Alberta

The Alberta energy transition you haven’t heard about

From the Canadian Energy Centre

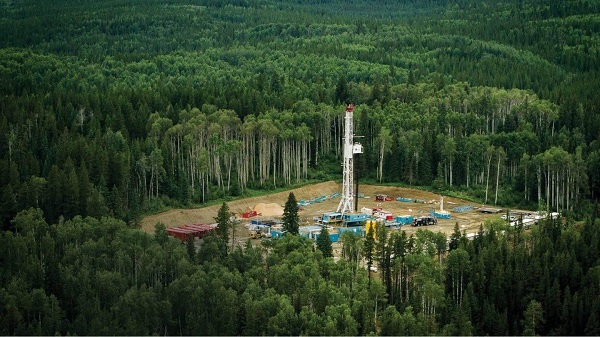

Horizontal drilling technology and more investment in oil production have fundamentally changed the industry

There’s extensive discussion today about energy transition and transformation. Its primary focus is a transition from fossil fuels to lower-carbon energy sources.

But in Alberta, a fundamental but different energy transition has already taken place, and its ripple effects stretch into businesses and communities across the province.

The shift has affected the full spectrum of oil and gas activity: where production happens, how it’s done, who does it and what type of energy is produced.

Oil and gas development in Alberta today largely happens in different places and uses different technologies than 20 years ago. As a result, the companies that support activity and the communities where operations happen have had to change.

Regional Shift

For the first decade of this century, in terms of numbers of wells, most drilling activity happened in central and southeast Alberta, with companies primarily using vertical wells to target conventional shallow natural gas deposits.

In 2005, producers drilled more than 8,000 natural gas wells in these areas, according to Alberta Energy Regulator (AER) records.

But then, three things happened. The price of natural gas declined, the price of oil went up and new horizontal drilling technology unlocked vast energy resources that were previously uneconomic to produce.

By 2015, the amount of natural gas wells companies drilled in central and southeast Alberta was just 256. In 2023, the number dropped to only 50. Over approximately 20 years, activity dropped by 99 per cent.

Where did the investment capital go? The oil sands and heavy oil reserves of Alberta’s northeast and shale plays, including the Montney and Duvernay, in the province’s foothills and northwest.

Nearly 60 per cent of activity outside of the oil-rich northeast occurred in central and southeast Alberta in 2005. By 2023, overall oil and gas drilling in those regions had dropped by 30 per cent, while at the same time increasing by 159 per cent in the foothills and northwest.

“The migration of activity from central and southern Alberta to other regions of the province has been significant,” says David Yager, a longtime oil and gas service company executive who now works as a special advisor to Alberta Premier Danielle Smith.

“For decades there were vibrant oil service communities in places like Medicine Hat, Taber, Brooks, Drumheller and Red Deer,” he says.

“These [oil service communities] have contracted materially with the new service centres growing in places like Lloydminster, Bonnyville, Rocky Mountain House, Edson, Whitecourt, Fox Creek and Grande Prairie.”

Fewer Wells and Fewer Rigs

Extended-reach horizontal drilling compared to shallow, vertical drilling enables more oil and gas production from fewer wells.

Outside the oil sands, in 2005, producers in Alberta drilled 17,300 wells. In 2023, that dropped to just 3,700 wells, according to AER data.

Despite that massive nearly 80 per cent decrease in wells drilled, total production of oil, natural gas and natural gas liquids outside of the oil sands is essentially the same today as it was in 2005.

Last year, non-oil sands production was 3.1 million barrels of oil equivalent (boe) per day, compared to 3.4 million boe per day in 2005–but from about 13,600 fewer new wells.

Innovation from drilling and energy services companies has been a major factor in achieving these impressive results, says Mark Scholz, CEO of the Canadian Association of Energy Contractors. But there’s been a downside.

Yager notes that much of the drilling and service equipment employed on conventional oil and gas development is not suited for unconventional resource exploitation.

Scholz says the productivity improvements resulted in an oversupply of rigs, especially rigs with limited depth ratings and limited capability for “pad” drilling, where multiple wells are drilled the same area on the surface.

Rigs have been required to drill significantly deeper wellbores than in the traditional shallow gas market, he says.

“This has resulted in rig decommissioning or relocations and a tactical effort to upgrade engines, mud pumps, walking systems and pipe-handling technology to meet evolving customer demands,” he says.

“You need not go beyond the reductions in Canada’s drilling rig fleet to understand the impact of these operational innovations. Twenty years ago, there were 950 drilling rigs; today, we have 350, a 65 per cent reduction. [And] further contractions are likely in the near term.”

Scholz says, “collaboration and partnerships between producers and contractors were necessary to make this transition successful, but the rig fleet has evolved into a much deeper, technologically advanced fleet.”

A Higher Cost of Entry

Yager says that along with growth in the oil sands, replacing thousands of new vertical shallow gas wells with fewer, high-volume extended-reach horizontal wells has made it more challenging for smaller companies to participate.

“The barriers to entry in terms of capital required have changed tremendously. At one time a new shallow gas well could be drilled and put on stream for $150,000. Today’s wells in unconventional plays cost from $3 million to $8 million each,” he says.

“This has materially changed the exploration and production companies developing the resource, and the type of oilfield services equipment employed. An industry that was once dominated by multiple smaller players is increasingly consolidating into fewer, larger entities. This has unintended consequences that are not well understood by the public.”

More Oil (Sands), Less Gas

Higher oil prices and horizontal drilling helped change Alberta from a natural gas hotbed to a global oil powerhouse.

In the oil sands, horizontal wells enabled a key technology called steam assisted gravity drainage (SAGD), which went into commercial service in 2001 to allow for a massive expansion of what is referred to as in situ oil sands production.

In 2005, mining dominated oil sands production, at about 625,000 barrels per day compared to 440,000 barrels per day from in situ projects. In situ oil sands production exceeded mining for the first time in 2013, at 1.1 million barrels per day compared to 975,000 barrels per day from mining.

Today the oil sands production split is nearly half and half. Last year, in situ projects–primarily SAGD–produced approximately 1.8 million barrels per day, compared to about 1.7 million barrels per day from mining.

Natural gas used to exceed oil production in Alberta. In 2005, natural gas provided 54 per cent of the province’s total oil and gas supply. Nearly two decades later, oil accounts for 60 per cent compared to 29 per cent from natural gas. The remaining approximately 11 per cent of production is natural gas liquids like propane, butane and ethane.

Alberta’s non-renewable resource revenue reflects the shift in activity to more oil sands and less natural gas.

In 2005, Alberta received $8.4 billion in natural gas royalties and $950 million from the oil sands. In 2023, the oil sands led by a wide margin, providing $16.9 billion in royalties compared to $3.6 billion from natural gas.

Innovation and Emerging Resources

As Alberta’s oil and gas industry continues to evolve, another shift is happening as investments increase into emissions reduction technologies like carbon capture and storage (CCS) and emerging resources.

Since 2015, CCS projects in Alberta have safely stored more than 14 million tonnes of CO2 that would have otherwise been emitted to the atmosphere. And more CCS capacity is being developed.

Construction is underway on an $8.9-billion new net-zero plant producing polyethylene, the world’s most widely used plastic, that will capture and store CO2 emissions using the Alberta Carbon Trunk Line hub. Two additional CCS projects got the green light to proceed this summer.

Meanwhile, in 2023, producers spent $700 million on emerging resources including hydrogen, geothermal energy, helium and lithium. That’s more than double the $230 million invested in 2020, the first year the AER collected the data.

“Energy service contractors are on the frontlines of Canada’s energy evolution, helping develop new subsurface commodities such as lithium, heat from geothermal and helium,” Scholz says.

“The next level of innovation will be on the emission reduction front, and we see breakthroughs in electrification, batteries, bi-fuel engines and fuel-switching,” he says.

“The same level of collaboration between service providers and operators that we saw in our productivity improvement is required to achieve similar results with emission reduction technologies.”

Alberta

Low oil prices could have big consequences for Alberta’s finances

From the Fraser Institute

By Tegan Hill

Amid the tariff war, the price of West Texas Intermediate oil—a common benchmark—recently dropped below US$60 per barrel. Given every $1 drop in oil prices is an estimated $750 million hit to provincial revenues, if oil prices remain low for long, there could be big implications for Alberta’s budget.

The Smith government already projects a $5.2 billion budget deficit in 2025/26 with continued deficits over the following two years. This year’s deficit is based on oil prices averaging US$68.00 per barrel. While the budget does include a $4 billion “contingency” for unforeseen events, given the economic and fiscal impact of Trump’s tariffs, it could quickly be eaten up.

Budget deficits come with costs for Albertans, who will already pay a projected $600 each in provincial government debt interest in 2025/26. That’s money that could have gone towards health care and education, or even tax relief.

Unfortunately, this is all part of the resource revenue rollercoaster that’s are all too familiar to Albertans.

Resource revenue (including oil and gas royalties) is inherently volatile. In the last 10 years alone, it has been as high as $25.2 billion in 2022/23 and as low as $2.8 billion in 2015/16. The provincial government typically enjoys budget surpluses—and increases government spending—when oil prices and resource revenue is relatively high, but is thrown into deficits when resource revenues inevitably fall.

Fortunately, the Smith government can mitigate this volatility.

The key is limiting the level of resource revenue included in the budget to a set stable amount. Any resource revenue above that stable amount is automatically saved in a rainy-day fund to be withdrawn to maintain that stable amount in the budget during years of relatively low resource revenue. The logic is simple: save during the good times so you can weather the storm during bad times.

Indeed, if the Smith government had created a rainy-day account in 2023, for example, it could have already built up a sizeable fund to help stabilize the budget when resource revenue declines. While the Smith government has deposited some money in the Heritage Fund in recent years, it has not created a dedicated rainy-day account or introduced a similar mechanism to help stabilize provincial finances.

