Economy

Toronto, Vancouver named “Impossibly Unaffordable”

From the Frontier Centre for Public Policy

Two Canadian cities — Toronto and Vancouver — have earned the title of “impossibly unaffordable” in a new report.

“There has been a considerable loss of housing affordability in Canada since the mid-2000s, especially in the Vancouver and Toronto markets,” according to the Demographia International Housing Affordability report, which is released annually.

“During the pandemic, the increase in remote work (working at home) fuelled a demand increase as many households were induced to move from more central areas to suburban, exurban and even more remote areas. The result was a demand shock that drove house prices up substantially, as households moved to obtain more space, within houses and in yards or gardens.”

Vancouver was the least affordable market in Canada, and the third least affordable out of all of the 94 markets observed in the report. The West Coast city’s affordability issue has “troublingly” spread to smaller areas like Chilliwack, the Fraser Valley, Kelowna, and markets on Vancouver Island, per the report.

Toronto was named as the second least affordable market in Canada. However, it fared slightly better than Vancouver when it came to the other markets, ranking 84 out of 94 in international affordability.

“As in Vancouver, severely unaffordable housing has spread to smaller, less unaffordable markets in Ontario, such as Kitchener-cambridge-waterloo, Brantford, London, and Guelph, as residents of metro Toronto seek lower costs of living outside the Toronto market,” the report says.

The findings of the report have “grave implications on the prospects for upward mobility,” said Joel Kotkin, the director at the Center for Demographics and Policy at Chapman University, a co-publisher of the report along with Canada’s Frontier Centre for Public Policy.

“As with any problem, the first step towards a resolution should be to understand the basic facts,” he said. “This is what the Demographia study offers.”

The report looked at housing affordability in 94 metropolitan areas in Australia, China, Ireland, New Zealand, Singapore, the United Kingdom, the United States and Canada. The data analyzed was taken from September 2023. The ratings are based on five categories (affordable, moderately unaffordable, seriously unaffordable, severely unaffordable, and impossibly unaffordable) with a points system to classify each area.

The report determined affordability by calculating the median price-to-income ratio (“median multiple”) in each market.

“There is a genuine need to substantially restore housing affordability in many markets throughout the covered nations,” said Frontier Centre for Public Policy president Peter Holle, in a statement. “In Canada, policymakers are scrambling to ‘magic wand’ more housing but continue to mostly ignore the main reason for our dysfunctional costly housing markets — suburban land use restrictions.”

Toronto and Vancouver both received the worst possible rating for affordability, making them stand out as the most expensive Canadian cities in which to buy a home. However, other Canadian markets — like Calgary, Montreal and Ottawa-gatineau — stood out as well. They were considered “severely unaffordable.”

“This is a long time coming,” senior economist with the Canadian Centre for Policy Alternatives David Macdonald told CTV News.

“We haven’t been building enough housing, we certainly haven’t had enough government investment in affordable housing for decades, and the chickens are coming home to roost.”

The most affordable Canadian city in the report was Edmonton, which was given a rating of “moderately unaffordable.” The city in Alberta was “at least twothirds more affordable” than Vancouver.

Overall, Canada ranked third in home ownership compared to the other regions observed in the report. The highest home ownership rate was in Singapore, at 89 per cent, followed by Ireland, at 70 per cent. In Canada, the rate was 67 per cent.

First published in the National Post here, June 17, 2024.

Business

Canada’s loyalty to globalism is bleeding our economy dry

This article supplied by Troy Media.

Trump’s controversial trade policies are delivering results. Canada keeps playing by global rules and losing

U.S. President Donald Trump’s brash trade agenda, though widely condemned, is delivering short-term economic results for the U.S. It’s also revealing the high cost of Canada’s blind loyalty to globalism.

While our leaders scold Trump and posture on the world stage, our economy is faltering, especially in sectors like food and farming, which have been sacrificed to international agendas that don’t serve Canadian interests.

The uncomfortable truth is that Trump’s unapologetic nationalism is working. Canada needs to take note.

Despite near-universal criticism, the U.S. economy is outperforming expectations. The Federal Reserve Bank of Atlanta projects 3.8 per cent second-quarter GDP growth.

Inflation remains tame, job creation is ahead of forecasts, and the trade deficit is shrinking fast, cut nearly in half. These results suggest that, at least in the short term, Trump’s economic nationalism is doing more than just stirring headlines.

Canada, by contrast, is slipping behind. The economy is contracting, manufacturing is under pressure from shifting U.S. trade priorities, and food

inflation is running higher than general inflation. One of our most essential sectors—agriculture and food production—is being squeezed by rising costs, policy burdens and vanishing market access. The contrast with the U.S. is striking and damning.

