Uncategorized

Turkish president: Saudis plotted writer’s killing for days

ANKARA, Turkey — Saudi officials murdered journalist Jamal Khashoggi in their Istanbul consulate after plotting his death for days, Turkey’s president said Tuesday, contradicting Saudi Arabia’s explanation that the writer was accidentally killed. He demanded that the kingdom reveal the identities of all involved, regardless of rank.

President Recep Tayyip Erdogan also said he wants Saudi Arabia to allow 18 suspects that it detained for the Saudi’s killing to be tried in Turkish courts, setting up further complications with the Saudi government, which has said it is conducting its own investigation and will punish those involved.

“To blame such an incident on a handful of security and intelligence members would not satisfy us or the international community,” Erdogan said in a speech to ruling party lawmakers in parliament.

“Saudi Arabia has taken an important step by admitting the murder. As of now we expect of them to openly bring to light those responsible — from the highest ranked to the lowest — and to bring them to justice,” the Turkish president said.

Erdogan’s speech was previously pitched as revealing the “naked truth” about Khashoggi’s slaying. Instead it served merely to put a named source to information already circulated by anonymous officials and the Turkish press in the days since the columnist for The Washington Post walked into the Saudi consulate in Istanbul.

However, he kept pressure on the kingdom with his demands for Turkish prosecution of the suspects as well as punishment for the plot’s masterminds.

“All evidence gathered shows that Jamal Khashoggi was the victim of a savage murder. To cover up such a savagery would hurt the human conscience,” he said.

Erdogan didn’t mention Saudi Arabia’s assertive Crown Prince Mohammed bin Salman in his speech, though officials linked to the royal have been implicated in the killing. The kingdom has said the heir-apparent of the world’s top oil exporter was not involved, but any major decision must be signed off by the highest powers within its ruling Al Saud family.

International skepticism has intensified since Saudi Arabia said on Saturday that Khashoggi died in a brawl. The case has shocked the world and raised suspicions that a Saudi hit squad planned Khashoggi’s killing after he walked into the consulate on Oct. 2, and then attempted to cover it up.

Before Erdogan’s announcement, top Turkish officials said Turkey would clarify exactly what happened to Khashoggi and a stream of leaks to national and international media has increased pressure on Saudi Arabia, which is hosting a glitzy investment conference this week that many dignitaries have decided to skip because of the scandal.

Saudi Arabia said it arrested suspects and that several top intelligence officials were fired over the killing, but critics alleged that the punishment was designed to absolve Prince Mohammed of any responsibility.

On Monday, leaked surveillance video showed a man strolling out of the diplomatic post hours after Khashoggi disappeared into the consulate, apparently wearing the columnist’s clothes as part of a macabre deception to sow confusion over his fate.

The new video broadcast by CNN, as well as a pro-government Turkish newspaper’s report that a member of Prince Mohammed’s entourage made four calls to the royal’s office from the consulate around the same time, put more pressure on the kingdom. Meanwhile, Turkish crime-scene investigators swarmed a garage Monday night in Istanbul where a Saudi consular vehicle had been parked.

Saudi Arabia’s foreign minister, meanwhile, said Tuesday the investigation into the killing of Khashoggi would produce the truth about what happened and that his country was committed to ensuring “that the investigation is thorough and complete and that the truth is revealed and that those responsible will be held to account.”

Foreign Minister Adel al-Jubeir, in Indonesia, also pledged that mechanisms will be put in place so that “something like this can never happen again.”

___

Associated Press writer Jon Gambrell contributed from Dubai, United Arab Emirates.