Limiting the amount of resource revenue in the budget, particularly during times of relatively high resource revenue, also tempers demand for higher spending, which is only fiscally sustainable with permanently high resource revenues. In other words, if the government creates a rainy-day account, spending would become more closely align with stable ongoing levels of revenue.

And it’s not too late. To end the boom-bust cycle and finally help stabilize provincial finances, the Smith government should create a rainy-day account.

Alberta

Governments in Alberta should spur homebuilding amid population explosion

From the Fraser Institute

By Tegan Hill and Austin Thompson

In 2024, construction started on 47,827 housing units—the most since 48,336 units in 2007 when population growth was less than half of what it was in 2024.

Alberta has long been viewed as an oasis in Canada’s overheated housing market—a refuge for Canadians priced out of high-cost centres such as Vancouver and Toronto. But the oasis is starting to dry up. House prices and rents in the province have spiked by about one-third since the start of the pandemic. According to a recent Maru poll, more than 70 per cent of Calgarians and Edmontonians doubt they will ever be able to afford a home in their city. Which raises the question: how much longer can this go on?

Alberta’s housing affordability problem reflects a simple reality—not enough homes have been built to accommodate the province’s growing population. The result? More Albertans competing for the same homes and rental units, pushing prices higher.

Population growth has always been volatile in Alberta, but the recent surge, fuelled by record levels of immigration, is unprecedented. Alberta has set new population growth records every year since 2022, culminating in the largest-ever increase of 186,704 new residents in 2024—nearly 70 per cent more than the largest pre-pandemic increase in 2013.

Homebuilding has increased, but not enough to keep pace with the rise in population. In 2024, construction started on 47,827 housing units—the most since 48,336 units in 2007 when population growth was less than half of what it was in 2024.

Moreover, from 1972 to 2019, Alberta added 2.1 new residents (on average) for every housing unit started compared to 3.9 new residents for every housing unit started in 2024. Put differently, today nearly twice as many new residents are potentially competing for each new home compared to historical norms.

While Alberta attracts more Canadians from other provinces than any other province, federal immigration and residency policies drive Alberta’s population growth. So while the provincial government has little control over its population growth, provincial and municipal governments can affect the pace of homebuilding.

For example, recent provincial amendments to the city charters in Calgary and Edmonton have helped standardize building codes, which should minimize cost and complexity for builders who operate across different jurisdictions. Municipal zoning reforms in Calgary, Edmonton and Red Deer have made it easier to build higher-density housing, and Lethbridge and Medicine Hat may soon follow suit. These changes should make it easier and faster to build homes, helping Alberta maintain some of the least restrictive building rules and quickest approval timelines in Canada.

There is, however, room for improvement. Policymakers at both the provincial and municipal level should streamline rules for building, reduce regulatory uncertainty and development costs, and shorten timelines for permit approvals. Calgary, for instance, imposes fees on developers to fund a wide array of public infrastructure—including roads, sewers, libraries, even buses—while Edmonton currently only imposes fees to fund the construction of new firehalls.

It’s difficult to say how long Alberta’s housing affordability woes will endure, but the situation is unlikely to improve unless homebuilding increases, spurred by government policies that facilitate more development.

-

Alberta2 days ago

Alberta2 days agoGovernments in Alberta should spur homebuilding amid population explosion

-

International2 days ago

International2 days agoHistory in the making? Trump, Zelensky hold meeting about Ukraine war in Vatican ahead of Francis’ funeral

-

Alberta2 days ago

Alberta2 days agoLow oil prices could have big consequences for Alberta’s finances

-

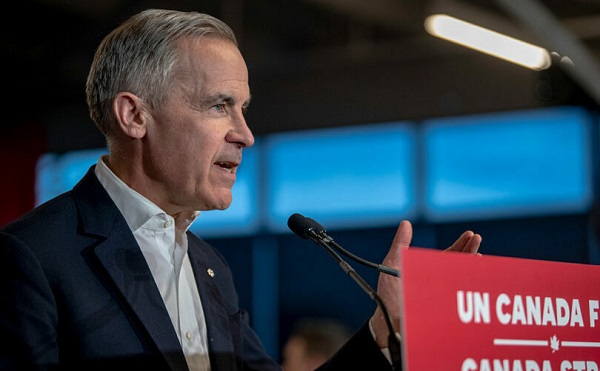

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s budget is worse than Trudeau’s

-

Business2 days ago

Business2 days agoIt Took Trump To Get Canada Serious About Free Trade With Itself

-

2025 Federal Election21 hours ago

2025 Federal Election21 hours agoColumnist warns Carney Liberals will consider a home equity tax on primary residences

-

C2C Journal2 days ago

C2C Journal2 days ago“Freedom of Expression Should Win Every Time”: In Conversation with Freedom Convoy Trial Lawyer Lawrence Greenspon

-

Opinion1 day ago

Opinion1 day agoCanadians Must Turn Out in Historic Numbers—Following Taiwan’s Example to Defeat PRC Election Interference