MacDonald Laurier Institute

Peterson’s case demonstrates where professional regulators have gone astray

From the Macdonald Laurier Institute

By Stéphane Sérafin

Professional regulators are losing sight of the purpose their disciplinary authority is supposed to serve, to protect society by preserving professional competence.

Members of restricted professions – doctors, lawyers, accountants and psychologists, among others – are subject to the disciplinary authority of their respective professional regulators. This arrangement is intended to ensure a minimum level of professional competence and to protect those relying on these professional services.

This has obvious advantages over purely market mechanisms, at least in theory, owing to the fact that professional regulators can set standards for members that apply before a member has engaged in serious professional misconduct. However, professional regulators have attracted significant controversy in Canada over the past few years as attempts to police members’ off-duty speech and conduct have become a recurring news item.

The problem is that professional regulators are losing sight of the purpose their disciplinary authority is supposed to serve – to protect society by preserving professional competence – and are policing members values for the sake of perceived reputational interests.

While it is tempting to conclude that the difficulties in these controversial cases arise from straightforward regulatory overreach, the problem is more complex. The fact is that regulators have always had the ability to police off-duty conduct, and for good reason, since such conduct may bear directly upon member competence. It is not that regulators are suddenly policing off-duty conduct which used to fall entirely outside their purview, but that the kinds of expression they are trying to censor are no longer focused on protecting society from an incompetent professional but on protecting themselves and their colleagues from association with political views which they find distasteful.

Professional regulators should reverse course, return to their mandates, and focus on ensuring professional competence, not political alignment, among their members.

Consider the best-known Canadian controversy concerning former University of Toronto professor-turned-social-media-influencer Jordan Peterson. As a member of the College of Psychologists of Ontario, Peterson was ordered to undergo social media training following complaints that his social media posts were discriminatory and unprofessional. The College felt that it could make such an order against Peterson without subjecting him to a full disciplinary procedure. It also felt that it could do so solely on the basis of complaints that did not originate with his clients, but arose out of positions that he had publicly staked out on controversial political and cultural issues.

When Peterson challenged the decision through a judicial process, the Ontario Divisional Court found that the College’s decision was reasonable. The Court was of the view that professional regulators had always held the requisite jurisdiction to police member expression, even when that expression did not arise in the context of a member’s strict professional activities. This included the capacity to police expression considered “discriminatory”. Moreover, it was thought to be enough that the expression might adversely impact the reputation of the psychology profession.

The principles invoked by the Divisional Court in this case are difficult to contest in the abstract. To recognize the authority of a professional regulator over a given profession, rather than relying on market mechanisms to ensure basic competence, means that the professional regulator must take a broad view of the kind of conduct that could fall within its ambit.

It would be difficult to claim that the off-duty conduct of a member is entirely without interest for professional regulators, since such conduct can be relevant to determining whether a particular person is fit to remain a member in good standing. An individual who commits a sexual assault outside of work hours, for example, is probably not fit to act as a clinical psychologist, just as someone who embezzles funds in a context divorced from his or her work should probably not be allowed to operate a trust account as a lawyer. No doubt, certain forms of expression that are not directly connected to the member’s professional activities – defaming others, threatening violence, or airing confidential information other than client information – raise similar concerns.

Criminal and civil court processes are not designed to address these concerns, since their purpose is to establish a criminal infringement of community norms and civil liability towards another person, respectively. Not all criminal acts or civil wrongs necessarily impugn a member’s professional competence, and conversely, there may be grounds to sanction a member where the threshold for criminal or civil liability has not been met.

