Fraser Institute

U.S. election should focus or what works and what doesn’t work

From the Fraser Institute

As Republicans and Democrats make their final pitch to voters, they’ve converged on some common themes. Kamala Harris wants to regulate the price of food. Donald Trump wants to regulate the price of credit. Harris wants the tax code to favour the 2.5 per cent of workers who earn tips. So does Trump. Harris wants the government to steer more labour and capital into manufacturing. And so does Trump.

With each of these proposals, the candidates think the United States would be better off if the government made more economic decisions and—by implication—if individual citizens made fewer economic decisions. Both should pay closer attention to Zimbabwe. Yes, Zimbabwe.

Why does a country with abundant natural resources, rich culture and unparalleled beauty have one-sixth the average income of neighbouring Botswana? While we’re at it, why do twice as many children die in infancy in Azerbaijan as across the border in Georgia? Why do Hungarians work 20 per cent longer than their Austrian neighbours but earn 45 per cent less? Why is extreme poverty 200 times more common in Laos than across the Mekong River in Thailand?

Or how about this one: Why were more than one-quarter of Estonians formerly exposed to dangerous levels of air pollution when the country was socialist while today nearly every Estonian breathes clean air in what is ranked the cleanest country in the world.

These are anecdotes. However, the plural of anecdote is data, and through careful and systematic study of the data, we can learn what works and what doesn’t. Unfortunately, the populist economic policies in vogue among Democrats and Republicans do not work.

What does work is economic freedom.

Economic freedoms are a subset of human freedoms. When people have more economic freedom, they are allowed to make more of their own economic choices—choices about work, about buying and selling goods and services, about acquiring and using property, and about forming contracts with others.

For nearly 30 years, the Fraser Institute has been measuring economic freedom across countries. On one hand, governments can stop people from making their own economic choices through taxes, regulations, barriers to trade and manipulation of the value of money (see the proposals of Harris and Trump above). On the other hand, governments can enable individual economic choice by protecting people and their property.

The index published in Fraser’s annual Economic Freedom of the World report incorporates 45 indicators to measure how governments either prevent or enable individual economic choice. The result reveals the degree of economic freedom in 165 countries and territories worldwide, with data going back to 1970.

According to the latest report, comparatively wealthy Botswanans rank 84 places ahead of Zimbabweans in terms of the economic freedom their government permits them. Georgians rank 107 places ahead of Azerbaijanis, Thais rank 60 places ahead of Laotians, and Austrians are 32 places ahead of Hungarians.

The benefits of economic freedom go far beyond anecdotes and rankings. As Estonia—once one of the least economically free places in the world and now among the freest—dramatically shows, freer countries tend not only to be more prosperous but greener and healthier.

In fact, economists and other social scientists have conducted nearly 1,000 studies using the index to assess the effect of economic freedom on different aspects of human wellbeing. Their statistical comparisons include hundreds and sometimes thousands of data points and carefully control for other factors like geography, natural resources and disease environment.

Their results overwhelmingly support the idea that when people are permitted more economic freedom, they prosper. Those who live in freer places enjoy higher and faster-growing incomes, better health, longer life, cleaner environments, more tolerance, less violence, lower infant mortality and less poverty.

Economic freedom isn’t the only thing that matters for prosperity. Research suggests that culture and geography matter as well. While policymakers can’t always change people’s attitudes or move mountains, they can permit their citizens more economic freedom. If more did so, more people would enjoy the living standards of Botswana or Estonia and fewer people would be stuck in poverty.

As for the U.S., it remains relatively free and prosperous. Whatever its problems, decades of research cast doubt on the notion that America would be better off with policies that chip away at the ability of Americans to make their own economic choices.

Author:

2025 Federal Election

Does Canada Need a DOGE?

From the Fraser Institute

By Philip Cross

The legions of Canadians wanting to see government spending shrink probably look enviously at how Elon Musk’s Department of Government Efficiency (DOGE) is slashing some government programs in the United States, even if DOGE’s non-surgical chainsaw approach is controversial, to say the least.

Some problems are common to cutting any government’s spending. Ironclad job security for union employees with seniority means cuts are skewed disproportionately to junior staff still on probation, with the regrettable side effect of denying an injection of fresh blood into a sclerotic workforce. Cutting employees and not programs makes it easier for higher staffing to resume: as documented by Carleton University Professor Ian Lee in How Ottawa Spends, even prolonged bouts of austerity do not derail government spending from long-term trend of higher growth. Across the board cuts do not allow for the surgical removal of redundant or inefficient programs and poor performing employees.

Canada has some unique problems with federal government spending. Savoie documents how 41 per cent of federal civil servants are located in Ottawa, versus 16 per cent in Washington and 19 per cent in London, despite Canada having the most decentralized federation in the G7. The concentration in Ottawa partly reflects the exceptional influence exerted by central agencies on all departments. As well, University of Cambridge Professor Dennis Grube found Canada’s civil service was the most resistant to public scrutiny and the most risk adverse in a comparative study of public servants in the U.S., the United Kingdom, Australia, New Zealand and Canada.

Canada’s federal employees are among the most expensive anywhere. The average civil servant costs taxpayers $146,500 a year including all salary, benefits and costs such as computers and training. Multiplying this average cost by 366,316 federal employees yields a total labour bill of $53.7 billion, not including other spending such as $17.8 billion on consultants. All the recent increase in the ranks of the civil service happened in Justin Trudeau’s tenure, expanding 38.5 per cent after Stephen Harper had cut them 9 per cent between 2010 and 2015 in his determination to balance the budget.

While the cost of government employees has risen sharply, the services they provide to the public are dwindling as government spending increasingly is devoted to managing its unwieldy and bloated bureaucracy. As Savoie observes, unions like to paint civil servants as providing essential services such as food inspectors and rescue workers, when in reality most are involved in a vast web of “policy, coordination, liaison, and performance evaluation units.” The fastest growing occupations in the federal government are in administrative services and program administration, whose share of jobs rose from 25.1 per cent in 2010 to 31.9 per cent in 2023 according to the latest report from the Treasury Board.

A chronic problem is the fierce defense offered by public service unions in “protecting non-performers and insulating the public sector from effective outside scrutiny” as Savoie wrote. The refusal to acknowledge and root out non-performers depresses the morale of the average civil servant who’s unfairly tarred with the reputation of a minority. It also motivates the across-the-board chainsaw approach of DOGE, which critics then decry as not discriminating between good and bad employees. The latter could easily be targeted by senior managers, who know exactly who the non-performers are but cannot be bothered with the years of documentation and bureaucratic headaches needed to get rid of them. The cost of poor performers is substantial; if even 10 per cent of the civil service was eliminated as redundant non-performers, the government would save $5.4 billion a year. Potential savings are likely well over $10 billion.

The federal government potentially has enormous leverage in negotiating civil service pay and getting rid of non-performers, because it can unilaterally change the federal pension plan without negotiating with public-sector unions. The federal pension plan is so generous that it’s referred to as the “golden handcuffs” that tie employees to their jobs irrespective of their pay or working conditions. To protect their lucrative pensions, unions inevitably would be willing to make concessions that substantially lower the burden on Canada’s taxpayers and still improve morale within the civil service.

Alberta

Energy sector will fuel Alberta economy and Canada’s exports for many years to come

From the Fraser Institute

By any measure, Alberta is an energy powerhouse—within Canada, but also on a global scale. In 2023, it produced 85 per cent of Canada’s oil and three-fifths of the country’s natural gas. Most of Canada’s oil reserves are in Alberta, along with a majority of natural gas reserves. Alberta is the beating heart of the Canadian energy economy. And energy, in turn, accounts for one-quarter of Canada’s international exports.

Consider some key facts about the province’s energy landscape, as noted in the Alberta Energy Regulator’s (AER) 2023 annual report. Oil and natural gas production continued to rise (on a volume basis) in 2023, on the heels of steady increases over the preceding half decade. However, the dollar value of Alberta’s oil and gas production fell in 2023, as the surging prices recorded in 2022 following Russia’s invasion of Ukraine retreated. Capital spending in the province’s energy sector reached $30 billion in 2023, making it the leading driver of private-sector investment. And completion of the Trans Mountain pipeline expansion project has opened new offshore export avenues for Canada’s oil industry and should boost Alberta’s energy production and exports going forward.

In a world striving to address climate change, Alberta’s hydrocarbon-heavy energy sector faces challenges. At some point, the world may start to consume less oil and, later, less natural gas (in absolute terms). But such “peak” consumption hasn’t arrived yet, nor does it appear imminent. While the demand for certain refined petroleum products is trending down in some advanced economies, particularly in Europe, we should take a broader global perspective when assessing energy demand and supply trends.

Looking at the worldwide picture, Goldman Sachs’ 2024 global energy forecast predicts that “oil usage will increase through 2034” thanks to strong demand in emerging markets and growing production of petrochemicals that depend on oil as the principal feedstock. Global demand for natural gas (including LNG) will also continue to increase, particularly since natural gas is the least carbon-intensive fossil fuel and more of it is being traded in the form of liquefied natural gas (LNG).

Against this backdrop, there are reasons to be optimistic about the prospects for Alberta’s energy sector, particularly if the federal government dials back some of the economically destructive energy and climate policies adopted by the last government. According to the AER’s “base case” forecast, overall energy output will expand over the next 10 years. Oilsands output is projected to grow modestly; natural gas production will also rise, in part due to greater demand for Alberta’s upstream gas from LNG operators in British Columbia.

The AER’s forecast also points to a positive trajectory for capital spending across the province’s energy sector. The agency sees annual investment rising from almost $30 billion to $40 billion by 2033. Most of this takes place in the oil and gas industry, but “emerging” energy resources and projects aimed at climate mitigation are expected to represent a bigger slice of energy-related capital spending going forward.

Like many other oil and gas producing jurisdictions, Alberta must navigate the bumpy journey to a lower-carbon future. But the world is set to remain dependent on fossil fuels for decades to come. This suggests the energy sector will continue to underpin not only the Alberta economy but also Canada’s export portfolio for the foreseeable future.

-

conflict2 days ago

conflict2 days agoZelensky Alleges Chinese Nationals Fighting for Russia, Calls for Global Response

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAn In-Depth Campaign Trail “Interview” With Pierre Poilievre

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHarper Endorses Poilievre at Historic Edmonton Rally: “This Crisis Was Made in Canada”

-

John Stossel1 day ago

John Stossel1 day agoGovernment Gambling Hypocrisy: Bad Odds and No Competition

-

2025 Federal Election1 day ago

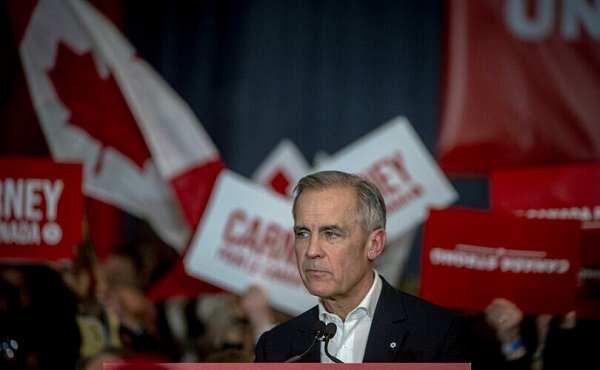

2025 Federal Election1 day agoMark Carney pledges another $150 million for CBC ahead of federal election

-

Alberta1 day ago

Alberta1 day agoAlberta’s embrace of activity-based funding is great news for patients

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoWATCH: Massive Crowd for Historic Edmonton Poilievre Rally

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoCommunist China helped boost Mark Carney’s image on social media, election watchdog reports