David Clinton

The Hidden and Tragic Costs of Housing and Immigration Policies

We’ve discussed the housing crisis before. That would include the destabilizing combination of housing availability – in particular a weak supply of new construction – and the immigration-driven population growth.

Parsing all the data can be fun, but we shouldn’t forget the human costs of the crisis. There’s the significant financial strain caused by rising ownership and rental costs, the stress so many experience when desperately searching for somewhere decent to live, and the pressure on businesses struggling to pay workers enough to survive in madly expensive cities.

If Canada doesn’t have the resources to house Canadians, should there be fewer of us?

Well we’ve also discussed the real problems caused by low fertility rates. As they’ve already discovered in low-immigration countries like Japan and South Korea, there’s the issue of who will care for the growing numbers of childless elderly. And who – as working-age populations sharply decline – will sign up for the jobs that are necessary to keep things running.

How much are the insights you discover in The Audit worth to you?

Consider becoming a paid subscriber.

The odds are that we’re only a decade or so behind Japan. Remember how a population’s replacement-level fertility rate is around 2.1 percent? Here’s how Canadian “fertility rates per female” have dropped since 1991:

Put differently, Canada’s crude birth rate per 1,000 population dropped from 14.4 in 1991, to 8.8 in 2023.

As a nation, we face very difficult constraints.

But there’s another cost to our problems that’s both powerful and personal, and it exists at a place that overlaps both crises. A recent analysis by the Parliamentary Budget Officer (PBO) frames it in terms of suppressed household formation.

Household formation happens when two more more people choose to share a home. As I’ve written previously, there are enormous economic benefits to such arrangements, and the more permanent and stable the better. There’s also plenty of evidence that children raised within stable families have statistically improved economic, educational, and social outcomes.

But if households can’t form, there won’t be a lot of children.

In fact, the PBO projects that population and housing availability numbers point to the suppression of nearly a half a million households in 2030. And that’s incorporating the government’s optimistic assumptions about their new Immigration Levels Plan (ILP) to reduce targets for both permanent and temporary residents. It also assumes that all 2.8 million non-permanent residents will leave the country when their visas expire. Things will be much worse if either of those assumptions doesn’t work out according to plan.

Think about a half a million suppressed households. That number represents the dreams and life’s goals of at least a million people. Hundreds of thousands of 30-somethings still living in their parents basements. Hundreds of thousands of stable, successful, and socially integrated families that will never exist.

And all that will be largely (although not exclusively) the result of dumb-as-dirt political decisions.

Who says policy doesn’t matter?

How much are the insights you discover in The Audit worth to you?

Consider becoming a paid subscriber.

For the full experience, upgrade your subscription.

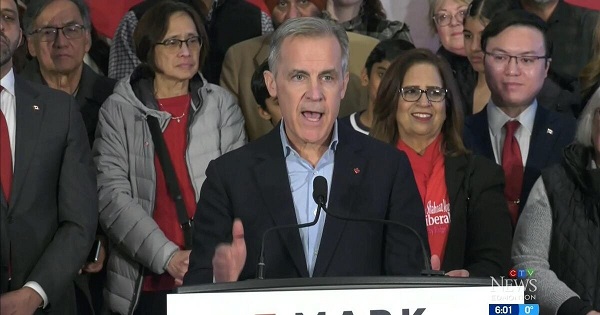

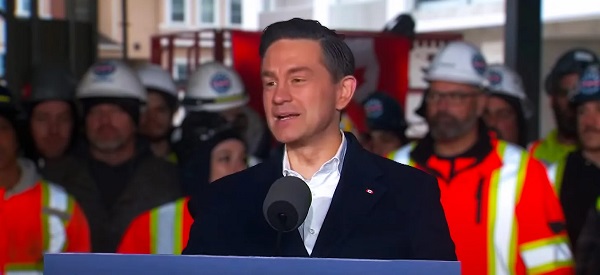

2025 Federal Election

Highly touted policies the Liberal government didn’t actually implement

From The Audit

State capacity is the measure of a government’s ability to get stuff done that benefits its population. There are many ways to quantify state capacity, including GDP per capita spent on health, education, and infrastructure versus outcomes; the tax-to-GDP ratio; judicial independence; enforcement of contracts; and crime rates.

But a government’s ability to actually implement its own policies has got to rank pretty high here, too. All the best intentions are worthless if, as I wrote in the context of the Liberal’s 2023 national action plan to end gender-based violence, your legislation just won’t work in the real world.

The Audit is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

So I thought I’d take a look at some examples of federal legislation from the past ten years that passed through Parliament but, for one reason or another, failed to do its job. We may agree or disagree with goals driving the various initiatives, but government’s failure to get the work done over and over again speaks to a striking lack of state capacity.

The 2018 Cannabis Act (Bill C-45). C-45 legalized recreational cannabis in Canada, with a larger goal of regulating production, distribution, and consumption while reducing illegal markets and protecting public health. However, research has shown that illegal sales persisted post-legalization due to high legal prices and taxation. Studies have also shown continued use among children despite regulations. And there are troubling indicators about the overall impact on public health.

The 2021 Canadian Net-Zero Emissions Accountability Act (Bill C-12). The legislation aimed to ensure Canada achieves net-zero greenhouse gas emissions by 2050 by setting five-year targets and requiring emissions reduction plans. However, critics argue it lacks enforceable mechanisms to guarantee results. A much-delayed progress report highlighted a lack of action and actual emissions reductions lagging far behind projections.

The First Nations Clean Water Act (Bill C-61) was introduced in late 2024 but, as of the recent dissolution of Parliament, not yet passed. This should be seen in the context of the Safe Drinking Water for First Nations Act (2013), which was repealed in 2021 after failing to deliver promised improvements in water quality due to inadequate funding and enforcement. The new bill aimed to address these shortcomings, but a decade and a half of inaction speaks to a special level of public impotence.

The 2019 Impact Assessment Act (Bill C-69). Passed in 2019, this legislation reformed environmental assessment processes for major projects. Many argue it failed to achieve its dual goals of streamlining approvals while enhancing environmental protection. Industry groups claim it created regulatory uncertainty (to put it mildly), while environmental groups argue it hasn’t adequately protected ecosystems. No one seems happy with this one.

The 2019 Firearms Act (Bill C-71). Parts of this firearms legislation were delayed in implementation, particularly the point-of-sale record keeping requirements for non-restricted firearms. Some provisions weren’t fully implemented until years after passage.

The 2013 First Nations Financial Transparency Act. – This legislation, while technically implemented, was not fully enforced after 2015 when the Liberal government stopped penalizing First Nations that didn’t comply with its financial disclosure requirements.

The 2019 National Housing Strategy Act. From the historical perspective of six years of hindsight, the law has manifestly failed to meaningfully address Canada’s housing affordability crisis. Housing prices and homelessness have continued their rise in major urban centers.

The 2019 Indigenous Languages Act (Bill C-91). Many Indigenous advocates have argued the funding and mechanisms have been insufficient to achieve its goal of revitalizing endangered Indigenous languages.

The 2007 Public Servants Disclosure Protection Act (PSDPA). Designed to protect whistleblowers within the federal public service, the PSDPA has been criticized for its ineffectiveness. During its first three years, the Office of the Public Sector Integrity Commissioner (OPSIC) astonishingly reported no findings of wrongdoing or reprisal, despite numerous submissions. A 2017 review by the Standing Committee on Government Operations and Estimates recommended significant reforms, but there’s been no visible progress.

There were, of course, many bills from the past ten years that were fully implemented.¹ But the failure rate is high enough that I’d argue it should be taken into account when measuring our state capacity.

Still, as a friend once noted, there’s a silver lining to all this: the one thing more frightening than an inefficient and ineffective government is an efficient and effective government. So there’s that.

The fact that we’re still living through the tail end of a massive bout of inflation provides clear testimony that Bill C-13 (COVID-19 Emergency Response Act) had an impact.

For the full experience, upgrade your subscription.

David Clinton

You’re Actually Voting for THEM? But why?

By David Clinton

By David Clinton

Putting the “dialog” back in dialog

I hate it when public figures suggest that serious issues require a “dialog” or a “conversation”. That’s because real dialog and real conversation involve bi-directional communication, which is something very few public figures seem ready to undertake. Still, it would be nice is there was some practical mechanism through which a conversation could happen.

It should be obvious – and I’m sure you’ll agree – that no intelligent individual will be voting in the coming federal election for any party besides the one I’ve chosen. And yet I’ve got a nagging sense that, inexplicably, many of you have other plans. Which, since only intelligent people read The Audit, leads me directly to an epistemological conflict.

I have my doubts about the prospects for meaningful leadership debates. Even if such events are being planned, they’ll probably produce more shouting and slogans than a useful comparison of policy positions.

And I have remarkably little patience for opinion polls. Even if they turn out to have been accurate, they tell us absolutely nothing about what Canadians actually want. Poll numbers may be valuable to party campaign planners, but there’s very little there for me.

If I can’t even visualize the thinking taking place in other camps, I’m missing a big part of Canada’s biggest story. And I really don’t like being left out.

So I decided to ask you for your thoughts. I’d love for each of you to take a super-simple, one question survey. I’m not really interested in how you’re planning to vote, but why. I’m asked for open-ended explanations that justify your choice. Will your vote be a protest against something you don’t like or an expression of your confidence in one particular party? Is it just one issue that’s pushing you to the polling station or a whole set?

I’d do this as a Substack survey, but the Substack platform associates way too much of your private information with the results. I really, really want this one to be truly anonymous.

And when I say this is a “super simple” survey, I mean it. To make sure that absolutely no personal data accompanies your answers (and to save me having to work harder), the survey page is a charming throwback to PHP code in all its 1996 glory.

So please do take the survey: theaudit.ca/voting.

If there are enough responses, I plan to share my analysis of patterns and trends through The Audit.

-

International2 days ago

International2 days agoPope Francis Dies on Day after Easter

-

International2 days ago

International2 days agoJD Vance was one of the last people to meet Pope Francis

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

COVID-191 day ago

COVID-191 day agoNearly Half of “COVID-19 Deaths” Were Not Due to COVID-19 – Scientific Reports Journal

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHow Canada’s Mainstream Media Lost the Public Trust

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

Media21 hours ago

Media21 hours agoCBC retracts false claims about residential schools after accusing Rebel News of ‘misinformation’

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoReal Homes vs. Modular Shoeboxes: The Housing Battle Between Poilievre and Carney