But to say that professional regulators ought to have jurisdiction over the off-duty conduct of their members is one thing; to determine what type of off-duty conduct, specifically, properly attracts their disciplinary jurisdiction is another. The trouble with the Peterson case, as with many of the other recent Canadian controversies, is that the justification offered for the exercise of professional regulatory jurisdiction does not fit the paradigm offered by the examples just referenced, in which the off-duty conduct, including off-duty expression, can be taken to cast doubt on the member’s ability to carry out his or her profession. Instead, these cases present the regulation of off-duty expression by regulators in a manner analogous to the employment context, where the concern is not with the protection of the public interest, but in allowing employers to preserve their own reputation and to avoid vicarious liability for the acts of subordinates.

The view suggested by the Divisional Court in the Peterson case – that professional regulators are simply doing what they have always done – misses the widening focus of regulators beyond professional competence. This widening focus has been precipitated by at least two factors.

First, technological shifts have significantly altered the balance of power between professional regulators and individual members of the public. In an era of social media, an opinion that would have once been expressed to a small audience now finds itself exposed in some cases to an audience of millions. The possibility that someone, somewhere, will find offense, or decide to find offence, with the expression of opinions grows with the scope of the audience. Moreover, the nature of social media is such that any member of that audience can react, in real time, individually or in concert with others, to the opinion being expressed. This means that potentially every public utterance, whether reasonable or not, creates a reputational risk not just for the individual member, but also for the broader profession. Professional regulators are unsurprisingly concerned by this possibility, which affects their own vested interests.

Second, and perhaps more importantly still, broader cultural shifts have also significantly altered the kinds of expressive content that regulators are likely to treat as “unprofessional” or otherwise raising reputational concerns.

Consider another decision, Simone v. Law Society of Ontario, which was narrowly decided by the Law Society of Ontario Tribunal (the body charged with adjudicating complaints against Ontario lawyers and paralegals). In that case, Lisa Simone, an individual seeking membership in the Law Society of Ontario as a paralegal, was subject to “good character review” because of social media posts that she had made which were, among other things, critical of vaccine mandates, the Black Lives Matter organization, and “pride” events. While the Tribunal ultimately decided in favour of the candidate’s good character, and thus her admission as a paralegal, a majority did so apparently on the sole basis that the candidate had expressed remorse for the social media posts in question.

As with the Peterson case, the comments that landed Simone into trouble were associated with positions on the “right” of the political spectrum. They were also brought to the attention of the Law Society through complaints by members of the general public, and were used against her outside of a formal disciplinary proceeding. In other words, this was also not a classic case involving a disciplinary proceeding brought for off-duty conduct that undermined confidence in Simone’s ability to work as a paralegal. Rather, the concern was that the social media posts themselves reflected poorly upon the profession, not just because of their tone (though this was the formal argument made against Ms. Simone’s accreditation) but also, ostensibly, because of their content. This appears to be why the majority in that case repeatedly reaffirmed Ms. Simon’s obligation to comply with human rights laws, as though the mere expression of views critical of vaccine mandates, the Black Lives Matter organization, and “pride” events might infringe those obligations.

To say that professional regulators appear increasingly concerned with the reputational interest of their profession is, in this context, to say that professional regulators appear increasingly concerned with the appearance of complying with narrow cultural and political orthodoxies. These are “orthodoxies”, since they are views that are now largely taken for granted among much of the professional class, or at least among those individuals who are most likely to staff professional regulators and make decisions concerning member conduct.

Where a member of a restricted profession expresses personal viewpoints at odds with these admissible perspectives, the concern is not that the member lacks the requisite competence to exercise their role. Rather, the concern is that the mere expression of these views is “unprofessional”, in the sense that they are potentially damaging, or at least embarrassing, to the profession. That is, the expression of this views is “unprofessional”, owing to the fact that the member’s personal opinions are at odds with the values that the regulator thinks the profession should embrace.

