Alberta

Todayville Travel: Turks and Caicos – The Road Less Travelled

Turks and Caicos – The Road Less Travelled

I once had political aspirations. It was the early 1980s. A federal election was brewing. At the same time a tiny chain of British islands in the Caribbean – the Turks and Caicos – had expressed interest in forming an association with Canada.

What a great idea: Canada’s own warm, winter destination. No more currency exchange swindles or fighting with hefty American tourists in a Cancun buffet line-up; just a happy bunch of Canucks soaking up the sun in our own polite corner of tropical paradise.

I would make political hay by running for office on this simple, single platform: promoting a union between Canada and the Turks and Caicos. It seemed a worthwhile diversion from Alberta’s traditional campaign issues: complaining about Quebec and letting the eastern bastards freeze in the dark.

Alas, I didn’t run and my nascent political ambitions, like the election, came and went. The Turks and Caicos dream faded into the blue yonder; our Prime Minister went back to exclaiming “fuddle duddle” in Parliament and the West returned to detesting the East over trivial issues such as who was going to get Alberta’s gazillion petro dollars. And instead of milking the federal treasury I ended up in law school and eventually Red Deer where I practiced law for a quarter century before concluding that life was too short to spend behind a desk – even if it were in the corner office.

But some people follow through on that early opportunity to chart a different course. Bruce Twa, a law school buddy, had lawyered through a few cold Alberta winters when a chance phone call offered him the prospect of practicing warm-winter law – in the Turks and Caicos. Bruce jumped at the offer. He has now been resident in the “TCIs” for over twenty-five years, transacting real estate deals on behalf of wealthy, sophisticated, discreet clients – when he’s not boating in the azure-coloured waters or snorkeling amongst parrotfish and turtles in the coral reef surrounding the islands.

I had promised (threatened?) to visit Bruce on numerous occasions over the years. Finally, arrangements were made. We’d see the tropical paradise Canada had snubbed and find out how my naïve 1980s political ambitions may have panned out.

My wife Florence and I learned even before clearing customs at Providenciales airport that the TCIs still maintain a quaint “small-island” feel. Bruce and his wife Darlene had graciously offered to host us during our stay but the border guard wouldn’t allow us entry. We didn’t have Bruce’s home address. The officer shook his head many times, threatening us with expulsion, before calling in his superior.

She looked at our paperwork, “Oh, you staying with Bruce? I just give him a call and get his house number.” She dialled and five minutes later we were standing on the curb, throwing our stuff into Bruce’s pickup.

We had only four days in the TCIs; a wise use of time was paramount. I wanted to evaluate whether Canada had blundered or done right in spurning the wishes of this British Protectorate. A quick but thorough analysis of the culture, economy and history was in order. I’d keep a tally of the positives and negatives. We began our research in a calculated, scientific fashion: so we went for beer and seafood, stuffing ourselves with fresh conch and island brew. The conch fritters were fantastic but the local beer (Turk’s Head) was awful. Score: one/one.

In the morning Bruce offered us the use of his beater truck so we could explore the island. I was a bit nervous about driving a standard stick shift in a strange country. “Don’t worry,” said Bruce, “Provo (that’s what the locals call Providenciales) is small, you really can’t get lost”. I felt better until I turned out of his driveway onto the main highway and realized everyone was driving on the wrong side of the road. I geared down and careened into the steamy Caribbean chaos.

Our methodical investigation continued… with lunch by the sea at Grace Bay – named by Condé Nast as one of the top beaches in the world. The fish was delectable and the beer (Presidente, imported from the Dominican Republic) palatable. The score was starting to favour the unionists.

That afternoon Bruce abandoned his clients to take us on an insider’s tour of his small island. The TCIs are a string of Cays (“Keys”) located at the eastern end of the Bahamas chain. The capital is Grand Turk, an island 100 kilometers from Providenciales. There are numerous small Cays – mostly uninhabited – between these two major islands. Due largely to the influence of Canadian ex-pats, Provo has evolved to become both the commercial and tourism center of the TCIs.

Bruce drove us through the high-rent district. If you are in the market for a multi-million dollar beachside home, Provo has plenty to offer. And if you change your mind and decide to sell, there is no tax payable on any gain in value. In fact there’s no tax of any kind in the TCIs: no tax on income or capital gains and no annual property tax on your house. But import duties and the cost of living are painfully high. Duty can be as much as 45% of a car’s value. And when you buy your dream home in paradise there is a one-time stamp fee payable equal to 9.75% of the purchase price. On a $1,000,000 property the fee is almost $100,000! Ouch, that’s a lot of postage.

These punishing import duties have led to some clever avoidance strategies. For example, the Turks and Caicos has many, many churches… all exempt from duty. Thus, even the humblest pastor usually drives a shiny new SUV.

We also toured the low-rent district, a stone’s throw from where the millionaire’s reside. The poor area, dubbed Five Cays, is where the immigrant workers – primarily Haitian – live.

The unmaintained road into Five Cays is almost impassable. This explains the abandoned vehicles we encountered – some converted into makeshift shelters; and many of the shanty houses here are a work-in-progress.

“We build piece-piece,” the locals explain. Bruce often does free legal work for the poor of Five Cays. He should be careful. This kind of attitude could bring an end to lawyer jokes.

There are a number of different, confusing categories of residency in the TCIs. We arrived on a temporary (30 day) permit. Bruce and his wife are permanent residents. The Haitians rely on work permit residency.

Then there are the “Belongers”. Only those persons born on the islands (with island ancestry) are true citizens, entitled to vote and hold office. Bruce and Darlene have been permanent residents of the TCIs for over two decades but can’t vote. They’ll never be Belongers.

This bizarre restriction on citizenship has led indirectly to a major challenge facing the Turks and Caicos: a legacy of nepotism and corruption. One afternoon Bruce took us snorkeling. We boated past the palatial home of ex-premier Michael Misick in the Leeward neighbourhood of Provo.

After building his mansion Mr. Misick leased it to the government. Then he moved in – as tenant – and collected $10,000 a month in rent from government coffers. The same day we cruised by the house, Interpol apprehended Mr. Misick in Rio de Janeiro on an international arrest warrant on charges of corruption and maladministration. Michael Misick apparently lacks neither cash nor gumption.

The tally was thickening. Would it really benefit Canada to get into bed with these types – even if the bed was a hammock swaying in a tropical breeze?

Time was running short. To judge matters objectively I needed more first-hand data… so I went bonefishing with “Bar”, a local guide. Wow! The fight presented by these fish is absurd. If you are a fly-fisherman put this adventure on your bucket-list. One moment I was admiring a juvenile nurse shark hovering in the shallow waters beneath Bar’s flat-bottomed boat and the next the line was spinning uncontrollably outward. It was ten minutes before I had that slippery little devil in my hands.

Motoring back to Provo we trolled past Bruce Willis’ house on Parrot Cay but the place looked deserted. Perhaps he was over at Demi Moore’s place having an ex-spouse, ex-pat spat.

I owed Bar $500 for the morning’s fishing (I told you the TCIs are expensive). We agreed to meet at a bank up the road – but as we pulled in it was being robbed. “What happened?” I asked the security guard next door. “Sketchy… it happen piece-piece,” he answered cryptically. Crime is not really an issue in the TCIs but, embarrassingly, the Provo Police Station had also recently been burgled. Thieves made off with guns, ammo and drugs held for pending court cases; adding insult to injury the police force’s new uniforms ended up at a local pawnshop.

Then there’s the “Potcakes” – Provo’s stray dogs. Packs of barking Potcakes roam the streets of this little island at night, stealing sleep from rich and poor alike. Unfortunately, the government funding for a much-needed sterilization program came unleashed amid allegations of… corruption.

