Alberta

Wetaskiwin RCMP Investigate Armed Robbery – Arrest – Seek Information

May 10, 2021

Wetaskiwin RCMP Investigate Armed Robbery – Arrest – Seek Information

Wetaskiwin Alta. – On Tuesday, May 4th, 2021, at 12:55 pm, Wetaskiwin RCMP responded to an armed robbery at the Rexall Drugs in Millet, AB. Three young males entered the store, two of them had firearms. They stole prescription drugs valued at over $3,000. Fortunately, numerous witnesses informed police the licence plate of a brown vehicle that sped from the area. Police responded immediately to the scene and began patrols looking for suspects. No one was hurt during the robbery.

Police believe the three males split up, and one male continued in a brown car back towards Millet, and the other two fled in an older blue SUV West towards QE II.

A short while later in Wetaskiwin County another witness noted a male in a brown car on the side of the road. Shortly after a fire started, growing to a small bush fire. Wetaskiwin Fire Services promptly attended and put out the blaze. While patrolling in the area of the fire police located the suspect vehicle, which fled from police. A pursuit was initiated. The suspect vehicle led police in a chase for over 30 km and the pursuit ended with the use of a Tire Deflation Device. Police Dog Services and the Central Alberta Crime Reduction Team as well as members from Leduc and Maskwacis detachments all assisted with the pursuit, resulting in the arrest of one male.

“This was a fantastic example of alert neighbours and community calling police when they see something suspicious” states Cst. Shaun Marchand of the Wetaskiwin RCMP. “The success in locating and arresting the accused and providing critical information for this investigation has everything to do with members of the public recognizing something was out of places in three separate occasions.”

As a result of the investigation, the following charges have been laid against one male:

Beckham Terrence Rawcliffe (19) of Airdrie, AB:

- Robbery with offensive weapon

- Disguised with intent

- Resist/Obstruct arrest (X2)

- Mischief under $5000

- Arson

- Possession of a weapon for a dangerous purpose

- Pointing a firearm

- Using firearm in commission of an offence

- Flight from police

- Dangerous operation of motor vehicle

- Fail to comply with release order (X3)

- Fail to comply with undertaking

- Fail to Remain at scene after MVC (x2)

- Learner drive motor vehicle without proper supervision

Two other suspects remain outstanding. They are described as:

- Male

- Caucasian

- Short (5’3 – 5’6)

- Young (18-25 in age)

- Wore all black during the robbery

- Drove an older blue SUV

- Have in their possession a firearm

Police consider the two outstanding suspects to be armed and dangerous.

Rawcliffe was brought before a Justice of the Peace. Beckham Rawcliffe was remanded and is scheduled to appear in court in Wetaskiwin on May 13th, 2021.

If anyone has information regarding these suspects, they are asked to contact the Wetaskiwin RCMP Detachment at 780-312-7267 or their local police. If you wish to remain anonymous, you can contact Crime Stoppers at 1-800-222-8477 (TIPS), online at www.P3Tips.com or by using the “P3 Tips” app available through the Apple App or Google Play Store.”

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

espionage21 hours ago

espionage21 hours agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNeil Young + Carney / Freedom Bros

-

Business1 day ago

Business1 day agoDOGE Is Ending The ‘Eternal Life’ Of Government

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBureau Exclusive: Chinese Election Interference Network Tied to Senate Breach Investigation

-

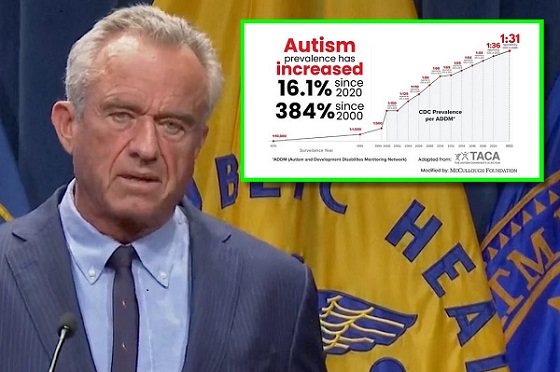

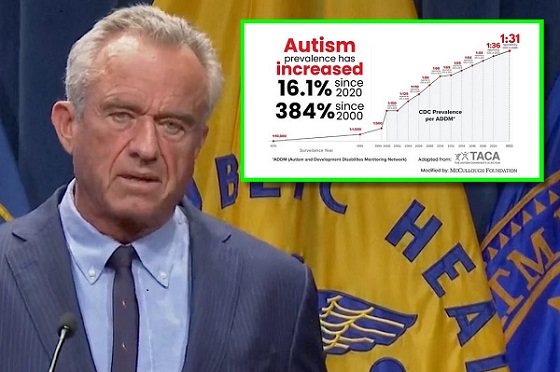

Autism2 days ago

Autism2 days agoRFK Jr. Exposes a Chilling New Autism Reality

-

International2 days ago

International2 days agoUK Supreme Court rules ‘woman’ means biological female

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoTucker Carlson Interviews Maxime Bernier: Trump’s Tariffs, Mass Immigration, and the Oncoming Canadian Revolution