Opinion

Election 2017 is almost over. Was it a repeat of past elections? Will Election 2021 be a repeat of this one?

Election 2017 will be over in about 48 hours, and then what?

“The odds are all the incumbents will get re-elected so nothing will change.” If that is your argument, then vote for a challenger. You do not have to vote for all 14 or 16 positions depending on school boards. Find one name that you would like to see win a seat, and vote for that person.

If you find some more names, all the better.

Remember the vote you gave your last choice may be the vote that gives your last choice the win over your first choice. In 2013 Paul Harris only beat Tanya Handley by 8 votes, Bill Stuebing got 5 more votes than Bev Manning, and Cathy Peacock and Jim Watters tied. Incumbents usually fill the last few blanks because of name recognition.

“Wasn’t the removal of the railyard going to revitalize the downtown, about 20 years ago, and haven’t the Riverlands been brought up in the last 3 or 4 elections?” The downtown revitalization is a continuous circle and will never be completely revitalized. There will be new ideas, new plans, changes, and hopes that the next project will be the one, that cures the downtown’s ailments. Next election we may be voting on a new vision for the downtown because the issues are still there.

This year the fashionable issue of the day was “Crime” and with Red Deer having the 2nd highest Crime Severity Index in Canada, it was no surprise. We have the highest number of Fentenyl deaths in Alberta and we hand out 500,000 needles per year and can only account for 350,000 back. Haven’t we heard some of the same arguments since 2004 and in 2011 weren’t we 15th on the Crime Severity Index and now we are up to 2nd. Are we trying for number 1? Is this an issue that disappears between elections?

“We are a growth community.” No we are not. We were in 2013 but we are declining in population, our businesses are closing and or relocating. “It is the recession.” No it isn’t. The province grew, the neighbours all grew, just us that declined. The tax differential is still there but it was there when we were growing.

“Our environmental stewardship is a leader.” We have the poorest air quality in Alberta which is the lowest across Canada. Perhaps we could look at the way we build our city, and make some changes. We have all industry in the north-west and we are building our high schools in the East, South-east. Do we need to build 5 high schools along 30th Ave. So either you commute across the city to work or your children commute across the city to high school. The monitors having been reading in the “needs immediate attention” range sine 2009. Harder to deal with but perhaps better planning may help. The next high school will be a public high school, and perhaps a new board might consider building it north of the river and not along 30th Ave?

There are a lot of reasons to change direction, and since the incumbents seem unwilling to let go the levers of power, the voters must.

If you are satisfied with the status quo, vote for the status quo.

I have voted in over 30 elections at different levels. I have seen the same discussions repeated time and again. The biggest change I saw was the 2015 Alberta election that brought in a whole new government. The world did not end, and the apocalypse did not arrive.

I am sure that the world will continue on but I am hoping for some fresh ideas, fresh thinking, fresh discussions and a fresh start in a new direction.

Perhaps we should just wait and see and discuss this during Election 2021. We might.

Business

Dallas mayor invites NYers to first ‘sanctuary city from socialism’

From The Center Square

By

After the self-described socialist Zohran Mamdani won the Democratic primary for mayor in New York, Dallas Mayor Eric Johnson invited New Yorkers and others to move to Dallas.

Mamdani has vowed to implement a wide range of tax increases on corporations and property and to “shift the tax burden” to “richer and whiter neighborhoods.”

New York businesses and individuals have already been relocating to states like Texas, which has no corporate or personal income taxes.

Johnson, a Black mayor and former Democrat, switched parties to become a Republican in 2023 after opposing a city council tax hike, The Center Square reported.

“Dear Concerned New York City Resident or Business Owner: Don’t panic,” Johnson said. “Just move to Dallas, where we strongly support our police, value our partners in the business community, embrace free markets, shun excessive regulation, and protect the American Dream!”