Bruce’s dog Biana is a former Potcake, now fully civilized. During our boating afternoon Biana grew seasick but jumped overboard rather than vomit in her master’s vessel. Bruce cut the motor, dove in and brought his AWOL canine back aboard; then she threw up.

The final tally? It’s difficult to say. On our last night any negative karma evaporated when I stepped onto Bruce’s deck, into the sultry Provo darkness, and smelled the air. Have you ever encountered night-blooming jasmine? The fragrance is difficult to describe but should I ever again detect its beauty floating on a tropical evening breeze, the recollection will return like scented déjà vu.

Perhaps it’s best to let the Turks and Caicos dream drift away, unfulfilled. Like most things in life – politics included – things aren’t so simple as may first appear. Still, it sure would be nice to see the Maple Leaf fluttering over a tropical sunset.

About the author:

Click below to read about some of Gerry’s other great travel adventures.

Alberta

Low oil prices could have big consequences for Alberta’s finances

From the Fraser Institute

By Tegan Hill

Amid the tariff war, the price of West Texas Intermediate oil—a common benchmark—recently dropped below US$60 per barrel. Given every $1 drop in oil prices is an estimated $750 million hit to provincial revenues, if oil prices remain low for long, there could be big implications for Alberta’s budget.

The Smith government already projects a $5.2 billion budget deficit in 2025/26 with continued deficits over the following two years. This year’s deficit is based on oil prices averaging US$68.00 per barrel. While the budget does include a $4 billion “contingency” for unforeseen events, given the economic and fiscal impact of Trump’s tariffs, it could quickly be eaten up.

Budget deficits come with costs for Albertans, who will already pay a projected $600 each in provincial government debt interest in 2025/26. That’s money that could have gone towards health care and education, or even tax relief.

Unfortunately, this is all part of the resource revenue rollercoaster that’s are all too familiar to Albertans.

Resource revenue (including oil and gas royalties) is inherently volatile. In the last 10 years alone, it has been as high as $25.2 billion in 2022/23 and as low as $2.8 billion in 2015/16. The provincial government typically enjoys budget surpluses—and increases government spending—when oil prices and resource revenue is relatively high, but is thrown into deficits when resource revenues inevitably fall.

Fortunately, the Smith government can mitigate this volatility.

The key is limiting the level of resource revenue included in the budget to a set stable amount. Any resource revenue above that stable amount is automatically saved in a rainy-day fund to be withdrawn to maintain that stable amount in the budget during years of relatively low resource revenue. The logic is simple: save during the good times so you can weather the storm during bad times.

Indeed, if the Smith government had created a rainy-day account in 2023, for example, it could have already built up a sizeable fund to help stabilize the budget when resource revenue declines. While the Smith government has deposited some money in the Heritage Fund in recent years, it has not created a dedicated rainy-day account or introduced a similar mechanism to help stabilize provincial finances.

Limiting the amount of resource revenue in the budget, particularly during times of relatively high resource revenue, also tempers demand for higher spending, which is only fiscally sustainable with permanently high resource revenues. In other words, if the government creates a rainy-day account, spending would become more closely align with stable ongoing levels of revenue.

And it’s not too late. To end the boom-bust cycle and finally help stabilize provincial finances, the Smith government should create a rainy-day account.

Alberta

Governments in Alberta should spur homebuilding amid population explosion

From the Fraser Institute

By Tegan Hill and Austin Thompson

In 2024, construction started on 47,827 housing units—the most since 48,336 units in 2007 when population growth was less than half of what it was in 2024.

Alberta has long been viewed as an oasis in Canada’s overheated housing market—a refuge for Canadians priced out of high-cost centres such as Vancouver and Toronto. But the oasis is starting to dry up. House prices and rents in the province have spiked by about one-third since the start of the pandemic. According to a recent Maru poll, more than 70 per cent of Calgarians and Edmontonians doubt they will ever be able to afford a home in their city. Which raises the question: how much longer can this go on?

Alberta’s housing affordability problem reflects a simple reality—not enough homes have been built to accommodate the province’s growing population. The result? More Albertans competing for the same homes and rental units, pushing prices higher.

Population growth has always been volatile in Alberta, but the recent surge, fuelled by record levels of immigration, is unprecedented. Alberta has set new population growth records every year since 2022, culminating in the largest-ever increase of 186,704 new residents in 2024—nearly 70 per cent more than the largest pre-pandemic increase in 2013.

Homebuilding has increased, but not enough to keep pace with the rise in population. In 2024, construction started on 47,827 housing units—the most since 48,336 units in 2007 when population growth was less than half of what it was in 2024.

Moreover, from 1972 to 2019, Alberta added 2.1 new residents (on average) for every housing unit started compared to 3.9 new residents for every housing unit started in 2024. Put differently, today nearly twice as many new residents are potentially competing for each new home compared to historical norms.

While Alberta attracts more Canadians from other provinces than any other province, federal immigration and residency policies drive Alberta’s population growth. So while the provincial government has little control over its population growth, provincial and municipal governments can affect the pace of homebuilding.

For example, recent provincial amendments to the city charters in Calgary and Edmonton have helped standardize building codes, which should minimize cost and complexity for builders who operate across different jurisdictions. Municipal zoning reforms in Calgary, Edmonton and Red Deer have made it easier to build higher-density housing, and Lethbridge and Medicine Hat may soon follow suit. These changes should make it easier and faster to build homes, helping Alberta maintain some of the least restrictive building rules and quickest approval timelines in Canada.

There is, however, room for improvement. Policymakers at both the provincial and municipal level should streamline rules for building, reduce regulatory uncertainty and development costs, and shorten timelines for permit approvals. Calgary, for instance, imposes fees on developers to fund a wide array of public infrastructure—including roads, sewers, libraries, even buses—while Edmonton currently only imposes fees to fund the construction of new firehalls.

It’s difficult to say how long Alberta’s housing affordability woes will endure, but the situation is unlikely to improve unless homebuilding increases, spurred by government policies that facilitate more development.

-

Alberta2 days ago

Alberta2 days agoGovernments in Alberta should spur homebuilding amid population explosion

-

International2 days ago

International2 days agoHistory in the making? Trump, Zelensky hold meeting about Ukraine war in Vatican ahead of Francis’ funeral

-

Alberta2 days ago

Alberta2 days agoLow oil prices could have big consequences for Alberta’s finances

-

conflict2 days ago

conflict2 days agoWhy are the globalists so opposed to Trump’s efforts to make peace in Ukraine?

-

2025 Federal Election2 days ago

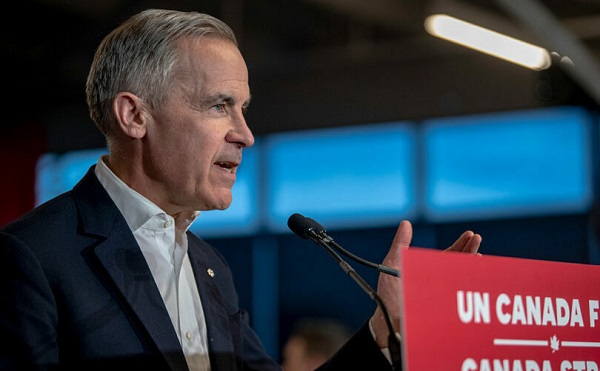

2025 Federal Election2 days agoCarney’s budget is worse than Trudeau’s

-

Business2 days ago

Business2 days agoIt Took Trump To Get Canada Serious About Free Trade With Itself

-

C2C Journal1 day ago

C2C Journal1 day ago“Freedom of Expression Should Win Every Time”: In Conversation with Freedom Convoy Trial Lawyer Lawrence Greenspon

-

2025 Federal Election16 hours ago

2025 Federal Election16 hours agoColumnist warns Carney Liberals will consider a home equity tax on primary residences