National

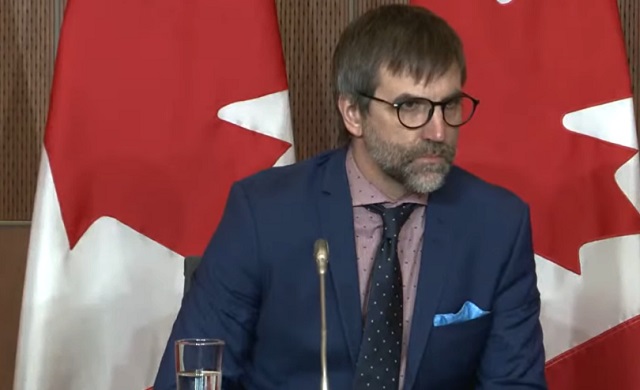

Trudeau’s environment minister proclaims himself ‘proud socialist’ before House of Commons

From LifeSiteNews

Steven Guilbeault made the declaration during a debate about the impact of carbon tax policies on soaring energy bills

Minister of Environment Steven Guilbeault proudly proclaimed before the House of Commons on Tuesday that he is a “proud socialist” during a debate over a carbon tax the federal government has imposed on Canadians that has contributed to sky-high energy bills.

“I’m a Liberal and a proud socialist,” Guilbeault said after being asked a question by Conservative Party of Canada (CPC) MP Ted Falk concerning the carbon tax.

Guilbeault then blamed former conservative Prime Minister Stephen Harper for not “believing” in “climate change” as a reason the current conservatives do not support a carbon tax.

“This reminds me of a certain quote from Prime Minister Harper who talked about the fight against climate change as a socialist plot,” he said.

“Here it is, you have it again, Mr. Speaker. They do not believe that climate change is an issue. They do not believe we should do anything about it.”

Where did he say this? I would love to share the clip.

— Nicholas Grillo🍎🍎 (@nicholas_grillo) November 7, 2023

Falk had said to Guilbeault before his “socialist” response that Prime Minister Justin Trudeau has created a “carbon tax” coalition with other socialist and separatist entities in Canada to cause financial pain for Canadians.

“After eight years, we now have the socialists, the separatists, and this prime minister who’s just not worth the cost,” Falk said.

“They’re all part of this costly carbon tax coalition that is leaving Canadians out in the cold.”

Trudeau has many times before blamed Harper for his government’s ills, it should be noted.

Reaction to Guilbeault’s comments came swiftly from many Canadian political pundits and others.

“Steven Guilbeault isn’t just a ‘proud socialist,’ he’s a total nutbar, climate extremist and incompetent minister,” wrote Paul Mitchell, a former People’s Party of Canada candidate and political commentator on X (formerly Twitter).

“Every provincial premier should demand that Guilbeault be sacked. Dealing with him is intolerable.”

Jim Murphy, a retired Toronto police officer, wrote on X, “I’m a bit confused, shouldn’t @s_guilbeaultbe a member of the NDP and not the @liberal_party? Serious question.”

The carbon tax has been a hot topic in the House of Commons, notably after Trudeau announced about two weeks ago he was pausing the collection of the carbon tax on home heating oil for three years but only for Atlantic Canadian provinces. The current cost of the carbon tax on home heating fuel is 17 cents per liter. Most Canadians, however, heat their homes with clean-burning natural gas, which will not be exempted from the carbon tax.

Trudeau’s carbon tax pause for Atlantic Canada announcement came amid dismal polling numbers showing his government is likely to be defeated in a landslide by the Conservative Party in the next election.

As a result, the CPC under leader Pierre Poilievre introduced a motion calling for the carbon tax to be paused for all Canadians. This motion was voted down on Monday by the Liberals with support from the Bloc Quebecois.

The New Democratic Party (NDP) voted in support of the CPC motion, despite the fact they have an informal coalition with the party that began last year, agreeing to support and keep the Liberals in power until the next election is mandated by law in 2025.

As for Guilbeault, he is perhaps Trudeau’s most radical minister in terms of his extreme environmental views. He recently said the Liberal government was going to push ahead with net-zero emission regulations despite the fact Canada’s Supreme Court recently ruled against the federal government’s “no more pipelines” legislation.

Earlier this year, the CPC slammed Trudeau for having Guilbeault accept an invite from China for climate talks.

Alberta Premier Danielle Smith has been a staunch opponent of Trudeau’s net-zero regulations and praised the court decision as returning power to the provinces.

Guilbeault has a history of environmental activism. In 2001, he was arrested after scaling the CN Tower in Toronto as part of a stunt for Greenpeace.

The CPC has previously called out extreme views emanating from the Liberal Party.

In September, Poilievre called Trudeau and his father Pierre Elliot Trudeau “Marxists” when asked by an Ontario resident what could be done to help prevent Canada from going “down” due to Liberal policies.

LifeSiteNews reported last month how Trudeau’s carbon tax is costing Canadians hundreds of dollars annually, as the rebates given out by the federal government are not enough to compensate for the increased fuel costs.

The Trudeau government’s current environmental goals – in lockstep with the United Nations’ “2030 Agenda for Sustainable Development” – include phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of the use of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum (WEF) – the globalist group behind the socialist “Great Reset” agenda – an organization in which Trudeau and some of his cabinet are involved.

Business

Carney’s Deficit Numbers Deserve Scrutiny After Trudeau’s Forecasting Failures

From the Frontier Centre for Public Policy

By Conrad Eder

Frontier Centre for Public Policy study reveals a decade of inflated Liberal forecasts—a track record that casts a long shadow over Carney’s first budget

The Frontier Centre for Public Policy has released a major new study revealing that the Trudeau government’s federal budget forecasts from 2016 to 2025 were consistently inaccurate and biased — a record that casts serious doubt on the projections in Prime Minister Mark Carney’s first budget.

Carney’s 2025–26 federal budget forecasts a $78.3-billion deficit — twice the size projected last year and four times what was forecast in Budget 2022. But if recent history is any guide, Canadians have good reason to question whether even this ballooning deficit reflects fiscal reality.

The 4,000-word study, Measuring Federal Budgetary Balance Forecasting Accuracy and Bias, by Frontier Centre policy analyst Conrad Eder, finds that forecast accuracy collapsed after the Trudeau government took office:

- Current-year forecasts were off by an average of $22.9 billion, or one per cent of GDP.

- Four-year forecasts missed the mark by an average of $94.4 billion, or four per cent of GDP.

- Long-term projections consistently overstated Canada’s fiscal health, showing a clear optimism bias.

Eder’s analysis shows that every three- and four-year forecast under Trudeau predicted a stronger financial position than what actually occurred, masking the true scale of deficits and debt accumulation. The study concludes that this reflects a systemic optimism bias, likely rooted in political incentives: short-term optics with no regard to long-term consequences.

“With Prime Minister Carney now setting Canada’s fiscal direction, it’s critical to assess his projections in light of this track record,” said Eder. “The pattern of bias and inaccuracy under previous Liberal governments gives reason to doubt the credibility of claims that deficits will shrink over time. Canadians deserve fiscal forecasts that are credible and transparent — not political messaging disguised as economic planning.”

The study warns that persistent optimism bias erodes fiscal accountability, weakens public trust and limits citizens’ ability to hold government to account — a threat to both economic sustainability and democratic transparency.

Business

Here’s what pundits and analysts get wrong about the Carney government’s first budget

From the Fraser Institute

By Jason Clemens and Jake Fuss

Under the new budget plan, this wedge between what the government collects in revenues versus what is actually spent on programs will rise to 13.0 per cent by 2029/30. Put differently, slightly more than one in every eight dollars sent to Ottawa will be used to pay interest on debt for past spending.

The Carney government’s much-anticipated first budget landed on Nov. 4. There’s been much discussion by pundits and analysts on the increase in the deficit and borrowing, the emphasis on infrastructure spending (broadly defined), and the continued activist approach of Ottawa. There are, however, several critically important aspects of the budget that are consistently being misstated or misinterpreted, which makes it harder for average Canadians to fully appreciate the consequences and costs of the budget.

One issue in need of greater clarity is the cost of Canada’s indebtedness. Like regular Canadians and businesses, the government must pay interest on federal debt. According to the budget plan, total federal debt will reach an expected $2.9 trillion in 2029/30. For reference, total federal debt stood at $1.0 trillion when the Trudeau government took office in 2015. The interest costs on that debt will rise from $53.4 billion last year to an expected $76.1 billion by 2029/30. Several analyses have noted this means federal interest costs will rise from 1.7 per cent of GDP to 2.1 per cent.

These are all worrying statistics about the indebtedness of the federal government. However, they ignore a key statistic—interest costs as a share of revenues. When the Trudeau government took office, interest costs consumed 7.5 per cent of revenues. This means taxpayers were foregoing 7.5 per cent of the resources they sent to Ottawa (in terms of spending on actual programs) because these monies were used to pay interest on debt accumulated from previous spending.

Under the new budget plan, this wedge between what the government collects in revenues versus what is actually spent on programs will rise to 13.0 per cent by 2029/30. Put differently, slightly more than one in every eight dollars sent to Ottawa will be used to pay interest on debt for past spending. This is one way governments get into financial problems, even crises, by continually increasing the share of revenues consumed by interest payments.

A second and fairly consistently misrepresented aspect of the budget pertains to large spending initiatives such as Build Canada Homes and Build Communities Strong Fund. The former is meant to increase the number of new homes, particularly affordable homes, being built annually and the latter is intended to provide funding to provincial governments (and through them, municipalities) for infrastructure spending. But few analysts question whether or not these programs will produce actual new spending for homebuilding or simply replace or “crowd-out” existing spending by the private sector.

Let’s first explore the homebuilding initiative. At any point in time, there are a limited number of skilled workers, raw materials, land, etc. available for homebuilding. When the federal government, or any government, initiates its own homebuilding program, it directly competes with private companies for that skilled labour (carpenters, electricians, etc.), raw materials (timber, concrete, etc.) and the land needed for development. Put simply, government homebuilding crowds out private-sector activity.

Moreover, there’s a strong argument that the crowding out by government results in less homebuilding than would otherwise be the case, because the incentives for private-sector homebuilding are dramatically different than government incentives. For example, private firms risk their own wealth and wellbeing (and the wellbeing of their employees) so they have very strong incentives to deliver homes demanded by people on time and at a reasonable price. Government bureaucrats and politicians, on the other hand, face no such incentives. They pay no price, in terms of personal wealth or wellbeing if homes, are late, not what consumers demand, or even produce less than expected. Put simply, homebuilding by Ottawa could easily result in less homes being built than if government had stayed out of the way of entrepreneurs, businessowners and developers.

Similarly, it’s debatable that infrastructure spending by Ottawa—specifically, providing funds to the provinces and municipalities—results in an actual increase in total infrastructure spending. There are numerous historical examples, including reports by the auditor general, detailing how similar infrastructure spending initiatives by the federal government were plagued by mismanagement. And in many circumstances, the provinces simply reduced their own infrastructure spending to save money, such that the actual incremental increase in overall infrastructure spending was negligible.

In reality, some of the major and large spending initiatives announced or expanded in the Carney government’s first budget, which will accelerate the deterioration of federal finances, may not deliver anything close to what the government suggests. Canadians should understand the real risks and challenges in these federal spending initiatives, along with the debt being accumulated, and the limited potential benefits.

-

Justice1 day ago

Justice1 day agoCarney government lets Supreme Court decision stand despite outrage over child porn ruling

-

Business1 day ago

Business1 day agoCarney’s budget spares tax status of Canadian churches, pro-life groups after backlash

-

COVID-191 day ago

COVID-191 day agoFreedom Convoy leader Tamara Lich to appeal her recent conviction

-

Daily Caller2 days ago

Daily Caller2 days agoUS Eating Canada’s Lunch While Liberals Stall – Trump Admin Announces Record-Shattering Energy Report

-

Daily Caller1 day ago

Daily Caller1 day agoUN Chief Rages Against Dying Of Climate Alarm Light

-

Business2 days ago

Business2 days agoPulling back the curtain on the Carney government’s first budget

-

Energy2 days ago

Energy2 days agoEby should put up, shut up, or pay up

-

Business2 days ago

Business2 days agoThe Liberal budget is a massive FAILURE: Former Liberal Cabinet Member Dan McTeague