Alberta

Red Deer Polytechnic homecoming featuring athletic, social, and academic events

As a way to connect with alumni, prospective and current students, employees and community members, Red Deer Polytechnic will host its inaugural Homecoming from October 20-22, 2022, on its main campus.

“The past few years have been challenging to fully engage with our stakeholders because of COVID-19, so we are extremely excited to open our doors for Homecoming,” says Stuart Cullum, President of Red Deer Polytechnic. “The range of events appeal to a diverse audience and it’s a great opportunity for the Polytechnic to showcase what we have to offer. With growing program offerings taught by industry experts in modern facilities, we are a premier polytechnic institution that serves not only in the region, but the entire province.”

Red Deer Polytechnic is intricately interconnected with the community in numerous ways. Students, staff and faculty make an important impact on the community through applied learning and research activities, community service and volunteerism, and as professionals.

At the same time, community members and alumni also contribute to learning experiences and the institution’s growth in many ways. This includes advocacy for post-secondary education, along with volunteering and enhancing the students’ education by providing experiential learning opportunities and support. Together, members of the Red Deer Polytechnic community contribute to the continued economic, intellectual, social and cultural development of central Alberta and province.

The network of Red Deer Polytechnic alumni continues to grow in numbers and impact.

“At Red Deer Polytechnic, we are extremely proud of our 58-year history, including the 80,000 alumni who are leaders in their professions and communities,” says Richard Longtin, Vice President, External Relations. “The valuable connections with alumni and community members enrich the Polytechnic, region and Alberta. Homecoming is an ideal opportunity for alumni to reconnect with one another, to meet current students and faculty, to interact with community members and to see how the institution has evolved as Red Deer Polytechnic.”

A variety of academic, athletic, cultural and social events will be held at the Polytechnic over the three days.

One of the Homecoming events is Palate: A Taste of Local, formerly known as Fine Wine and Food Tasting Festival. This elegant tasting event provides opportunities for guests to explore local, hand-crafted food and beverages. The new name reflects the increased diversity of items offered and the event’s mission to celebrate regional businesses and ingredients.

Open House provides an opportunity for prospective students to explore Red Deer Polytechnic’s programs and services, to tour main campus, to participate in interactive activities, and to apply for one of the institution’s more than 80 programs. Community members are also invited to explore main campus and learn more about the Polytechnic’s offerings. At Open House, application fees to study in 2023 will be waived.

Here is a summary of the Homecoming events:

Thursday, October 20

- Palate: A Taste of Local | Cenovus Learning Commons | 7 pm

- Philosopher’s Café | Library Information Commons | 7 pm

- Queens and Kings Basketball Home Opener | Fas Gas – On The Run Gymnasium | 6 and 8 pm

Friday, October 21

- Free 30 Minute Fitness Sessions | Collicutt Performance Fitness Zone | Cycle 6 pm | Fitness Step 6:45 pm

- Library 20th Anniversary Celebration | Library Information Commons | 7 pm

- Kings Hockey | Gary W. Harris Canada Games Centre Arena | 7 pm

Saturday, October 22

- Open House | Main Campus | 9 am – 12 pm

- Queens and Kings Soccer | Red Deer Polytechnic Main Field | 12 and 2 pm | tickets are not required

More information about Red Deer Polytechnic’s Homecoming is available online.

Featured Events

Palate: A Taste of Local

Cenovus Energy Learning Common

Thursday, October 20 | 7 – 10 pm

The Red Deer Polytechnic Alumni Association is proud to introduce a new, elevated rendition of our annual signature event – Palate: A Taste of Local.

Philosopher’s Café

Library Information Common

Thursday, October 20 | 7 pm

Hosts: Dr. Stephen Brown & Dr. Carrie Dennett

No philosophical training or expertise required.

Free 30 Minute Fitness Sessions

Collicutt Performance Fitness Zone

Friday, October 21 – Cycle at 6 pm | Fitness Step at 6:45 pm

Saturday, October 22 – Fitness Step at 2 pm | Cycle at 2:45 pm

Queens and Kings Basketball Home Opener

vs St. Mary’s University Lightning

Fas Gas On The Run Gymnasium

Friday, October 21

Queens at 6 pm | Kings at 8 pm

Library 20th Anniversary Author Reading

Library Information Common

Friday, October 21 | 7 pm

Featuring Jenna Butler, Joan Crate, Leslie Greentree, and Rod Schumacher.

NOTE: The Library will be open exclusively for this event. No other access or services will be available during this event.

Kings Hockey vs SAIT Trojans

Gary W. Harris Canada Games Centre Arena

Friday, October 21 | 7 pm

Open House

Main Campus

Saturday, October 22 | 9 am – Noon

Join us for program and service information, interactive activities, and tours of our main campus and the Gary W. Harris Canada Games Centre.

Apply in person to Winter 2023, Spring 2023 or Fall 2023 programs at Open House and we will waive the application fee!

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

espionage6 hours ago

espionage6 hours agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours agoNeil Young + Carney / Freedom Bros

-

2025 Federal Election14 hours ago

2025 Federal Election14 hours agoTucker Carlson Interviews Maxime Bernier: Trump’s Tariffs, Mass Immigration, and the Oncoming Canadian Revolution

-

Business13 hours ago

Business13 hours agoDOGE Is Ending The ‘Eternal Life’ Of Government

-

2025 Federal Election13 hours ago

2025 Federal Election13 hours agoCanada drops retaliatory tariffs on automakers, pauses other tariffs

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBureau Exclusive: Chinese Election Interference Network Tied to Senate Breach Investigation

-

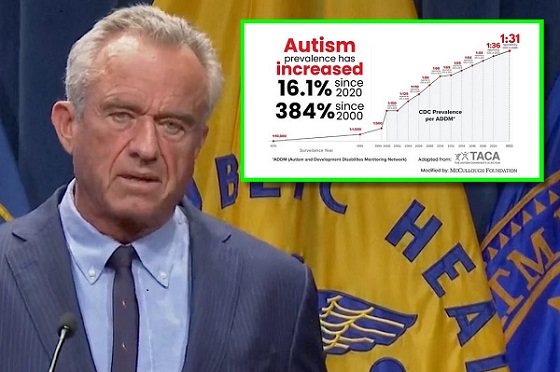

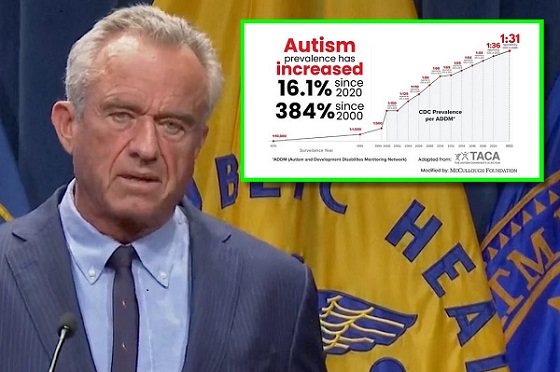

Autism1 day ago

Autism1 day agoRFK Jr. Exposes a Chilling New Autism Reality