Uncategorized

Trump doubts negotiators will strike budget deal he’d accept

WASHINGTON — President Donald Trump said the odds congressional negotiators will craft a deal to end his border wall standoff with Congress are “less than 50-50.”

As hundreds of thousands of furloughed federal workers prepared to return to work, Trump told The Wall Street Journal that he doesn’t think the negotiators will strike a deal that he’d accept. He pledged to build a wall anyway using his executive powers to declare a national emergency if necessary.

“I personally think it’s less than 50-50, but you have a lot of very good people on that board,” Trump said in an interview Sunday with the newspaper.

The president was referring to a bipartisan committee of House and Senate lawmakers that will consider border spending as part of the legislative process.

The president’s standoff with Democrats on Capitol Hill is far from over and the clock is ticking. The spending bill Trump signed on Friday to temporarily end the partial government shutdown funds the shuttered agencies only until Feb. 15.

It’s unclear if the Democrats will budge. Trump seemed girded for battle over the weekend, sending out a series of online messages that foreshadowed the upcoming fight with lawmakers. “BUILD A WALL & CRIME WILL FALL!” he tweeted.

Is Trump prepared to shut down the government again in three weeks?

“Yeah, I think he actually is,” acting White House chief of staff Mick Mulvaney said. “He doesn’t want to shut the government down, let’s make that very clear. He doesn’t want to declare a national emergency.”

But Mulvaney said that at “the end of the day, the president’s commitment is to defend the nation and he will do it with or without Congress.”

The linchpin in the standoff is Trump’s demand for $5.7 billion for his prized wall at the U.S.-Mexico border, a project Democrats consider an ineffective, wasteful monument to a ridiculous Trump campaign promise.

Asked if he’d willing to accept less than $5.7 billion to build a barrier on the southern border, Trump replied: “I doubt it.” He added: “I have to do it right.”

He also said he’d be wary of any proposed deal that exchanged funds for a wall for broad immigration reform. And when asked if he would agree to citizenship for immigrants who were illegally brought into the U.S. as children, he again replied, “I doubt it.”

California Rep. Kevin McCarthy, the leading Republican in the House, said Democrats have funded border barriers in the past and are refusing this time simply because Trump is asking for it.

“The president is the only one who has been reasonable in these negotiations,” he said.

Rep. Hakeem Jeffries of New York, a member of the Democratic leadership in the House, said his colleagues are looking for “evidence-based” legislation.

“Shutdowns are not legitimate negotiating tactics when there’s a public policy disagreement between two branches of government,” he said.

Jeffries said that Democrats are willing to invest in additional infrastructure, especially at legal ports of entry where the majority of drugs come into the country.

“We’re willing to invest in personnel. We’re willing to invest in additional technology. … In the past, we have supported enhanced fencing and I think that’s something that’s reasonable that should be on the table,” he said.

Trump has asserted there is a “crisis” at the southern border requiring a wall, blaming previous presidents and Congress for failing to overhaul an immigration system that has allowed millions of people to live in the U.S. illegally.

Last month, he put that number at 35 million, while on Sunday he pegged it at 25.7 million-plus — figures offered without evidence. “I’m not exactly sure where the president got that number this morning,” Mulvaney said.

Both are higher than government and private estimates.

His homeland security chief cited “somewhere” between 11 million and 22 million last month. In November, the nonpartisan Pew Research Center reported 10.7 million in 2016 — the lowest in a decade.

The president also tweeted Sunday that the cost of illegal immigration so far this year was nearly $19 billion; he didn’t cite a source.

Compare that with research in 2017 from a conservative group, the Federation for American Immigration Reform, which advocates for less immigration: $135 billion a year or about $11.25 billion a month — a figure that included health care and education, plus money spent on immigration enforcement.

Sen. Roy Blunt, R-Mo. said that he thinks a compromise is possible.

“The president went from talking about a wall along the entire southern border at one point during the campaign … to let’s have barriers where they work and let’s have something else where barriers wouldn’t work as well,” Blunt said.

The partial federal shutdown ended Friday when Trump gave in to mounting pressure, retreating from his demand that Congress commit to the border wall funding before federal agencies could resume work. The bill he signed did not provide the money Trump wanted for a barrier, which House Speaker Nancy Pelosi has called “immoral” and has insisted Congress will not finance.

Mulvaney said Trump agreed to temporarily end the shutdown because some Democrats have stepped forward, publicly and privately, to say they agree with Trump’s plan to better secure the border.

Mulvaney said they told Trump they couldn’t split with Pelosi and Senate Democratic Leader Chuck Schumer, and work with the White House if the government remained closed.

“Everybody wants to look at this and say the president lost,” Mulvaney said. “We’re still in the middle of negotiations.”

___

Mulvaney appeared on “Fox News Sunday” and CBS’ “Face the Nation.” Jeffries and McCarthy spoke on NBC’s “Meet the Press,” Blunt was on Fox.

Deb Riechmann, The Associated Press

Uncategorized

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

Uncategorized

New report warns WHO health rules erode Canada’s democracy and Charter rights

The Justice Centre for Constitutional Freedoms has released a new report titled Canada’s Surrender of Sovereignty: New WHO health regulations undermine Canadian democracy and Charter freedoms. Authored by Nigel Hannaford, a veteran journalist and researcher, the report warns that Canada’s acceptance of the World Health Organization’s (WHO) revised International Health Regulations (IHR) represents a serious erosion of national independence and democratic accountability.

The IHR amendments, which took effect on September 19, 2025, authorize the WHO Director-General to declare global “health emergencies” that could require Canada to follow directives from bureaucrats in Geneva, bypassing the House of Commons and the will of Canadian voters.

The WHO regards these regulations as “binding,” despite having no ability or legal authority to impose such regulations. Even so, Canada is opting to accept the regulations as binding.

By accepting the WHO’s revised IHR, the report explains, Canada has relinquished its own control over future health crises and instead has agreed to let the WHO determine when a “pandemic emergency” exists and what Canada must do to respond to it, after which Canada must report back to the WHO.

In fact, under these International Health Regulations, the WHO could demand countries like Canada impose stringent freedom-violating health policies, such as lockdowns, vaccine mandates, or travel restrictions without debate, evidence review, or public accountability, the report explains.

Once the WHO declares a “Pandemic Emergency,” member states are obligated to implement such emergency measures “without delay” for a minimum of three months.

Importantly, following these WHO directives would undermine government accountability as politicians may hide behind international “commitments” to justify their actions as “simply following international rules,” the report warns.

Canada should instead withdraw from the revised IHR, following the example of countries like Germany, Austria, Italy, Czech Republic, and the United States. The report recommends continued international cooperation without surrendering control over domestic health policies.

Constitutional lawyer Allison Pejovic said, “[b]y treating WHO edicts as binding, the federal government has effectively placed Canadian sovereignty on loan to an unelected international body.”

“Such directives, if enforced, would likely violate Canadians’ Charter rights and freedoms,” she added.

Mr. Hannaford agreed, saying, “Canada’s health policies must be made in Canada. No free and democratic nation should outsource its emergency powers to unelected bureaucrats in Geneva.”

The Justice Centre urges Canadians to contact their Members of Parliament and demand they support withdrawing from the revised IHR to restore Canadian sovereignty and reject blind compliance with WHO directives.

-

International2 days ago

International2 days agoSagrada Familia Basilica in Barcelona is now tallest church in the world

-

Alberta2 days ago

Alberta2 days agoGondek’s exit as mayor marks a turning point for Calgary

-

Agriculture2 days ago

Agriculture2 days agoCloned foods are coming to a grocer near you

-

Censorship Industrial Complex16 hours ago

Censorship Industrial Complex16 hours agoSenate Grills Meta and Google Over Biden Administration’s Role in COVID-Era Content Censorship

-

Fraser Institute2 days ago

Fraser Institute2 days agoOttawa continues to infringe in areas of provincial jurisdiction

-

Business17 hours ago

Business17 hours agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

Business15 hours ago

Business15 hours agoMystery cloaks Doug Ford’s funding of media through Ontario advertising subsidy

-

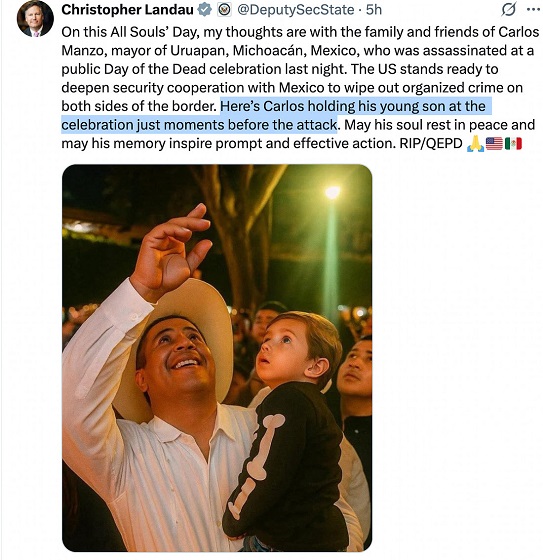

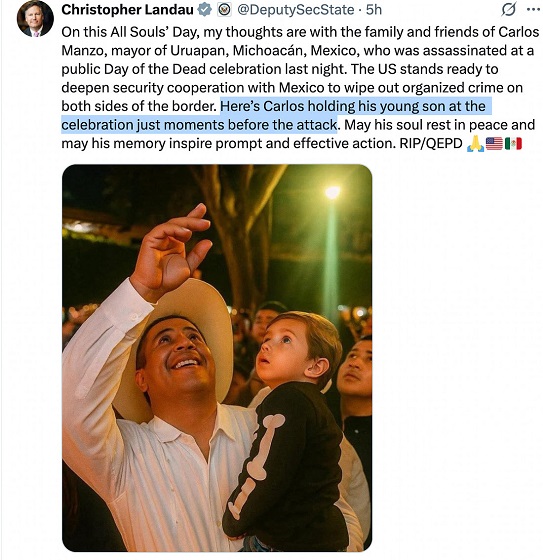

Crime3 hours ago

Crime3 hours agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels