Agriculture

The China – Russia “Grain Entente” – what is at stake for Canada and its allies?

From the Macdonald Laurier Institute

By Serghey Sukhankin

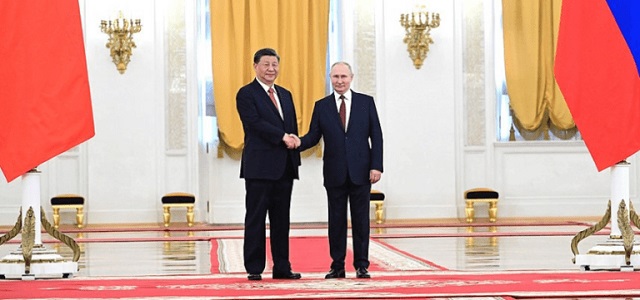

Moscow – with China’s help, approval, and likely, guidance – intends to challenge the West by changing the rules of trade in foods critical to global buyers.

Throughout its entire history the Soviet Union faced one existential peril that was never solved until its collapse in 1991 – the prospect of food shortage and mass starvation. Its cumbersome, utterly ineffective, and artificially subsidized agricultural sector was a living testament to the erroneous nature of a planned command-administrative economic model.

The situation with food and staples became so dire that starting from 1963 the Soviet Bloc (the USSR, Hungary, Bulgaria, and Czechoslovakia) started importing wheat from the United States, Canada, and Australia. This practice continued until the demise of the Soviet Empire. Everything changed after the collapse of the USSR and introduction of market-oriented reforms in Russia in the 1990s, along with the growth of commodity prices and Russia’s inclusion in the global economic architecture.

By 2000, Russia had already doubled the amount of grain it produced, making it one of the world’s top producers of this strategic commodity. By the late 2010s to early 2020s, Russia emerged as a one of the world’s largest exporters of grain and agricultural products.

However, Russia quickly realized that commodities – especially food along with hydrocarbons – could become a very useful tool of coercion in geopolitical confrontations with its rivals. This became abundantly clear after the outbreak of Russia’s full-scale war of aggression against Ukraine in 2022, when both Russia’s top-tier politicians (such as Deputy Chairman of the Security Council and former President Dmitry Medvedev) and chief propagandists (such as Margarita Simonyan, the editor-in-chief of the Russian state-controlled broadcaster RT) claimed “hunger” to be Russia’s natural ally, and threaten to cut supplies of food staples to “unfriendly countries.”

At the same time, Russia tried to spark a confrontation between Ukraine and Poland, Hungary, Slovakia over commodities and staples supplies. Ironically, rather than hurting the West, Russia’s actions had a worse impact on so-called “friendly countries” – especially those in the Global South, where access to inexpensive and available foodstuffs is a matter of life and death.

Russia’s strategy of intimidation was also ineffective due to its invasion of Ukraine in February 2022. Its so-called “special military operation” was supposed to be quick and decisive. Two years later, the war has imposed massive pressure on the Russian budget, requiring a constant cash flow that mainly comes from exporting raw materials and commodities.

Forced to evolve its strategy, Russia seems to be abandoning its plan of threatening to starve its adversaries. Instead, Moscow – with China’s help, approval, and likely, guidance – intends to challenge the West by changing the rules of trade in foods critical to global buyers. This strategy is being implemented via pursuit of two interrelated initiatives: formation of a “Grain Entente” between Beijing and Moscow, and the use of the BRICS trading bloc (consisting of nine nations led by founding countries Brazil, Russia, India, China, and South Africa) as a critical vehicle of change.

The first major step in this direction was made in October 2023, when the Russian Food Export Trade LLC company and China Chengtong International Limited concluded the “grain deal of the century” – the largest contract of this type ever signed between the two countries – according to which the Russian side pledges to deliver 70 million tons of various types of grain (produced in the Urals, Siberia, and the Far East) over the next twelve years for US$26.5 billion. As a result, already in the first quarter of 2024, Russia broke a historical record by supplying China with large volumes of oats (.7 times more than the previous year) and buckwheat (3.3 more than the previous year) receiving a staggering US$127 million. Yet, mounting grain sales is only the tip of the iceberg. The most critical development is China’s gradual overtaking of Russia’s logistical infrastructure, which could pave the way for China’s growing control over Eurasian logistics and trade routes.

