From the Fraser Institute By: Jake Fuss and Tegan Hill Two federal cabinet ministers criticized the report because it “fails to properly acknowledge that CEBA was...

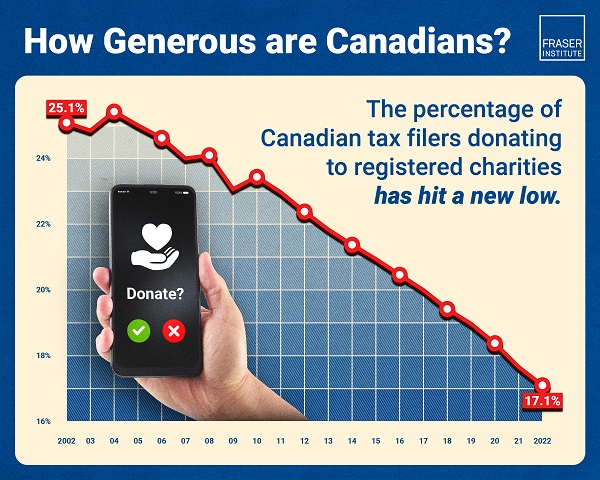

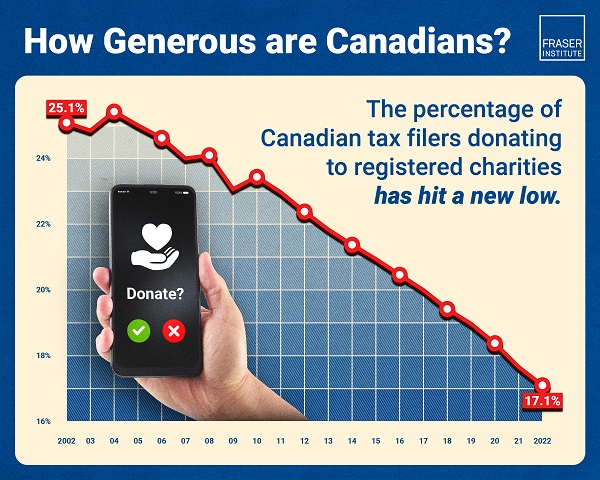

From the Fraser Institute By: Jake Fuss and Grady Munro The number of Canadians donating to charity—as a percentage of all tax filers—is at the lowest...

From the Fraser Institute By Jake Fuss and Grady Munro In light of recent comments from federal Finance Minister Chrystia Freeland about the supposed “vibecession” infecting the brains...

From the Fraser Institute By Jake Fuss and Grady Munro Last week, Yves Giroux, the Parliamentary Budgetary Officer, raised a rarely-talked-about issue with the federal government—that is, the release of...

From the Fraser Institute By Jake Fuss and Grady Munro On Thursday, the House of Commons passed legislation (tabled by the Trudeau government) that would temporarily...

From the Fraser Institute By Jake Fuss and Grady Munro To much fanfare, President-elect Donald Trump has threatened to impose a 25 per cent tariff on...

From the Fraser Institute By Ben Eisen and Jake Fuss Recently, Prime Minister Justin Trudeau announced several short-term initiatives related to tax policy. Most notably, the package includes...

From the Fraser Institute By Jake Fuss and Grady Munro The Trudeau government will soon release its fall economic statement. Though technically intended to be an update on...

From the Fraser Institute By Jake Fuss and Alex Whalen Following Donald Trump’s victory in Tuesday’s presidential election, lower taxes for both U.S. businesses and individuals will be...

From the Fraser Institute By Jake Fuss and Grady Munro Finance Minister Chrystia Freeland recently said Canada will have “the strongest economic growth in the G7.” But is...