Energy

Ukraine war proves value of LNG Canada, CEO tells global gas conference in Vancouver

Delegates are silhouetted before the start of the LNG 2023 conference, in Vancouver, B.C., Monday, July 10, 2023. THE CANADIAN PRESS/Darryl Dyck

Vancouver

Volatility in the supply and price of natural gas worldwide since Russia’s invasion of Ukraine shows the value of the LNG Canada project as a source of “affordable, reliable” and “responsibly produced” liquefied natural gas, the project’s CEO said.

“I can’t think of any country better placed to supply Asia with exactly that than Canada,” said Jason Klein of LNG Canada, the massive export facility currently under construction in Kitimat, B.C.

Klein said the $40-billion project is close to 85-per-cent complete and will aim to compete globally, not only on price but also its environmental and social track record.

Klein made the comments at the opening of the LNG 2023 conference in Vancouver, an event that was originally scheduled for last year in the Russian city of St. Petersburg before being moved to B.C. because of the war in Ukraine.

That situation, Klein said, may be the best example of the value of Canadian energy and its stability on the world stage.

“I think it’s an amazing opportunity to reflect on the fact that the very act that causes us to be in Vancouver today is the same one that’s upending global energy markets,” Klein said.

The LNG 2023 conference runs until Thursday, drawing multinational energy corporations such as energy giants Petronas, BP and ConocoPhillips, as well as government representatives from key producing countries such as Qatar. The conference is held every three years.

Organizers said the discussion at the conference would be centred around economic consequences of market upheaval. The disappearance of Russia, the world’s largest natural gas exporter, from Western supply chains was at the forefront of several conference panels.

Experts said that while Europe took the brunt of losing Russian gas supplies, Asia also suffered, because European buyers pushed up the prices for liquefied natural gas globally, and many countries struggled to secure supply.

Sarah Bairstow, president and chief commercial officer for U.S. LNG producer Mexico Pacific, said that was why the industry should keep its attention on Asia — which she described as the “demand engine” for the commodity.

“What we’ve seen as a result of the last 12-15 months is Asia-Pacific buyers … they know they need baseline gas supply not only for their own generation, but also for their own energy transition goals,” Bairstow told the conference. “And they are really seeking to get ahead of the curve of Europe.”

Canadian organizers of the conference said that, in addition to stability, First Nations economic reconciliation is a major part of what the sector wants to present to the global natural gas industry.

First Nations LNG Alliance chair Crystal Smith told the conference that more extensive Indigenous community involvement is on the way in projects such as the planned Cedar LNG facility in Kitimat.

“I think about where our community was even 10 years ago in regards to our participation in our economies,” Smith said of Haisla Nation’s ownership of the project.

“We essentially sat on the sidelines and watched everybody in our territory and surrounding area proper … to now, I can’t help but smile and get absolutely emotional at being majority owners of Cedar LNG.”

This report by The Canadian Press was first published July 10, 2023.

Business

Net Zero by 2050: There is no realistic path to affordable and reliable electricity

By Dave Morton of the Canadian Energy Reliability Council.

By Dave Morton of the Canadian Energy Reliability Council.

Maintaining energy diversity is crucial to a truly sustainable future

Canada is on an ambitious path to “decarbonize” its economy by 2050 to deliver on its political commitment to achieve net-zero greenhouse gas (GHG) emissions. Although policy varies across provinces and federally, a default policy of electrification has emerged, and the electricity industry, which in Canada is largely owned by our provincial governments, appears to be on board.

In a November 2023 submission to the federal government, Electricity Canada, an association of major electric generators and suppliers in Canada, stated: “Every credible path to Net Zero by 2050 relies on electrification of other sectors.” In a single generation, then, will clean electricity become the dominant source of energy in Canada? If so, this puts all our energy eggs in one basket. Lost in the debate seem to be considerations of energy diversity and its role in energy system reliability.

What does an electrification strategy mean for Canada? Currently, for every 100 units of energy we consume in Canada, over 40 come to us as liquid fuels like gasoline and diesel, almost 40 as gaseous fuels like natural gas and propane, and a little less than 20 in the form of electrons produced by those fuels as well as by water, uranium, wind, solar and biomass. In British Columbia, for example, the gas system delivered approximately double the energy of the electricity system.

