Business

Trump 2.0 means Canada must put income tax cuts on the table

From the Canadian Taxpayers Federation

By Jay Goldberg

The topic on everyone’s mind is tariffs: Will Trump act on his threat to impose 25 per cent across-the-board tariffs on the Canadian economy?

But there’s something else Canadians should worry about: income taxes.

During President-Elect Donald Trump’s first term, he lowered income taxes for Americans at virtually at all income levels. And Trump pledged during the presidential election campaign to cut taxes further.

Here in Canada, our tax rates are already uncompetitive. With a possible tax cut south of the border, it’s time to re-examine Canada’s income tax policies.

Let’s take a gander at how Canadians who earn $75,000 a year are taxed compared to Americans.

A taxpayer in Ontario earning $75,000 a year pays an income tax rate of about 30 per cent.

Compare that to the two states bordering Ontario: Michigan and New York. In Michigan, a taxpayer earning $75,000 a year pays a 26.3 per cent income tax rate. And in New York, one of the highest-taxed states in the U.S., that taxpayer would face a 27.5 per cent income tax bill.

Considering that sales taxes and hydro rates are lower south of the border, Canada is clearly at a disadvantage. Add to that the fact that Canadians pay a punishing carbon tax while Americans don’t.

The situation is even more stark for those with higher incomes.

A taxpayer earning $150,000 in Ontario sends roughly 41.7 per cent of their income to Queen’s Park and Ottawa in income taxes.

Compare that once again to Michigan and New York. A Michigander making $150,000 a year pays a 28.3 per cent income tax rate. And a New Yorker pays 30 per cent.

These numbers are glaring. Canadians pay dramatically higher income taxes than our neighbours to the south. And Michigan and New York are some of the higher-tax states.

In Texas, a taxpayer earning $150,000 pays a 24 per cent income tax rate. That’s lower than the income tax rate for an Ontarian who earns half that much.

The cross-border tax gap will likely grow further in the new year. Trump says he plans to further lower income taxes while the Trudeau and Ford governments show little appetite for providing taxpayers up north with a similar break.

For the sake of Canada’s economic competitiveness, income tax cuts need to be placed firmly back on the public policy agenda.

Premier Doug Ford promised to cut income taxes for middle-class Ontarians by nearly $800 a year when he was first became premier six years ago. He pledged to do so by lowering Ontario’s second income tax bracket by 20 per cent.

If there was ever a time for Ford to follow through on his election promise, that time is now.

The feds need to look at cutting income taxes too. Most of the income tax burden in Canada is caused by high tax rates at the federal level.

To insulate Canada from the magnetic pull that will be triggered by a second round of Trump tax cuts, Prime Minister Justin Trudeau must look at lowering personal income tax rates.

Trudeau can cut income taxes substantially without hiking the deficit because there’s plenty of opportunities for savings.

Here’s where to start: The Trudeau government spent $47 billion on corporate welfare in 2021.

If Trudeau eliminated corporate welfare, the feds could cut personal income taxes by 20 per cent across the board without hiking the deficit.

Canada’s politicians can’t be complacent. We can’t control what Trump chooses to do when he gets back into the White House, but Canada’s politicians can control public policy north of the border to make the Canadian economy more competitive.

That starts with cutting income taxes.

Bjorn Lomborg

Net zero’s cost-benefit ratio is crazy high

From the Fraser Institute

The best academic estimates show that over the century, policies to achieve net zero would cost every person on Earth the equivalent of more than CAD $4,000 every year. Of course, most people in poor countries cannot afford anywhere near this. If the cost falls solely on the rich world, the price-tag adds up to almost $30,000 (CAD) per person, per year, over the century.

Canada has made a legal commitment to achieve “net zero” carbon emissions by 2050. Back in 2015, then-Prime Minister Trudeau promised that climate action will “create jobs and economic growth” and the federal government insists it will create a “strong economy.” The truth is that the net zero policy generates vast costs and very little benefit—and Canada would be better off changing direction.

Achieving net zero carbon emissions is far more daunting than politicians have ever admitted. Canada is nowhere near on track. Annual Canadian CO₂ emissions have increased 20 per cent since 1990. In the time that Trudeau was prime minister, fossil fuel energy supply actually increased over 11 per cent. Similarly, the share of fossil fuels in Canada’s total energy supply (not just electricity) increased from 75 per cent in 2015 to 77 per cent in 2023.

Over the same period, the switch from coal to gas, and a tiny 0.4 percentage point increase in the energy from solar and wind, has reduced annual CO₂ emissions by less than three per cent. On that trend, getting to zero won’t take 25 years as the Liberal government promised, but more than 160 years. One study shows that the government’s current plan which won’t even reach net-zero will cost Canada a quarter of a million jobs, seven per cent lower GDP and wages on average $8,000 lower.

Globally, achieving net-zero will be even harder. Remember, Canada makes up about 1.5 per cent of global CO₂ emissions, and while Canada is already rich with plenty of energy, the world’s poor want much more energy.

In order to achieve global net-zero by 2050, by 2030 we would already need to achieve the equivalent of removing the combined emissions of China and the United States — every year. This is in the realm of science fiction.

The painful Covid lockdowns of 2020 only reduced global emissions by about six per cent. To achieve net zero, the UN points out that we would need to have doubled those reductions in 2021, tripled them in 2022, quadrupled them in 2023, and so on. This year they would need to be sextupled, and by 2030 increased 11-fold. So far, the world hasn’t even managed to start reducing global carbon emissions, which last year hit a new record.

Data from both the International Energy Agency and the US Energy Information Administration give added cause for skepticism. Both organizations foresee the world getting more energy from renewables: an increase from today’s 16 per cent to between one-quarter to one-third of all primary energy by 2050. But that is far from a transition. On an optimistically linear trend, this means we’re a century or two away from achieving 100 percent renewables.

Politicians like to blithely suggest the shift away from fossil fuels isn’t unprecedented, because in the past we transitioned from wood to coal, from coal to oil, and from oil to gas. The truth is, humanity hasn’t made a real energy transition even once. Coal didn’t replace wood but mostly added to global energy, just like oil and gas have added further additional energy. As in the past, solar and wind are now mostly adding to our global energy output, rather than replacing fossil fuels.

Indeed, it’s worth remembering that even after two centuries, humanity’s transition away from wood is not over. More than two billion mostly poor people still depend on wood for cooking and heating, and it still provides about 5 per cent of global energy.

Like Canada, the world remains fossil fuel-based, as it delivers more than four-fifths of energy. Over the last half century, our dependence has declined only slightly from 87 per cent to 82 per cent, but in absolute terms we have increased our fossil fuel use by more than 150 per cent. On the trajectory since 1971, we will reach zero fossil fuel use some nine centuries from now, and even the fastest period of recent decline from 2014 would see us taking over three centuries.

Global warming will create more problems than benefits, so achieving net-zero would see real benefits. Over the century, the average person would experience benefits worth $700 (CAD) each year.

But net zero policies will be much more expensive. The best academic estimates show that over the century, policies to achieve net zero would cost every person on Earth the equivalent of more than CAD $4,000 every year. Of course, most people in poor countries cannot afford anywhere near this. If the cost falls solely on the rich world, the price-tag adds up to almost $30,000 (CAD) per person, per year, over the century.

Every year over the 21st century, costs would vastly outweigh benefits, and global costs would exceed benefits by over CAD 32 trillion each year.

We would see much higher transport costs, higher electricity costs, higher heating and cooling costs and — as businesses would also have to pay for all this — drastic increases in the price of food and all other necessities. Just one example: net-zero targets would likely increase gas costs some two-to-four times even by 2030, costing consumers up to $US52.6 trillion. All that makes it a policy that just doesn’t make sense—for Canada and for the world.

Business

‘Great Reset’ champion Klaus Schwab resigns from WEF

From LifeSiteNews

Schwab’s World Economic Forum became a globalist hub for population control, radical climate agenda, and transhuman ideology under his decades-long leadership.

Klaus Schwab, founder of the World Economic Forum and the face of the NGO’s elitist annual get-together in Davos, Switzerland, has resigned as chair of WEF.

Over the decades, but especially over the past several years, the WEF’s Davos annual symposium has become a lightning rod for conservative criticism due to the agendas being pushed there by the elites. As the Associated Press noted:

Widely regarded as a cheerleader for globalization, the WEF’s Davos gathering has in recent years drawn criticism from opponents on both left and right as an elitist talking shop detached from lives of ordinary people.

While WEF itself had no formal power, the annual Davos meeting brought together many of the world’s wealthiest and most influential figures, contributing to Schwab’s personal worth and influence.

Schwab’s resignation on April 20 was announced by the Geneva-based WEF on April 21, but did not indicate why the 88-year-old was resigning. “Following my recent announcement, and as I enter my 88th year, I have decided to step down from the position of Chair and as a member of the Board of Trustees, with immediate effect,” Schwab said in a brief statement. He gave no indication of what he plans to do next.

