Business

Worst kept secret—red tape strangling Canada’s economy

From the Fraser Institute

By Matthew Lau

In the past nine years, business investment in Canada has fallen while increasing more than 30 per cent in the U.S. on a real per-person basis. Workers in Canada now receive barely half as much new capital per worker than in the U.S.

According to a new Statistics Canada report, government regulation has grown over the years and it’s hurting Canada’s economy. The report, which uses a regulatory burden measure devised by KPMG and Transport Canada, shows government regulatory requirements increased 2.1 per cent annually from 2006 to 2021, with the effect of reducing the business sector’s GDP, employment, labour productivity and investment.

Specifically, the growth in regulation over these years cut business-sector investment by an estimated nine per cent and “reduced business start-ups and business dynamism,” cut GDP in the business sector by 1.7 percentage points, cut employment growth by 1.3 percentage points, and labour productivity by 0.4 percentage points.

While the report only covered regulatory growth through 2021, in the past four years an avalanche of new regulations has made the already existing problem of overregulation worse.

The Trudeau government in particular has intensified its regulatory assault on the extraction sector with a greenhouse gas emissions cap, new fuel regulations and new methane emissions regulations. In the last few years, federal diktats and expansions of bureaucratic control have swept the auto industry, child care, supermarkets and many other sectors.

Again, the negative results are evident. Over the past nine years, Canada’s cumulative real growth in per-person GDP (an indicator of incomes and living standards) has been a paltry 1.7 per cent and trending downward, compared to 18.6 per cent and trending upward in the United States. Put differently, if the Canadian economy had tracked with the U.S. economy over the past nine years, average incomes in Canada would be much higher today.

Also in the past nine years, business investment in Canada has fallen while increasing more than 30 per cent in the U.S. on a real per-person basis. Workers in Canada now receive barely half as much new capital per worker than in the U.S., and only about two-thirds as much new capital (on average) as workers in other developed countries.

Consequently, Canada is mired in an economic growth crisis—a fact that even the Trudeau government does not deny. “We have more work to do,” said Anita Anand, then-president of the Treasury Board, last August, “to examine the causes of low productivity levels.” The Statistics Canada report, if nothing else, confirms what economists and the business community already knew—the regulatory burden is much of the problem.

Of course, regulation is not the only factor hurting Canada’s economy. Higher federal carbon taxes, higher payroll taxes and higher top marginal income tax rates are also weakening Canada’s productivity, GDP, business investment and entrepreneurship.

Finally, while the Statistics Canada report shows significant economic costs of regulation, the authors note that their estimate of the effect of regulatory accumulation on GDP is “much smaller” than the effect estimated in an American study published several years ago in the Review of Economic Dynamics. In other words, the negative effects of regulation in Canada may be even higher than StatsCan suggests.

Whether Statistics Canada has underestimated the economic costs of regulation or not, one thing is clear: reducing regulation and reversing the policy course of recent years would help get Canada out of its current economic rut. The country is effectively in a recession even if, as a result of rapid population growth fuelled by record levels of immigration, the GDP statistics do not meet the technical definition of a recession.

With dismal GDP and business investment numbers, a turnaround—both in policy and outcomes—can’t come quickly enough for Canadians.

2025 Federal Election

POLL: Canadians want spending cuts

By Gage Haubrich

By Gage Haubrich

The Canadian Taxpayers Federation released Leger polling showing Canadians want the federal government to cut spending and shrink the size and cost of the bureaucracy.

“The poll shows most Canadians want the federal government to cut spending,” said Gage Haubrich, CTF Prairie Director. “Canadians know they pay too much tax because the government wastes too much money.”

