Uncategorized

Trump urges Senate to vote after Kavanaugh’s fierce defence

WASHINGTON — Glued to high-stakes testimony on his Supreme Court nominee, President Donald Trump and his allies were shaken by Christine Blasey Ford’s emotional appearance on Capitol Hill. But they stood by Judge Brett Kavanaugh after his forceful pushback against the woman who accused him of sexual misconduct.

Trump missed hardly a moment of the proceedings, relying on DVRs to keep up on the Senate Judiciary Committee hearing Thursday from his private office on Air Force One as he

Within moments of the eight-hour proceedings concluding, Trump tweeted his approval of Kavanaugh’s performance and called on the Senate to move swiftly to a vote. “His testimony was powerful, honest, and riveting,” Trump said. “Democrats’ search and destroy strategy is disgraceful and this process has been a total sham and effort to delay, obstruct, and resist. The Senate must vote!”

Ford’s tearful recounting of allegations that Kavanaugh sexually assaulted her when they were in high school led Trump to express sympathy for Kavanaugh and his family for having to listen to the testimony, according to two Republicans close to the White House but not authorized to speak publicly about private conversations. They added that Trump expressed some frustration at the process — and the staff work — that led Kavanaugh to this point.

After seeing Ford’s powerful testimony, White House aides and allies expressed concern that Kavanaugh, whose nomination already seemed to be teetering, would have an uphill climb to deliver a strong enough showing to match hers.

White House officials believe Kavanaugh’s passionate denials of Ford’s claims, including the judge’s tearful description of the impact the accusations had on his family, met the challenge. A White House official who was not authorized to speak publicly said the West Wing saw the judge’s opening statement as “game changing” and said Trump appeared to be reacting positively.

Trump told associates after the hearing that he liked Kavanaugh’s fighting attitude and was critical of Democrats who he sees as politicizing the process, said a person familiar with his thinking who was not authorized to disclose private conversations. He was happy with Republicans on the committee, though he was not impressed with the questioning from an outside female prosecutor. While he acknowledges the vote will be close, he currently thinks they will get there.

Trump’s son, Donald Jr., also tweeted his review: “I love Kavanaugh’s tone. It’s nice to see a conservative man fight for his

Going into the hearing, Trump had grown increasingly frustrated, angry at members of his staff — and, in particular, White House counsel Don McGahn — for not better managing the confirmation process for his second Supreme Court nominee. McGahn, who is set to depart his post in coming weeks, had advocated for Kavanaugh, seeing his confirmation as the crowning achievement of his tenure — and part of a decades-long effort to install more conservatives on the high court.

Trump has also criticized Republican leaders in Congress for not speeding the process along, leading to days’ worth of revelations against Kavanaugh. White House aides have bemoaned the drip-drip-drip nature of the emerging allegations and thought a faster process could have avoided Ford’s testimony.

As the day unfolded, White House aides and allies offered a mix of optimism and frustration. Viewing the hearing from their desks, some aides expressed concerns that Ford appeared highly credible, though others noted there were still gaps in her decades-old story.

How the proceedings were playing out on television was a key anxiety. Some White House officials were not pleased with the questioning from Phoenix prosecutor Rachel Mitchell, saying she did not effectively target the weak spots in Ford’s narrative and worrying that the Democrats had seized the moment.

But many felt the proceeding took a turn once Kavanaugh appeared. Aides said they thought Kavanaugh was effectively fighting back and expressed optimism he could survive the process.

Trump has also told allies that he wished Kavanaugh’s Fox News interview Monday had gone better, believing it was a missed opportunity to change the momentum around the story, according to the two Republicans and another outside adviser. And White House allies noted the importance of how Fox would cover the proceedings in shaping Trump’s reactions.

___

Lemire reported from New York. Associated Press writer Jill Colvin contributed from Washington.

Jonathan Lemire, Zeke Miller And Catherine Lucey, The Associated Press

Uncategorized

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

Uncategorized

New report warns WHO health rules erode Canada’s democracy and Charter rights

The Justice Centre for Constitutional Freedoms has released a new report titled Canada’s Surrender of Sovereignty: New WHO health regulations undermine Canadian democracy and Charter freedoms. Authored by Nigel Hannaford, a veteran journalist and researcher, the report warns that Canada’s acceptance of the World Health Organization’s (WHO) revised International Health Regulations (IHR) represents a serious erosion of national independence and democratic accountability.

