Crime

The first accused Islamic terrorist to illegally cross the southern border and shoot an American for jihad

Sidi Mohammad Abdallahi shot by Chicago Police

From the Center for Immigration Studies

First Blood: Anatomy of Border-Crosser’s Chicago Terror Attack

“I can tell you the threats that come from the other side of the border are very much consuming FBI field offices, not just in border states.” – FBI Director Christopher Wray, November 2023 testimony before the House Homeland Security Committee

(Part 1 of 3)

CHICAGO, Illinois – Since October 26, 2024, was Saturday, the mandatory Jewish day of rest when the orthodox may not drive, the orthodox Jewish man woke early to walk the mile to his suburban Chicago synagogue.

But his wife and children decided to stay home, a rare exception, while he went alone to weekly morning service at KINS of West Rogers Park synagogue, the second largest synagogue in Chicago. Their choice may have been divine providence for them all, he and his wife later recounted to the Center for Immigration Studies (CIS) in late December.

Wearing religious garb – a yarmulke for his head and a clear plastic prayer shawl bag over a shoulder – that readily identified him as a Jew, the 39-year-old man headed out on the 20-minute walk through West Rogers Park, his predominantly Jewish upper-middle class suburban neighborhood where crime of any sort is virtually unknown.

He recalls “just walking, like spacing out,” nodding good morning to other walkers. Suddenly, a noise that sounded like a lightning bolt strike yanked him from the reverie.

“I like felt something hit my shoulder, and I fell,” the man recalled in a December interview at his house in his first and only interview, given to CIS on condition that identities remain undisclosed for fear of future targeting.

“I thought like some lightning crashed and hit a tree branch and that it fell on my shoulder. I wasn’t aware that the sound I heard was a gunshot.”

As he scrambled to his feet, he looked down to see a bloody hole in his suit lapel and realized his arm had gone numb. He turned in time to see a young man wearing a green workman’s safety vest – a clothing item common among pro-Hamas demonstrators worldwide – running away with a pistol in one hand, looking back at him. In that split second, the bleeding Jewish man spoke to his assailant.

“Did you just shoot me?!!?”

The assailant responded by turning around and chasing after his victim. He fired twice more to finish the job but missed. The assailant’s gun then jammed, authorities later said, giving the victim a chance to sprint for cover.

“I just ran. I thought he was still chasing me. I was screaming, ‘help!’ and just ran down the street.”

But that was just the beginning of an unprecedented life-threatening storm of violence that would go on to wrack this peaceful neighborhood for another 20 minutes in what state prosecutors would later deem a full-fledged planned terror attack. Thunderous, echoing gunfire gripped the upper middle-class residential area in white-knuckled fright, leaving shell casings strewn across streets, blood stains on sidewalks, bullet-riddled vehicles, and residents cowering with children and pets inside their homes.

Sidi Mohammad Abdallahi

“Allahu Akbar!” Sidi Mohammad Abdallahi screamed the notorious Islamic terrorist war cry as he fired, including yet a third time at his first victim.

Police would finally arrest Abdallahi, after trading fire with him and critically wounding him on a sidewalk between manicured lawns of the leafy neighborhood. Neighborhood children later found the reflective safety vest he discarded in someone’s back yard. Later, in a hospital, the Jewish victim would find himself waiting next to his terrorist assailant in triage, separated only by a thin sheet.

But unlike most Islamic terror attacks, such as the New Years Day ISIS-inspired vehicle-ramming attack by a U.S.-born citizen in New Orleans, one circumstance about the one in Chicago elevates its national security and political significance to a different plane.

The Chicago shooter – a 22-year-old Mauritanian national – had illegally crossed into the United States through Mexico in 2023 and joined some 50,000 other border-crossers who arrived in Chicago since 2022 and whose deportations under the coming Trump administration are about to become subject of a heated national political conflict.

The distinctive border-crossing aspect that made the Chicago attack possible benchmarks it as the first terror attack by a border-crossing Muslim extremist who drew blood from an American victim. And that key enabling element matters because it brings to fruition fears expressed with increasing frequency by homeland security professionals that migrants prone to act on Islamic extremist beliefs would come in on the historic mass migration tide of millions illegally crossing the Southwest border from around the world.

“I think greater fidelity about who is coming into this country and how they are getting in is essential,” FBI Director Christopher Wray testified to Congress in November 2023, when asked about terrorist border crossings nearly a year before Abdallahi’s attack. “I can tell you the threats that come from the other side of the border are very much consuming FBI field offices, not just in the border states…threats that come from the other side of the border are affecting every state, yes.”

But if seeking “greater fidelity” about how terrorists enter the country was important to Wray, the FBI oddly kept an arms-length distance from the Chicago case for reasons that no one has demanded, while quickly taking charge of the New Years attack in New Orleans and the Tesla truck bombing in front of Trump’s Las Vegas hotel.

Instead, Illinois State’s Attorney prosecutors were left to charge the wounded Abdallahi with terrorism under the state’s anti-terrorism statute after local police detectives found he methodically planned his attack on Jewish targets, inspired by Hamas’s tactics in its war on Israel and Jews. His online searches, they said, showed Abdallahi had probably planned to attack Jews as they prayed inside Chicago’s metro synagogues but opportunistically shot the Jewish man walking to one, sparing the lives of many.

Abdallahi’s online search history showed he’d researched two West Rogers Park synagogues and an area gun store. His recovered cell phone brimmed with violent jihadist, pro-Hamas, anti-Semitic murder propaganda, prosecutors and police disclosed. And there was the vest indicating solidarity with pro-Hamas demonstrators worldwide.

“This was not anything but a planned attack…an attempted assassination of these people,” Assistant State’s Attorney Anne McCord Rodgers said during Abdallahi’s arraignment on terrorism and other charges. “This was a calculated plan, on a public street…and attempted slaughter of that person and law enforcement officers.”

But the attack won’t make it to trial; nor will further details become known of the sort that, normally, the FBI, counterterrorism intelligence professionals, and elected leaders would rigorously study to prevent more attacks by those who have already illegally crossed the southern border and are here: On November 30, Abdallahi hanged himself in Cook County jail, robbing all of a potentially illuminating trial.

The prospect of lingering unanswered questions and “greater fidelity” about how this one happened prompted CIS to travel to Chicago in a quest to learn more about the attack and to emphatically remind the country that a border-crossing terrorist – a scenario often disparaged as hypothetical fantasy – has drawn first blood.

Overlooked terror attack with national security and political significance

Public and media attention to the October 26 attack quickly receded amid national preoccupation with the impending November 5 presidential election and its aftermath of Donald Trump’s victory, which was largely based on his promise to end a four-year mass migration crisis created by his predecessor. Throughout the campaign, Trump and his surrogates had often cited the terrorist infiltration national security threat posed by open-border policies he intends to reverse.

Yet the Chicago attack somehow has defied wide acknowledgement or any public sign of attendant introspection. In one of his final campaign rallies, in North Carolina on November 4, Trump did introduce the Chicago terror attack as a new justification for his plans to deport the illegal aliens who entered during the Biden-Harris border crisis of 2021-2024 in large numbers.

“Only days ago, an illegal alien from North [Africa] – and this was a rough one,” Trump began. “Just happened days ago, who Kamala Harris let into the country with her horrendous open border – just a dangerous, horrendous situation – traveled to a Jewish neighborhood in Chicago and tried to execute a Jewish man on the street, shooting him in the back as he walked to synagogue.”

Trump went on to describe the rest of the attack and drew resounding applause when he noted that Chicago police shot Abdallahi and “ended his rampage.”

No media outlet quoted Trump’s new line about the attack, which he hasn’t mentioned again.

The Abdallahi attack, however, warrants the same dedicated attention and study as all other terror attacks, for lessons and tactics used that might help authorities prevent future ones by other illegally present border-crossers from Muslim-majority countries of terrorism concern. The Border Patrol has apprehended more than 400 migrants on the FBI’s terrorism watch list since 2021, in addition to hundreds of thousands “special interest aliens” from 26 countries the U.S. deems a national security threat, according to an October 2024 House Judiciary Committee report.

Beyond FBI Director Wray’s testimony about the need for “fidelity” about terrorist travel over the border, the Chicago attack gives life to recent public U.S. intelligence community warnings about the vulnerability. In both its 2024 and 2025 annual Homeland Threat Assessments, the Biden administration’s Department of Homeland Security warned that migrants with terrorism connections and interest have and will continue to “exploit our border” amid historic mass “migration trends that complicate our ability to identify and interdict these threats.”

“Over the next year, we expect some individuals with terrorism ties … will continue their efforts to exploit migration flows and the complex border security environment to enter the United States,” the 2025 public report stated.

Beyond the chance for improved preventative measures that might detect and deport other illegal alien border-crossers from Muslim-majority nations, the Abdallahi attack warrants attention in time for an almost certain national political battle now ginning up nationwide – but with an epicenter developing in Chicago – over Trump plans to mount more aggressive interior deportations.

Democratic Chicago Mayor Brandon Johnson has repeatedly vowed to defy Trump’s deportation program and protect every illegal immigrant from ICE agents, presumably to include largely unvetted border-crossers from special interest Muslim-majority nations like Mauritania. Trump’s appointed “Border Czar” Tom Homan, who visited the city in December, swore to outmaneuver its leaders.

“The mayor of Chicago, not a real bright guy, says Tom Homan isn’t welcome to Chicago,” Homan said recently in a speech in Phoenix. “Well guess where Tom Homan’s going to be on day one? Chicago, Illinois! You don’t want me there, come get me! The people of Chicago have already spoken.”

If Chicago becomes a political epicenter for this legitimate partisan policy argument, discussion of the Mauritanian’s attack in the city would serve an obvious public interest by introducing a citable fact on the ground.

But to collect the public interest benefits of improved counterterrorism and fuller discourse about Trump’s deportation program in resistant interior cities, the public must know what happened. And as Trump described, the life-threatening attack on Jews, police, and paramedics more than qualified as “a rough one”, even though only two were injured, including the shooter, and no one died.

True terror in an attack

After he was shot through the shoulder, the Jewish man fled down the street looking for someone to let him in.

Resident Ken Boggs was just backing his car out of his driveway to go to a wedding when the wounded man suddenly pounded on his driver-side window.

“I’ve been shot!” Boggs recalled the man telling him through the closed window. “And I was like, ‘what do you mean you’ve been shot?’ I was kind of taken off guard but then he pulled his jacket open and I could see the blood and was like, ‘okay you’ve been shot.’” Boggs called 911 from inside his car but before he could act further, other neighbors across the street pulled the victim into the home of a woman who worked as a nurse, who began treating him indoors. An ambulance soon pulled up, and Chicago Fire Department paramedics began prepping him for the ride to a hospital.

None of them were safe yet.

This all occurred during what would turn out to be about a 15-minute lull in Abdallahi’s attack. Chicago police and the Illinois State Attorney’s Office declined to discuss the case, but the following account of the attack was pieced together based on police reports, witness testimony, and police body cam video released after CIS filed a Freedom of Information Act request.

After his gun jammed, Abdallahi disappeared into an alley and, rather than flee and disappear, began moving from back yard to back yard preparing to attack again.

Some 15 minutes later, when police were surveying the original crime scene for evidence and the paramedics were working on the first victim in the nurse’s home, Abdallahi was in Malka Reich’s backyard preparing to attack them all. An Orthodox Jewish homemaker and mother of four, Reich was home alone that day with her youngest, a baby. She’d been reading upstairs near a window while the baby slept, heard the initial shots just outside a quarter block away and heard the victim screaming for help. She looked outside and saw the gunman running.

Once the police arrived a few minutes later, curious neighbors began to venture outside.

“Women were pushing strollers, like life was back to normal,” she said.

Reich’s doorbell camera videotaped her a few minutes into the ensuing lull stepping out on her front porch – a large Israeli flag hanging from it next to an American flag and identifying her home as Jewish — to ask a dog-walking neighbor on her lawn if he wanted to take shelter inside. The neighbor declined and walked toward where police were taping off the crime scene and gathering evidence.

But seconds later, she saw through the doorway Abdallahi suddenly appear exiting her very own driveway from her backyard, gripping his pistol in his right hand. Her door camera videotaped it.

Extreme fright overtook her.

“This is a terrorist on my property.” Reich recalled thinking. “When he came back, I realized that this was terrorism. I needed to take this seriously. I felt like I needed to protect my baby.”

She saw Abdallahi turn left from her driveway on the sidewalk, raise his gun, and trot toward the police officers and the dog walker. Her doorbell camera clearly captured Abdallahi shouting “Allahu Akbar” and then he fired, she said, on the dog-walking neighbor to whom she’d just offered shelter. Next came dozens of deafening gunshots as Abdallahi opened fire on the officers, and they returned it amid much unintelligible shouting and screaming.

An Orthodox Jew well-schooled in the October 7, 2023, Hamas attack that butchered 1,200 Israelis in and around their own homes, Reich’s thoughts raced straight to “This is like October 7. How am I going to save my baby?”

She grabbed a kitchen knife and retreated with the child to a back bedroom to hide behind furniture as the gun battle raged outside. But she was tormented by second guessing if this was the correct tactical move.

Maybe a better move, she thought, clutching the knife, would be to hide the child in the attic so that the terrorists would go after her instead. Maybe she could open a window upstairs and leap when they came in like some Israelis did. Except that she knew Hamas terrorists shot and burned others who’d also tried that escape.

“You’re thinking, ‘so many people tried to survive in so many different ways’” during the October 7 massacre, she recalled. “Some people hiding got burned alive. Some people hid and survived. Some people jumped out of a window and got shot. And you just wonder what do you do in this situation?”

Non-Jewish neighbors also went into survival mode when they heard and saw the confusing gun battle between police and Abdallahi, whom they saw fire, then retreat and pop out elsewhere to start firing again.

“It was terrifying. It was just terrifying,” recalled another woman who requested anonymity. After that first lull ended and new shooting began, she grabbed their 7-year-old daughter and hid with her husband in the bedroom furthest from the street.

“The shooting was just constant. It was a volley, back and forth, back and forth. You didn’t know where it was, where it was moving to, where the shots were being directed. We heard lots of yelling. The police were yelling.”

An elderly woman retiree who lives across the street from the Reich family said she opened her front door during the lull and spotted Abdallahi standing facing the other way wearing “this very bright vest” and holding a gun, probably on the Reich property.

“I saw him run that way, and I don’t know anything more except the gunshots started and I hid on my bathroom floor with my dog,” said the woman who declined to identify herself. “The police were firing in this direction. I know my neighbor has a bullet in the back of his car.”

In all, the second phase of the attack lasted nearly four minutes. Five police officers took fire and fired back, police reports and released body cam video show.

Sidi Mohammad Abdallahi shot by police

The Chicago Police Department declined CIS requests to interview any of the officers or to speak about them or the case, as did a spokesman for the Fraternal Order of Police association.

Doorbell camera video shows one of the officers, from behind the brick cover of a porch stoop, shooting Abdallahi down as the gunman moved toward him on a sidewalk, just feet away. Other body cam video released December 19 in response to a CIS open records request shows highly stressed officers with weapons raised advancing on Abdallahi, yelling at him to put down his weapon and firing.

Abdallahi did not just fire on police. He went for his original victim a third time as two Chicago Fire Department paramedics were loading him onto Ambulance 13. A video shows the gunman firing at it as it raced past him with sirens blaring. Firefighters at the station where Ambulance 13 is assigned refused a CIS interview request.

The victim, whom neighbors had taken into their home for field treatment, recalled that paramedics who showed up to help had him on a gurney and were loading into the ambulance when gunfire raked them all. Rounds were hitting the ambulance.

“The paramedics were like, ‘did they shoot at the ambulance?’ They [the paramedics] told me to duck but there was nowhere to duck,” the shooting victim said, noting that he couldn’t duck being on a gurney. “They were scared. The paramedics were absolutely scared. They were like, this has never happened. They, like, didn’t know what to do. They’re like, let’s just get out of here! Let’s go!”

Door camera video shows the gunman continued firing at the ambulance as it sped down the street past him. In the moment, he was unaware that rounds had hit the vehicle.

After about four minutes, police finally were finally able to shoot Abdallahi down, although he continued to rise and point his gun until he simply no longer could.

From her living room windows, one woman videotaped a police officer just outside on the sidewalk feet away, gun drawn and pointed, shouting and advancing on Abdallahi and then Abdallahi himself.

“They just shot some guy right in front of our house,” she said, before moving to another window and seeing Abdallahi. “My God, there are police everywhere.”

“huuuuhh! Oh my God. Oh my God. Oh my God. What the hell,” was all the woman could muster as she trained her camera through the window down onto Abdallahi sprawled out on her sidewalk. A man’s voice beside her said “Oh shit. He’s dead.”

He wasn’t, of course, not yet. But he would soon hang himself in jail, an incident about which virtually nothing is publicly known.

Aftermath

The bullet had gone clean through the victim’s shoulder blade, tore some nerves and clipped his clavicle. There’d been a lot of blood. But two months later, the man reported full use of the numbed arm and that he was feeling physically fine.

A week after the terror attack, he decided to walk to synagogue again. More than 200 people joined him along the way in a show of defiant support, ringed by state and local police.

Chicago Rabbi Leonard Matanky

In part because Chicago had become a hotbed of pro-Hamas, anti-Israel demonstrations, a brief controversy rose and fell when the Jewish community noticed that politically liberal state and local officials in line with demonstrators downplayed the attack and omitted the fact that a Muslim extremist had attacked a Jewish neighborhood out of terroristic animus. The spat was largely resolved when state officials added the terrorism charges.

But there was no denying that Abdallahi’s wild melee shook Chicago’s Orthodox Jewish community, which already had security measures in place against anti-semitic mischief related to the war in Gaza, Rabbi Leonard Matanky of Congregation KINS told CIS.

“A person who I care about was hurt. A family had to endure a trauma that they shouldn’t have had to endure, and a community was made to feel unsafe,” he said, inside a Jewish day school that flies a large Israeli flag outside. “Can a person be shot now? It’s shifted a sense of what’s within the realm of possibility in my world. Just as October 7th was a global shift on Jews in the world, this was a shift on the Jewish community in the city of Chicago.”

Few in the community seem more hostile about illegal immigration now than before the attack, Rabbi Matanky indicated, even though it clearly played a role on October 26 and could again at any time. That’s in part because of a long history when Jews around the world had to emigrate away from various persecutions.

But Matanky also said he personally supported Border Czar Tom Homan’s plan to rid Chicago of illegal criminal aliens.

“I would hope that the law enforcement government would be able to get all of the criminals out of every community.”

And Abdallahi’s suicide in jail has left him with a great many questions about how and why he was able to cross the southern border.

“Why did he come to Chicago? How did he come to Chicago. What was his goal in coming to Chicago? Was it to find a Jew and kill him?”

Next: What we know and don’t know about Abdallahi.

2025 Federal Election

Liberal MP Paul Chiang Resigns Without Naming the Real Threat—The CCP

Dan Knight

Dan Knight

After parroting a Chinese bounty on a Canadian citizen, Chiang exits the race without once mentioning the regime behind it—opting instead to blame “distractions” and Donald Trump.

So Paul Chiang is gone. Stepped aside. Out of the race. And if you’re expecting a moment of reflection, an ounce of honesty, or even the basic decency to acknowledge what this was really about—forget it.

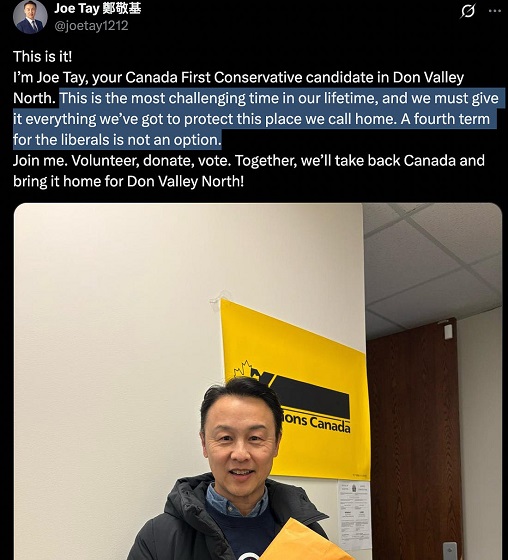

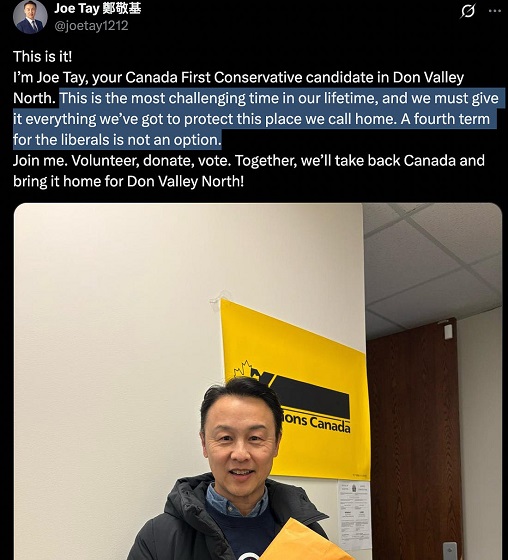

In his carefully scripted resignation statement, Chiang didn’t even mention the Chinese Communist Party. Not once. He echoed a foreign bounty placed on a Canadian citizen—Joe Tay—and he couldn’t even bring himself to name the regime responsible.

Instead, he talked about… Donald Trump. That’s right. He dragged Trump into a resignation about repeating CCP bounty threats. The guy who effectively told Canadians, “If you deliver a Conservative to the Chinese consulate, you can collect a reward,” now wants us to believe the real threat is Trump?

I haven’t seen Donald Trump put bounties on Canadian citizens. But Beijing has. And Chiang parroted it like a good little foot soldier—and then blamed someone who lives 2,000 miles away.

But here’s the part you can’t miss: Mark Carney let him stay.

Let’s not forget, Carney called Chiang’s comments “deeply offensive” and a “lapse in judgment”—and then said he was staying on as the candidate. It wasn’t until the outrage hit boiling point, the headlines stacked up, and groups like Hong Kong Watch got the RCMP involved, that Chiang bailed. Not because Carney made a decision—because the optics got too toxic.

And where is Carney now? Still refusing to disclose his financial assets. Still dodging questions about that $250 million loan from the Bank of China to the firm he chaired. Still giving sanctimonious speeches about “protecting democracy” while his own caucus parrots authoritarian propaganda.

If you think Chiang’s resignation fixes the problem, you’re missing the real issue. Because Chiang was just the symptom.

Carney is the disease.

He covered for it. He excused it. He enabled it. And now he wants to pose as the man who will stand up to foreign interference?

He can’t even stand up to it in his own party.

So no, we’re not letting this go. Chiang may be gone—but the stench is still in the room. And it’s wearing a tailored suit, smiling for the cameras, and calling itself “leader of the Liberal Party.”

2025 Federal Election

RCMP Confirms It Is ‘Looking Into’ Alleged Foreign Threat Following Liberal Candidate Paul Chiang Comments

Sam Cooper

Sam Cooper

The confirmation followed a day of escalating pressure on Canadian law enforcement after The Bureau revealed that the UK-based human rights organization Hong Kong Watch sent a formal letter to RCMP Commissioner Mike Duheme, calling for a criminal investigation into Chiang’s reported remarks.

The Royal Canadian Mounted Police confirmed late Monday it is actively reviewing the controversy surrounding Liberal MP Paul Chiang’s alleged remarks that appeared to endorse delivering a political rival to a foreign government in exchange for a bounty.

In a statement sent to The Bureau, the RCMP said: “Foreign actor interference, including instances of transnational repression, continues to be a pervasive threat in Canada. The RCMP takes all such reports and allegations seriously and — in close partnership with intelligence, law enforcement and regulatory agencies — dedicates significant resources to combatting and investigating criminal activity related to foreign interference in Canada’s democratic processes.”

“The RCMP is looking into the matter,” the statement continued, “however no specific details can be provided at this time.”

The confirmation followed a day of escalating pressure on Canadian law enforcement after The Bureau revealed that the UK-based human rights organization Hong Kong Watch sent a formal letter to RCMP Commissioner Mike Duheme, calling for a criminal investigation into Chiang’s reported remarks. The comments, made during a January meeting with Chinese-language journalists, suggested that Conservative candidate Joe Tay could be brought to the Chinese Consulate in Toronto to claim a bounty placed on him by the Hong Kong police under Beijing’s National Security Law.

The organization alleged the remarks could constitute “counselling to commit kidnapping” under Canada’s Criminal Code. In their letter, Hong Kong Watch also referenced the Foreign Interference and Security of Information Act, which prohibits attempts to coerce or intimidate individuals for the benefit of a foreign state.

While the RCMP’s statement did not confirm the launch of a formal investigation, it emphasized that if “criminal or illegal activities occurring in Canada [are] found to be backed by a foreign state, it is within the RCMP’s mandate to investigate this activity.”

The RCMP said it does not typically disclose information related to ongoing investigations unless charges are laid. Nor will it confirm which individuals may be under protective watch.

Earlier Monday, Tay confirmed that he contacted the RCMP over concerns for his personal safety even before Chiang’s comments became public. Chiang, a former police officer and Liberal candidate in Markham–Unionville, has apologized for the remarks, calling them a “terrible lapse in judgment.”

Meanwhile, more than 40 Hong Kong diaspora organizations based in Canada and abroad issued a joint statement condemning Chiang’s remarks and calling on Prime Minister Mark Carney to remove him as a candidate. Carney told reporters in Toronto that Chiang still has his “confidence,” and described the incident as a “teachable moment.”

The RCMP said its “overarching priority is the safety and security of the public,” and encouraged anyone who feels threatened online or in person to report such incidents to their local police. In cases of immediate danger, individuals are urged to call 911.

The statement also pointed to the existence of protective mechanisms for election candidates, including through Elections Canada and the federal government.

More to come

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

Daily Caller20 hours ago

Daily Caller20 hours agoBiden Administration Was Secretly More Involved In Ukraine Than It Let On, Investigation Reveals

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoLondon-Based Human Rights Group Urges RCMP to Investigate Liberal MP for Possible Counselling of Kidnapping

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours agoRCMP Confirms It Is ‘Looking Into’ Alleged Foreign Threat Following Liberal Candidate Paul Chiang Comments

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoPoilievre, Conservatives receive election endorsement from large Canadian trade union