Alberta

Pot Meet Kettle – Group points out hypocrisy in opposition to Smith’s Alberta Sovereignty Act

News release from Free Alberta Strategy

Earlier this week, the UCP leadership candidates running to be Premier participated in their final debate before voting gets underway.

Once again, our Free Alberta Strategy and our Alberta Sovereignty Act were featured heavily, but this time something else caught our eye too.

Throughout the campaign, some of the harshest critics of the Alberta Sovereignty Act have been candidates Travis Toews and Rebecca Schulz, who say that it’s “nuts” for Alberta to do anything that might be unconstitutional, and that such actions would create economic “chaos.”

But, as was revealed during the debate, apparently both candidates actually have no problem doing unconstitutional things…

Travis Toews has, right in his campaign platform, a plan to impose tariffs on goods and services from parts of Canada “deemed hostile to Alberta”.

That’s a clearly unconstitutional proposal, that would certainly cause economic “chaos”, and yet Toews seems perfectly fine with that when it’s *his* idea.

Schulz, meanwhile, is proposing to use the “turn off the taps” legislation to punish other Provinces.

Again, this is clearly unconstitutional, and certain to cause economic “chaos”, and yet Schulz is fine with that as long as it’s *her* idea.

Both of these policies would be a direct violation of section 121 of the Constitution, which states:

“All Articles of the Growth, Produce, or Manufacture of any one of the Provinces shall, from and after the Union, be admitted free into each of the other Provinces.”

This means that arbitrarily setting tariffs on goods from hostile regions, whether justified or not, is clearly a contravention of the constitution.

Now, this isn’t to say that neither Toews nor Schulz are wrong to make these suggestions – it’s vital for Alberta to stand up for itself, and these policies may well help us do so!

But isn’t it interesting that they’re in favour of unconstitutional “chaos-creating” ideas, as long as they’re the ones proposing them?

It’s almost as if it’s more about politics than about implementing the best policies to protect Alberta’s interests.

The Sovereignty Act is a tool to be used to keep the federal government in its lane.

It forms just one piece of our detailed, well-thought-through Free Alberta Strategy, which all works together to help promote Alberta’s interests.

It isn’t a solitary line in a campaign platform, or a talking point to be used at a debate.

It’s a full, 48-page, detailed report that proposes a series of initiatives the Alberta government could implement today, without needing any permission from Ottawa, to make Alberta a sovereign jurisdiction within Canada.

If you want to learn more, and help us advance Alberta’s interests, you can do so by:

- Reading the full, detailed Free Alberta Strategy here.

- Signing, and getting your family and friends to sign, our petition.

- Helping us promote and advance the cause by making a donation.

Thanks for your support, as we continue to develop and promote details solutions to the challenges facing Alberta.

Regards,

The Free Alberta Strategy Team

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

Alberta

Province to expand services provided by Alberta Sheriffs: New policing option for municipalities

Expanding municipal police service options |

Proposed amendments would help ensure Alberta’s evolving public safety needs are met while also giving municipalities more options for local policing.

As first announced with the introduction of the Public Safety Statutes Amendment Act, 2024, Alberta’s government is considering creating a new independent agency police service to assume the police-like duties currently performed by Alberta Sheriffs. If passed, Bill 49 would lay additional groundwork for the new police service.

Proposed amendments to the Police Act recognize the unique challenges faced by different communities and seek to empower local governments to adopt strategies that effectively respond to their specific safety concerns, enhancing overall public safety across the province.

If passed, Bill 49 would specify that the new agency would be a Crown corporation with an independent board of directors to oversee its day-to-day operations. The new agency would be operationally independent from the government, consistent with all police services in Alberta. Unlike the Alberta Sheriffs, officers in the new police service would be directly employed by the police service rather than by the government.

“With this bill, we are taking the necessary steps to address the unique public safety concerns in communities across Alberta. As we work towards creating an independent agency police service, we are providing an essential component of Alberta’s police framework for years to come. Our aim is for the new agency is to ensure that Albertans are safe in their communities and receive the best possible service when they need it most.”

Additional amendments would allow municipalities to select the new agency as their local police service once it becomes fully operational and the necessary standards, capacity and frameworks are in place. Alberta’s government is committed to ensuring the new agency works collaboratively with all police services to meet the province’s evolving public safety needs and improve law enforcement response times, particularly in rural communities. While the RCMP would remain the official provincial police service, municipalities would have a new option for their local policing needs.

Once established, the agency would strengthen Alberta’s existing policing model and complement the province’s current police services, which include the RCMP, Indigenous police services and municipal police. It would help fill gaps and ensure law enforcement resources are deployed efficiently across the province.

Related information

-

illegal immigration2 days ago

illegal immigration2 days agoDespite court rulings, the Trump Administration shows no interest in helping Abrego Garcia return to the U.S.

-

2025 Federal Election16 hours ago

2025 Federal Election16 hours agoRCMP Whistleblowers Accuse Members of Mark Carney’s Inner Circle of Security Breaches and Surveillance

-

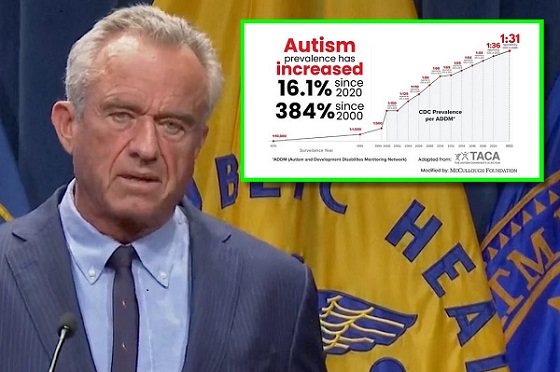

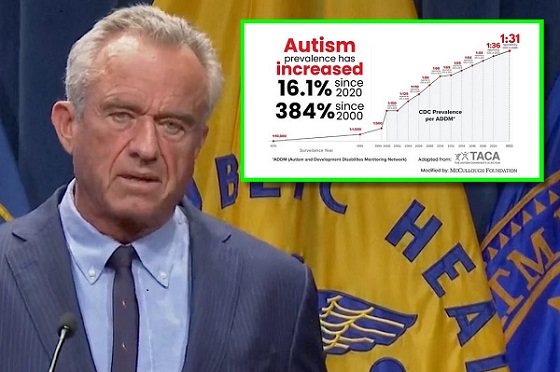

Autism13 hours ago

Autism13 hours agoRFK Jr. Exposes a Chilling New Autism Reality

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoConservative MP Leslyn Lewis warns Canadian voters of Liberal plan to penalize religious charities

-

International12 hours ago

International12 hours agoUK Supreme Court rules ‘woman’ means biological female

-

Education2 days ago

Education2 days agoSchools should focus on falling math and reading skills—not environmental activism

-

Health12 hours ago

Health12 hours agoWHO member states agree on draft of ‘pandemic treaty’ that could be adopted in May

-

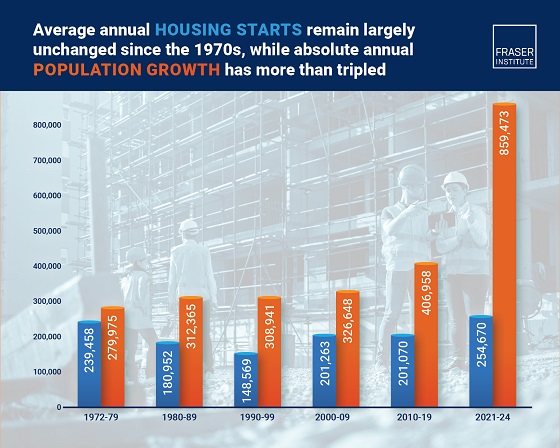

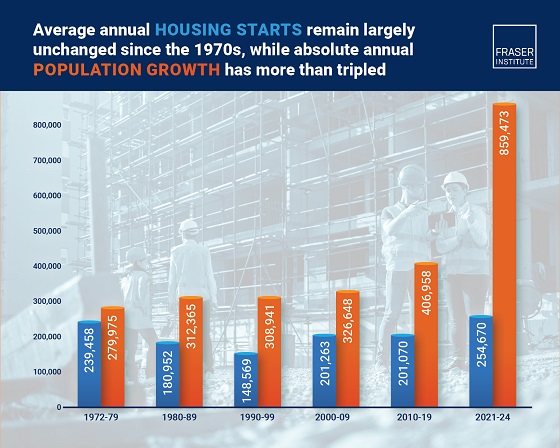

2025 Federal Election2 days ago

2025 Federal Election2 days agoHousing starts unchanged since 1970s, while Canadian population growth has more than tripled