In September 2023, officials from Russia and China met at the 8th Eastern Economic Summit in Vladivostok, where officials from Russia and China agreed to create a logistical hub – the “Grain Terminal Nizhneleninskoye–Tongjiang” in the Jewish Autonomous Oblast. The goal is to create the Russia’s first “land-based grain fleet.” Consisting of 22,000 containers transporting grain, it will be capable of moving up to 600,000 tons of grain with a maximum storage capacity of up to 8 million per year. The strategic significance of this move is clear. On one hand, it allows Russia to “safeguard” itself against sanctions pressure, which will likely make Russia’s behaviour in Europe (and elsewhere) even more aggressive and unpredictable. On the other hand, China – which will acquire de facto control over Russia’s grain – will see Beijing become the world’s largest grain hub, giving it enormous power to influence and set global food prices.

Russia’s next major move was to push for the creation of a BRICS grain exchange. Fully supported by Russian President Vladimir Putin, the proposed grain exchange would bring together some of the world’s biggest grain buyers and exporters, cumulatively accounting for more than 42 per cent of global grain production (at nearly 1.2 million ) and 40 per cent of global consumption. International observers and subject experts have already warned that Russia- and China- adverse exporters of grain and agricultural products such as the United States, Canada, and Australia “might face challenges in maintaining their market share and negotiating for favourable trade terms, while facing competition from cheaper Russian .” In effect, this may have “significant implications for global agricultural dynamics, ranging from geopolitical and geoeconomic realignments to increased competition in agricultural trade. For traditional exporters such as Australia and the US, it is a call to reassess their national policies and strategies to navigate the evolving landscape of international trade to maintain competitiveness.”

The emergence of the BRICS grain exchange – which will undoubtedly increase Russia’s (and most likely China’s) geoeconomic role – is only a part of a much bigger strategic challenge. If the BRICS grain exchange is successful, it will have a spillover effect on another critical product – the fertilizers required by both developed and developing nations. Russia already has a competitive advantage in fertilizer production, and post-2022, has tried to use its fertilizers as geopolitical tools pressuring international organizations (such as the United Nations) to lobby for the end of sanctions imposed on Russia after its full-scale invasion of Ukraine.

– If the Russia-China grain alliance proliferates and BRICS becomes a major player in the global flow of grains and other foodstuffs, it could prompt even greater changes to the established world market. Analysis of Russian-language sources and publications indicates that the next step would be the creation of an alternative to the “West-dominated” financial architecture, and ultimately, the transformation of global trade.

Russia’s plans (undoubtedly supported by China) pose a very serious challenge to Canada, its allies, and other liberal democracies.

They will likely suffer economic losses of grain exports due to the cheapness of Russian grain, and that country’s current occupation of a large part of Ukraine’s most fertile black-earth areas. If unchecked, Russia could assume control of more than 30 percent of global grain supplies.

Currently, the Indo-Pacific region is Canada’s largest export destination, with agriculture and food exports totaling $9.4 billion in 2022. If China gains unfettered access to Russian grain, it could seriously undercut Canada’s trade.

Making matters worse for Canada, its relationship with New Delhi is arguably at an all-time low, making it challenging to pivot sales of its agricultural products toward India or other countries without significant economic losses.

Looking at the bigger picture, there are a host of other potential threats to the global foods market, from the ongoing war in Ukraine to droughts and adverse climate conditions in the US, Argentina, and Australia. Amid growing uncertainty and upheaval, it’s possible that the global foods market will be carved up and dominated by Russia and other undemocratic, aggressive nations. Given Russia’s strategic goal of weakening the European Union, and ultimately causing its disintegration, it will continue to use artificially created food shortages in Africa and the Greater Middle East as a geopolitical weapon against the EU. The Kremlin hopes to replicate the crisis that occurred in 2015, when hundreds of thousands (now, potentially millions) of illegal migrants and asylum seekers poured into the EU – wreaking havoc, fostering intra-EU conflict, and assisting the rise of far-right (and left) populists.

The first step in Russia’s grand strategy is the de facto establishment of the Russo-Chinese “Grain Entente.” The next move will be the creation of a BRICS grain exchange and inclusion of other strategic commodities under the umbrella of BRICS operations. This is clearly a wakeup call for the West. We need to heed it, or else risk more dire, far-reaching consequences.

Dr. Sergey Sukhankin is a Senior Fellow at the Jamestown Foundation (Washington, DC) and a Fellow at the North American and Arctic Defence and Security Network (NAADSN). His project discussing the activities of Russian PMCs, “War by Other Means,” informed the United Nations General Assembly report entitled “Use of Mercenaries as a Means of Violating Human Rights and Impeding the Exercise of the Right of Peoples to Self-Determination.”

This article was published with support from Konrad-Adenauer-Stiftung Canada.

Agriculture

Health Canada pauses plan to sell unlabeled cloned meat

From LifeSiteNews

Health Canada has indefinitely paused its plan to allow unlabeled cloned meat in grocery stores after thousands of Canadians, prominent figures, and industry leaders condemned the move.

Health Canada is pausing its plan to put unlabeled cloned meat in Canadian grocery stores, following public outcry.

In a November 19 update on its website, Health Canada announced an indefinite suspension of the decision to remove labels from cloned meat products after thousands of Canadians condemned the plan online.

“The Government of Canada has received significant input from both consumers and industry about the implications of this potential policy update,” the publication read. “The Department has therefore indefinitely paused the policy update to provide time for further discussions and consideration,” it continued, adding, “Until the policy is updated, foods made from cloned cattle and swine will remain subject to the novel food assessment.”

In late October, Health Canada quietly approved removing labels from foods derived from somatic cell nuclear transfer (SCNT) clones and their offspring. As a result, Canadians buying meat from the grocery store would have had no way of knowing if the product was cloned meat.

Many researchers have documented high rates of cloning failure, large offspring syndrome (LOS), placental abnormalities, early death, and organ defects in cloned animals. The animals are also administered heavy doses of antibiotics due to infections and immune issues.

Typically, the offspring of cloned animals, rather than the cloned animals themselves, are processed for human consumption. As a result, researchers allege that the health defects and high drug use does not affect the final product.

However, there are no comprehensive human studies on the effects of eating cloned meat, meaning that the side-effects for humans are unknown.

News of the plan spread quickly on social media, with thousands of Canadians condemning the plan and promising to switch to local meat providers.

“By authorizing the sale of meat from cloned animals without mandatory labeling or a formal public announcement, Health Canada risks repeating a familiar and costly failure in risk communication. Deeply disappointing,” food policy expert and professor at Dalhousie University Sylvain Charlebois wrote on X.

"By authorizing the sale of meat from cloned animals without mandatory labeling or a formal public announcement, Health Canada risks repeating a familiar and costly failure in risk communication. Deeply disappointing."

More on this week's Food Professor Podcast! https://t.co/UZTIcQzUN3

— The Food Professor (@FoodProfessor) October 30, 2025

Likewise, Conservative MP Leslyn Lewis warned, “Health Canada recently decided that meat from cloned animals and their offspring no longer needs a special review or any form of disclosure.”

“That means, soon you could buy beef or pork and have no idea how it was bred,” she continued. “Other countries debate this openly: the EU has considered strict labelling, and even the U.S. has admitted that cloned-offspring meat is circulating.”

“But here in Canada, the public wasn’t even told. This is about informed choice,” Lewis declared. “If government and industry don’t have to tell us when meat comes from cloned animals, then Canadians need to ask a simple, honest question: What else are we not being told?”

Health Canada recently decided that meat from cloned animals and their offspring no longer needs a special review or any form of disclosure. That means, soon you could buy beef or pork and have no idea how it was bred.

