Alberta

The USMCA’s self-destruct button: review clause conjures fears of 2018 all over again

WASHINGTON — It’s been less than three years since the U.S.-Mexico-Canada Agreement replaced NAFTA as the law of the land in continental trade, and there are already hints of the existential anxiety that preceded it.

That’s because of the so-called “sunset provision,” a clause that reflects the lingering working-class distrust of globalization in the U.S. that helped Donald Trump get elected president back in 2016.

Article 34.7 of the agreement, the “review and term extension” clause, establishes a 16-year life cycle that requires all three countries to sit down every six years to ensure everyone is still satisfied.

That clock began ticking in the summer of 2020. If it runs out in 2026, it triggers a self-destruct mechanism of sorts, ensuring the agreement — known in Canada as CUSMA — would expire 10 years later without a three-way consensus.

For Canada, the sunset provision “is a minefield,” said Lawrence Herman, an international trade lawyer and public policy expert based in Toronto.

“It is certainly not a rubber-stamping exercise — far from it.”

Of particular concern is the fact that the provision doesn’t spell out in detail what happens if one of the parties indicates that it won’t sign off on extending the deal without significant changes to the terms.

“The concern is that this could mean, in effect, that we’ll be into a major renegotiation of CUSMA in 2026,” by which time the political landscape in both the U.S. and Mexico could look very different, Herman said.

“What happens then? The government and business community need to be thinking about this and start preparing the groundwork and doing contingency planning now.”

The deal as it stands is hardly perfect, if the number of disputes is any indication.

In the 33 months since USMCA went into effect in July 2020, 17 disputes have been launched among the three countries, compared with a total of 77 initiated over the course of NAFTA’s 25-year lifespan.

The U.S. remains unhappy with how Canada has allocated the quotas that give American dairy producers access to markets north of the border. Canada and Mexico both took issue with how the U.S. defined foreign auto content. And Canada and the U.S. oppose Mexico favouring state-owned energy providers.

The Canada-U.S. disputes are likely to be on the agenda when Prime Minister Justin Trudeau sits down later this week in Ottawa with President Joe Biden, his first official visit to Canada since being sworn in two years ago.

“The president’s really excited about doing this, about going up there and really going to Ottawa for no other purpose than the bilateral relationship,” National Security Council spokesman John Kirby told the White House briefing Monday.

Prior meetings between the two have typically been on the margins of international summits or at trilateral gatherings with their Mexican counterpart, Andrés Manuel López Obrador.

Kirby cited climate change, trade, the economy, irregular migration and modernizing the continental defence system known as Norad as just some of “a bunch of things” the two leaders are expected to talk about.

“He has a terrific relationship with Prime Minister Trudeau — warm and friendly and productive.”

Trade disputes notwithstanding, the overwhelming consensus — in Canada, at least — is that USMCA is vastly better than nothing.

“I don’t want to be alarmist about this, but we cannot take renewal for granted,” said Goldy Hyder, president and CEO of the Business Council of Canada, after several days of meetings last week with Capitol Hill lawmakers.

Constantly talking up the vital role bilateral trade plays in the continent’s continued economic health is a cornerstone of Canada’s diplomatic strategy. The message Hyder brought home from D.C.? Don’t stop now.

“We met several senators, we met people from the administration, and their message was, ‘Be down here. Make your case. Continue to remind Americans of the role that Canada has in their economy,'” he said.

“We’ve got to … be a little less humble in the United States and start reminding Americans just how much skin in the game that they have in Canada.”

That can be a challenging domestic political truth in the U.S., where deep-seated resentment over free trade in general and NAFTA in particular metastasized in 2016 and persists to this day.

Biden likes to put a blue-collar, Buy American frame around policy decisions. His original plan to advance electric-vehicle sales saved the richest incentives for vehicles assembled in the U.S. with union labour.

Aggressive lobbying by Canada helped avert a serious crisis for Canada’s auto sector; the Inflation Reduction Act that Biden ultimately signed included EV tax credits for vehicles assembled in North America.

For many, it was a cautionary tale about the importance of arguing Canada’s interests in Washington.

A strong U.S. depends on a strong Canada, said Rob Wildeboer, executive chairman and co-founder of Ontario-based auto parts supplier Martinrea International Inc., who took part in last week’s D.C. meetings.

“The USMCA and the ability to move goods across borders is extremely important to us, it’s extremely important to our industry, it’s extremely important to this country, and it’s a template for the things we can do together with the United States,” Wildeboer said.

“In order for the U.S. to be strong, it needs strong neighbours, and Canada’s right at the top of the list.”

This report by The Canadian Press was first published March 21, 2023.

James McCarten, The Canadian Press

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

Health2 days ago

Health2 days agoHorrific and Deadly Effects of Antidepressants

-

COVID-192 days ago

COVID-192 days agoCOVID virus, vaccines are driving explosion in cancer, billionaire scientist tells Tucker Carlson

-

Dr. Robert Malone2 days ago

Dr. Robert Malone2 days agoThe West Texas Measles Outbreak as a Societal and Political Mirror

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

illegal immigration1 day ago

illegal immigration1 day agoDespite court rulings, the Trump Administration shows no interest in helping Abrego Garcia return to the U.S.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoConservative MP Leslyn Lewis warns Canadian voters of Liberal plan to penalize religious charities

-

Education1 day ago

Education1 day agoSchools should focus on falling math and reading skills—not environmental activism

-

2025 Federal Election1 day ago

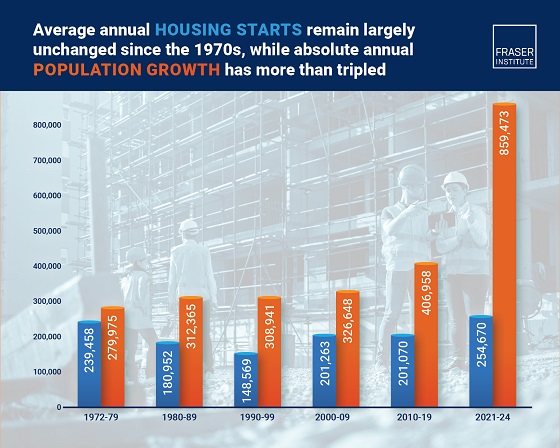

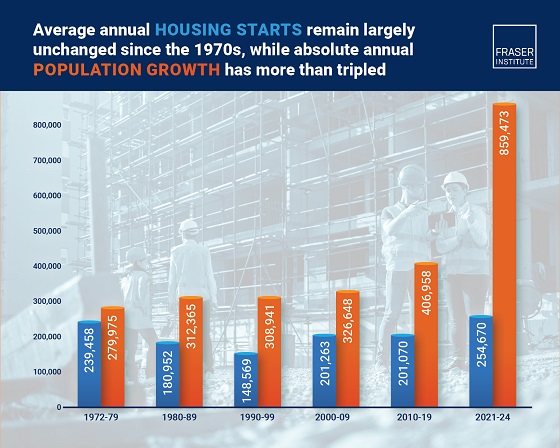

2025 Federal Election1 day agoHousing starts unchanged since 1970s, while Canadian population growth has more than tripled