That said, while the opinions that have run afoul of professional regulators have typically been associated with the “right” of the political spectrum – as in the Peterson and Simone cases – there have also been cases in which the authority of professional regulators has been invoked to punish those expressing views more typically associated with the “left”. In one particularly notable incident after the October 7 attacks on Israel by Hamas, students enrolled at the Faculty of Law at Toronto Metropolitan University (formerly Ryerson University) circulated a letter that purported to express solidarity with Palestinians, but also included language referencing a right of “resistance”. Many in the legal profession interpreted the letter as condoning the October 7 terrorist attacks. This prompted calls to deny the students articling positions (a requirement of lawyer licensing in Ontario) and potentially to deny them accreditation altogether.

This and similar cases that have arisen since October 7 may well suggest that the phenomenon that has until recently targeted mostly “right”-coded political opinions may now be weaponized by either side of the political spectrum.

What each of these cases undoubtedly serve to highlight, in any event, is a need to recover the importance of professional competence as the aim of regulators. Ensuring professional competence is the very reason for which professional regulation exists, and why determinations as to who can exercise these particular professions are not left solely to the market.

Canadians need professional regulators to return to their mandate: ensuring a minimum level of professional competence and protecting those relying on professional services. Regulators should not concern themselves with whether the opinions expressed by members are potentially embarrassing because they happen to fall outside the “values” that regulators believe professionals should embrace.

Stéphane Sérafin is an assistant professor in the French Common Law Program at the University of Ottawa.

MacDonald Laurier Institute

Rushing to death in Canada’s MAiD regime

By Ramona Coelho for Inside Policy

By Ramona Coelho for Inside Policy

Canada legalized Medical Assistance in Dying (MAiD) in 2016, encompassing both euthanasia and assisted suicide. Initially limited to those nearing their natural death, eligibility expanded in 2021 to individuals with physical disabilities, with eligibility for individuals with mental illness in 2027. Parliamentary recommendations include MAiD for children. A recent federal consultation explored extending MAiD to those who lack capacity via advance directives, an approach Quebec has already adopted, despite its criminal status under federal law.

Despite its compassionate framing, investigative journalists and government reports reveal troubling patterns where inadequate exploration of reversible suffering – such as lack of access to medical treatments, poverty, loneliness, and feelings of being a burden – have driven Canadians to choose death. As described by our former Disability Inclusion Minister, Canada’s system at times makes it easier to access MAiD than to receive basic care like a wheelchair. With over 60,000 MAiD cases by the end of 2023, the evidence raises grave concerns about Canada’s MAiD regime.

I am a member of Ontario’s MAiD Death Review Committee (MDRC). Last year, the Chief Coroner released MDRC reports, and a new set of reports has just been published. The first report released by the Office of the Chief Coroner, Waivers of Final Consent, examines how individuals in Track 1 (reasonably foreseeable natural death) can sign waivers to have their lives ended even if they lose the capacity to consent by the scheduled date of MAiD. The second, Navigating Complex Issues within Same Day and Next Day MAiD Provisions, includes cases where MAiD was provided on the same day or the day after it was requested. These reports raise questions about whether proper assessments, thorough exploration of suffering, and informed consent were consistently practised by MAiD clinicians. While MDRC members hold diverse views, here is my take.

Rushing to death, Ignoring Reversible Causes of Suffering

In the same-day or next-day MAiD report, Mrs. B, in her 80s, after complications from surgery, opted for palliative care, leading to discharge home. She later requested a MAiD assessment, but her assessor noted she preferred palliative care based on personal and religious values. The next day, her spouse, struggling with caregiver burnout, took her to the emergency department, but she was discharged home. When a request for hospice palliative care was denied, her spouse contacted the provincial MAiD coordination service for an urgent assessment. A new assessor deemed her eligible for MAiD, despite concerns from the first practitioner, who questioned the new assessor on the urgency, the sudden shift in patient perspective, and the influence of caregiver burnout. The initial assessor requested an opportunity for re-evaluation, but this was denied, with the second assessor deeming it urgent. That evening, a third MAiD practitioner was brought in, and Mrs. B underwent MAiD that night.