Schwab founded the World Economic Forum – originally the European Management Forum – in 1971, and its initial mission was to assist European business leaders in competing with American business and to learn from U.S. models and innovation. However, the mission soon expanded to the development of a global economic agenda.

Schwab detailed his own agenda in several books, including The Fourth Industrial Revolution (2016), in which he described the rise of a new industrial era in which technologies such artificial intelligence, gene editing, and advanced robotics would blur the lines between the digital, physical, and biological worlds. Schwab wrote:

We stand on the brink of a technological revolution that will fundamentally alter the way we live, work, and relate to one another. In its scale, scope, and complexity, the transformation will be unlike anything humankind has experienced before. We do not yet know just how it will unfold, but one thing is clear: the response to it must be integrated and comprehensive, involving all stakeholders of the global polity, from the public and private sectors to academia and civil society …

The Fourth Industrial Revolution, finally, will change not only what we do but also who we are. It will affect our identity and all the issues associated with it: our sense of privacy, our notions of ownership, our consumption patterns, the time we devote to work and leisure, and how we develop our careers, cultivate our skills, meet people, and nurture relationships. It is already changing our health and leading to a “quantified” self, and sooner than we think it may lead to human augmentation.

How? Microchips implanted into humans, for one. Schwab was a tech optimist who appeared to heartily welcome transhumanism; in a 2016 interview with France 24 discussing his book, he stated:

And then you have the microchip, which will be implanted, probably within the next ten years, first to open your car, your home, or to do your passport, your payments, and then it will be in your body to monitor your health.

In 2020, mere months into the pandemic, Schwab published COVID-19: The Great Reset, in which he detailed his view of the opportunity presented by the growing global crisis. According to Schwab, the crisis was an opportunity for a global reset that included “stakeholder capitalism,” in which corporations could integrate social and environmental goals into their operations, especially working toward “net-zero emissions” and a massive transition to green energy, and “harnessing” the Fourth Industrial Revolution, including artificial intelligence and automation.

Much of Schwab’s personal wealth came from running the World Economic Forum; as chairman, he earned an annual salary of 1 million Swiss francs (approximately $1 million USD), and the WEF was supported financially through membership fees from over 1,000 companies worldwide as well as significant contributions from organizations such as the Bill & Melinda Gates Foundation. Vice Chairman Peter Brabeck-Letmathe is now serving as interim chairman until his replacement has been selected.

-

International1 day ago

International1 day agoPope Francis has died aged 88

-

International1 day ago

International1 day agoJD Vance was one of the last people to meet Pope Francis

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoHow Canada’s Mainstream Media Lost the Public Trust

-

International1 day ago

International1 day agoPope Francis Dies on Day after Easter

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election17 hours ago

2025 Federal Election17 hours agoPOLL: Canadians want spending cuts

-

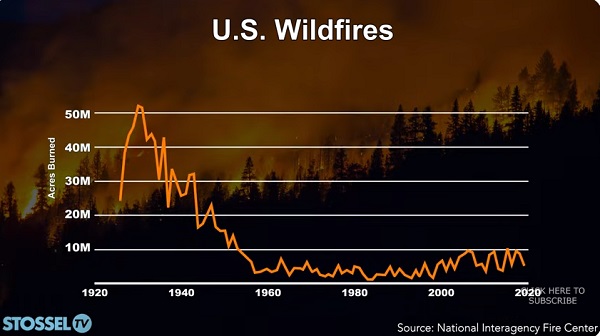

John Stossel10 hours ago

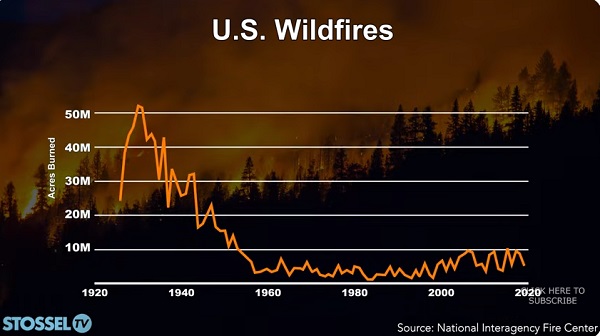

John Stossel10 hours agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs

-

Business1 day ago

Business1 day agoCanada Urgently Needs A Watchdog For Government Waste