Uncategorized

Pope accepts Washington cardinal’s resignation amid scandal

VATICAN CITY — Pope Francis accepted the resignation Friday of Washington Cardinal Donald Wuerl after he became entangled in two major sexual abuse and

But in a letter released by Wuerl’s office, Francis praised his longtime ally and suggested Wuerl had unfairly become a scapegoat, having made some “mistakes” in handling sex abuse cases, but not having covered them up.

With the resignation, Wuerl becomes the most prominent head to roll in the scandal roiling the Catholic Church after his predecessor as Washington archbishop, Theodore McCarrick, was forced to resign as cardinal over allegations he sexually abused at least two minors and adult seminarians.

A Vatican statement Friday said Francis had accepted Wuerl’s resignation, but named no replacement; in his letter, the pope asked him to stay on in a temporary capacity until a new archbishop is found.

The decision came after months in which Wuerl, who turns 78 in November, initially downplayed the scandal, insisted on his own good record, but then progressively came to the conclusion that he could no longer lead the archdiocese.

“The Holy Father’s decision to provide new leadership to the Archdiocese can allow all of the faithful, clergy, religious and lay, to focus on healing and the future,” Wuerl said in a statement Friday. “Once again for any past errors in judgment I apologize and ask for pardon.”

In his letter accepting the resignation, Francis said he recognized that in asking to retire, Wuerl had put the interests and unity of his flock ahead of his own ambitions, as all shepherds must do.

“You have sufficient elements to justify your actions and distinguish between what it means to cover up crimes or not to deal with problems, and to commit some mistakes,” Francis wrote. “However, your nobility has led you not to choose this way of

Wuerl had submitted his resignation to Francis nearly three years ago, when he turned 75, the normal retirement age for bishops. But Francis kept him on, as popes tend to do with able-bodied bishops who share their pastoral priorities.

But a grand jury report issued in August on rampant sex abuse in six Pennsylvania dioceses accused Wuerl of helping to protect some child-molesting priests while he was bishop of Pittsburgh from 1988 to 2006. Simultaneously, Wuerl faced widespread skepticism over his insistence that he knew nothing about years of alleged sexual misconduct by McCarrick.

Wuerl has not been charged with any wrongdoing but was named numerous times in the grand jury report, which details instances in which he allowed priests accused of misconduct to be reassigned or reinstated.

In one case cited in the report, Wuerl — acting on a doctor’s recommendation — enabled priest William O’Malley to return to active ministry as a canonical consultant in 1998 despite allegations of abuse lodged against him in the past and his own admission that he was sexually interested in adolescents. Years later, according to the report, six more people alleged that they were sexually assaulted by O’Malley, in some cases after he had been reinstated.

In another case, Wuerl returned a priest to active ministry in 1995 despite having received multiple complaints that the priest, George Zirwas, had molested boys in the late 1980s.

Wuerl apologized for the damage inflicted on the victims but also defended his efforts to combat clergy sex abuse.

His defenders have cited a case that surfaced in 1988, when a 19-year-old former seminarian, Tim Bendig, filed a lawsuit accusing a priest, Anthony Cipolla, of molesting him. Wuerl initially questioned Bendig’s account but later accepted it and moved to oust Cipolla from the priesthood. The Vatican’s highest court ordered Wuerl to restore Cipolla to priestly ministry, but Wuerl resisted and, after two years of legal procedures, prevailed in preventing Cipolla’s return.

“No bishop or cardinal in the nation has had a more consistent and courageous record than Donald Wuerl in addressing priestly sexual abuse,” contends Bill Donahue, president of the Catholic League.

Wuerl’s archdiocese issued a series of similar plaudits on Friday, coinciding with the Vatican announcement. They included a letter from the archdiocesan chancellor Kim Vitti Fiorentino, who lamented that Wuerl’s “pioneering leadership in the enhancement, implementation and enforcement of historically innovative child protection policies was overshadowed by the (Pennsylvania grand jury) report’s flaws and its interpretation by the media.”

A joint statement by Washington auxiliary bishops also praised Wuerl for his service and pastoral care and said his decision to step down was a “clear manifestation of his love and concern for the people of the archdiocese.”

The Rev. Thomas Reese, a Jesuit priest who writes for Religion News Service, described Wuerl as an ideological moderate.

“He was totally enthusiastic about John Paul II, and then Pope Benedict, and now he’s totally enthusiastic about Pope Francis,” Reese said. “There are not many people in the church who are totally enthusiastic about all three of them.”

Numerous conservative Catholic activists and commentators, though, considered him too tolerant of the LGBT community and too liberal on some other issues. They resented his pivotal role a decade ago in resisting a push by some of his fellow bishops to deny Communion to Catholic politicians who support the right to abortion.

Survivor advocate David Clohessy of the group SNAP said Wuerl’s “long-overdue” resignation might give solace to victims. But he said it would likely do little to deter others in the hierarchy from covering up for abusers.

“But if archaic, predatory-friendly laws were reformed and if more prosecutors showed real courage, these complicit clerics might face criminal charges, and that might make a real difference,” he said in a statement.

Wuerl was born in Pittsburgh, attended Catholic University in Washington and received a doctorate in theology from the University of Saint Thomas in Rome. He joined the priesthood in 1966, was ordained a bishop by Pope John Paul II in 1986, and served briefly as auxiliary bishop in Seattle before going to Pittsburgh.

___

Crary reported from New York.

David Crary And Nicole Winfield, The Associated Press

Uncategorized

Cost of bureaucracy balloons 80 per cent in 10 years: Public Accounts

The cost of the bureaucracy increased by $6 billion last year, according to newly released numbers in Public Accounts disclosures. The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to immediately shrink the bureaucracy.

“The Public Accounts show the cost of the federal bureaucracy is out of control,” said Franco Terrazzano, CTF Federal Director. “Tinkering around the edges won’t cut it, Carney needs to take urgent action to shrink the bloated federal bureaucracy.”

The federal bureaucracy cost taxpayers $71.4 billion in 2024-25, according to the Public Accounts. The cost of the federal bureaucracy increased by $6 billion, or more than nine per cent, over the last year.

The federal bureaucracy cost taxpayers $39.6 billion in 2015-16, according to the Public Accounts. That means the cost of the federal bureaucracy increased 80 per cent over the last 10 years. The government added 99,000 extra bureaucrats between 2015-16 and 2024-25.

Half of Canadians say federal services have gotten worse since 2016, despite the massive increase in the federal bureaucracy, according to a Leger poll.

Not only has the size of the bureaucracy increased, the cost of consultants, contractors and outsourcing has increased as well. The government spent $23.1 billion on “professional and special services” last year, according to the Public Accounts. That’s an 11 per cent increase over the previous year. The government’s spending on professional and special services more than doubled since 2015-16.

“Taxpayers should not be paying way more for in-house government bureaucrats and way more for outside help,” Terrazzano said. “Mere promises to find minor savings in the federal bureaucracy won’t fix Canada’s finances.

“Taxpayers need Carney to take urgent action and significantly cut the number of bureaucrats now.”

Table: Cost of bureaucracy and professional and special services, Public Accounts

| Year | Bureaucracy | Professional and special services |

|

$71,369,677,000 |

$23,145,218,000 |

|

|

$65,326,643,000 |

$20,771,477,000 |

|

|

$56,467,851,000 |

$18,591,373,000 |

|

|

$60,676,243,000 |

$17,511,078,000 |

|

|

$52,984,272,000 |

$14,720,455,000 |

|

|

$46,349,166,000 |

$13,334,341,000 |

|

|

$46,131,628,000 |

$12,940,395,000 |

|

|

$45,262,821,000 |

$12,950,619,000 |

|

|

$38,909,594,000 |

$11,910,257,000 |

|

|

$39,616,656,000 |

$11,082,974,000 |

Uncategorized

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

-

Business1 day ago

Business1 day agoFederal major projects list raises questions

-

COVID-192 days ago

COVID-192 days agoCrown seeks to punish peaceful protestor Chris Barber by confiscating his family work truck “Big Red”

-

Health2 days ago

Health2 days agoOrgan donation industry’s redefinitions of death threaten living people

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoGoogle denies scanning users’ email and attachments with its AI software

-

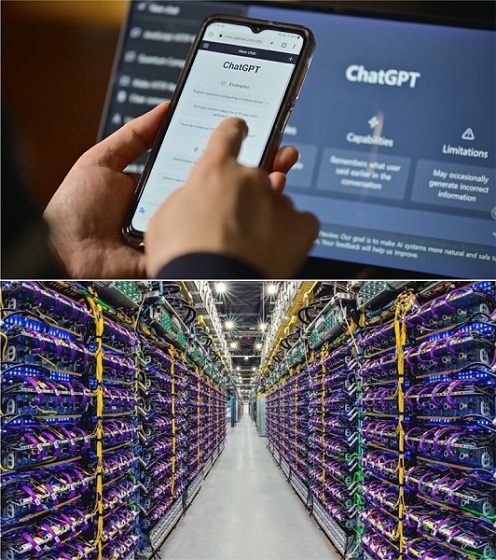

Artificial Intelligence22 hours ago

Artificial Intelligence22 hours agoTrump’s New AI Focused ‘Manhattan Project’ Adds Pressure To Grid

-

Business2 days ago

Business2 days agoBlacked-Out Democracy: The Stellantis Deal Ottawa Won’t Show Its Own MPs

-

International13 hours ago

International13 hours agoAfghan Ex–CIA Partner Accused in D.C. National Guard Ambush

-

Agriculture1 day ago

Agriculture1 day agoHealth Canada indefinitely pauses plan to sell unlabeled cloned meat after massive public backlash