Canadian Energy Centre

Energy Perspectives: Trading Up – Canadian oil and gas exports

From the Canadian Energy Centre

The composition of Canadian trade has changed significantly in the last 20 years, with oil and gas now Canada’s most significant export

Global trade patterns have changed in recent years due to ongoing political and economic turmoil. In Canada, these changes are apparent at all levels – provincial, national, and international. The share of goods and services exported has been exceptionally high since 2002 and stood at 33.7 per cent of GDP in 2022. In Canada, 1 in 6 jobs are linked to exports.

Exports have always been essential to Canada’s economy. In 2022, Canada exported $779 billion worth of goods and services, double the value from 2002. One main reason for the country’s substantial export numbers relates to soaring oil and gas prices. Oil and gas accounted for more than 50 per cent of the growth in Canada’s goods exports in 2022. Those numbers are part of a trend: in the last 20 years, from 2002 to 2022, oil and gas exports increased significantly, rising from $36.5 billion in 2002 to $182 billion in 2022, most of it going to the United States (see Figure 1).

Canada’s Top Five Exported Products, 2002 vs. 2022

Since 2002, the composition of Canada’s trade has shifted. In 2002, the top exported product was motor vehicle parts. That year Canada exported $61.1 billion worth of automotive parts, accounting for 16 per cent of total exports. Also, that year Canada’s oil and gas exports stood at $36.5 billion, or 9 per cent of exports (see Figure 2).

Since then, the share of automotive exports as a proportion of all Canada’s exports has declined, while the share of oil and gas exports has increased, mainly due to greater demand from the United States. In the last 20 years, on average, Canada exported $82 billion of oil and gas each year.

In 2022, Canada’s annual oil and gas exports reached a record $182 billion, and the sector accounted for 23 per cent of Canada’s total exports. Accompanying the increase in exports from the sector were increased prices for oil and gas, partly as a result of rising demand in the United States.

The Canadian Energy Centre’s “Energy Perspectives” are short analyses released periodically to provide context on energy issues for investors, policymakers, and the public. The source of profiled data depends on the specific issue.

Canadian Energy Centre

RBC says Canada’s Indigenous owned energy projects are ‘economic reconciliation in action’

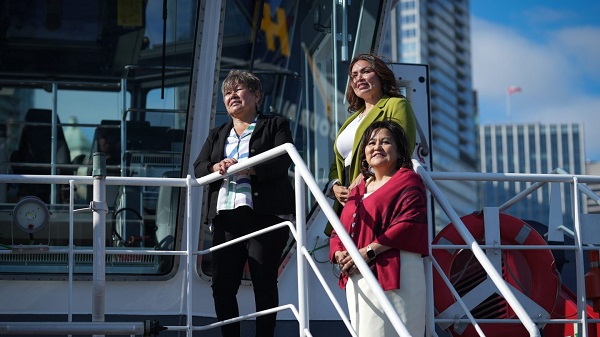

Eva Clayton, back left, President of the Nisga’a Lisims Government (joint venture owner of the proposed Ksi Lisims LNG project), Crystal Smith, back right, Haisla Nation Chief Councillor (joint venture owner of the Cedar LNG project, now under construction), and Karen Ogen, front right, CEO of the First Nations Natural Gas Alliance pose for a photograph on the HaiSea Wamis zero-emission tugboat outside the LNG2023 conference, in Vancouver, B.C., Monday, July 10, 2023. CP Images photo

From the Canadian Energy Centre

As construction gets underway on Cedar LNG, the world’s first Indigenous majority-owned LNG export terminal, a report from RBC highlights the project as a model of successful energy development in Canada.

“We broke a pattern that had existed for over a century,” said Karen Ogen, CEO of the First Nations Natural Gas Alliance.

“First Nations have been at the heart of the LNG opportunity, not on the sidelines or just on the job sites but in the boardrooms helping to make it happen.”

RBC said the Cedar LNG project in Kitimat, B.C. – a partnership between the Haisla Nation (50.1 per cent) and Pembina Pipeline Corporation (49.9 per cent) – is a model for Indigenous economic reconciliation in action.

“Canada’s future growth and prosperity depends heavily on getting Indigenous economic reconciliation right,” said report co-author Varun Srivatsan, RBC’s director of policy and strategic engagement.

“If not, the country’s ability to diversify our resource exports, enjoy independence and resiliency in strategic sectors, and improve productivity, which has lagged that of other countries for years, are all at risk.”

RBC outlined the enormous potential of Indigenous-led energy projects to drive economic growth.

Almost three-quarters of the 504 major resource and energy projects planned or underway in Canada run through or are within 20 kilometres of Indigenous territories.

The value of Indigenous equity opportunity from these projects is estimated at $98 billion over the next 10 years, with oil and gas projects dominating the list at $57.6 billion.

“It’s clear that First Nations are critical to LNG in Canada. It’s First Nations territory from where the gas is extracted in Treaty 8 territory, it’s First Nations territory across which gas is transported via pipeline, it’s First Nations territory where LNG terminals are located, and it’s First Nations waters through which carriers take LNG to market. This is why we say Canadian LNG is Indigenous LNG. And we are going to make history,” Ogen said.

Cedar LNG reached a final investment decision last June, following a permitting process that saw the Haisla Nation directly involved in planning the facilities and operations.

This includes a floating LNG terminal with emissions among the world’s lowest, at 0.08 per cent CO2 equivalent per tonne of LNG compared to the global average of 0.35 per cent. Operations are slated to start in late 2028.

“Our community felt it was important that our values of being Haisla, being Indigenous, were felt through every decision that was being made. That is what makes this project unique,” said Crystal Smith, the Haisla Nation’s elected chief councillor.

Central to the Haisla’s involvement in Cedar LNG are the jobs and ongoing revenues that benefit the nation and neighbouring communities.

This has included support for education and cultural programs and building a state-of-the-art health facility and a new housing development.

“Cedar LNG shows what is achievable when you have a shared vision,” Smith said.

“It is going to mean that my kids and grandkids have a different future from what I or anybody in my generation have experienced in our community. It is going to revive our culture, revive our language, and make us stronger going forward.”

Alberta

As LNG opens new markets for Canadian natural gas, reliance on U.S. to decline: analyst

From The Canadian Energy Centre

By Cody Ciona

Starting with LNG Canada, producers will finally have access to new customers overseas

Canada’s natural gas production and exports are primed for growth as LNG projects come online, according to Houston, Texas-based consultancy RBN Energy.

Long-awaited LNG export terminals will open the door to Asian markets and break the decades-long grip of the United States as the sole customer for Canada’s natural gas.

RBN projects that Canada’s natural gas exports will rise to 12 billion cubic feet per day (bcf/d) by 2034, up from about 8 bcf/d today. But as more LNG terminals come online, less of that natural gas will head south.

“We think the real possibility exists that the amount of natural gas being exported to the United States by pipeline will actually decline,” said Martin King, RBN’s managing director of North America energy market analysis, on a recent webinar.

RBN’s analysis suggests that Canada’s natural gas exports to the United States could drop to 6 bcf/d by the early 2030s compared to around 8 bcf/d today.

With the first cargo from the LNG Canada terminal at Kitimat, B.C. expected to ship in late June, Canada will finally have access to new markets for natural gas. The first phase of the project will have capacity to ship about 1.8 bcf/d.

And more projects are on the way.

LNG Canada’s joint venture partners are considering a second phase that would double export capacity.

Also at Kitimat, the Cedar LNG project is under construction and is expected to be completed in 2028. The floating terminal led by the Haisla Nation will have capacity to export 0.4 bcf/d.

Woodfibre LNG, located near Squamish, B.C. began construction in late 2023 and is expected to be substantially completed by 2027, with export capacity of about 0.3 bcf/d.

Expansions of LNG Canada and Cedar LNG could put LNG exports into the range of 5 bcf/d in the early 2030s, King said.

-

Brownstone Institute7 hours ago

Brownstone Institute7 hours agoAnthony Fauci Gets Demolished by White House in New Covid Update

-

Business8 hours ago

Business8 hours agoSobering reality check – Trump is right: Canada’s economy can’t survive a fair trade agreement with the US

-

Business9 hours ago

Business9 hours agoOttawa must listen to the West

-

Fraser Institute10 hours ago

Fraser Institute10 hours agoDeclining stature of foreign affairs minister underscores Canada’s waning influence on world stage

-

Crime6 hours ago

Crime6 hours agoMexican Cartels Expanding Operations in Canada, Using Indigenous Reserves as Factory Hubs

-

Alberta1 day ago

Alberta1 day agoAlberta’s Environmental Changemakers Shine at the 2025 Emerald Awards

-

Banks1 day ago

Banks1 day agoLiberal border bill could usher in cashless economy by outlawing cash payments

-

Business1 day ago

Business1 day agoBeef is becoming a luxury item in Canada