Between 2019 and 2024, federal government spending increased 26 per cent even after accounting for inflation. Leger asked Canadians what they think should happen to federal government spending in the next five years. Results of the poll show:

- 43 per cent say reduce spending

- 20 per cent say increase spending

- 16 per cent say maintain spending

- 20 per cent don’t know

The federal government added 108,000 bureaucrats and increased the cost of the bureaucracy 73 per cent since 2016. Leger asked Canadians what they think should happen to the size and cost of the federal bureaucracy. Results of the poll show:

- 53 per cent say reduce

- 24 per cent say maintain

- 4 per cent say increase

- 19 per cent don’t know

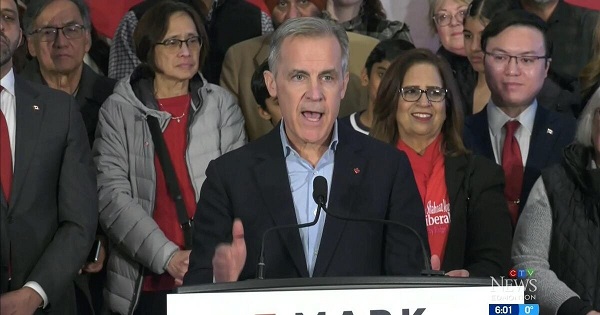

Liberal Leader Mark Carney promised to “balance the operating budget in three years.” Leger asked Canadians if they believed Carney’s promise to balance the budget. Results of the poll show:

- 58 per cent are skeptical

- 32 per cent are confident

- 10 per cent don’t know

“Any politician that wants to fix the budget and cut taxes will need to shrink the size and cost of Ottawa’s bloated bureaucracy,” Haubrich said. “The polls show Canadians want to put the federal government on a diet and they won’t trust promises about balancing the budget unless politicians present credible plans.”

2025 Federal Election

Carney’s budget means more debt than Trudeau’s

The Canadian Taxpayers Federation is criticizing Liberal Party Leader Mark Carney’s budget plan for adding another $225 billion to the debt.

“Carney plans to borrow even more money than the Trudeau government planned to borrow,” said Franco Terrazzano, CTF Federal Director. “Carney claims he’s not like Trudeau and when it comes to the debt, here’s the truth: Carney’s plan is billions of dollars worse than Trudeau’s plan.”

Today, Carney released the Liberal Party’s “fiscal and costing plan.” Carney’s plan projects the debt to increase consistently.

Here is the breakdown of Carney’s annual budget deficits:

- 2025-26: $62 billion

- 2026-27: $60 billion

- 2027-28: $55 billion

- 2028-29: $48 billion

Over the next four years, Carney plans to add an extra $225 billion to the debt. For comparison, the Trudeau government planned on increasing the debt by $131 billion over those years, according to the most recent Fall Economic Statement.

Carney’s additional debt means he will waste an extra $5.6 billion on debt interest charges over the next four years. Debt interest charges already cost taxpayers $54 billion every year – more than $1 billion every week.

“Carney’s debt binge means he will waste $1 billion more every year on debt interest charges,” Terrazzano said. “Carney’s plan isn’t credible and it’s even more irresponsible than the Trudeau plan.

“After years of runaway spending Canadians need a government that will cut spending and stop wasting so much money on debt interest charges.”

-

International1 day ago

International1 day agoPope Francis has died aged 88

-

International23 hours ago

International23 hours agoJD Vance was one of the last people to meet Pope Francis

-

International1 day ago

International1 day agoPope Francis Dies on Day after Easter

-

2025 Federal Election12 hours ago

2025 Federal Election12 hours agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election12 hours ago

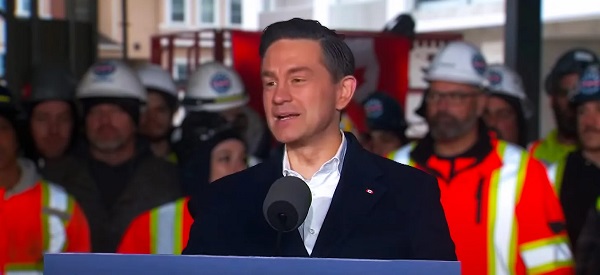

2025 Federal Election12 hours agoReal Homes vs. Modular Shoeboxes: The Housing Battle Between Poilievre and Carney

-

COVID-1912 hours ago

COVID-1912 hours agoNearly Half of “COVID-19 Deaths” Were Not Due to COVID-19 – Scientific Reports Journal

-

2025 Federal Election12 hours ago

2025 Federal Election12 hours agoHow Canada’s Mainstream Media Lost the Public Trust

-

2025 Federal Election12 hours ago

2025 Federal Election12 hours agoPOLL: Canadians want spending cuts