Frontier Centre for Public Policy

Why is Trudeau sticking to the unmarked graves falsehood?

From the Frontier Centre for Public Policy

There is simply no possibility that Trudeau didn’t know on June 17th, 2024 that he was spreading misinformation when he said that unmarked graves were found. In plain English — he knew he was lying.

The claim made by Chief Rosanne Casimir on May 27th, 2021, that the remains of 215 children, former students of the Kamloops Indian Residential School (KIRS) had been found in unmarked graves on the school grounds, was false.

Only soil anomalies were detected by a radar device. Those anomalies could be tree roots, previous excavations, or almost anything. In fact, research since that time makes it clear that the anomalies were almost certainly the trenches of a former septic field installed in 1924 to dispose of the school’s sewage.

No “unmarked graves”, “human remains”, “bodies” or “mass graves” were found.

Chief Casimir finally confessed to making that false claim three years after making it. She admitted what was known to most of all along: no graves, human remains, or bodies were found — only 215 “anomalies”.

So, everyone in Canada now knows that the May 27th, 2021 claim of unmarked graves containing human remains found at Kamloops was false. Everybody except the prime minister it seems, and his former Indigenous Affairs Minister, Marc Miller.

However on June 17th, 2024, Prime Minister Trudeau — instead of taking the opportunity to set the record straight — repeated at an indigenous event the whopper that “unmarked graves” have been found. He has been spreading that misinformation for three years.

One would think that now that the person who originally made the false claim has admitted that no graves were found — only anomalies — that Trudeau would take the opportunity to clear up the confusion and go with the truth, instead of repeating the original lie.

There is simply no possibility that Trudeau didn’t know on June 17th, 2024 that he was spreading misinformation when he said that unmarked graves were found. In plain English — he knew he was lying.

So, why would he do such a thing? Doesn’t a prime minister have a duty to refrain from deliberately lying to Canadian citizens? After all, the great majority of Canadians know by now that no graves were found at Kamloops.

The only answer that makes sense is that the Prime Minister was not speaking to all Canadians on June 17th, 2024. He was speaking only to indigenous Canadians when he falsely stated that unmarked graves had been found at Kamloops. He was repeating a lie they believed. They believed that lie in large part because he and Marc Miller were doing their best to keep the lie alive.

Everything that he and his colleagues have done since May 27, 2021 — lowering flags, kneeling with a teddy bear in an ordinary community cemetery, lavishing money on indigenous communities to search for missing children he knows were never “missing” — has been done to pander to an indigenous community that largely believes those false stories about evil priests and secret burials. I repeat — believes that anti- Catholic bilge in large part because the Trudeau Liberals have encouraged them to believe it.

What has come to be known as the “Kamloops Graves Hoax” is now known to most Canadians for what it is — a false claim. However, we have a prime minister who, for his own reasons, seems intent on keeping the hoax going within the indigenous community. The deception being practiced by the prime minister will have serious consequences in the years ahead. And those consequences are all negative.

Prime ministers come and go. Some remain popular throughout their term, but some become increasingly unpopular. For example, the late Brian Mulroney was so unpopular with Canadians toward the end of his term that the Conservatives, led by his successor, Kim Campbell, were virtually wiped in the election following his retirement.

Trudeau’s fate remains to be seen.

However, that is just politics. But what Trudeau is doing, in deliberately lying to an already marginalized demographic that has a history of being lied to by indigenous and non-indigenous politicians, is not just politics. It is reprehensible conduct. Those people are going to be very angry when they realize that they have been deceived.

Under Trudeau’s watch, we have already seen churches burn, statues topple, and other mayhem as a result of a claim that the PMO knows is false.

Exactly why he is practicing this deception we do not know. We do know with certainty that Indigenous Affairs Minister Marc Miller spoke with Chief Rosanne Casimir on the evening of May 27, 2021, immediately after she made her false claim that the remains of 215 children, who were students at KIRS, had been found. Here’s what he said about his May 27, 2021 telephone conversation with Casimir, according to Hansard:

“On Thursday evening, I spoke to Chief Casimir and assured her of my steadfast support for the grieving and reconciliation process over the coming weeks. We have been in contact since then as well. We will be there with them as they lead this initiative, and we will help meet their needs in the coming weeks and months.”

Unless Chief Casimir told Miller that “remains” had been found, and not the truth — that only anomalies had been detected — the Trudeau government and the Kamloops band together, for reasons unknown, created the false narrative that the remains of 215 children had been found, knowing that their claim was false. Why did this happen?

The prime minister is now keeping this false narrative alive, knowing that it was, and is, false. Why is he doing this?.

And why are the CBC and our mainstream media not even trying to find out?

Something is very wrong here.

Brian Giesbrecht, retired judge, is a Senior Fellow at the Frontier Centre for Public Policy

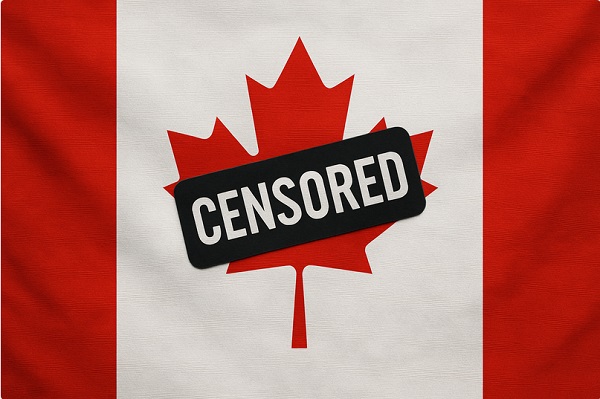

Censorship Industrial Complex

Ottawa’s New Hate Law Goes Too Far

From the Frontier Centre for Public Policy

By Lee Harding

Ottawa says Bill C-9 fights hate. Critics say it turns ordinary disagreement into a potential crime.

Discriminatory hate is not a good thing. Neither, however, is the latest bill by the federal Liberal government meant to fight it. Civil liberties organizations and conservative commentators warn that Bill C-9 could do more to chill legitimate speech than curb actual hate.

Bill C-9 creates a new offence allowing up to life imprisonment for acts motivated by hatred against identifiable groups. It also creates new crimes for intimidation or obstruction near places of worship or community buildings used by identifiable groups. The bill adds a new hate propaganda offence for displaying terrorism or hate symbols.

The Canadian Civil Liberties Association (CCLA) warns the legislation “risks criminalizing some forms of protected speech and peaceful protest—two cornerstones of a free and democratic society—around tens of thousands of community gathering spaces in Canada.” The CCLA sees no need to add to existing hate laws.

Bill C-9 also removes the requirement that the Attorney General consent to lay charges for existing hate propaganda offences. The Canadian Constitution Foundation (CCF) calls this a major flaw, noting it removes “an important safeguard for freedom of expression that has been part of Canada’s law for decades.” Without that safeguard, decisions to prosecute may depend more on local political pressures and less on consistent national standards.

Strange as it sounds, hatred just will not be what it used to be if this legislation passes. The core problem begins with how the bill redefines the term itself.

Previously, the Supreme Court of Canada said hatred requires “extreme manifestations” of detestation or vilification that involve destruction, abhorrence or portraying groups as subhuman or innately evil. Instead, Bill C-9 defines hatred as “detestation or vilification,” stronger than “disdain or dislike.” That is a notably lower threshold. This shift means that ordinary political disagreement or sharp criticism could now be treated as criminal hatred, putting a wide range of protected expression at real risk.

The bill also punishes a hateful motivation more than the underlying crime. For example, if a criminal conviction prompted a sentence of two years to less than five years, a hateful motivation would add as much as an additional five years of jail time.

On paper, most Canadians may assume they will never be affected by these offences. In practice, the definition of “hate” is already stretched far beyond genuine threats or violence.

Two years ago, the 1 Million March for Children took place across Canada to protest the teaching of transgender concepts to schoolchildren, especially the very young. Although such opposition is a valid position, unions, LGBT advocates and even Newfoundland and Labrador Conservatives adopted the “No Space For Hate” slogan in response to the march. That label now gets applied far beyond real extremism.

Public pressure also shapes how police respond to protests. If citizens with traditional values protest a drag queen story hour near a public library, attendees may demand that police lay charges and accuse officers of implicit hatred if they refuse. The practical result is clear: officers may feel institutional pressure to lay charges to avoid being accused of bias, regardless of whether any genuine threat or harm occurred.

Police, some of whom take part in Pride week or work in stations decorated with rainbow colours in June, may be wary of appearing insensitive or intolerant. There have also been cases where residents involved in home invasion incidents were charged, and courts later determined whether excessive force was used. In a similar way, officers may lay charges first and allow the courts to sort out whether a protest crossed a line. Identity-related considerations are included in many workplace “sensitivity training” programs, and these broader cultural trends may influence how such situations are viewed. In practice, this could mean that protests viewed as ideologically unfashionable face a higher risk of criminal sanction than those aligned with current political priorities.

If a demonstrator is charged and convicted for hate, the Liberal government could present the prosecution as a matter for the justice system rather than political discretion. It may say, “It was never our choice to charge or convict these people. The system is doing its job. We must fight hate everywhere.”

Provincial governments that support prosecution will be shielded by the inability to show discretion, while those that would prefer to let matters drop will be unable to intervene. Either way, the bill could increase tensions between Ottawa and the provinces. This could effectively centralize political authority over hate-related prosecutions in Ottawa, regardless of regional differences in values or enforcement priorities.

The bill also raises concerns about how symbols are interpreted. While most Canadians would associate the term “hate symbol” with a swastika, some have linked Canada’s former flag to extremism. The Canadian Anti-Hate Network did so in 2022 in an educational resource entitled “Confronting and preventing hate in Canadian schools.”

The flag, last used nationally in 1965, was listed under “hate-promoting symbols” for its alleged use by the “alt-right/Canada First movement” to recall when Canada was predominantly white. “Its usage in modern times is an indicator of hate-promoting beliefs,” the resource insisted. If a historic Canadian symbol can be reclassified this easily, it shows how subjective and unstable the definition of a “hate symbol” could become under this bill.

