Frontier Centre for Public Policy

The Destructive Legacy of Gender Theory’s Popular Pioneer

From the Frontier Centre for Public Policy

By Lee Harding

The idea that gender is disconnected from sex was popularized by psychologist John Money. Perverted minds produce perverted ideas. Unfortunately, Money’s legacy of destruction continues.

The idea that sex drives come out of nowhere and have nothing to do with biology should be dismissed out of hand, given the countless generations of procreated human and even animal species. Yet, in 1961, Money claimed that “erotic outlook and orientation is an autonomous psychological phenomenon independent of genes and hormones.”

Money later said that “like hermaphrodites, all the human race follow the same pattern, namely, of psychological undifferentiation at birth.”

In other words, no one is born heterosexual, and there are no biology-based differences in how men and women act. By 1973, even Money had to acknowledge a wide body of research that showed “fetal gonadal hormones . . . have an influence on neural pathways in the brain.” Still, he emphasized nurture over nature.

Money had a chance to test his theories after the birth of Winnipeg twin brothers Bruce and Ron Reimer, born in 1965. A botched circumcision left Bruce’s penis almost severed, seemingly damaged beyond function. Their parents saw Money on TV in 1967 and went to his gender clinic at Johns Hopkins University.

The clinic was the first of its kind and specialized in cross-sex surgeries. Money convinced the parents to have Bruce’s penis and testes removed, rename him Brenda, and raise him as a girl. Both twins visited Money annually, and Money used their example on a lecture circuit to insist that gender roles were instilled and not innate.

This was complete fiction, but the truth didn’t come out until it was exposed by psychologist H. Keith Sigmundson and biologist Milton Diamond in a medical journal in 1997.

The twins’ mother Janet recalled how Brenda hated dresses, sewing, and dolls. Instead, the child preferred to play soldier, dress in men’s clothes, tinker with tools and gadgets, and even stand up to pee. When Brenda told doctors “she” felt she wasn’t a girl, they discounted it.

It turns out Money made the twins inspect each other’s genitals. His therapy involved forcing the twins into a simulation of sexual positions and motions, something Money justified as healthy childhood sexual exploration. Money photographed this while as many as six colleagues looked in person. If either child resisted orders, the doctor responded with anger and verbal abuse.

This disturbing account is not entirely surprising. Money participated in nudism and group sex as part of the Society for the Scientific Study of Sexuality. He advocated open marriages and even compiled a pornographic presentation for students at Johns Hopkins Medical School called “Pornography in the Home.”

In his 1975 book Sexual Signatures, Money wrote, “[E]xplicit sexual pictures can and should be used as part of a child’s sex education…. [to] reinforce his or her own gender identity/role,” Money explained.

By the age of 13, Brenda so dreaded the annual visit to Money that she threatened suicide. Her parents sent her anyway. Consultants at the Baltimore clinic recruited male-to-female transsexuals to convince Reimer it was better to be female and have a vagina. This so disturbed Reimer, that she ran away from the hospital and hid on the roof of a nearby building.

In 1980, Reimer begged her father to know the truth and he finally admitted her birth as a male. The family moved and the child took the name David. Next, endocrinologists, psychologists, and surgeons did their best to reconstruct Reimer’s manliness. Money stopped talking about the twins on the lecture circuit but did not confess how woefully wrong he was.

In 1979, Dr. Paul McHugh, chief psychiatrist at Johns Hopkins Hospital, investigated whether their sex reassignment surgeries helped the psycho-social problems of patients. The answer was so clearly “no” that the clinic stopped doing them.

In 2004, McHugh recalled that those operated on “had much the same problems with relationships, work, and emotions as before.” He added, “I concluded that Hopkins was fundamentally cooperating with a mental illness. We psychiatrists, I thought, would do better to concentrate on trying to fix their minds and not their genitalia.”

When the gender clinic was shut down in 1980, Money started another clinic at Johns Hopkins for gender “paraphilias,” a polite term for deviancies. That year, he told Time magazine, “A childhood sexual experience, such as being the partner of a relative or of an older person, need not necessarily affect the child adversely.”

In 1991, Money told Paidika, a pro-pedophilia journal in the Netherlands that a mutually acceptable sexual relationship between a ten-year-old boy and a man in his 30s was not “pathological in any way.” He said efforts to keep children from sexual activity, including sexual consent laws, was “really a diabolically clever ploy to establish anti-sexualism on a big scale.”

David Reimer killed himself in 2004, while Money died in 2006. Too bad the psychologist’s warped ideas didn’t die with him. In practice, they lead to futility and failure.

Lee Harding is a Research Fellow for the Frontier Centre for Public Policy.

Business

Hudson’s Bay Bid Raises Red Flags Over Foreign Influence

From the Frontier Centre for Public Policy

A billionaire’s retail ambition might also serve Beijing’s global influence strategy. Canada must look beyond the storefront

When B.C. billionaire Weihong Liu publicly declared interest in acquiring Hudson’s Bay stores, it wasn’t just a retail story—it was a signal flare in an era where foreign investment increasingly doubles as geopolitical strategy.

The Hudson’s Bay Company, founded in 1670, remains an enduring symbol of Canadian heritage. While its commercial relevance has waned in recent years, its brand is deeply etched into the national identity. That’s precisely why any potential acquisition, particularly by an investor with strong ties to the People’s Republic of China (PRC), deserves thoughtful, measured scrutiny.

Liu, a prominent figure in Vancouver’s Chinese-Canadian business community, announced her interest in acquiring several Hudson’s Bay stores on Chinese social media platform Xiaohongshu (RedNote), expressing a desire to “make the Bay great again.” Though revitalizing a Canadian retail icon may seem commendable, the timing and context of this bid suggest a broader strategic positioning—one that aligns with the People’s Republic of China’s increasingly nuanced approach to economic diplomacy, especially in countries like Canada that sit at the crossroads of American and Chinese spheres of influence.

This fits a familiar pattern. In recent years, we’ve seen examples of Chinese corporate involvement in Canadian cultural and commercial institutions, such as Huawei’s past sponsorship of Hockey Night in Canada. Even as national security concerns were raised by allies and intelligence agencies, Huawei’s logo remained a visible presence during one of the country’s most cherished broadcasts. These engagements, though often framed as commercially justified, serve another purpose: to normalize Chinese brand and state-linked presence within the fabric of Canadian identity and daily life.

What we may be witnessing is part of a broader PRC strategy to deepen economic and cultural ties with Canada at a time when U.S.-China relations remain strained. As American tariffs on Canadian goods—particularly in aluminum, lumber and dairy—have tested cross-border loyalties, Beijing has positioned itself as an alternative economic partner. Investments into cultural and heritage-linked assets like Hudson’s Bay could be seen as a symbolic extension of this effort to draw Canada further into its orbit of influence, subtly decoupling the country from the gravitational pull of its traditional allies.

From my perspective, as a professional with experience in threat finance, economic subversion and political leveraging, this does not necessarily imply nefarious intent in each case. However, it does demand a conscious awareness of how soft power is exercised through commercial influence, particularly by state-aligned actors. As I continue my research in international business law, I see how investment vehicles, trade deals and brand acquisitions can function as instruments of foreign policy—tools for shaping narratives, building alliances and shifting influence over time.

Canada must neither overreact nor overlook these developments. Open markets and cultural exchange are vital to our prosperity and pluralism. But so too is the responsibility to preserve our sovereignty—not only in the physical sense, but in the cultural and institutional dimensions that shape our national identity.

Strategic investment review processes, cultural asset protections and greater transparency around foreign corporate ownership can help strike this balance. We should be cautious not to allow historically Canadian institutions to become conduits, however unintentionally, for geopolitical leverage.

In a world where power is increasingly exercised through influence rather than force, safeguarding our heritage means understanding who is buying—and why.

Scott McGregor is the managing partner and CEO of Close Hold Intelligence Consulting.

Business

Canada Urgently Needs A Watchdog For Government Waste

From the Frontier Centre for Public Policy

By Ian Madsen

From overstaffed departments to subsidy giveaways, Canadians are paying a high price for government excess

Not all the Trump administration’s policies are dubious. One is very good, in theory at least: the Department of Government Efficiency. While that term could be an oxymoron, like ‘political wisdom,’ if DOGE is useful, so may be a Canadian version.

DOGE aims to identify wasteful, duplicative, unnecessary or destructive government programs and replace outdated data systems. It also seeks to lower overall costs and ensure mechanisms are in place to evaluate proposed programs for effectiveness and value for money. This can, and usually does, involve eliminating some departments and, eventually, thousands of jobs. Some new roles within DOGE may need to become permanent.

The goal in the U.S. is to lower annual operating costs and ensure that the growth in government spending is lower than in revenues. Washington’s spending has exploded in recent years. The U.S. federal deficit exceeds six per cent of gross domestic product. According to the U.S. Treasury Department, annual debt service cost is escalating unsustainably.

Canada’s latest budget deficit of $61.9 billion in fiscal 2023–24 is about two per cent of GDP, which seems minor compared to our neighbour. However, it adds to the federal debt of $1.236 trillion, about 41 per cent of our approximate $3 trillion GDP. Ottawa’s public accounts show that expenses are 17.8 per cent of GDP, up from about 14 per cent just eight years ago. Interest on the escalating debt were 10.2 per cent of revenues in the most recent fiscal year, up from just five per cent a mere two years ago.

The Canadian Taxpayers Federation (CTF) continually identifies dubious or frivolous spending and outright waste or extravagance: “$30 billion in subsidies to multinational corporations like Honda, Volkswagen, Stellantis and Northvolt. Federal corporate subsidies totalled $11.2 billion in 2022 alone. Shutting down the federal government’s seven regional development agencies would save taxpayers an estimated $1.5 billion annually.”

The CTF also noted that Ottawa hired 108,000 more staff in the past eight years at an average annual cost of over $125,000. Hiring in line with population growth would have added only 35,500, saving about $9 billion annually. The scale of waste is staggering. Canada Post, the CBC and Via Rail lose, in total, over $5 billion a year. For reference, $1 billion would buy Toyota RAV4s for over 25,600 families.

Ottawa also duplicates provincial government functions, intruding on their constitutional authority. Shifting those programs to the provinces, in health, education, environment and welfare, could save many more billions of dollars per year. Bad infrastructure decisions lead to failures such as the $33.4 billion squandered on what should have been a relatively inexpensive expansion of the Trans Mountain pipeline—a case where hiring better staff could have saved money. Terrible federal IT systems, exemplified by the $4 billion Phoenix payroll horror, are another failure. The Green Slush Fund misallocated nearly $900 million.

Ominously, the fast-growing Old Age Supplement and Guaranteed Income Security programs are unfunded, unlike the Canada Pension Plan. Their costs are already roughly equal to the deficit and could become unsustainable.

Canada is sleepwalking toward financial perdition. A Canadian version of DOGE—Canada Accountability, Efficiency and Transparency Team, or CAETT—is vital. The Auditor General Office admirably identifies waste and bad performance, but is not proactive, nor does it have enforcement powers. There is currently no mechanism to evaluate or end unnecessary programs to ensure Canadians will have a prosperous and secure future. CAETT could fill that role.

Ian Madsen is the Senior Policy Analyst at the Frontier Centre for Public Policy.

-

International2 days ago

International2 days agoPope Francis Dies on Day after Easter

-

International2 days ago

International2 days agoJD Vance was one of the last people to meet Pope Francis

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

COVID-191 day ago

COVID-191 day agoNearly Half of “COVID-19 Deaths” Were Not Due to COVID-19 – Scientific Reports Journal

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHow Canada’s Mainstream Media Lost the Public Trust

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPOLL: Canadians want spending cuts

-

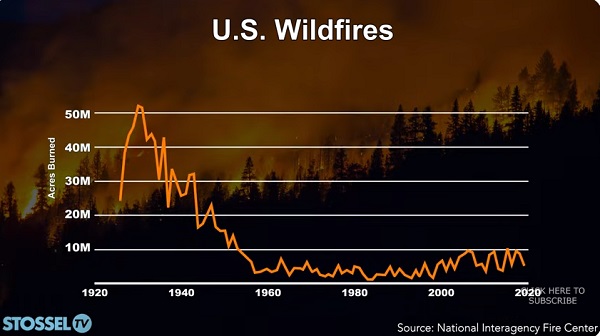

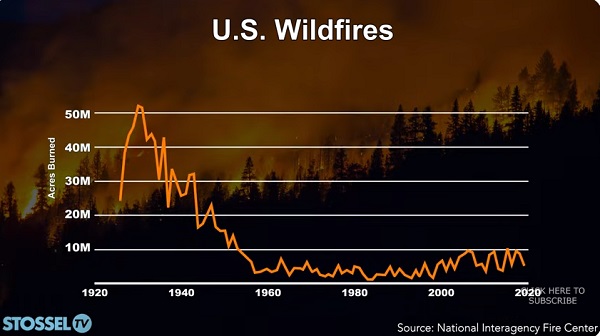

John Stossel1 day ago

John Stossel1 day agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs