Alberta

Premier Jason Kenney shares photos of the Keystone XL pipeline crossing the Canada US border.

Alberta Premier Jason Kenney announces that shovels are in the ground in Alberta, Saskatchewan and parts of the United States on the Keystone XL pipeline expansion.

On Saturday, the day after Alberta premier announced at a press release that after the province made a $1.1 billion dollar equity investment in the Keystone XL pipeline, that shovels were already in the ground. Jason Kenney shared pictures on social media pictures of the pipeline crossing into the United States along the Saskatchewan border.

Keystone XL pipeline construction shows progress as it crosses the border into the United States from Saskatchewan

A long with the initial investment to get the pipeline project going again, the province will also provide an additional $4.2 billion in loan guarantees to help developer TC Energy start construction immediately. Kenney has said that the government had been negotiating with the company for months, and that no private sector bidders were ready to finance the project at this time. “In other words,” Kenney has said, “without this investment by Alberta, the pipeline would not be built.”

The project when completed, “in the spring or summer of 2023 will connect Canada’s oil sands with refineries in the United States. The pipeline is critical to the long-term future of Alberta’s oil industry, which has maxed out its capacity to bring oil to foreign markets using rail. Cars and existing pipelines. The Keystone XL pipeline will carry 830,000 barrels per day south from Alberta to a number of locations in the states.

Aside from announcing that, “construction is well under way” Kenney also added, “Our historic investment in getting a major pipeline built, creating good, high paying jobs – one of the reasons was to get work moving now in this construction season and throughout 2020.”

Alberta faces a long road to an economic recovery once the country can get past the Covid- 19 pandemic, Kenney is staying positive, “This investment will create 7,000 jobs, directly and indirectly here in Alberta this year alone. We believe that Alberta’s government will receive back at least 30 billion dollars in additional royalties and other revenues because of the additional shipments that Keystone XL will make possible.”

2025 Federal Election

Next federal government should recognize Alberta’s important role in the federation

From the Fraser Institute

By Tegan Hill

With the tariff war continuing and the federal election underway, Canadians should understand what the last federal government seemingly did not—a strong Alberta makes for a stronger Canada.

And yet, current federal policies disproportionately and negatively impact the province. The list includes Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off British Columbia’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

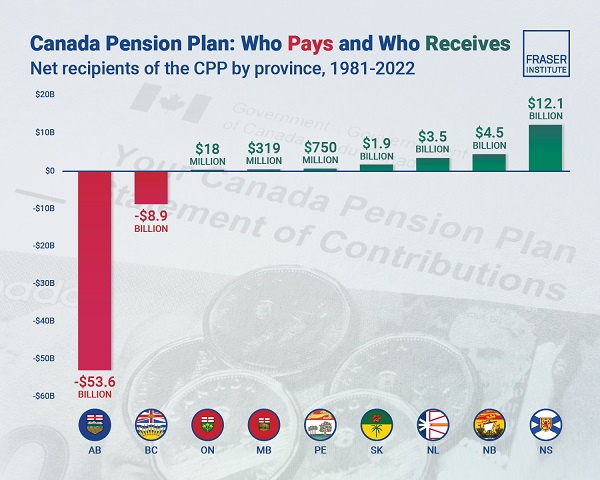

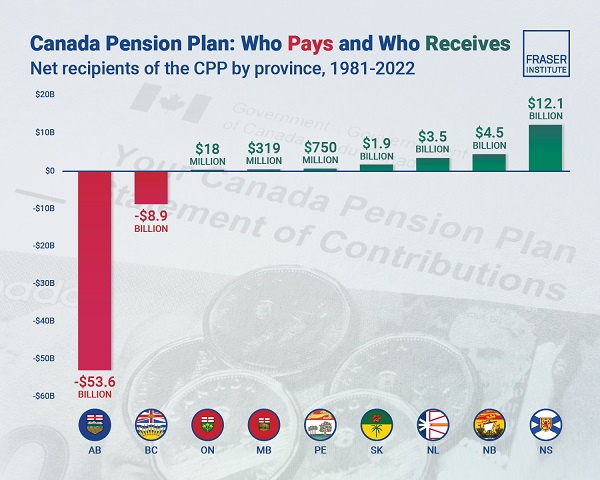

Meanwhile, Albertans contribute significantly more to federal revenues and national programs than they receive back in spending on transfers and programs including the Canada Pension Plan (CPP) because Alberta has relatively high rates of employment, higher average incomes and a younger population.

For instance, since 1976 Alberta’s employment rate (the number of employed people as a share of the population 15 years of age and over) has averaged 67.4 per cent compared to 59.7 per cent in the rest of Canada, and annual market income (including employment and investment income) has exceeded that in the other provinces by $10,918 (on average).

As a result, Alberta’s total net contribution to federal finances (total federal taxes and payments paid by Albertans minus federal money spent or transferred to Albertans) was $244.6 billion from 2007 to 2022—more than five times as much as the net contribution from British Columbians or Ontarians. That’s a massive outsized contribution given Alberta’s population, which is smaller than B.C. and much smaller than Ontario.

Albertans’ net contribution to the CPP is particularly significant. From 1981 to 2022, Alberta workers contributed 14.4 per cent (on average) of total CPP payments paid to retirees in Canada while retirees in the province received only 10.0 per cent of the payments. Albertans made a cumulative net contribution to the CPP (the difference between total CPP contributions made by Albertans and CPP benefits paid to retirees in Alberta) of $53.6 billion over the period—approximately six times greater than the net contribution of B.C., the only other net contributing province to the CPP. Indeed, only two of the nine provinces that participate in the CPP contribute more in payroll taxes to the program than their residents receive back in benefits.