Fortune 500 companies and others in recent years continue to relocate their headquarters to Dallas; it’s also home to the new Texas Stock Exchange (TXSE). The TXSE will provide an alternative to the New York Stock Exchange and Nasdaq and there are already more finance professionals in Texas than in New York, TXSE Group Inc. founder and CEO James Lee argues.

From 2020-2023, the Dallas-Fort Worth-Arlington MSA reported the greatest percentage of growth in the country of 34%, The Center Square reported.

Johnson on Thursday continued his invitation to New Yorkers and others living in “socialist” sanctuary cities, saying on social media, “If your city is (or is about to be) a sanctuary for criminals, mayhem, job-killing regulations, and failed socialist experiments, I have a modest invitation for you: MOVE TO DALLAS. You can call us the nation’s first official ‘Sanctuary City from Socialism.’”

“We value free enterprise, law and order, and our first responders. Common sense and the American Dream still reside here. We have all your big-city comforts and conveniences without the suffocating vice grip of government bureaucrats.”

As many Democratic-led cities joined a movement to defund their police departments, Johnson prioritized police funding and supporting law and order.

“Back in the 1800s, people moving to Texas for greater opportunities would etch ‘GTT’ for ‘Gone to Texas’ on their doors moving to the Mexican colony of Tejas,” Johnson continued, referring to Americans who moved to the Mexican colony of Tejas to acquire land grants from the Mexican government.

“If you’re a New Yorker heading to Dallas, maybe try ‘GTD’ to let fellow lovers of law and order know where you’ve gone,” Johnson said.

Modern-day GTT movers, including a large number of New Yorkers, cite high personal income taxes, high property taxes, high costs of living, high crime, and other factors as their reasons for leaving their states and moving to Texas, according to multiple reports over the last few years.

In response to Johnson’s invitation, Gov. Greg Abbott said, “Dallas is the first self-declared “Sanctuary City from Socialism. The State of Texas will provide whatever support is needed to fulfill that mission.”

The governor has already been doing this by signing pro-business bills into law and awarding Texas Enterprise Grants to businesses that relocate or expand operations in Texas, many of which are doing so in the Dallas area.

“Texas truly is the Best State for Business and stands as a model for the nation,” Abbott said. “Freedom is a magnet, and Texas offers entrepreneurs and hardworking Texans the freedom to succeed. When choosing where to relocate or expand their businesses, more innovative industry leaders recognize the competitive advantages found only in Texas. The nation’s leading CEOs continually cite our pro-growth economic policies – with no corporate income tax and no personal income tax – along with our young, skilled, diverse, and growing workforce, easy access to global markets, robust infrastructure, and predictable business-friendly regulations.”

conflict

US airstrike on Iran’s nuclear facilities. Was it obliteration?

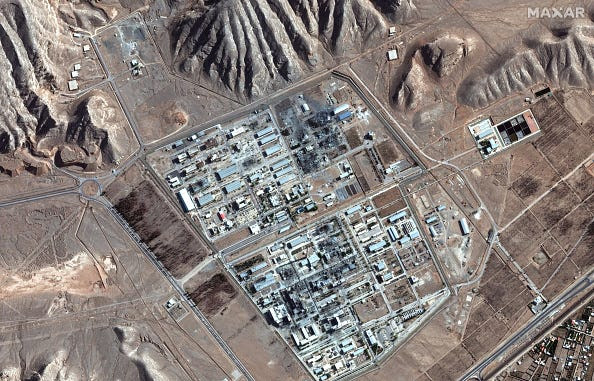

A satellite image of the Isfahan nuclear research center in Iran shows visible damage to structures and nearby tunnel entrances from recent US airstrikes. / Satellite image (c) 2025 Maxar Technologies.

Seymour Hersh

Seymour Hersh

The US attack on Iran may not have wiped out its nuclear ambitions but it did set them back years

I started my career in journalism during the early 1960s as a reporter for the City News Bureau of Chicago, a now long-gone local news agency that was set up by the Chicago newspapers in the 1890s to cover the police and fire departments, City Hall, the courts, the morgue, and so on. It was a training ground, and the essential message for its aspiring reporters was: “If your mother says she loves you, check it out.”

