Uncategorized

Sombre Christmas, prayers in tsunami-hit Indonesian region

SUMUR, Indonesia — Christmas celebrations traditionally filled with laughter and uplifting music were replaced by

Pastor Markus Taekz said Tuesday his Rahmat Pentecostal Church in the hard-hit area of Carita did not celebrate with joyous songs. Instead, he said only about 100 people showed up for the Christmas Eve service, usually attended by double that number. Many congregation members had already left the area for the capital, Jakarta, or other locations away from the disaster zone.

“This is an unusual situation because we have a very bad disaster that killed hundreds of our sisters and brothers in Banten,” he said, referring to the Javanese province. “So our celebration is full of grief.”

Church leaders called on Christians across Indonesia, the world’s most populous Muslim nation, to pray for victims of the tsunami.

The death toll had climbed to 429 on Tuesday with more than 1,400 people injured and at least 128 missing after the tsunami slammed into parts of western Java and southern Sumatra islands, said Sutopo Purwo Nugroho, spokesman for Indonesia Disaster Mitigation Agency.

Military troops, government personnel and volunteers were searching along debris-strewn beaches. Where victims were found, yellow, orange and black body bags were laid out, and weeping relatives identified the dead. Chunks of broken concrete and splintered wood littered the coast where hundreds of homes and hotels had stood.

The waves followed an eruption and apparent landslide on Anak Krakatau, or “Child of Krakatoa,” a volcanic island that formed in the early part of the 20th century near the site of the cataclysmic 1883 eruption of Krakatoa.

Indonesian President Joko Widodo, who faces what promises to be a tough re-election campaign next year, vowed to have all tsunami-detection equipment replaced or repaired.

Nugroho acknowledged on Twitter that the country’s network of detection buoys had been out of order since 2012 because of vandalism and budget shortfalls.

But the head of Indonesia’s Meteorology, Climatology and Geophysics Agency, Dwikorita Karnawati, said the tsunami was caused by Krakatau’s volcanic activity and so could not have been picked up by the agency’s sensors, which monitor conventional earthquakes responsible for more than 90

Karnawati said the tsunami was probably caused by the collapse of a big section of the volcano’s slope. Anak Krakatau been erupting since June and did so again 24 minutes before the tsunami, the geophysics agency said.

Indonesia, a vast archipelago of more than 17,000 islands and home to 260 million people, lies along the Ring of Fire, an arc of volcanoes and fault lines in the Pacific Basin.

The massive eruption of Krakatoa killed more than 30,000 people and hurled so much ash that it turned day to night in the area and reduced global temperatures. Thousands were believed killed by a quake and tsunami that hit Sulawesi island in September, and an earlier quake on the island of Lombok killed 505 people in August.

___

Associated Press writers Margie Mason and Ali Kotarumalos in Jakarta, Indonesia, contributed to this report.

Niniek Karmini, The Associated Press

Uncategorized

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

Uncategorized

New report warns WHO health rules erode Canada’s democracy and Charter rights

The Justice Centre for Constitutional Freedoms has released a new report titled Canada’s Surrender of Sovereignty: New WHO health regulations undermine Canadian democracy and Charter freedoms. Authored by Nigel Hannaford, a veteran journalist and researcher, the report warns that Canada’s acceptance of the World Health Organization’s (WHO) revised International Health Regulations (IHR) represents a serious erosion of national independence and democratic accountability.

The IHR amendments, which took effect on September 19, 2025, authorize the WHO Director-General to declare global “health emergencies” that could require Canada to follow directives from bureaucrats in Geneva, bypassing the House of Commons and the will of Canadian voters.

The WHO regards these regulations as “binding,” despite having no ability or legal authority to impose such regulations. Even so, Canada is opting to accept the regulations as binding.

By accepting the WHO’s revised IHR, the report explains, Canada has relinquished its own control over future health crises and instead has agreed to let the WHO determine when a “pandemic emergency” exists and what Canada must do to respond to it, after which Canada must report back to the WHO.

In fact, under these International Health Regulations, the WHO could demand countries like Canada impose stringent freedom-violating health policies, such as lockdowns, vaccine mandates, or travel restrictions without debate, evidence review, or public accountability, the report explains.

Once the WHO declares a “Pandemic Emergency,” member states are obligated to implement such emergency measures “without delay” for a minimum of three months.

Importantly, following these WHO directives would undermine government accountability as politicians may hide behind international “commitments” to justify their actions as “simply following international rules,” the report warns.

Canada should instead withdraw from the revised IHR, following the example of countries like Germany, Austria, Italy, Czech Republic, and the United States. The report recommends continued international cooperation without surrendering control over domestic health policies.

Constitutional lawyer Allison Pejovic said, “[b]y treating WHO edicts as binding, the federal government has effectively placed Canadian sovereignty on loan to an unelected international body.”

“Such directives, if enforced, would likely violate Canadians’ Charter rights and freedoms,” she added.

Mr. Hannaford agreed, saying, “Canada’s health policies must be made in Canada. No free and democratic nation should outsource its emergency powers to unelected bureaucrats in Geneva.”

The Justice Centre urges Canadians to contact their Members of Parliament and demand they support withdrawing from the revised IHR to restore Canadian sovereignty and reject blind compliance with WHO directives.

-

Health1 day ago

Health1 day agoLack of adequate health care pushing Canadians toward assisted suicide

-

National21 hours ago

National21 hours agoWatchdog Demands Answers as MP Chris d’Entremont Crosses Floor

-

Alberta21 hours ago

Alberta21 hours agoATA Collect $72 Million in Dues But Couldn’t Pay Striking Teachers a Dime

-

Artificial Intelligence20 hours ago

Artificial Intelligence20 hours agoAI seems fairly impressed by Pierre Poilievre’s ability to communicate

-

Energy2 days ago

Energy2 days agoIt should not take a crisis for Canada to develop the resources that make people and communities thrive.

-

Dr John Campbell2 days ago

Dr John Campbell2 days agoCures for Cancer? A new study shows incredible results from cheap generic drug Fenbendazole

-

Artificial Intelligence1 day ago

Artificial Intelligence1 day agoAI Faces Energy Problem With Only One Solution, Oil and Gas

-

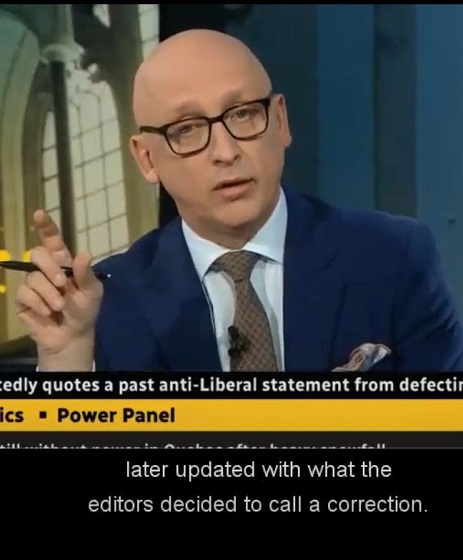

Media20 hours ago

Media20 hours agoBreaking News: the public actually expects journalists to determine the truth of statements they report