How much electricity will we need? According to a recent Fraser Institute report, a decarbonized electricity grid by 2050 requires a doubling of electricity. This means adding the equivalent of 134 new large hydro projects like BC’s Site C, 18 nuclear facilities like Ontario’s Bruce Power Plant, or installing almost 75,000 large wind turbines on over one million hectares of land, an area nearly 14.5 times the size of the municipality of Calgary.

Is it feasible to achieve a fully decarbonized electricity grid in the next 25 years that will supply much of our energy requirements? There is a real risk of skilled labour and supply chain shortages that may be impossible to overcome, especially as many other countries are also racing towards net-zero by 2050. Even now, shortages of transformers and copper wire are impacting capital projects. The Fraser Institute report looks at the construction challenges and concludes that doing so “is likely impossible within the 2050 timeframe”.

How we get there matters a lot to our energy reliability along the way. As we put more eggs in the basket, our reliability risk increases. Pursuing electrification while not continuing to invest in our existing fossil fuel-based infrastructure risks leaving our homes and industries short of basic energy needs if we miss our electrification targets.

The IEA 2023 Roadmap to Net Zero estimates that technologies not yet available on the market will be needed to deliver 35 percent of emissions reductions needed for net zero in 2050. It comes then as no surprise that many of the technologies needed to grow a green electric grid are not fully mature. While wind and solar, increasingly the new generation source of choice in many jurisdictions, serve as a relatively inexpensive source of electricity and play a key role in meeting expanded demand for electricity, they introduce significant challenges to grid stability and reliability that remain largely unresolved. As most people know, they only produce electricity when the wind blows and the sun shines, thereby requiring a firm back-up source of electricity generation.

Given the unpopularity of fossil fuel generation, the difficulty of building hydro and the reluctance to adopt nuclear in much of Canada, there is little in the way of firm electricity available to provide that backup. Large “utility scale” batteries may help mitigate intermittent electricity production in the short term, but these facilities too are immature. Furthermore, wind, solar and batteries, because of the way they connect to the grid don’t contribute to grid reliability in the same way the previous generation of electric generation does.

Other zero-emitting electricity generation technologies are in various stages of development – for example, Carbon Capture Utilization and Storage (CCUS) fitted to GHG emitting generation facilities can allow gas or even coal to generate firm electricity and along with Small Modular Reactors (SMRs) can provide a firm and flexible source of electricity.

What if everything can’t be electrified? In June 2024, a report commissioned by the federal government concluded that the share of overall energy supplied by electricity will need to roughly triple by 2050, increasing from the current 17 percent to between 40 and 70 percent. In this analysis, then, even a tripling of existing electricity generation, will at best only meet 70 percent of our energy needs by 2050.

Therefore, to ensure the continued supply of reliable energy, non-electrification pathways to net zero are also required. CCUS and SMR technologies currently being developed for producing electricity could potentially be used to provide thermal energy for industrial processes and even building heat; biofuels to replace gasoline, diesel and natural gas; and hydrogen to augment natural gas, along with GHG offsets and various emission trading schemes are similarly

While many of these technologies can and currently do contribute to GHG emission reductions, uncertainties remain relating to their scalability, cost and public acceptance. These uncertainties in all sectors of our energy system leaves us with the question: Is there any credible pathway to reliable net-zero energy by 2050?

Electricity Canada states: “Ensuring reliability, affordability, and sustainability is a balancing act … the energy transition is in large part policy-driven; thus, current policy preferences are uniquely impactful on the way utilities can manage the energy trilemma. The energy trilemma is often referred to colloquially as a three-legged stool, with GHG reductions only one of those legs. But the other two, reliability and affordability, are key to the success of the transition.

Policymakers should urgently consider whether any pathway exists to deliver reliable net-zero energy by 2050. If not, letting the pace of the transition be dictated by only one of those legs guarantees, at best, a wobbly stool. Matching the pace of GHG reductions with achievable measures to maintain energy diversity and reliability at prices that are affordable will be critical to setting us on a truly sustainable pathway to net zero, even if it isn’t achieved by 2050.

Dave Morton, former Chair and CEO of the British Columbia Utilities Commission (BCUC), is with the Canadian Energy Reliability Council.

2025 Federal Election

Canada is squandering the greatest oil opportunity on Earth

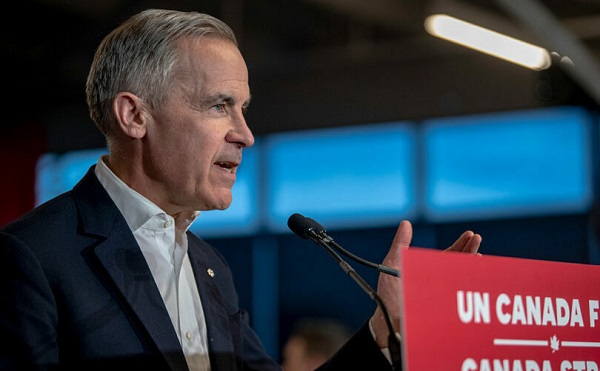

Canada has 3X US oil reserves but less than 40% the production. Why? Anti-oil politicians like Mark Carney who say they’re protecting Earth’s coldest country from global warming.

- Canada has 170 billion barrels of proven oil reserves—by far the largest of any free country. And its producers can profit at $44 oil, vs. >$57 for US shale.

- Canadian oil production is also continuing to get cheaper. Oil sands operating costs have dropped 19% over the past five years, and the industry—which is still fine-tuning how to coax oil-like bitumen out of oil sands—has substantial room for further cost reductions.

- In addition to its massive proven oil reserves, Canada also has massive unexplored oil resources. Canada’s Northwest Territories may contain up to 37% of Canada’s total oil reserves, much of it light crude, which is even cheaper to extract and transport than bitumen from oil sands.

Canada is squandering this opportunity, with < 40% of US production and much slower growth

- Given Canada’s massive oil reserves and lower production costs, Canadian oil should have been growing far faster than US oil—on a path to producing even more oil than the US does.

Instead, Canada is totally squandering its oil opportunity, with less than 40% of US production and slower growth since 2010.

The lost opportunity is costing Canadians 100s of billions of dollars a year—and undermining global security

- In 2023, oil sands directly contributed C$38 billion to GDP—while total economic impact was 100s of billions of dollars. It could have been far, far greater.

- Canada’s oil underproduction is undermining both Canadian prosperity and global security. E.g., Europe’s dependence on Russian oil triggered an energy crisis after Russia invaded Ukraine. By doubling its oil production, Canada could make oil dictators weaker, the free world stronger—and Canada more powerful.

The cause: False climate ideas have led Canada to senselessly strangle its oil industry

Canada is squandering its oil opportunity by preventing its abundant oil from being transported to world markets

- With 3X US oil reserves but 1/8 the people, Canada can produce far more oil than it can use. So it needs a lot of transportation. Yet it wages war on pipelines, which are the cheapest, fastest, safest way to transport oil.

- In 2016, the Canadian government rejected the Northern Gateway pipeline from Alberta to B.C. after nearly a decade of review, citing insufficient Indigenous consultation. The pipeline would have carried 535K barrels of oil per day to Asia-Pacific markets, generating ~C$300B in GDP over 30 years.

- To make matters worse, several years after the cancellation of the Northern Gateway pipeline, Canadian Parliament passed Bill C-48 (the Oil Tanker Moratorium Act), banning large oil tankers from calling at northern B.C. ports and effectively shutting the door on any future pipeline to that region.

- In 2017, TC Energy canceled their Energy East pipeline project after the Canadian government demanded they calculate all of its indirect GHG emissions. The pipeline would have carried 1.1M barrels per day of Albertan and Saskatchewan oil to Eastern Canada, generating ~C$55B in GDP over 20 years.

- The Trans Mountain Expansion (TMX), operational in 2024, is Canada’s only new major pipeline in over a decade. Proposed in 2012, it barely survived years of political hurdles, progressing only after the federal government bought it in 2018. By completion, its costs had ballooned from the projected C$7.4B to C$34B.

- The main government-created obstacle for pipelines in Canada is the onerous federal “environmental review” process called the Impact Assessment Act (IAA), and before that, its precursor, the Canadian Environmental Assessment Act (CEAA).

- Under the Impact Assessment Act, the Canadian government can effectively veto a pipeline project by deeming it not in the “public interest,” as determined by factors including “sustainability,” alignment with climate goals, and impacts on Indigenous groups—but not economic benefits (!)

- Before the Impact Assessment Act was instituted in 2019, pipelines faced similarly onerous environmental reviews under its precursor, the Canadian Environmental Assessment Act (CEAA). Under CEAA, government could veto projects it judged to cause “significant adverse environmental effects,” a vague and open-ended criteria.

- Even if a pipeline project isn’t formally rejected by the Canadian government, the environmental review process can stretch on for years—often causing projects to collapse from escalating costs or investors withdrawing amid uncertainty. This is exactly what happened with the Energy East pipeline in 2017.

- If Canada built ample transportation, it would have the potential to produce even more oil than the US does and sell it around the world. Instead, its production is < 40% of the US’s, and 97% of its exports are to the US—at below-market prices.

Canada is also strangling oil investment, production, and refining

- Canada isn’t just strangling oil transport, it’s sabotaging oil at every stage—from Mark Carney’s proposed emissions cap to “Clean Fuel Regulations” to EV mandates to drilling bans to refinery restrictions.

- Investment in Canadian oil plunged over 50% (C$76B to C$35B) between 2014-2023—with investors pointing to regulatory uncertainty, inconsistencies, and compliance costs as major barriers to investments.

- A further looming threat to oil investment is the proposed cap on oil and gas sector GHG emissions. If implemented, as promised by Mark Carney’s government, this proposal will require the oil industry to reduce its GHG emissions to 35% of the 2019 level, which would significantly discourage investment and production.

- The Clean Fuel Regulations (CFRs), which mandate that Canadian fossil fuel producers reduce the emissions from fuels to 15% lower than 2016 levels by 2030, harms Canadian oil production by significantly increasing the cost of production and thus decreasing the domestic demand for gasoline and diesel.

- Canada’s EV mandate, which requires that 20% of vehicles sold in 2026, at least 60% of vehicles sold in 2030, and all new vehicles sold in 2035 are electric, harms Canadian oil production by greatly reducing the demand for gasoline and diesel.

- Canada’s consumer carbon tax, which until earlier this month imposed a fee of C$80 per ton of CO2, harmed Canadian oil production by raising gasoline prices by 17.6 cents per litre, thereby decreasing demand. Though this tax has been repealed, gasoline and diesel remain subject to the industrial carbon tax.

- In addition to measures that heavily disincentivize oil production, the federal government also directly limits production through moratoria on oil development on Canada’s Pacific and Arctic coasts, blocking access to hundreds of billions of barrels of oil.

- On top of Canada’s oil underinvestment and underproduction, Canadian oil refining has stagnated, with Canada’s refineries able to process less than half of the oil it produces and only one new refinery built since the 1980s.

The leading stranglers of Canadian oil, such as Trudeau and Carney, say they are protecting Canada and the world from a climate crisis

- The root cause of Canada’s squandered oil opportunity is leaders’ belief that world’s coldest country must stop global warming at all costs.

That’s why they advocate pursuing “net zero” by 2050—which necessarily means destroying Canada’s domestic oil industry.

- Canada has embraced climate catastrophism for over 3 decades now. For example, it was one of the original signatories of the UN Framework Convention on Climate Change (UNFCCC) in 1992. The UNFCCC has been the driving force behind “net zero” policies.

- Justin Trudeau took Canadian anti-oil policy to a new level, making the destruction of Canada’s oil opportunity a central focus: “We need to phase [oil sands] out,” he said in 2017, “We need to manage the transition off of our dependence on fossil fuels.”

- While Trudeau’s opposition to Canadian oil and therefore its economy is well-known, most Canadians do not know that Mark Carney is a far more committed opponent of Canadian oil than Justin Trudeau ever was. Indeed, Carney is one of the world’s leading “net zero” advocates.

- The last several decades of Mark Carney’s career have been focused on pressuring countries like Canada to adopt “net zero” policies that have proved ruinous. He did this as the head of the Bank of Canada and the Bank of England, and as the UN Special Envoy for Climate Action.

- Mark Carney’s past statements on climate include:

“investing for a net-zero world must go mainstream” (2019)

“those that fail to adapt [to net-zero] will cease to exist” (2019)

“build a financial system in which every decision takes climate change into account” (2021)

- Myth: Mark Carney used to be for carbon taxes but has changed his mind, as shown by his elimination of Canada’s carbon tax.

Truth: Carney is still for carbon taxes—because he is still for the net-zero agenda that requires taxing CO2 along with all other means to eliminate fossil fuels.

But while climate change is real, it is not a crisis—thanks to increasing resilience—nor is it addressed by unilateral Canadian sacrifice

- Far from facing a catastrophic climate crisis, Canada and the world are safer than ever from climate.