It was a message I wish our cable networks would take to heart. CNN and MSNBC, basing their reporting on an alleged Defense Intelligence Agency analysis, have consistently reported that the Air Force raids in Iran on June 22 did not accomplish their primary goal: total destruction of Iran’s nuclear-weapons capacity. US newspapers also joined in, but it was the two nominally liberal cable channels, with their dislike—make that contempt—for President Donald Trump, that drove the early coverage.

There was no DIA analysis per se. All US units that engage in combat must file an “after-action report” to the DIA after a military engagement. In this case, the report would have come from the US Central Command, located at MacDill Air Force base in Tampa, Florida. CENTCOM is responsible for all US military operations in the Middle East, Egypt, Central Asia, Afghanistan, and Pakistan. One US official involved in the process told me that “the first thing out of the box is you have to tell your boss what happened.” It was that initial report of the bombing attack that was forwarded to DIA headquarters along the Potomac River in Washington and copied or summarized by someone not authorized to do so and sent to the various media outlets.

The view of many who were involved in the planning and execution of the mission is that the report was summarized and leaked “for political purposes”—to cast immediate doubt on the success of the mission. The early reports went so far as to suggest that Iran’s nuclear program has survived incapacitation by the attack. Seven US B-2 “Spirit” bombers, each carrying two deep-penetration “bunker-busters” weighing 30,000 pounds, had flown without challenge from their base in Missouri to the primary target: Iran’s Fordo nuclear facility, concealed deep inside a mountain twenty miles north of the city of Qom.

The planning for the attack began with the knowledge that the main target—the working area of the nuclear program—was buried at least 260 feet below the rocky surface at Fordo. The gas centrifuges spinning there were repeatedly enriching uranium, in what is known as a cascade, not to weapons-grade level—uranium-235 isotopes enriched to 90 percent—but to 60 percent. Further processing to create weapons grade uranium, if Iran chose to do so, could be done in a matter of weeks, or less. The Air Force planning group had also been informed before the bombing raid, most likely by the Israelis, who have a vast spy network in Iran, that more than 450 pounds of the enriched gas stored at Fordo had been shipped to safety at another vital Iranian nuclear site at Isfahan, 215 miles south of Tehran. Isfahan was the only known facility in Iran capable of converting the Fordo gas into a highly enriched metal—a critical early stage of building the bomb. Isfahan also was a separate target of the US attack on Fordo, and was pulverized by Tomahawk missiles fired by a U.S. submarine operating in the Gulf of Aden, off Yemen.

As a journalist who for decades has covered the nascent nuclear crisis in the Middle East, it seemed clear to me and to informed friends I have in Washington and Israel that if Fordo somehow survived its bunker-buster attack, as was initially suggested, and continued to enrich more uranium, Isfahan would not. No enrichment, no Iranian bomb.

I’ve been frustrated and angry at cable news coverage for years, and that includes Fox News, too, and decided to try and find the real story. If your mother says she loves you, check it out. And I checked out enough of it to share.

I was told that “the first question for the American planners was how big was the actual workspace at Fordo? Was it a structure? We had to find that out before we got rid of it.” Some of the planners estimated that the working space “was the size of two hockey rinks: 200 feet long and 85 feet wide.” It came to 34,000 square feet. The height of the underground working space was assumed to be ten-and-a-half feet—I was not told the genesis of that assumption—and the size of the target was determined to be 357,000 cubic feet.

The next step was to measure the power of the dozen or more bunker-busters that were planned to be “carefully spaced and dropped” by the US B-2 bombers, using the most advanced guidance systems. (During one high-level session in Washington, one of the Air Force planners was asked what would happen if the B-2’s guidance systems were corrupted by an outside signal. “We’d miss the target” was the answer.)

