Business

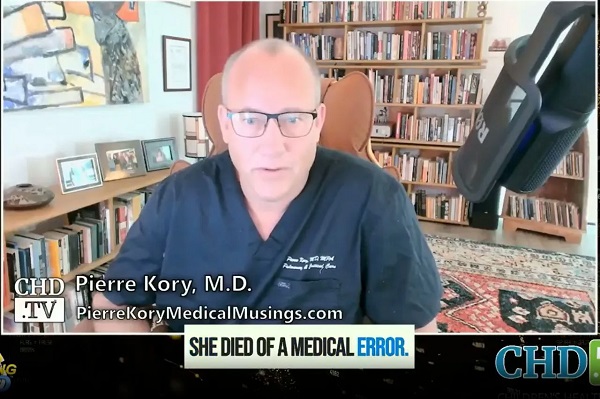

Planet Fitness says ‘discomfort’ not a reason to ban ‘transgender’ men from women’s locker rooms

From LifeSiteNews

The company’s stock plummeted after it terminated a member who exposed a man shaving in a woman’s locker room in front of a girl estimated to be around 12 years old.

Popular exercise chain Planet Fitness is doubling down on its prioritization of “gender identity” over female customers’ welfare, putting in writing that “discomfort” over sharing intimate facilities with the opposite sex should not be accommodated.

Planet Fitness, which for years has allowed gender-confused men in women’s locker rooms, came back in the news this month when an Alaskan Planet Fitness member named Patricia Silva shared online a video she took of a man who “identifies” as a woman shaving in a women’s locker room. She said that at the time of the incident, a girl estimated to be 12 years old was sitting in a corner, wrapped in a towel, and “freaked out” by having an adult male in her changing area.

In accordance with the company’s woke priorities, however, instead of removing the man, Planet Fitness revoked Silva’s membership, citing her violation of a policy against photographing other gym members.

“So, I would like for you women to stand up and have a voice and stop these shenanigans,” Silva said. “You have authority! Use your authority.”

Since the story broke, Planet Fitness’s stock price has dropped from $66.92 on March 7 to $56.46 on March 19. “The chain saw a $400 million dive in valuation from $5.3 billion to $4.9 billion,” Fox Business reported Thursday.

But the company is digging in its heels.

Chief corporate affairs officer McCall Gosselin told the Christian Post that the policy is part of the company’s vision of an “inclusive environment,” and that its “gender identity non-discrimination policy states that members and guests may use the gym facilities that best align with their sincere, self-reported gender identity.” The company also said that members claiming trans status may only be asked to leave “if it is confirmed that a member is acting in bad faith” and is not sincerely gender confused.

Libs of TikTok also shared a page from Planet Fitness’s operations manual, which states that “Some members may feel uncomfortable with a transgender member using the same locker room facilities, bathrooms, showers, or other facilities/programs separated by sex,” but “this discomfort is not a reason to deny access to the transgender members.” It calls on staff to resolve such situations by attempting to “foster a climate of understanding,” i.e., transgender accommodation.

The company “reserves the right to terminate a person’s membership immediately for any violation of this policy,” which also requires staff (but not explicitly members) to honor preferred names and gender pronouns.

WOW. Planet Fitness is standing by their decision to allow men in women's locker rooms.

Their policies actually allow males in female spaces. They instruct women to just deal with their discomfort and make sure not to misgender the trans person in their locker room.… https://t.co/1fA52PY21Q pic.twitter.com/wl5ZCxMtVs

— Libs of TikTok (@libsoftiktok) March 15, 2024

Conservatives have long argued that forcing girls to share intimate facilities such as bathrooms, showers, or changing areas with members of the opposite sex violates their privacy rights, subjects them to needless emotional stress, and gives potential male predators a viable pretext to enter female bathrooms or lockers by simply claiming transgender status. (Planet Fitness ostensibly accounts for the last danger by reserving the right to eject men who are only faking gender confusion, but in practice such a policy is unlikely to be enforced for fear of being branded “intolerant” and the difficulty of proving what may be going on in someone’s mind.)

The harm has been highlighted by University of Pennsylvania swimmer William “Lia” Thomas, who reportedly retains male genitalia and is still attracted to women yet “identifies” as female and lesbian, causing his female teammates unrest due to sharing lockers with them; and by Loudoun County Public Schools in Virginia, where a female student was raped by a “transgender” classmate in a girls bathroom.

2025 Federal Election

Alcohol tax and MP pay hike tomorrow (April 1)

The Canadian Taxpayers Federation is calling on all party leaders to stop a pair of bad policies that are scheduled to happen automatically on April 1: pay raises for members Parliament and another alcohol tax increase.

“Party leaders owe taxpayers answers to these two questions: Why do you think you deserve a pay raise and why should Canadians pay higher taxes on beer and wine?” said Franco Terrazzano, CTF Federal Director. “Politicians don’t deserve a raise while millions of Canadians are struggling.

“And the last thing Canadians need is another tax hike when they pour a cold one or uncork a bottle with that special someone.”

MPs give themselves pay raises each year on April 1, based on the average annual increase in union contracts with corporations with 500 or more employees.

The CTF estimates tomorrow’s pay raise will amount to an extra $6,200 for backbench MPs, $9,200 for ministers and $12,400 for the prime minister, based on contract data published by the federal government.

After tomorrow’s pay raise, backbench MPs will receive a $209,300 annual salary, according to CTF estimates. A minister will collect $309,100 and the prime minister will take home $418,600.

Meanwhile, the alcohol escalator automatically increases excise taxes on beer, wine and spirits every year on April 1, without a vote in Parliament. Alcohol taxes will increase by two per cent tomorrow, costing taxpayers about $40 million this year, according to Beer Canada estimates.

The alcohol escalator tax has cost taxpayers more than $900 million since it was imposed in 2017, according to Beer Canada estimates.

“Politicians are padding their pockets on the same day they’re raising beer taxes and that’s wrong,” Terrazzano said. “If party leaders want to prove they care about taxpayers, they should stop the MP pay raises.

“And if party leaders care about giving Canadian brewers, distillers and wineries a fighting chance against tariffs, it’s time to stop hitting them with alcohol tax hikes year after year.”

The CTF released Leger polling showing 79 per cent of Canadians oppose tomorrow’s MP pay raise.

2025 Federal Election

Poilievre To Create ‘Canada First’ National Energy Corridor

From Conservative Party Communications

Poilievre will create the ‘Canada First’ National Energy Corridor to rapidly approve & build the infrastructure we need to end our energy dependence on America so we can stand up to Trump from a position of strength.

Conservative Leader Pierre Poilievre announced today he will create a ‘Canada First’ National Energy Corridor to fast-track approvals for transmission lines, railways, pipelines, and other critical infrastructure across Canada in a pre-approved transport corridor entirely within Canada, transporting our resources within Canada and to the world while bypassing the United States. It will bring billions of dollars of new investment into Canada’s economy, create powerful paycheques for Canadian workers, and restore our economic independence.

“After the Lost Liberal decade, Canada is poorer, weaker, and more dependent on the United States than ever before,” said Poilievre. “My ‘Canada First National Energy Corridor’ will enable us to quickly build the infrastructure we need to strengthen our country so we can stand on our own two feet and stand up to the Americans.”

In the corridor, all levels of government will provide legally binding commitments to approve projects. This means investors will no longer face the endless regulatory limbo that has made Canadians poorer. First Nations will be involved from the outset, ensuring that economic benefits flow directly to them and that their approval is secured before any money is spent.

Between 2015 and 2020, Canada cancelled 16 major energy projects, resulting in a $176 billion hit to our economy. The Liberals killed the Energy East pipeline and passed Bill C-69, the “No-New-Pipelines” law, which makes it all but impossible to build the pipelines and energy infrastructure we need to strengthen the Canadian economy. And now, the PBO projects that the ‘Carney cap’ on Canadian energy will reduce oil and gas production by nearly 5%, slash GDP by $20.5 billion annually, and eliminate 54,400 full-time jobs by 2032. An average mine opening lead time is now nearly 18 years—23% longer than Australia and 38% longer than the US. As a result of the Lost Liberal Decade, Canada now ranks 23rd in the World Bank’s Ease of Doing Business Index for 2024, a seven-place drop since 2015.

“In 2024, Canada exported 98% of its crude oil to the United States. This leaves us too dependent on the Americans,” said Poilievre. “Our Canada First National Energy Corridor will get us out from under America’s thumb and enable us to build the infrastructure we need to sell our natural resources to new markets, bring home jobs and dollars, and make us sovereign and self-reliant to stand up to Trump from a position of strength.”

Mark Carney’s economic advice to Justin Trudeau made Canada weaker while he and his rich friends made out like bandits. While he advised Trudeau to cancel Canadian energy projects, his own company spent billions on pipelines in South America and the Middle East. And unlike our competitors Australia and America, which work with builders to get projects approved, Mark Carney and Steven Guilbeault’s radical “keep-it-in-the-ground” ideology has blocked development, killed jobs, and left Canada dependent on foreign imports.

“The choice is clear: a fourth Liberal term that will keep our resources in the ground and keep us weak and vulnerable to Trump’s threats, or a strong new Conservative government that will approve projects, build an economic fortress, bring jobs and dollars home, and put Canada First—For a Change.”

-

Business1 day ago

Business1 day agoCuba has lost 24% of it’s population to emigration in the last 4 years

-

2025 Federal Election24 hours ago

2025 Federal Election24 hours ago2025 Federal Election Interference from China! Carney Pressed to Remove Liberal MP Over CCP Bounty Remark

-

Uncategorized23 hours ago

Uncategorized23 hours agoPoilievre on 2025 Election Interference – Carney sill hasn’t fired Liberal MP in Chinese election interference scandal

-

Business2 days ago

Business2 days agoTariff-driven increase of U.S. manufacturing investment would face dearth of workers

-

Economy2 days ago

Economy2 days agoClearing the Path: Why Canada Needs Energy Corridors to Compete

-

International1 day ago

International1 day agoTrump signs executive order to make Washington D.C. “safe and beautiful”

-

Media1 day ago

Media1 day agoTop Five Huge Stories the Media Buried This Week

-

2025 Federal Election24 hours ago

2025 Federal Election24 hours ago2025 Election Interference – CCP Bounty on Conservative Candidate – Carney Says Nothing