The global rate of climate disaster-related deaths has fallen 98% in the last 100 years—thanks to increasing climate resilience from reliable, affordable energy, including oil.

- Myth: Even if climate-related disaster deaths are down, climate-related damages are way up, pointing to a bankrupting climate future.

Truth: Even though there are many incentives for climate damages to go up—preferences for riskier areas, government bailouts—GDP-adjusted damages are flat.

- Sacrificing Canadian oil won’t make the coldest country in an increasingly climate-resilient world safer from global warming—since countries like China and India will never follow suit. What it will do is leave Canada far poorer, weaker, and more endangered from lack of energy.

The solution: Unleashing responsible oil development will make Canada rich, resilient, and secure

The rational path forward on climate is to embrace prosperity, which drives resilience and energy innovation

- Canada is safer than ever from climate, and other countries won’t cut emissions until it’s truly cost-effective to do so. The path forward is to embrace prosperity.

- The more prosperous Canada is, the more it can make itself more and more resilient to all manner of climate dangers. And the more prosperous Canada is, the more it can innovate new forms of energy that have the long-term prospect of outcompeting fossil fuels.

The number one path to Canadian prosperity is unleashing responsible development in the oil industry and other energy industries

- Canada must finally seize its enormous oil opportunity, unleashing investment, production, refining, and transport from irrational restrictions. Only then can Canada can deliver oil to eager markets worldwide.

- Canada should renounce its pledge to achieve “net zero by 2050” by repealing the Net-Zero Emissions Accountability Act where it is enshrined and withdrawing from the Paris Agreement. This will massively increase investor certainty about the future viability of the oil industry.

- Canada should reject the proposed GHG emissions cap for the oil industry. Canadian provinces that have their own carbon taxes and emission credit trading schemes should eliminate them too. This will improve investor expectations about the oil industry’s future viability.

- Canada should repeal the Impact Assessment Act (IAA) and replace it with a framework that minimizes the cost and duration of reviews and enshrines clear and narrow criteria for rejecting projects. This will help build more oil pipelines and reduce investor uncertainty about environmental regulations.

- Canada should revise the Canadian Energy Regulator Act (CERA) by limiting the certification review of the covered oil pipeline projects to the question of whether there is sufficient proven demand for the oil they are planning to transport. This will expedite pipeline approval.

- Canada should repeal the Oil Tanker Moratorium Act (Bill C-48), which bans large oil tankers off the northern and central coast of British Columbia. This will open the door to building pipelines to B.C. that can transfer oil to crucial Asian markets.

- Canada should repeal the Clean Fuel Regulations (CFR) and the EV mandate. This will boost investor confidence in oil by increasing both current and anticipated domestic demand for oil-derived fuels.

- Canada should repeal the federal moratoria on offshore oil drilling on the Pacific Coast and in the Canadian Arctic. This will unlock up to hundreds of billions of barrels of Canadian oil.

- To stop squandering the world’s greatest energy opportunity, Canada must start electing leaders who value Canadian energy, and stop electing leaders with a proven track record of destroying it.

Daniil Gorbatenko, Steffen Henne, and Michelle Hung contributed to this piece.

“Energy Talking Points by Alex Epstein” is my free Substack newsletter designed to give as many people as possible access to concise, powerful, well-referenced talking points on the latest energy, environmental, and climate issues from a pro-human, pro-energy perspective.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoColumnist warns Carney Liberals will consider a home equity tax on primary residences

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoNine Dead After SUV Plows Into Vancouver Festival Crowd, Raising Election-Eve Concerns Over Public Safety

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoMark Carney: Our Number-One Alberta Separatist

-

Opinion2 days ago

Opinion2 days agoCanadians Must Turn Out in Historic Numbers—Following Taiwan’s Example to Defeat PRC Election Interference

-

International1 day ago

International1 day agoJeffrey Epstein accuser Virginia Giuffre reportedly dies by suicide

-

COVID-197 hours ago

COVID-197 hours agoFormer Australian state premier accused of lying about justification for COVID lockdowns

-

2025 Federal Election21 hours ago

2025 Federal Election21 hours agoCanada is squandering the greatest oil opportunity on Earth

-

International17 hours ago

International17 hours agoU.S. Army names new long-range hypersonic weapon ‘Dark Eagle’