So what would happen if Alberta withdrew from the CPP?

For starters, the basic CPP contribution rate of 9.9 per cent (typically deducted from our paycheques) for Canadians outside Alberta (excluding Quebec) would have to increase for the program to remain sustainable. For a new standalone plan in Alberta, the rate would likely be lower, with estimates ranging from 5.85 per cent to 8.2 per cent. In other words, based on these estimates, if Alberta withdrew from the CPP, Alberta workers could receive the same retirement benefits but at a lower cost (i.e. lower payroll tax) than other Canadians while the payroll tax would have to increase for the rest of the country while the benefits remained the same.

Finally, despite any claims to the contrary, according to Statistics Canada, Alberta’s demographic advantage, which fuels its outsized contribution to the CPP, will only widen in the years ahead. Alberta will likely maintain relatively high employment rates and continue to welcome workers from across Canada and around the world. And considering Alberta recorded the highest average inflation-adjusted economic growth in Canada since 1981, with Albertans’ inflation-adjusted market income exceeding the average of the other provinces every year since 1971, Albertans will likely continue to pay an outsized portion for the CPP. Of course, the idea for Alberta to withdraw from the CPP and create its own provincial plan isn’t new. In 2001, several notable public figures, including Stephen Harper, wrote the famous Alberta “firewall” letter suggesting the province should take control of its future after being marginalized by the federal government.

The next federal government—whoever that may be—should understand Alberta’s crucial role in the federation. For a stronger Canada, especially during uncertain times, Ottawa should support a strong Alberta including its energy industry.

Alberta

Province announces plans for nine new ‘urgent care centres’ – redirecting 200,000 hospital visits

Expanding urgent care across Alberta

If passed, Budget 2025 includes $17 million in planning funds to support the development of urgent care facilities across the province.

As Alberta’s population grows, so does the demand for health care. In response, the government is making significant investments to ensure every Albertan has access to high-quality care close to home. Currently, more than 35 per cent of emergency department visits are for non-life-threatening conditions that could be treated at urgent care centres. By expanding these centres, Alberta’s government is enhancing the health care system and improving access to timely care.

If passed, Budget 2025 includes $15 million to support plans for eight new urgent care centres and an additional $2 million in planning funds for an integrated primary and urgent care facility in Airdrie. These investments will help redirect up to 200,000 lower-acuity emergency department visits annually, freeing up capacity for life-threatening cases, reducing wait times and improving access to care for Albertans.

“More people are choosing to call Alberta home, which is why we are taking action to build capacity across the health care system. Urgent care centres help bridge the gap between primary care and emergency departments, providing timely care for non-life-threatening conditions.”

“Our team at Infrastructure is fully committed to leading the important task of planning these eight new urgent care facilities across the province. Investments into facilities like these help strengthen our communities by alleviating strains on emergency departments and enhance access to care. I am looking forward to the important work ahead.”

The locations for the eight new urgent care centres were selected based on current and projected increases in demand for lower-acuity care at emergency departments. The new facilities will be in west Edmonton, south Edmonton, Westview (Stony Plain/Spruce Grove), east Calgary, Lethbridge, Medicine Hat, Cold Lake and Fort McMurray.

“Too many Albertans, especially those living in rural communities, are travelling significant distances to receive care. Advancing plans for new urgent care centres will build capacity across the health care system.”

“Additional urgent care centres across Alberta will give Albertans more options for accessing the right level of care when it’s needed. This is a necessary and substantial investment that will eventually ease some of the pressures on our emergency departments.”

The remaining $2 million will support planning for One Health Airdrie’s integrated primary and urgent care facility. The operating model, approved last fall, will see One Health Airdrie as the primary care operator, while urgent care services will be publicly funded and operated by a provider selected through a competitive process.

“Our new Airdrie facility, offering integrated primary and urgent care, will provide same-day access to approximately 30,000 primary care patients and increase urgent care capacity by around 200 per cent, benefiting the entire community and surrounding areas. We are very excited.”

Alberta’s government will continue to make smart, strategic investments in health facilities to support the delivery of publicly funded health programs and services to ensure Albertans have access to the care they need, when and where they need it.

Budget 2025 is meeting the challenge faced by Alberta with continued investments in education and health, lower taxes for families and a focus on the economy.

Quick facts

- The $2 million in planning funds for One Health Airdrie are part of a total $24-million investment to advance planning on several health capital initiatives across the province through Budget 2025.

- Alberta’s population is growing, and visits to emergency departments are projected to increase by 27 per cent by 2038.

- Last year, Alberta’s government provided $8.4 million for renovations to the existing Airdrie Community Health Centre.

Related information

-

Alberta2 days ago

Alberta2 days agoAlberta Institute urging Premier Smith to follow Saskatchewan and drop Industrial Carbon Tax

-

Health2 days ago

Health2 days agoHow the once-blacklisted Dr. Jay Bhattacharya could help save healthcare

-

Alberta2 days ago

Alberta2 days agoAlbertans have contributed $53.6 billion to the retirement of Canadians in other provinces

-

Alberta17 hours ago

Alberta17 hours agoProvince announces plans for nine new ‘urgent care centres’ – redirecting 200,000 hospital visits

-

Energy2 days ago

Energy2 days agoPoll: Majority says energy independence more important than fighting climate change

-

Business1 day ago

Business1 day agoFeds Spent Roughly $1 Billion To Conduct Survey That Could’ve Been Done For $10,000, Musk Says

-

Health1 day ago

Health1 day agoRFK Jr. Drops Stunning Vaccine Announcement

-

Alberta23 hours ago

Alberta23 hours agoPhoto radar to be restricted to School, Playground, and Construction Zones as Alberta ends photo radar era