These trends suggest the legislation jeopardizes not only symbols associated with Canada’s past, but also the values that supported open debate and free expression. Taken together, these changes do not merely target hateful behaviour. They create a legal framework that can be stretched to police dissent and suppress unpopular viewpoints. Rest in peace, free speech.

Lee Harding is a research fellow for the Frontier Centre for Public Policy.

Business

Canada Can Finally Profit From LNG If Ottawa Stops Dragging Its Feet

From the Frontier Centre for Public Policy

By Ian Madsen

Canada’s growing LNG exports are opening global markets and reducing dependence on U.S. prices, if Ottawa allows the pipelines and export facilities needed to reach those markets

Canada’s LNG advantage is clear, but federal bottlenecks still risk turning a rare opening into another missed opportunity

Canada is finally in a position to profit from global LNG demand. But that opportunity will slip away unless Ottawa supports the pipelines and export capacity needed to reach those markets.

Most major LNG and pipeline projects still need federal impact assessments and approvals, which means Ottawa can delay or block them even when provincial and Indigenous governments are onside. Several major projects are already moving ahead, which makes Ottawa’s role even more important.

The Ksi Lisims floating liquefaction and export facility near Prince Rupert, British Columbia, along with the LNG Canada terminal at Kitimat, B.C., Cedar LNG and a likely expansion of LNG Canada, are all increasing Canada’s export capacity. For the first time, Canada will be able to sell natural gas to overseas buyers instead of relying solely on the U.S. market and its lower prices.

These projects give the northeast B.C. and northwest Alberta Montney region a long-needed outlet for its natural gas. Horizontal drilling and hydraulic fracturing made it possible to tap these reserves at scale. Until 2025, producers had no choice but to sell into the saturated U.S. market at whatever price American buyers offered. Gaining access to world markets marks one of the most significant changes for an industry long tied to U.S. pricing.

According to an International Gas Union report, “Global liquefied natural gas (LNG) trade grew by 2.4 per cent in 2024 to 411.24 million tonnes, connecting 22 exporting markets with 48 importing markets.” LNG still represents a small share of global natural gas production, but it opens the door to buyers willing to pay more than U.S. markets.

LNG Canada is expected to export a meaningful share of Canada’s natural gas when fully operational. Statistics Canada reports that Canada already contributes to global LNG exports, and that contribution is poised to rise as new facilities come online.

Higher returns have encouraged more development in the Montney region, which produces more than half of Canada’s natural gas. A growing share now goes directly to LNG Canada.

Canadian LNG projects have lower estimated break-even costs than several U.S. or Mexican facilities. That gives Canada a cost advantage in Asia, where LNG demand continues to grow.

Asian LNG prices are higher because major buyers such as Japan and South Korea lack domestic natural gas and rely heavily on imports tied to global price benchmarks. In June 2025, LNG in East Asia sold well above Canadian break-even levels. This price difference, combined with Canada’s competitive costs, gives exporters strong margins compared with sales into North American markets.

The International Energy Agency expects global LNG exports to rise significantly by 2030 as Europe replaces Russian pipeline gas and Asian economies increase their LNG use. Canada is entering the global market at the right time, which strengthens the case for expanding LNG capacity.

As Canadian and U.S. LNG exports grow, North American supply will tighten and local prices will rise. Higher domestic prices will raise revenues and shrink the discount that drains billions from Canada’s economy.

Canada loses more than $20 billion a year because of an estimated $20-per-barrel discount on oil and about $2 per gigajoule on natural gas, according to the Frontier Centre for Public Policy’s energy discount tracker. Those losses appear directly in public budgets. Higher natural gas revenues help fund provincial services, health care, infrastructure and Indigenous revenue-sharing agreements that rely on resource income.

Canada is already seeing early gains from selling more natural gas into global markets. Government support for more pipelines and LNG export capacity would build on those gains and lift GDP and incomes. Ottawa’s job is straightforward. Let the industry reach the markets willing to pay.

Ian Madsen is a senior policy analyst at the Frontier Centre for Public Policy.

-

National2 days ago

National2 days agoCanada’s free speech record is cracking under pressure

-

Digital ID1 day ago

Digital ID1 day agoCanada considers creating national ID system using digital passports for domestic use

-

Business2 days ago

Business2 days agoAlbertans give most on average but Canadian generosity hits lowest point in 20 years

-

International2 days ago

International2 days ago100 Catholic schoolchildren rescued, Nigeria promises release of remaining hostages

-

Fraser Institute1 day ago

Fraser Institute1 day agoClaims about ‘unmarked graves’ don’t withstand scrutiny

-

Business2 days ago

Business2 days agoTaxpayers Federation calls on politicians to reject funding for new Ottawa Senators arena

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoCarney Hears A Who: Here Comes The Grinch

-

Alberta1 day ago

Alberta1 day agoHere’s why city hall should save ‘blanket rezoning’ in Calgary