The focus should have been on ensuring adequate palliative care and support for Mrs. B and her spouse. Hospice and palliative care teams should have been urgently re-engaged, given the severity of the situation. Additionally, the MAiD provider expedited the process despite the first assessor’s and Mrs. B’s concerns without fully considering the impact of her spouse’s burnout.

The report also has worrying trends suggesting that local medical cultures—rather than patient choice—could be influencing rushed MAiD. Geographic clustering, particularly in Western Ontario, where same-day and next-day MAiD deaths occur most frequently, raises concerns that some MAiD providers may be predisposed to rapidly approve patients for quick death rather than ensuring patients have access to adequate care or exploring if suffering is remediable. This highlights a worrying trend where the speed of the MAiD provision is prioritized over patient-centered care and ethical safeguards.

MAiD without Free and Informed Choice

Consent has been central to Canadians’ acceptance of the legalization of euthanasia and assisted suicide. However, some cases in these reports point to concerns already raised by clinicians: the lack of thorough capacity assessments and concerns that individuals may not have freely chosen MAiD.

In the waiver of final consent report, Mr. B, a man with Alzheimer’s, had been approved for MAiD with such a waiver. However, by the scheduled provision date, his spouse reported increased confusion. Upon arrival, the MAiD provider noted that Mr. B no longer recognized them and so chose not to engage him in discussion at all. Without any verbal interaction to determine his current wishes or understanding, Mr. B’s life was ended.

In the same-day or next-day MAiD report, Mr. C, diagnosed with metastatic cancer, initially expressed interest in MAiD but then experienced cognitive decline and became delirious. He was sedated for pain management. Despite the treating team confirming that capacity was no longer present, a MAiD practitioner arrived and withheld sedation, attempting to rouse him. It was documented that the patient mouthed “yes” and nodded and blinked in response to questions. Based on this interaction, the MAiD provider deemed the patient to have capacity. The MAiD practitioner then facilitated a virtual second assessment, and MAiD was administered.

These individuals were not given genuine opportunities to confirm whether they wished to die. Instead, their past wishes or inquiries were prioritized, raising concerns about ensuring free and informed consent for MAiD. As early as 2020, the Chief Coroner of Ontario identified cases where patients received MAiD without well-documented capacity assessments, even though their medical records suggested they lacked capacity. Further, when Dr. Leonie Herx, past president of the Canadian Society of Palliative Medicine, testified before Parliament about MAiD frequently occurring without capacity, an MP dismissed her, advising Parliament to be cautious about considering seriously evidence under parliamentary immunities that amounted to malpractice allegations, which should be handled by the appropriate regulatory bodies or police. These dismissive comments stand in stark contrast with the gravity of assessing financial capacity, and yet the magnitude is greater when ending life. By way of comparison, for my father, an Ontario-approved capacity expert conducted a rigorous evaluation before declaring him incapable of managing his finances. This included a lengthy interview, collateral history, and review of financial documents—yet no such rigorous capacity assessment is mandated for MAiD.

What is Compassion?

While the federal government has finished its consultation on advance directives for MAiD, experts warn against overlooking the complexities of choosing death based on hypothetical suffering and no lived experience to inform those choices. A substitute decision-maker has to interpret prior wishes, leading to guesswork and ethical dilemmas. These cases highlight how vulnerable individuals, having lost the capacity to consent, may be coerced or unduly influenced to die—whether through financial abuse, caregiver burnout, or other pressures—reminding us that the stakes are high – life and death, no less.

The fundamental expectation of health care should be to rush to care for the patient, providing support through a system that embraces them—not rush them toward death without efforts to mitigate suffering or ensure free and informed consent. If we truly value dignity, we must invest in comprehensive care to prevent patients from being administered speedy death in their most vulnerable moment, turning their worst day into potentially their last.

Dr. Ramona Coelho is a family physician whose practice largely serves marginalised persons in London, Ontario. She is a senior fellow at the Macdonald-Laurier Institute and co-editor of the new book “Unravelling MAiD in Canada” from McGill University Press.