I was assured that even if the rough estimate of the working space at Fordo was far off, the bombers targeting Fordo each carried a 30,000-pound bomb with an explosive payload of as much as five thousand pounds, which was more than enough to pulverize the mythical hockey rinks, or even a much larger working space.

Some of the bombs were also outfitted with what is known as a hard target void sensing fuze, which enabled the bombs to penetrate multiple layers of a site like Fordo before detonating. This would maximize the destructive effect. Each bomb, dropped in sequence, would create a force of rubble that would cause increasing havoc in the working areas deep inside the mountain.

“The bombs made their own hole. We built a 30,000-pound steel bullet,” the official told me, referring with pride to the bunker-busters.

Most important, he said, was that there were no post-strike hints detected of radioactivity—more evidence that the 450 pounds of enriched uranium had been moved from Fordo to the reprocessing site at Isfahan prior to the US attack there, which was code-named “Midnight Hammer.” That operation included a third US strike at yet another nuclear facility at Natanz.

“The Air Force got everything on the hit list,” the official told me. “Even if Iran rebuilds some centrifuges, it will still need Isfahan. There is no conversion capability without it.”

Why not, I asked, tell the public about the success of the raid and the fact that Iran no longer has a potential nuclear weapon?

The answer: “There will be a top-secret report about all of this, but we don’t tell people how hard we work. We tell the public what we think it wants to hear.”

The US official, asked about the future of the Iranian nuclear program, quickly acknowledged that “there is a communication problem” when it comes to the fate of the program.

The intent of the strike planners, he said, “was to prevent the Iranians from building a nuclear weapon in the near term—a year or so—with the hope they would not try again. The clear understanding was that there was no expectation to ‘obliterate’ every aspect of their nuclear program. We don’t even know what that is.

“Obliteration means the glass—[eliminating] Iran’s nuclear program—is full. The planning and the results are the glass is half-full. For Trump critics, the results are the glass is half-empty—the centrifuges may have survived and four hundred pounds of 60 percent enriched uranium are missing. The bombs could not be assured to penetrate the centrifuge chamber . . . too deep, but they could cover them up [with rocks and other bomb debris] and in the process cause unknown damage to them.

“Whether the 60 percent [enriched uranium] was there or not is irrelevant because without centrifuges they cannot refine it to weapons grade. Add to this the research and refinement and conversion from gas to metal—required for a bomb—at Isfahan are also gone.

“Results? Glass is half-full . . . a couple of years of respite and uncertain future. So now Trump’s defense is Full Glass. Critics? Half-empty. Reality? Half-full. There you are.”

The immediate beneficiary of the use of US force in Iran will not be a more placid Middle East, but Israel, and Prime Minister Benjamin Netanyahu. The Israeli Air Force and army are still killing massive numbers of Palestinians in Gaza.

There remains no evidence that Iran was on the cusp of becoming a nuclear power. But as the world has known for decades, Israel maintains a significant nuclear arsenal that it officially claims does not exist.

This is a story not about the bigger picture, which is muddled, but about a successful US mission that was the subject of a lot of sloppy reporting because of a reviled president. It would have been a breakthrough had anyone in the mainstream press spoken or written about the double standard that benefits Israel and its nuclear umbrella, but in America that remains a taboo.

-

Agriculture2 days ago

Agriculture2 days agoCanada’s supply management system is failing consumers

-

Economy2 days ago

Economy2 days agoTrump opens door to Iranian oil exports

-

Alberta1 day ago

Alberta1 day agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

Business1 day ago

Business1 day agoCanada’s loyalty to globalism is bleeding our economy dry

-

Alberta1 day ago

Alberta1 day agoAlberta uncorks new rules for liquor and cannabis

-

Business1 day ago

Business1 day agoCarney’s spending makes Trudeau look like a cheapskate

-

armed forces23 hours ago

armed forces23 hours agoCanada’s Military Can’t Be Fixed With Cash Alone

-

Crime1 day ago

Crime1 day agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel