Uncategorized

Saudi crown prince in UAE, first trip abroad since Khashoggi

DUBAI, United Arab Emirates — Saudi Arabia’s Crown Prince Mohammed bin Salman was in the United Arab Emirates on Friday, on his first tour abroad since the killing of Saudi writer Jamal Khashoggi at the kingdom’s consulate in Istanbul.

The prince, who arrived in Abu Dhabi late on Thursday, is also due to visit other Mideast countries, where he will be warmly received by Arab leaders who have stood firmly by his side amid international outrage over Khashoggi’s horrific slaying.

The crown prince will round off his tour with a two-day stop in Argentina where he’ll come face-to-face with world leaders on Nov. 30 for the two-day Group of 20 summit. Among those expected to attend that summit are President Donald Trump and Turkish President Recep Tayyip Erdogan, who has kept international pressure mounting on the kingdom in the wake of Khashoggi’s killing.

His tour abroad underscores the strong support the crown prince continues to have from his 82-year-old father, King Salman, and signals that he faces no immediate threats to his grip on power at home.

Upon arrival to the UAE, Prince Mohammed was warmly embraced by Abu Dhabi Crown Prince Mohammed bin Zayed. The two crown princes— who also command their countries’ armed forces— are known to be close, with the more experienced Abu Dhabi crown prince reportedly offering his insights to the 33-year-old Saudi prince on past occasions.

The UAE’s state-run news agency, WAM, reported Friday that the two discussed “brotherly and strategic ties” in their talks, which were attended by a wide-range of Emirati officials, as well as a number of senior Saudi officials, including the head of general intelligence, the interior minister and key advisers.

Saudi Arabia and the UAE, at war in Yemen against Shiite Houthi rebels there since 2015, are also expected to take part in U.N.-led peace talks in Sweden next month. The two sides likely discussed Yemen, with the WAM news agency reporting that among those present for the bilateral talks was an Emirati official in charge of liaising with families of UAE soldiers killed in battle.

Prince Mohammed is scheduled to visit Bahrain and Egypt next on his tour.

He has faced intense criticism since the Oct. 2 killing of Khashoggi by Saudi agents inside the kingdom’s consulate in Istanbul. Khashoggi’s body was dismembered, and his remains have yet to be found.

Intelligence officials and analysts say the operation to kill Khashoggi, who wrote critically of the crown prince for The Washington Post, could not have happened without Prince Mohammed’s knowledge. The kingdom denies the crown prince had any involvement.

Trump insists there’s not enough evidence to blame the crown prince for Khashoggi’s killing, despite a U.S. intelligence report’s assessment to the contrary. Trump says the kingdom is an important ally that has helped to lower oil prices.

Saudi Arabia initially said Khashoggi had walked out of the consulate before shifting its account of what happened amid Turkish intelligence leaks. Saudi Arabia is now seeking the death penalty for five of those accused in the killing. The U.S. has sanctioned 17 Saudis involved in the incident, including one of the crown prince’s closest advisers who was fired from his post after fallout from the killing.

On Friday, Turkey’s Foreign Minister Mevlut Cavusoglu said the Saudi crown prince has requested to meet Erdogan on the sidelines of the G-20 summit.

Turkey sees no “obstacle” for the meeting, Cavusoglu told Turkey’s CNN-Turk television, but added that Erdogan would make the final decision. It would be the first official contact between the prince and Erdogan.

Cavusoglu also criticized Trump, saying the U.S. leader appears to want to turn a blind eye to the killing.

“Trump’s statements amount to him saying ‘I’ll turn a blind eye no matter what,'” he said. “Money isn’t everything. We must not move away from human values.”

___

Associated Press writer Suzan Fraser in Ankara, Turkey, contributed to this report.

Aya Batrawy, The Associated Press

Uncategorized

CNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

From the Daily Caller News Foundation

As the Trump administration and Republican-controlled Congress move aggressively to roll back the climate alarm-driven energy policies of the Biden presidency, proponents of climate change theory have ramped up their scare tactics in hopes of shifting public opinion in their favor.

But CNN’s energetic polling analyst, the irrepressible Harry Enten, says those tactics aren’t working. Indeed, Enten points out the climate alarm messaging which has permeated every nook and cranny of American society for at least 25 years now has failed to move the public opinion needle even a smidgen since 2000.

Appearing on the cable channel’s “CNN News Central” program with host John Berman Thursday, Enten cited polling data showing that just 40% of U.S. citizens are “afraid” of climate change. That is the same percentage who gave a similar answer in 2000.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Enten’s own report is an example of this fealty. Saying the findings “kind of boggles the mind,” Enten emphasized the fact that, despite all the media hysteria that takes place in the wake of any weather disaster or wildfire, an even lower percentage of Americans are concerned such events might impact them personally.

“In 2006, it was 38%,” Enten says of the percentage who are even “sometimes worried” about being hit by a natural disaster, and adds, “Look at where we are now in 2025. It’s 32%, 38% to 32%. The number’s actually gone down.”

In terms of all adults who worry that a major disaster might hit their own hometown, Enten notes that just 17% admit to such a concern. Even among Democrats, whose party has been the major proponent of climate alarm theory in the U.S., the percentage is a paltry 27%.

While Enten and Berman both appear to be shocked by these findings, they really aren’t surprising. Enten himself notes that climate concerns have never been a driving issue in electoral politics in his conclusion, when Berman points out, “People might think it’s an issue, but clearly not a driving issue when people go to the polls.”

“That’s exactly right,” Enten says, adding, “They may worry about in the abstract, but when it comes to their own lives, they don’t worry.”

This reality of public opinion is a major reason why President Donald Trump and his key cabinet officials have felt free to mount their aggressive push to end any remaining notion that a government-subsidized ‘energy transition’ from oil, gas, and coal to renewables and electric vehicles is happening in the U.S. It is also a big reason why congressional Republicans included language in the One Big Beautiful Bill Act to phase out subsidies for those alternative energy technologies.

It is key to understand that the administration’s reprioritization of energy and climate policies goes well beyond just rolling back the Biden policies. EPA Administrator Lee Zeldin is working on plans to revoke the 2010 endangerment finding related to greenhouse gases which served as the foundation for most of the Obama climate agenda as well.

If that plan can survive the inevitable court challenges, then Trump’s ambitions will only accelerate. Last year’s elimination of the Chevron Deference by the Supreme Court increases the chances of that happening. Ultimately, by the end of 2028, it will be almost as if the Obama and Biden presidencies never happened.

The reality here is that, with such a low percentage of voters expressing concerns about any of this, Trump and congressional Republicans will pay little or no political price for moving in this direction. Thus, unless the polls change radically, the policy direction will remain the same.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Uncategorized

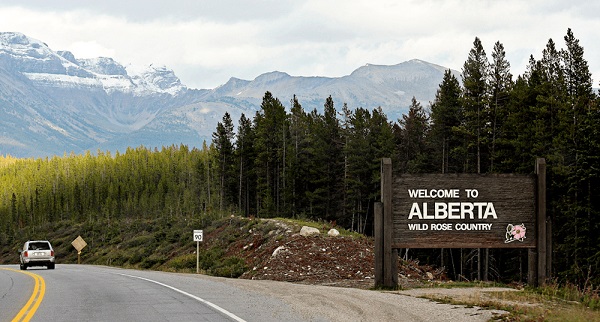

Kananaskis G7 meeting the right setting for U.S. and Canada to reassert energy ties

Energy security, resilience and affordability have long been protected by a continentally integrated energy sector.

The G7 summit in Kananaskis, Alberta, offers a key platform to reassert how North American energy cooperation has made the U.S. and Canada stronger, according to a joint statement from The Heritage Foundation, the foremost American conservative think tank, and MEI, a pan-Canadian research and educational policy organization.

“Energy cooperation between Canada, Mexico and the United States is vital for the Western World’s energy security,” says Diana Furchtgott-Roth, director of the Center for Energy, Climate and Environment and the Herbert and Joyce Morgan Fellow at the Heritage Foundation, and one of America’s most prominent energy experts. “Both President Trump and Prime Minister Carney share energy as a key priority for their respective administrations.

She added, “The G7 should embrace energy abundance by cooperating and committing to a rapid expansion of energy infrastructure. Members should commit to streamlined permitting, including a one-stop shop permitting and environmental review process, to unleash the capital investment necessary to make energy abundance a reality.”

North America’s energy industry is continentally integrated, benefitting from a blend of U.S. light crude oil and Mexican and Canadian heavy crude oil that keeps the continent’s refineries running smoothly.

Each day, Canada exports 2.8 million barrels of oil to the United States.

These get refined into gasoline, diesel and other higher value-added products that furnish the U.S. market with reliable and affordable energy, as well as exported to other countries, including some 780,000 barrels per day of finished products that get exported to Canada and 1.08 million barrels per day to Mexico.

A similar situation occurs with natural gas, where Canada ships 8.7 billion cubic feet of natural gas per day to the United States through a continental network of pipelines.

This gets consumed by U.S. households, as well as transformed into liquefied natural gas products, of which the United States exports 11.5 billion cubic feet per day, mostly from ports in Louisiana, Texas and Maryland.

“The abundance and complementarity of Canada and the United States’ energy resources have made both nations more prosperous and more secure in their supply,” says Daniel Dufort, president and CEO of the MEI. “Both countries stand to reduce dependence on Chinese and Russian energy by expanding their pipeline networks – the United States to the East and Canada to the West – to supply their European and Asian allies in an increasingly turbulent world.”

Under this scenario, Europe would buy more high-value light oil from the U.S., whose domestic needs would be back-stopped by lower-priced heavy oil imports from Canada, whereas Asia would consume more LNG from Canada, diminishing China and Russia’s economic and strategic leverage over it.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

As the nation’s largest, most broadly supported conservative research and educational institution, The Heritage Foundation has been leading the American conservative movement since our founding in 1973. The Heritage Foundation reaches more than 10 million members, advocates, and concerned Americans every day with information on critical issues facing America.

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoCanada’s privacy commissioner says he was not consulted on bill to ban dissidents from internet

-

Business2 days ago

Business2 days agoFormer Trump Advisor Says US Must Stop UN ‘Net Zero’ Climate Tax On American Ships

-

Alberta2 days ago

Alberta2 days agoEnbridge CEO says ‘there’s a good reason’ for Alberta to champion new oil pipeline

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoLong-Distance Field Goals Have Flipped The Field. Will The NFL Panic?

-

Business2 days ago

Business2 days ago“Nation Building,” Liberal Style: We’re Fixing a Sewer, You’re Welcome, Canada

-

National1 day ago

National1 day agoDemocracy Watch Renews Push for Independent Prosecutor in SNC-Lavalin Case

-

Business1 day ago

Business1 day agoOver two thirds of Canadians say Ottawa should reduce size of federal bureaucracy

-

Alberta7 hours ago

Alberta7 hours agoAlberta taxpayers should know how much their municipal governments spend