From the Fraser Institute By Julio Mejía and Elmira Aliakbari On its first day in office, the Trump administration withdrew from the Paris climate agreement and...

From the Fraser Institute By Alex Whalen and Jake Fuss On the eve of a possible trade war with the United States, Canadian policymakers have a...

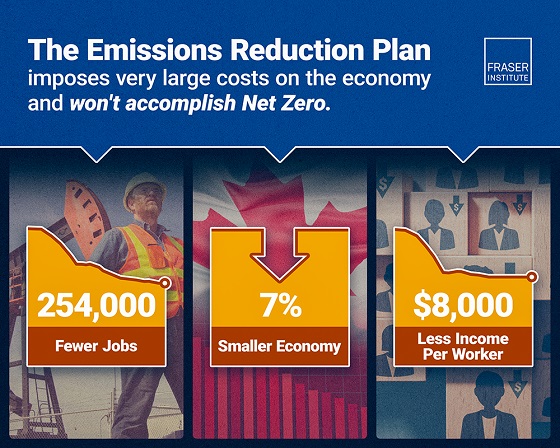

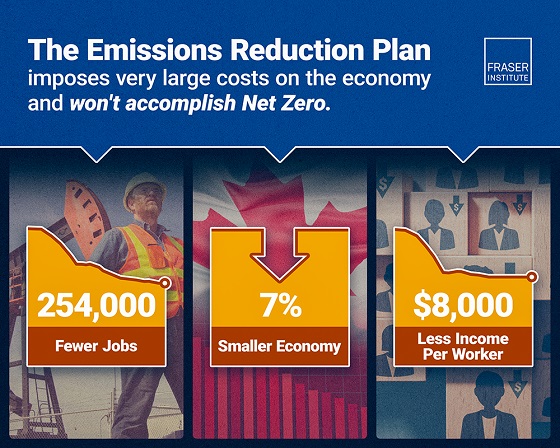

From the Fraser Institute Ross McKitrick Professor of Economics, University of Guelph Canada’s Path to Net Zero by 2050: Darkness at the End of the Tunnel...

From the Fraser Institute By Jake Fuss and Grady Munro Defence Minister Bill Blair recently claimed the federal government could “absolutely” achieve the North Atlantic Treaty Organization (NATO)...

From the Fraser Institute By Kenneth P. Green Donald Trump had a busy first day back on the job. From his desk in the Oval Office,...

From the Fraser Institute By Jake Fuss and Grady Munro Premier Doug Ford, who will trigger an election this week, recently said he plans to “spend...

From the Fraser Institute By Kenneth P. Green Justin Trudeau’s imminent exit from office may mark the beginning of the end of a 10-year war on Canada’s...

From the Fraser Institute By Jock Finlayson Late last year, Statistics Canada reported that Canada’s population reached 41.5 million in October, up 177,000 from July 2024....

From the Fraser Institute By Ross McKitrick Canadian federal politicians are floundering in their responses to Donald Trump’s tariff and annexation threats. Unfortunately, they’re stuck in a...

From the Fraser Institute By Steven Globerman To state the obvious, president-elect Donald Trump’s threat to impose an across-the-board 25 per cent tariff on Canadian exports to...