to file, but not pay – otherwise, you’re still trapped.

If not, you’re still trapped – keep playing.

18) Is the property unable to be accessed year-round because there is no maintained public access during the off-season?

If yes, Congrats! You have to file but don’t have to pay.

If not, you’re still trapped – keep playing.

19) Is the property unsuitable for year-round use as a place of residence?

If yes, Congrats! Keep following that boiled water advisory and burning everything around you to stay warm. The government is providing you with more blessings: you have to file but don’t have to pay.

If not, you’re still trapped – keep playing.

20) Is the property being used for at least a month consecutively and more than 180 days in the year by you, your spouse or common-law partner, child, or parent who is a Canadian citizen or permanent resident?

If yes, Congrats! You have to file but don’t have to pay – wasn’t this fun? – Be sure to play again next year!

If not, you’re still trapped – keep playing.

21) Is the property the primary residence for you, your spouse or common-law partner, or for your child attending a designated learning institution?

If yes, Congrats! You might have to file an election and your spouse must agree. If you need to convince them, tell them that marriage counselling will be cheaper than the failure to file penalty. That should get them to agree to anything. You have to file but don’t have to pay.

If not, you’re still trapped – keep playing.

22) Is the property a vacation property that is used by you or your spouse or common-law partner for at least 28 days in the year and is located in an “eligible area of Canada” (basically rural enough area where they might get dirty trying to find you)

If yes, Congrats on being able to take 4-weeks of vacation every year – you have to file, but won’t have to pay.

If not, you’re still trapped – and likely still at work – keep playing.

23) Speaking of work – is the property being used by you or your spouse or common-law partner for at least a month consecutively and more than 180 days in the year just while you are working in Canada, and the property relates to that purpose?

If yes, Congrats! You have to file but won’t have to pay.

If not, you’re still trapped – have you considered renting it out?

24) Is the property being rented under a written agreement for at least a month consecutively and more than 180 days in the year to someone paying at least 5% of the property value per year as rent?

If yes, Congrats! You have to file but won’t have to pay.

If not, you’re still trapped – keep playing – and raise that rent! We wouldn’t want anyone to have affordable housing.

25) Is the property being rented under a written agreement for at least a month consecutively and more than 180 days in the year to an unrelated person?

If yes, Congrats! But why are you charging them less than fair-value rent? What kind of slum lord are you? Stop making things affordable! You have to file but won’t have to pay.

If not, you are still trapped and now move on to the UHT Escape Room Game – High Stakes Edition

Welcome to UHT Escape Room Game – High Stakes Edition

In this edition of the UHT Escape Room Game, everyone must ante up and Pay to Play!

26) Is the Fair Market Value of the property lower than both the Property Tax Assessed Value and the most recent purchase price of the property?

If yes, you must have a formal appraisal done effective as of a date in the filing year or before the filing deadline. Then you only have to pay 1% of this value multiplied by your percentage of ownership as your UHT.

If not, either get that appraisal done or be happy that your property has increased in value. In the meantime keep playing.

27) Is the Property Tax Assessed Value more than the most recent purchase price?

If yes, Congrats! Not only has your property tax gone up, but so has your UHT – you owe 1% of this value multiplied by your percentage of ownership.

If no, Congrats on your property being worth less than you paid for it – keep playing.

28) Congrats on making it to the end. If you’ve come this far, it means:

- You own property in Canada;

- You are not a Canadian Citizen or Permanent Resident;

- You are alive, or you’ve been dead for more than two years;

- You don’t rent out the property under a written agreement …or if you do, it is to a relative, and it is way too affordable;

- If it is a vacation property, you don’t use it for 4-weeks of vacation likely because you don’t get 4-weeks of vacation;

- You don’t use the property for more than 30 days consecutively, nor more than 180 days in the year for a work-related purpose;

- You didn’t bother getting a formal appraisal done;

- You paid more than the current Property Tax Assessed value for the property; and

- You wonder why they didn’t just say all this in the first place

Congrats – you get to pay 1% of the purchase price when you last acquired the property multiplied by your percentage of ownership.

Do you feel like you won?

Now… as for next year…

… I want to play a game…

Freedom Convoy

Court Orders Bank Freezing Records in Freedom Convoy Case

|

A Canadian court has ordered the release of documents that could shed light on how federal authorities and law enforcement worked together to freeze the bank accounts of a protester involved in the Freedom Convoy.

Both the RCMP and TD Bank are now required to provide records related to Evan Blackman, who took part in the 2022 demonstrations and had his accounts frozen despite not being convicted of any crime at the time.

The Justice Centre for Constitutional Freedoms (JCCF) announced the Ontario Court of Justice ruling. The organization is representing Blackman, whose legal team argues that the actions taken against him amounted to a serious abuse of power.

“The freezing of Mr. Blackman’s bank accounts was an extreme overreach on the part of the police and the federal government,” said his lawyer, Chris Fleury. “These records will hopefully reveal exactly how and why Mr. Blackman’s accounts [were] frozen.”

Blackman was arrested during the mass protests in Ottawa, which drew thousands of Canadians opposed to vaccine mandates and other pandemic-era restrictions.

Although he faced charges of mischief and obstructing police, those charges were dismissed in October due to a lack of evidence. Despite this, prosecutors have appealed, and a trial is set to begin on August 14.

At the height of the protests, TD Bank froze three of Blackman’s accounts following government orders issued under the Emergencies Act. Then-Prime Minister Justin Trudeau had invoked the act to grant his government broad powers to disrupt the protest movement, including the unprecedented use of financial institutions to penalize individuals for their support or participation.

In 2024, a Federal Court Justice ruled that Trudeau’s decision to invoke the act had not been justified.

Blackman’s legal team plans to use the newly released records to demonstrate the extent of government intrusion into personal freedoms.

According to the JCCF, this case may be the first in Canada where a criminal trial includes a Charter challenge over the freezing of personal bank accounts under emergency legislation.

|

Alberta

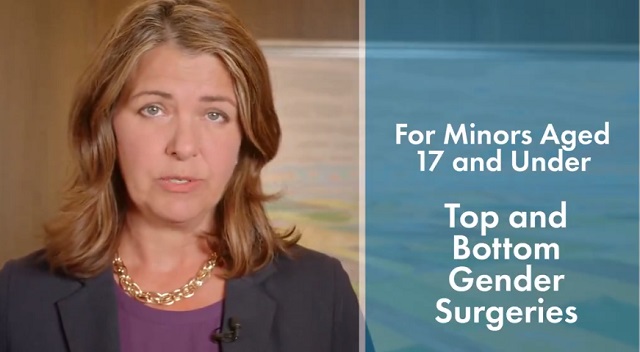

‘Far too serious for such uninformed, careless journalism’: Complaint filed against Globe and Mail article challenging Alberta’s gender surgery law

Macdonald Laurier Institute challenges Globe article on gender medicine

The complaint, now endorsed by 41 physicians, was filed in response to an article about Alberta’s law restricting gender surgery and hormones for minors.

On June 9, the Macdonald-Laurier Institute submitted a formal complaint to The Globe and Mail regarding its May 29 Morning Update by Danielle Groen, which reported on the Canadian Medical Association’s legal challenge to Alberta’s Bill 26.

Written by MLI Senior Fellow Mia Hughes and signed by 34 Canadian medical professionals at the time of submission to the Globe, the complaint stated that the Morning Update was misleading, ideologically slanted, and in violation the Globe’s own editorial standards of accuracy, fairness, and balance. It objected to the article’s repetition of discredited claims—that puberty blockers are reversible, that they “buy time to think,” and that denying access could lead to suicide—all assertions that have been thoroughly debunked in recent years.

Given the article’s reliance on the World Professional Association for Transgender Health (WPATH), the complaint detailed the collapse of WPATH’s credibility, citing unsealed discovery documents from an Alabama court case and the Cass Review’s conclusion that WPATH’s guidelines—and those based on them—lack developmental rigour. It also noted the newsletter’s failure to mention the growing international shift away from paediatric medical transition in countries such as the UK, Sweden, and Finland. MLI called for the article to be corrected and urged the Globe to uphold its commitment to balanced, evidence-based journalism on this critical issue.

On June 18, Globe and Mail Standards Editor Sandra Martin responded, defending the article as a brief summary that provided a variety of links to offer further context. However, the three Globe and Mail news stories linked to in the article likewise lacked the necessary balance and context. Martin also pointed to a Canadian Paediatric Society (CPS) statement linked to in the newsletter. She argued it provided “sufficient context and qualification”—despite the fact that the CPS itself relies on WPATH’s discredited guidelines. Notwithstanding, Martin claimed the article met editorial standards and that brevity justified the lack of balance.

MLI responded that brevity does not excuse misinformation, particularly on a matter as serious as paediatric medical care, and reiterated the need for the Globe to address the scientific inaccuracies directly. MLI again called for the article to be corrected and for the unsupported suicide claim to be removed. As of this writing, the Globe has not responded.

Letter of complaint

June 9, 2025

To: The Globe and Mail

Attn: Sandra Martin, standards editor

CC: Caroline Alphonso, health editor; Mark Iype, deputy national editor and Alberta bureau chief

To the editors;

Your May 29 Morning Update: The Politics of Care by Danielle Groen, covering the Canadian Medical Association’s legal challenge to Alberta’s Bill 26, was misleading and ideologically slanted. It is journalistically irresponsible to report on contested medical claims as undisputed fact.

This issue is far too serious for such uninformed, careless journalism lacking vital perspectives and scientific context. At stake is the health and future of vulnerable children, and your reporting risks misleading parents into consenting to irreversible interventions based on misinformation.

According to The Globe and Mail’s own Journalistic Principles outlined in its Editorial Code of Conduct, the credibility of your reporting rests on “solid research, clear, intelligent writing, and maintaining a reputation for honesty, accuracy, fairness, balance and transparency.” Moreover, your principles go on to state that The Globe will “seek to provide reasonable accounts of competing views in any controversy.” The May 29 update violated these principles. There is, as I will show, a widely available body of scientific information that directly contests the claims and perspectives presented in your article. Yet this information is completely absent from your reporting.

The collapse of WPATH’s credibility

The article’s claim that Alberta’s law “falls well outside established medical practice” and could pose the “greatest threat” to transgender youth is both false and inflammatory. There is no global medical consensus on how to treat gender-distressed young people. In fact, in North America, guidelines are based on the Standards of Care developed by the World Professional Association for Transgender Health (WPATH)—an organization now indisputably shown to place ideology above evidence.

For example, in a U.S. legal case over Alabama’s youth transition ban, WPATH was forced to disclose over two million internal emails. These revealed the organization commissioned independent evidence reviews for its latest Standards of Care (SOC8)—then suppressed those reviews when they found overwhelmingly low-quality evidence. Yet WPATH proceeded to publish the SOC8 as if it were evidence-based. This is not science. It is fraudulent and unethical conduct.

These emails also showed Admiral Rachel Levine—then-assistant secretary for Health in the Biden administration—pressured WPATH to remove all lower age recommendations from the guidelines—not on scientific grounds, but to avoid undermining ongoing legal cases at the state level. This is politics, not sound medical practice.

The U.K.’s Cass Review, a major multi-year investigation, included a systematic review of the guidelines in gender medicine. A systematic review is considered the gold standard because it assesses and synthesizes all the available research in a field, thereby reducing bias and providing a large comprehensive set of data upon which to reach findings. The systematic review of gender medicine guidelines concluded that WPATH’s standards of care “lack developmental rigour” and should not be used as a basis for clinical practice. The Cass Review also exposed citation laundering where medical associations endlessly recycled weak evidence across interlocking guidelines to fabricate a false consensus. This led Cass to suggest that “the circularity of this approach may explain why there has been an apparent consensus on key areas of practice despite the evidence being poor.”