Worse, Canada had been pushed to the periphery. The Trump administration had paused trade negotiations with Ottawa over Canada’s proposed digital services tax. Talks have since resumed after Ottawa backed away from implementing it, but the episode underscored how little strategic value

Washington currently places on its relationship with Canada, especially under a Carney-led government more focused on courting Europe than securing stable access to our largest export market. But Europe, with its own protectionist agricultural policies and slower growth, is no substitute for the scale and proximity of the U.S. market. This drift has real consequences, particularly for

Canadian farmers and food producers.

The problem isn’t a trade war; it’s a global realignment. And while Canada clings to old assumptions, Trump is redrawing the map. He’s pulling back from institutions like the World Health Organization, threatening to sever ties with NATO, and defunding UN agencies like the Food and Agriculture Organization (FAO), the global body responsible for coordinating efforts to improve food security and support agricultural development worldwide. The message is blunt: global institutions will no longer enjoy U.S. support without measurable benefit.

To some, this sounds reckless. But it’s forcing accountability. A senior FAO official recently admitted that donors are now asking hard questions: why fund these agencies at all? What do they deliver at home? That scrutiny is spreading. Countries are quietly realigning their own policies in response, reconsidering the cost-benefit of multilateralism. It’s a shift long in the making and long resisted in Canada.

Nowhere is this resistance more damaging than in agriculture. Canada’s food producers have become casualties of global climate symbolism. The carbon tax, pushed in the name of international leadership, penalizes food producers for feeding people. Policies that should support the food and farming sector instead frame it as a problem. This is globalism at work: a one-size-fits-all policy that punishes the local for the sake of the international.

Trump’s rhetoric may be provocative, but his core point stands: national interest matters. Countries have different economic structures, priorities and vulnerabilities.

Pretending that a uniform global policy can serve them all equally is not just naïve, it’s harmful. America First may grate on Canadian ears, but it reflects a reality: effective policy begins at home.

Canada doesn’t need to mimic Trump. But we do need to wake up. The globalist consensus we’ve followed for decades is eroding. Multilateralism is no longer a guarantee of prosperity, especially for sectors like food and farming. We must stop anchoring ourselves to frameworks we can’t influence and start defining what works for Canadians: secure trade access, competitive food production, and policy that recognizes agriculture not as a liability but as a national asset.

If this moment of disruption spurs us to rethink how we balance international cooperation with domestic priorities, we’ll emerge stronger. But if we continue down our current path, governed by symbolism, not strategy, we’ll have no one to blame for our decline but ourselves.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

Business

Carney’s spending makes Trudeau look like a cheapskate

This article supplied by Troy Media.

By Gwyn Morgan

By Gwyn Morgan

The Carney government’s spending plans will push Canada’s debt higher, balloon the deficit, and drive us straight toward a credit downgrade

Prime Minister Mark Carney was sold to Canadians as the grown-up in the room, the one who’d restore order after Justin Trudeau’s reckless deficits. Instead, he’s spending even more and steering Canada deeper into trouble. His newly unveiled fiscal plan will balloon the deficit, drive up

interest costs and put Canada’s credit rating and economic future in jeopardy.

When Trudeau first ran for office, he promised “modest short-term deficits” of under $10 billion annually and a balanced budget by 2019. Instead, he ran nine consecutive deficits, peaking at $62 billion in 2023–24, and nearly doubled the national debt, from $650 billion to $1.236 trillion. That

reckless spending should have been a warning.

Yet Carney, presented for years as a safe, globally respected economic steward, is proving to be anything but. The recently released Main Estimates (the federal government’s official spending blueprint) project program spending will rise 8.4 per cent in 2025–26 to $488 billion. Add in at least $50 billion to service the national debt, and the federal tab balloons to $538 billion.

Even assuming tax revenues stay flat, we’re looking at a $40-billion deficit. But that’s optimistic. The ongoing tariff war with the United States, now hitting everything from autos to metals to consumer goods, is cutting deep into economic output. That means weaker revenues and a much larger shortfall. Carney’s response? Spend even more.

And the Canadian dollar is already paying the price. Since 2015, the loonie has slipped from 78 cents U.S. to 73. Carney’s spending spree is likely

to drive it even lower, eroding the value of Canadians’ wages, savings and retirement funds. Inflation? Buckle up.

Franco Terrazzano of the Canadian Taxpayers Federation nailed it in a recent Financial Post column: “Mark Carney was right: He’s not like Justin Trudeau, he spends more,” Terrazzano argues. “The government will spend $49 billion on interest this year and the Parliamentary Budget Officer projects interest charges will be blowing a $70-billion hole in the budget by 2029. That means our kids and grandkids will be making payments on Ottawa’s debt for the rest of their lives.”

Meanwhile, Canada’s credit rating is under real threat. An April 29 report by Fitch Ratings warned that “Canada has experienced rapid and steep fiscal deterioration, driven by a sharply weaker economic outlook and increased government spending during the electoral cycle. If the Liberal program is implemented, higher deficits are likely to increase federal, provincial and local debt to above 90 per cent of GDP.”

That’s not just a red flag; it’s a fire alarm. A downgraded credit rating means Ottawa will pay more to borrow, which trickles down to higher interest rates on everything from provincial debt to mortgages and business loans.

But this decline didn’t start with tariffs. The rot runs deeper. One of the clearest signs of a faltering economy is falling business investment per worker. According to the C.D. Howe Institute, investment has been shrinking since 2015. Canadian businesses now invest just 66 cents of new capital for every dollar invested by their OECD counterparts; only 55 cents compared to U.S. firms. That means less productivity, fewer wage gains and stagnating living standards.

Why is investment collapsing? Policy. Regulation. Taxes. Uncertainty.

The C.D. Howe report laid out a straightforward to-do list, one the federal government continues to ignore:

Reform corporate taxes to attract capital investment.

Introduce early-stage investment incentives.

Tear down regulatory barriers delaying resource and infrastructure projects, especially in energy (maybe then Alberta won’t feel like seceding).

Promote IP investment with targeted tax credits.

Bring stability and predictability back to the regulatory process.

Instead, what Canadians get is policy chaos and endless virtue-signalling. That’s no substitute for economic growth. And let’s talk about Carney’s much-touted past. Voters were bombarded with reminders that he led the Bank of Canada during the 2008–09 financial crisis. But it was Jim Flaherty, Stephen Harper’s finance minister, who made the hard fiscal decisions that got the country through it. Carney’s tenure at the Bank of England? A different story. As former U.K. Prime Minister Liz Truss put it: “Mark Carney did a terrible job” at the Bank of England. “He printed money to a huge extent, creating inflation.”

Fast-forward to today, and Canada’s performance is nothing short of dismal. Our GDP per capita sits at just $53,431, compared to America’s $82,769. That’s not just a bragging-rights statistic. It reflects real differences in productivity, competitiveness and national prosperity. Worse, over the past 10 years, Canada’s per capita GDP has grown just 1.1 per cent, second worst in the OECD, ahead of only Luxembourg.

We remain a great country filled with capable people, but our most significant fault may be how easily we fall for image over substance. First with Trudeau’s sunny ways. Now with Carney’s global banker persona. The reality? His plan risks stripping Canadians of their prosperity, downgrading our creditworthiness and deepening long-term decline.

It pains me to say it, but unless something changes fast, Canadians face continued erosion in their standard of living and inflation-driven losses in their savings. The numbers are grim. The direction is wrong. And the consequences are generational.

Trudeau fooled voters with promises of restraint. Carney’s now asking for the same trust, with an even bigger bill attached. Canadians can’t afford to make the same mistake twice.

Gwyn Morgan is a retired business leader who has been a director of five global corporations

-

Business1 day ago

Business1 day agoCanada’s loyalty to globalism is bleeding our economy dry

-

Agriculture2 days ago

Agriculture2 days agoCanada’s supply management system is failing consumers

-

Alberta1 day ago

Alberta1 day agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

armed forces1 day ago

armed forces1 day agoCanada’s Military Can’t Be Fixed With Cash Alone

-

Alberta1 day ago

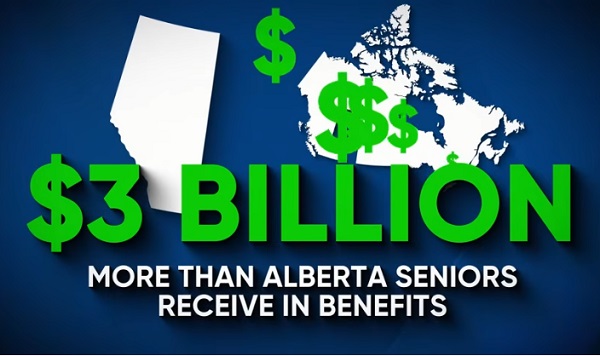

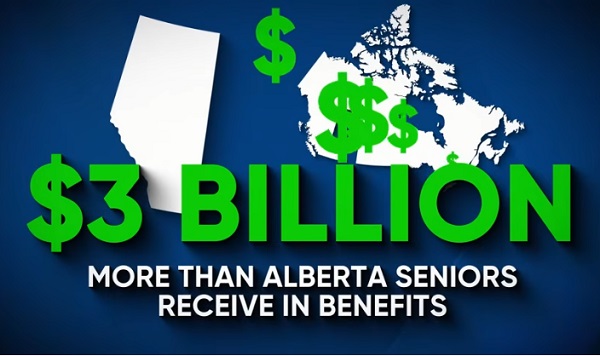

Alberta1 day agoAlberta Next: Alberta Pension Plan

-

International1 day ago

International1 day agoTrump transportation secretary tells governors to remove ‘rainbow crosswalks’

-

Business1 day ago

Business1 day agoCarney’s spending makes Trudeau look like a cheapskate

-

Crime2 days ago

Crime2 days agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel