Alberta

Premier Kenney addresses Alberta’s COVID-19 economic crisis

From the Province of Alberta

Additional financial support for Albertans and employers

More relief is on the way for Albertans and Alberta employers.

The government has made three significant decisions that will give Albertans and Alberta employers additional supports as they deal with the impacts of the COVID-19 crisis.

“Our priority is to keep our province strong while we get through these difficult times together. We’re doing everything we can to support Albertans and Alberta employers through this crisis. That’s why we’re focused on creating tangible savings for households and freeing up necessary cash for businesses to help them through these unprecedented times.”

Education property tax freeze

During a pandemic, Alberta households should not need to worry about paying additional property taxes.

- The government will immediately cancel the decision made in Budget 2020 and will freeze education property taxes at last year’s level.

- Reversing the 3.4 per cent population and inflation adjustment will save Alberta households and businesses about $87 million in 2020-21, which means $55 million for households and $32 million for employers.

- The government expects that Albertans and Alberta businesses will fully realize these savings and that municipal property tax levels will not be increased as a result of the lower provincial education property tax levels.

Education property tax deferral for business

When Alberta businesses are operating, they employ Albertans who can support themselves, their families and help keep the economy running. Effective immediately, the government will defer education property tax for businesses for six months.

- In the next six months, $458 million in cash will remain with employers to help them pay employees and continue operations.

- The government expects municipalities to set education property tax rates as they normally would, but defer collection. Deferred amounts will be repaid in future tax years.

- The government encourages commercial landlords to pass on these savings to their tenants through reduced or deferred payments. This will help employers continue to manage their debts, pay their employees and stay in business.

- Businesses capable of paying their taxes in full are strongly encouraged to do so. This will assist the province in being able to support Albertans through this pandemic.

“Eliminating the scheduled adjustment of education property taxes and deferring collection of non-residential property taxes will result in savings to Albertans and improved business cash flow. This measure will help Alberta households and businesses during this time – we want to keep Albertans working while we get through these difficult times together.”

WCB premiums deferral for private sector businesses and support for small and medium businesses

Private sector employers can save money on their WCB premium payments at a time when they need it most. These actions ensure the sustainability of the workers’ compensation system and that injured workers continue to receive the benefits and supports they need to return to work.

- Private sector employers will have immediate financial relief by deferring WCB premiums until early 2021, effectively for one year.

- Employers who have already paid their WCB premium payment for 2020 are eligible for a rebate or credit.

- For small and medium businesses, the government will cover 50 per cent of the premium when it is due.

- Large employers will also receive a break by having their 2020 WCB premium payments deferred until 2021, at which time their premiums will be due.

- Paying 50 per cent of small and medium private sector WCB premiums for 2020 will cost government approximately $350 million.

Additional measures to help families, students and employers

Previously announced measure taken by the province to protect Albertans and assist businesses include:

- The collection of corporate income tax balances and instalment payments is deferred until Aug. 31, 2020. This gives Alberta businesses access to about $1.5 billion in funds to help them cope with the COVID-19 crisis.

- $50 million to support emergency isolation for working adult Albertans who must self-isolate, including persons who are the sole caregiver for a dependent who must self-isolate, and who will not have another source of pay or compensation while they are self-isolated. It is distributed in one payment instalment to bridge the gap until the federal emergency payments begin in April.

- Utility payment deferral for residential, farm, and small commercial customers to defer bill payments for the next 90 days and ensure no one is cut off from electricity and natural gas services during this time of crisis.

- A six-month, interest-free moratorium on Alberta student loan payments for all individuals who are in the process of repaying these loans.

COVID-19 a ‘devastating blow’ to mountain towns that rely on tourism

Alberta

Red Deer Justice Centre Grand Opening: Building access to justice for Albertans

The new Red Deer Justice Centre will help Albertans resolve their legal matters faster.

Albertans deserve to have access to a fair, accessible and transparent justice system. Modernizing Alberta’s courthouse infrastructure will help make sure Alberta’s justice system runs efficiently and meets the needs of the province’s growing population.

Alberta’s government has invested $191 million to build the new Red Deer Justice Centre, increasing the number of courtrooms from eight to 12, allowing more cases to be heard at one time.

“Modern, accessible courthouses and streamlined services not only strengthen our justice

system – they build safer, stronger communities across the province. Investing in the new Red Deer Justice Centre is vital to helping our justice system operate more efficiently, and will give people in Red Deer and across central Alberta better access to justice.”

Government of Alberta and Judiciary representatives with special guests at the Red Deer Justice Centre plaque unveiling event April 22, 2025.

On March 3, all court services in Red Deer began operating out of the new justice centre. The new justice centre has 12 courtrooms fully built and equipped with video-conference equipment to allow witnesses to attend remotely if they cannot travel, and vulnerable witnesses to testify from outside the courtroom.

The new justice centre also has spaces for people taking alternative approaches to the traditional courtroom trial process, with the three new suites for judicial dispute resolution services, a specific suite for other dispute resolution services, such as family mediation and civil mediation, and a new Indigenous courtroom with dedicated venting for smudging purposes.

“We are very excited about this new courthouse for central Alberta. Investing in the places where people seek justice shows respect for the rights of all Albertans. The Red Deer Justice Centre fills a significant infrastructure need for this rapidly growing part of the province. It is also an important symbol of the rule of law, meaning that none of us are above the law, and there is an independent judiciary to decide disputes. This is essential for a healthy functioning democracy.”

“Public safety and access to justice go hand in hand. With this investment in the new Red Deer Justice Centre, Alberta’s government is ensuring that communities are safer, legal matters are resolved more efficiently and all Albertans get the support they need.”

“This state-of-the-art facility will serve the people of Red Deer and surrounding communities for generations. Our team at Infrastructure is incredibly proud of the work done to plan, design and build this project. I want to thank everyone, at all levels, who helped make this project a reality.”

Budget 2025 is meeting the challenge faced by Alberta with continued investments in education and health, lower taxes for families and a focus on the economy.

Quick facts

- The new Red Deer Justice Centre is 312,000 sq ft (29,000 m2). (The old courthouse is 98,780 sq ft (9,177 m2)).

- The approved project funding for the Red Deer Justice Centre is about $191 million.

Alberta

CPP another example of Albertans’ outsized contribution to Canada

From the Fraser Institute

By Tegan Hill

Amid the economic uncertainty fuelled by Trump’s trade war, its perhaps more important than ever to understand Alberta’s crucial role in the federation and its outsized contribution to programs such as the Canada Pension Plan (CPP).

From 1981 to 2022, Albertan’s net contribution to the CPP—meaning the amount Albertans paid into the program over and above what retirees in Alberta received in CPP payments—was $53.6 billion. In 2022 (the latest year of available data), Albertans’ net contribution to the CPP was $3.0 billion.

During that same period (1981 to 2022), British Columbia was the only other province where residents paid more into the CPP than retirees received in benefits—and Alberta’s contribution was six times greater than B.C.’s contribution. Put differently, residents in seven out of the nine provinces that participate in the CPP (Quebec has its own plan) receive more back in benefits than they contribute to the program.

Albertans pay an outsized contribution to federal and national programs, including the CPP because of the province’s relatively high rates of employment, higher average incomes and younger population (i.e. more workers pay into the CPP and less retirees take from it).

Put simply, Albertan workers have been helping fund the retirement of Canadians from coast to coast for decades, and without Alberta, the CPP would look much different.

How different?

If Alberta withdrew from the CPP and established its own standalone provincial pension plan, Alberta workers would receive the same retirement benefits but at a lower cost (i.e. lower CPP contribution rate deducted from our paycheques) than other Canadians, while the contribution rate—essentially the CPP tax rate—to fund the program would likely need to increase for the rest of the country to maintain the same benefits.

And given current demographic projections, immigration patterns and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into the CPP than Albertan retirees get back from it.

Therefore, considering Alberta’s crucial role in national programs, the next federal government—whoever that may be—should undo and prevent policies that negatively impact the province and Albertans ability to contribute to Canada. Think of Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off B.C.’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

Canada faces serious economic challenges, including a trade war with the United States. In times like this, it’s important to remember Alberta’s crucial role in the federation and the outsized contributions of Alberta workers to the wellbeing of Canadians across the country.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

2025 Federal Election2 days ago

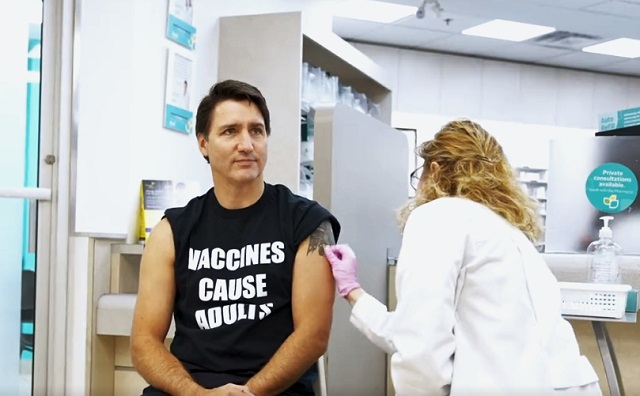

2025 Federal Election2 days agoConservatives promise to ban firing of Canadian federal workers based on COVID jab status

-

Business2 days ago

Business2 days agoIs Government Inflation Reporting Accurate?

-

Environment2 days ago

Environment2 days agoExperiments to dim sunlight will soon be approved by UK government: report

-

International2 days ago

International2 days agoPope Francis Got Canadian History Wrong

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s Hidden Climate Finance Agenda

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoWhen it comes to pipelines, Carney’s words flow both ways

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoIs free speech over in the UK? Government censorship reaches frightening new levels