Countries like Sweden, Finland, and the U.K. have now abandoned WPATH and limited or halted medicalized youth transitions in favour of a therapy-first approach. In Norway, UKOM, an independent government health agency, has made similar recommendations. This shows the direction of global practice is moving away from WPATH’s medicalized approach—not toward it. As part of any serious effort to “provide reasonable accounts of competing views,” your reporting should acknowledge these developments.

Any journalist who cites WPATH as a credible authority on paediatric gender medicine—especially in the absence of contextualizing or competing views—signals a lack of due diligence and a fundamental misunderstanding of the field. It demonstrates that either no independent research was undertaken, or it was ignored despite your editorial standards.

Puberty blockers don’t ‘buy time’ and are not reversible

Your article repeats a widely debunked claim: that puberty blockers are a harmless pause to allow young people time to explore their identity. In fact, studies have consistently shown that between 98 per cent and 100 per cent of children placed on puberty blockers go on to take cross-sex hormones. Before puberty blockers, most children desisted and reconciled with their birth sex during or after puberty. Now, virtually none do.

This strongly suggests that blocking puberty in fact prevents the natural resolution of gender distress. Therefore, the most accurate and up-to-date understanding is that puberty blockers function not as a pause, but as the first step in a treatment continuum involving irreversible cross-sex hormones. Indeed, a 2022 paper found that while puberty suppression had been “justified by claims that it was reversible … these claims are increasingly implausible.” Again, adherence to the Globe’s own editorial guidelines would require, at minimum, the acknowledgement of the above findings alongside the claims your May 29 article makes.

Moreover, it is categorically false to describe puberty blockers as “completely reversible.” Besides locking youth into a pathway of further medicalization, puberty blockers pose serious physical risks: loss of bone density, impaired sexual development, stunted fertility, and psychosocial harm from being developmentally out of sync with peers. There are no long-term safety studies. These drugs are being prescribed to children despite glaring gaps in our understanding of their long-term effects.

Given the Globe’s stated editorial commitment to principles such as “accuracy,” the crucial information from the studies linked above should be provided in any article discussing puberty blockers. At a bare minimum, in adherence to the Globe’s commitment to “balance,” this information should be included alongside the contentious and disputed claims the article makes that these treatments are reversible.

No proof of suicide prevention

The most irresponsible and dangerous claim in your article is that denying access to puberty blockers could lead to “depression, self-harm and suicide.” There is no robust evidence supporting this transition-or-suicide narrative, and in fact, the findings of the highest-quality study conducted to date found no evidence that puberty suppression reduces suicide risk.

Suicide is complex and attributing it to a single cause is not only false—it violates all established suicide reporting guidelines. Sensationalized claims like this risk creating contagion effects and fuelling panic. In the public interest, reporting on the topic of suicide must be held to the most rigorous standards, and provide the most high-quality and accurate information.

Euphemism hides medical harm

Your use of euphemistic language obscures the extreme nature of the medical interventions being performed in gender clinics. Calling double mastectomies for teenage girls “paediatric breast surgeries for gender-affirming reasons” sanitizes the medically unnecessary removal of a child’s healthy organs. Referring to phalloplasty and vaginoplasty as “gender-affirming surgeries on lower body parts” conceals the fact that these are extreme operations involving permanent disfigurement, high complication rates, and often requiring multiple revisions.

Honest journalism should not hide these facts behind comforting language. Your reporting denies youth, their parents, and the general public the necessary information to understand the nature of these interventions. Members of the general public rely greatly on the news media to equip them with such information, and your own editorial standards claim you will fulfill this core responsibility.

Your responsibility to the public

As a flagship Canadian news outlet, your responsibility is not to amplify activist messaging, but to report the truth with integrity. On a subject as medically and ethically fraught as paediatric gender medicine, accuracy is not optional. The public depends on you to scrutinize claims, not echo ideology. Parents may make irreversible decisions on behalf of their children based on the narratives you promote. When reporting is false or ideologically distorted, the cost is measured in real-world harm to some of our society’s most vulnerable young people.

I encourage the Globe and Mail to publish an updated version on this article in order to correct the public record with the relevant information discussed above, and to modify your reporting practices on this matter going forward—by meeting your own journalistic standards—so that the public receives balanced, correct, and reliable information on this vital topic.

Trustworthy journalism is a cornerstone of public health—and on the issue of paediatric gender medicine, the stakes could not be higher.

Sincerely,

Mia Hughes

Senior Fellow, Macdonald-Laurier Institute

Author of The WPATH Files

The following 41 physicians have signed to endorse this letter:

Dr. Mike Ackermann, MD

Dr. Duncan Veasey, Psy MD

Dr. Rick Gibson, MD

Dr. Benjamin Turner, MD, FRCSC

Dr. J.N. Mahy, MD, FRCSC, FACS

Dr. Khai T. Phan, MD, CCFP

Dr. Martha Fulford, MD

Dr. J. Edward Les, MD, FRCPC

Dr. Darrell Palmer, MD, FRCPC

Dr. Jane Cassie, MD, FRCPC

Dr. David Lowen, MD, FCFP

Dr. Shawn Whatley, MD, FCFP (EM)

Dr. David Zitner, MD

Dr. Leonora Regenstreif, MD, CCFP(AM), FCFP

Dr. Gregory Chan, MD

Dr. Alanna Fitzpatrick, MD, FRCSC

Dr. Chris Millburn, MD, CCFP

Dr. Julie Curwin, MD, FRCPC

Dr. Roy Eappen, MD, MDCM, FRCP (c)

Dr. York N. Hsiang, MD, FRCSC

Dr. Dion Davidson, MD, FRCSC, FACS

Dr. Kevin Sclater, MD, CCFP (PC)

Dr. Theresa Szezepaniak, MB, ChB, DRCOG

Dr. Sofia Bayfield, MD, CCFP

Dr. Elizabeth Henry, MD, CCFP

Dr. Stephen Malthouse, MD

Dr. Darrell Hamm, MD, CCFP

Dr. Dale Classen, MD, FRCSC

Dr. Adam T. Gorner, MD, CCFP

Dr. Wesley B. Steed, MD

Dr. Timothy Ehmann, MD, FRCPC

Dr. Ryan Torrie, MD

Dr. Zachary Heinricks, MD, CCFP

Dr. Jessica Shintani, MD, CCFP

Dr. Mark D’Souza, MD, CCFP(EM), FCFP*

Dr. Joanne Sinai, MD, FRCPC*

Dr. Jane Batt, MD*

Dr. Brent McGrath, MD, FRCPC*

Dr. Leslie MacMillan MD FRCPC (emeritus)*

Dr. Ian Mitchell, MD, FRCPC*

Dr. John Cunnington, MD

*Indicates physician who signed following the letter’s June 9 submission to the Globe and Mail, but in advance of this letter being published on the MLI website.

-

Fraser Institute1 day ago

Fraser Institute1 day agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million annually

-

Crime2 days ago

Crime2 days ago“This is a total fucking disaster”

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV

-

Daily Caller2 days ago

Daily Caller2 days ago‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

-

MAiD2 days ago

MAiD2 days agoCanada’s euthanasia regime is already killing the disabled. It’s about to get worse

-

Daily Caller2 days ago

Daily Caller2 days agoBlackouts Coming If America Continues With Biden-Era Green Frenzy, Trump Admin Warns

-

Red Deer2 days ago

Red Deer2 days agoJoin SPARC in spreading kindness by July 14th

-

Business1 day ago

Business1 day agoPrime minister can make good on campaign promise by reforming Canada Health Act