Suzan Fraser, Zeynep Bilginsoy And Christopher Torchia, The Associated Press

Uncategorized

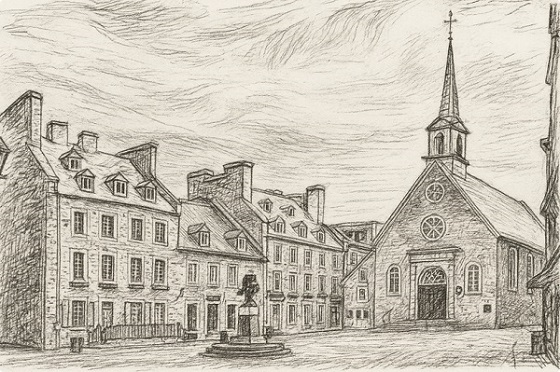

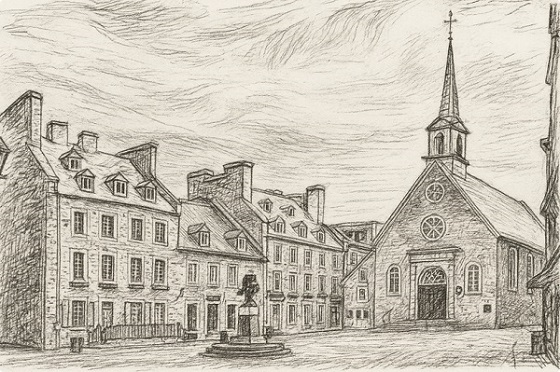

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

Uncategorized

New report warns WHO health rules erode Canada’s democracy and Charter rights

The Justice Centre for Constitutional Freedoms has released a new report titled Canada’s Surrender of Sovereignty: New WHO health regulations undermine Canadian democracy and Charter freedoms. Authored by Nigel Hannaford, a veteran journalist and researcher, the report warns that Canada’s acceptance of the World Health Organization’s (WHO) revised International Health Regulations (IHR) represents a serious erosion of national independence and democratic accountability.

The IHR amendments, which took effect on September 19, 2025, authorize the WHO Director-General to declare global “health emergencies” that could require Canada to follow directives from bureaucrats in Geneva, bypassing the House of Commons and the will of Canadian voters.

The WHO regards these regulations as “binding,” despite having no ability or legal authority to impose such regulations. Even so, Canada is opting to accept the regulations as binding.

By accepting the WHO’s revised IHR, the report explains, Canada has relinquished its own control over future health crises and instead has agreed to let the WHO determine when a “pandemic emergency” exists and what Canada must do to respond to it, after which Canada must report back to the WHO.

In fact, under these International Health Regulations, the WHO could demand countries like Canada impose stringent freedom-violating health policies, such as lockdowns, vaccine mandates, or travel restrictions without debate, evidence review, or public accountability, the report explains.

Once the WHO declares a “Pandemic Emergency,” member states are obligated to implement such emergency measures “without delay” for a minimum of three months.

Importantly, following these WHO directives would undermine government accountability as politicians may hide behind international “commitments” to justify their actions as “simply following international rules,” the report warns.

Canada should instead withdraw from the revised IHR, following the example of countries like Germany, Austria, Italy, Czech Republic, and the United States. The report recommends continued international cooperation without surrendering control over domestic health policies.

Constitutional lawyer Allison Pejovic said, “[b]y treating WHO edicts as binding, the federal government has effectively placed Canadian sovereignty on loan to an unelected international body.”

“Such directives, if enforced, would likely violate Canadians’ Charter rights and freedoms,” she added.

Mr. Hannaford agreed, saying, “Canada’s health policies must be made in Canada. No free and democratic nation should outsource its emergency powers to unelected bureaucrats in Geneva.”

The Justice Centre urges Canadians to contact their Members of Parliament and demand they support withdrawing from the revised IHR to restore Canadian sovereignty and reject blind compliance with WHO directives.

-

Alberta1 day ago

Alberta1 day agoB.C. would benefit from new pipeline but bad policy stands in the way

-

Uncategorized2 days ago

Uncategorized2 days agoTrump Admin Establishing Council To Make Buildings Beautiful Again

-

Economy1 day ago

Economy1 day agoTop Scientists Deliberately Misrepresented Sea Level Rise For Years

-

Energy18 hours ago

Energy18 hours agoCAPP calls on federal government to reset energy policy before it’s too late

-

International2 days ago

International2 days agoUS Deploys Gerald Ford Carrier Strike Group To Target Cartels

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoChurches Are All That Stands Between Canada And Tyranny

-

Alberta1 day ago

Alberta1 day agoAlberta introduces bill allowing province to reject international agreements

-

Business19 hours ago

Business19 hours agoTrump Raises US Tariffs on Canadian Products by 10% after Doug Ford’s $75,000,000 Ad Campaign