Other countries debate this openly: the EU has considered… pic.twitter.com/zCnqJOpvf3

— Dr. Leslyn Lewis (@LeslynLewis) November 14, 2025

Likewise, duBreton, a leading North American supplier of organic pork based out of Quebec, denounced the move, saying, “Canadians expect clarity, transparency, and meaningful consultation on issues that directly touch their food supply. As producers, we consider it our responsibility and believe our governing food authorities should too.”

According to a survey conducted by duBreton, 74 percent of Canadians believe that “cloned meat and genetic editing practices have no place in farm and food systems.”

Agriculture

Federal cabinet calls for Canadian bank used primarily by white farmers to be more diverse

From LifeSiteNews

A finance department review suggested women, youth, Indigenous, LGBTQ, Black and racialized entrepreneurs are underserved by Farm Credit Canada.

The Cabinet of Prime Minister Mark Carney said in a note that a Canadian Crown bank mostly used by farmers is too “white” and not diverse enough in its lending to “traditionally underrepresented groups” such as LGBT minorities.

Farm Credit Canada Regina, in Saskatchewan, is used by thousands of farmers, yet federal cabinet overseers claim its loan portfolio needs greater diversity.

The finance department note, which aims to make amendments to the Farm Credit Canada Act, claims that agriculture is “predominantly older white men.”

Proposed changes to the Act mean the government will mandate “regular legislative reviews to ensure alignment with the needs of the agriculture and agri-food sector.”

“Farm operators are predominantly older white men and farm families tend to have higher average incomes compared to all Canadians,” the note reads.

“Traditionally underrepresented groups such as women, youth, Indigenous, LGBTQ, and Black and racialized entrepreneurs may particularly benefit from regular legislative reviews to better enable Farm Credit Canada to align its activities with their specific needs.”

The text includes no legal amendment, and the finance department did not say why it was brought forward or who asked for the changes.

Canadian census data shows that there are only 590,710 farmers and their families, a number that keeps going down. The average farmer is a 55-year-old male and predominantly Christian, either Catholic or from the United Church.

Data shows that 6.9 percent of farmers are immigrants, with about 3.7 percent being “from racialized groups.”

National census data from 2021 indicates that about four percent of Canadians say they are LGBT; however, those who are farmers is not stated.

Historically, most farmers in Canada are multi-generational descendants of Christian/Catholic Europeans who came to Canada in the mid to late 1800s, mainly from the United Kingdom, Ireland, Ukraine, Russia, Italy, Poland, the Netherlands, Germany, and France.

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoGoogle denies scanning users’ email and attachments with its AI software

-

COVID-192 days ago

COVID-192 days agoFDA says COVID shots ‘killed’ at least 10 children, promises new vaccine safeguards

-

Alberta2 days ago

Alberta2 days agoNet Zero goal is a fundamental flaw in the Ottawa-Alberta MOU

-

Addictions2 days ago

Addictions2 days agoManitoba Is Doubling Down On A Failed Drug Policy

-

Food2 days ago

Food2 days agoCanada Still Serves Up Food Dyes The FDA Has Banned

-

COVID-192 days ago

COVID-192 days agoThe dangers of mRNA vaccines explained by Dr. John Campbell

-

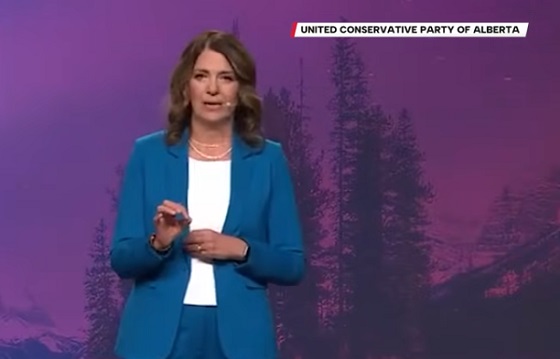

Alberta2 days ago

Alberta2 days agoKeynote address of Premier Danielle Smith at 2025 UCP AGM

-

Artificial Intelligence1 day ago

Artificial Intelligence1 day ago‘Trouble in Toyland’ report sounds alarm on AI toys