From The Center Square

“We’re going to have tariffs, mostly reciprocal tariffs … probably reciprocal tariffs where a country pays so much or charges us so much and we do the same, so very reciprocal because I think that’s the only fair way to do it. That way no one is hurt. They charge us, we charge them”

President Donald Trump said Friday he was considering reciprocal trade deals with countries rather than flat fee tariffs on imported goods from other countries.

Trump touted tariffs throughout his campaign and during his inauguration said tariff revenue would make the U.S. “rich as hell.” He also said that tariff revenue would lower the tax burden on American taxpayers.

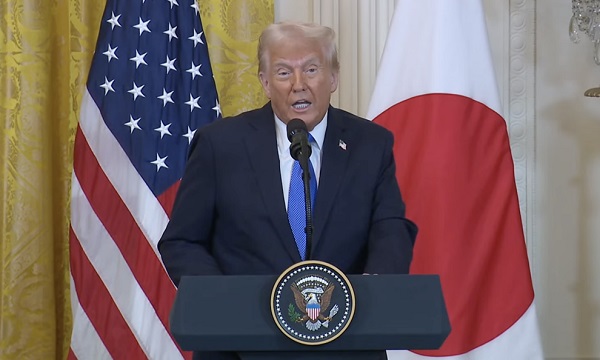

On Friday, the president said he would announce reciprocal trade agreements next week with multiple countries. His remarks came during a news conference with Japan Prime Minister Shigeru Ishiba.

“The United States will be conducting trade with all countries based on the principle of fairness and reciprocity,” Trump said.

The president said that chronic trade deficits undermine the U.S. economy.

“We’re going to have tariffs, mostly reciprocal tariffs … probably reciprocal tariffs where a country pays so much or charges us so much and we do the same, so very reciprocal because I think that’s the only fair way to do it. That way no one is hurt. They charge us, we charge them,” Trump said.

Trump said the reciprocal trade deals seem to be the path forward rather than flat fee tariffs. He said he would be announcing trade deals as early as Monday or Tuesday.

On Feb. 1, Trump hit Mexico and Canada with 25% tariffs and levied an additional 10% tariff on China. Two days later, Trump suspended tariffs on the U.S. neighbors for 30 days after reaching preliminary deals with both Mexico and Canada. The leaders of both neighboring countries promised to strengthen border security. China responded with limited tariffs on U.S. goods and filed a complaint about Trump’s unilateral trade move with the World Trade Organization.

Most economists have panned Trump’s tariff plans. On Thursday, S&P Global, a credit-rating agency, reported the potential effects of Trump’s tariffs were “overwhelmingly negative.” S&P analysts said the tariffs could slow gross domestic product growth, boost unemployment and inflation. It noted that “the effects on the U.S. are smaller than for trading partners.” Gross domestic product, or GDP, is a measure of economic output. S&P noted the uncertainty around Trump’s tariff plans creates problems for businesses and U.S. families.

“Uncertainty around the path of U.S. policy and its objectives is high, and confidence bands around our forecasts are correspondingly wide,” according to the S&P report. “Moreover, the ongoing deal-making mode of the new administration risks complicating long-term decision making by both firms and households.”