The IHR amendments, which took effect on September 19, 2025, authorize the WHO Director-General to declare global “health emergencies” that could require Canada to follow directives from bureaucrats in Geneva, bypassing the House of Commons and the will of Canadian voters.

The WHO regards these regulations as “binding,” despite having no ability or legal authority to impose such regulations. Even so, Canada is opting to accept the regulations as binding.

By accepting the WHO’s revised IHR, the report explains, Canada has relinquished its own control over future health crises and instead has agreed to let the WHO determine when a “pandemic emergency” exists and what Canada must do to respond to it, after which Canada must report back to the WHO.

In fact, under these International Health Regulations, the WHO could demand countries like Canada impose stringent freedom-violating health policies, such as lockdowns, vaccine mandates, or travel restrictions without debate, evidence review, or public accountability, the report explains.

Once the WHO declares a “Pandemic Emergency,” member states are obligated to implement such emergency measures “without delay” for a minimum of three months.

Importantly, following these WHO directives would undermine government accountability as politicians may hide behind international “commitments” to justify their actions as “simply following international rules,” the report warns.

Canada should instead withdraw from the revised IHR, following the example of countries like Germany, Austria, Italy, Czech Republic, and the United States. The report recommends continued international cooperation without surrendering control over domestic health policies.

Constitutional lawyer Allison Pejovic said, “[b]y treating WHO edicts as binding, the federal government has effectively placed Canadian sovereignty on loan to an unelected international body.”

“Such directives, if enforced, would likely violate Canadians’ Charter rights and freedoms,” she added.

Mr. Hannaford agreed, saying, “Canada’s health policies must be made in Canada. No free and democratic nation should outsource its emergency powers to unelected bureaucrats in Geneva.”

The Justice Centre urges Canadians to contact their Members of Parliament and demand they support withdrawing from the revised IHR to restore Canadian sovereignty and reject blind compliance with WHO directives.

-

Business1 day ago

Business1 day agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoSenate Grills Meta and Google Over Biden Administration’s Role in COVID-Era Content Censorship

-

Business1 day ago

Business1 day agoMystery cloaks Doug Ford’s funding of media through Ontario advertising subsidy

-

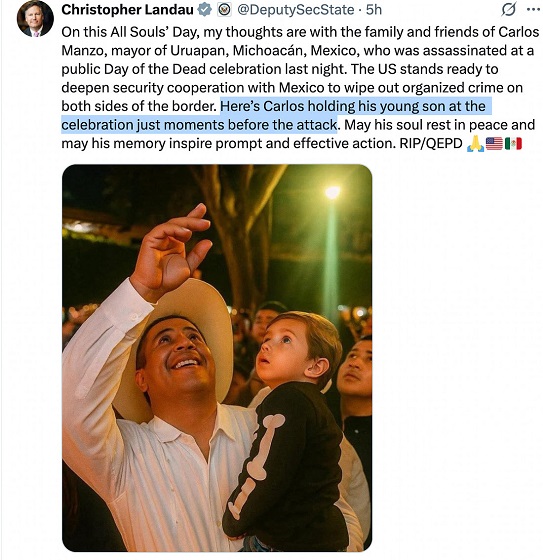

Crime14 hours ago

Crime14 hours agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Automotive1 day ago

Automotive1 day agoCarney’s Budget Risks Another Costly EV Bet

-

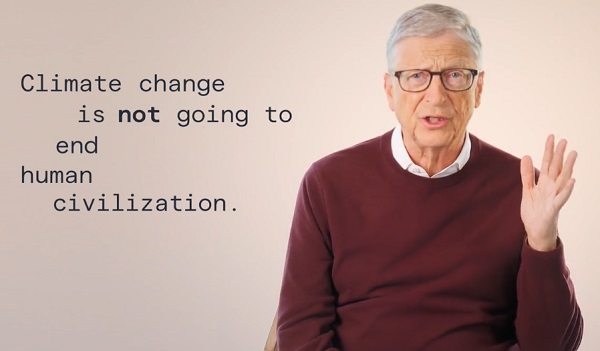

Environment21 hours ago

Environment21 hours agoThe era of Climate Change Alarmism is over

-

Aristotle Foundation13 hours ago

Aristotle Foundation13 hours agoB.C. government laid groundwork for turning private property into Aboriginal land

-

International13 hours ago

International13 hours agoNigeria better stop killing Christians — or America’s coming “guns-a-blazing”