Immigration

Immigrant background checks are unrelated to national security?

By David L. Thomas for Inside Policy

By David L. Thomas for Inside Policy

Canadians are rightly under the impression that migrants have been properly vetted before coming into our country. But it’s clear we’re not living up to expectations.

A recently de-classified 2022 report of the National Security and Intelligence Review Agency (NSIRA) suggests we’ve entirely misplaced our priorities when it comes to protecting Canadians from foreigners with dangerous backgrounds. Apparently referring prospective immigrants from places in the world beset with violent extremism for deeper background checks could constitute discrimination against those individuals that is “not justifiable on security grounds.”

Arbitrary discrimination on a prohibited ground is wrong. However, it is obviously important, for example, for the government to conduct proper security checks when we admit people into Canada as immigrants. There are times when certain discrimination might be warranted.

Essentially, for fear of being accused of discrimination, our national security oversight committee has deemed that checking prospective immigrants for ties to terrorist organizations is not a matter of national security. This is plainly absurd and is a grave risk to our national security.

The decision-style report of the NSIRA tribunal related to a group of complaints before the Canadian Human Rights Tribunal (CHRT) under the Canadian Human Rights Act (CHRA). The large group of complainants were citizens of Iran seeking temporary or permanent visas to Canada and who were subjected to security background checks. They alleged discrimination on the basis of race and that the CSIS checks delayed the processing of their visa applications (reported by NSIRA as an average delay of 14 days for temporary visas and 26 days for immigration visas). Iran is a country with which we have no diplomatic relations and we have designated as a state sponsor of terrorism since 2012.

Without the resources of CSIS and a deeper security check, how could an immigration officer in the field determine if a visa applicant may have once been a member of a terrorist organization, like al-Qaeda, or a drug cartel? CSIS security checks are designed to look deeper into an individual’s background, sometimes with the co-operation of foreign spy agencies.

These complaints came across my desk in the final months of my term as the Chairperson of the CHRT. Having previously practiced immigration law for more than 20 years, I was well aware of CSIS security background checks. My expectation was that the NSIRA would recommend dismissal of the complaints because, well of course, checking whether a prospective immigrant is connected to a terrorist organization has to be related to the security of Canada, no?

Apparently not.

The CHRT complaints were suspended under a never-before-used section of the CHRA. Under Section 45, the Minister of Immigration, Refugees and Citizenship Canada gave notice “that the (alleged discriminatory) practice to which the complaint relates was based on considerations relating to the security of Canada.” Despite this notice, the Human Rights Commission declined to dismiss the complaints and instead referred the matter to the NSIRA to provide a report on the matter.

The NSIRA report was the first of its kind and acknowledged there is little legislative guidance on the nature of its role under a Section 45 referral. However, in my view, the NSIRA has usurped the role of the CHRT by determining that the criteria applied for requesting the CSIS background checks “was not justifiable on security grounds.” In my view, their determination should have been limited to only whether the alleged discriminatory practices related to national security.

Nevertheless, the complaints are now proceeding before the CHRT to determine if it was discriminatory to make referrals for security background checks.

Arbitrary discrimination is, in most cases, against the law. However, there are exceptions, and one of them is Section 45 of the CHRA which creates a “carve out” from the normal rules when a matter of national security is on the line. And yet, the NSIRA decision bizarrely set aside national security and failed to grant the exception.

Canada has drastically increased its intake of migrants in recent years. Since 2021, the annual target for permanent residents was almost doubled to 500,000. Non-immigrant foreigners, mostly students and temporary workers, accounted for 2.5 million people, or 6.2% or the population in 2023. As these are people entering Canada legally, Canadians are rightly under the impression that migrants have been properly vetted before coming into our country. But it’s clear we’re not living up to expectations.

Canada recently admitted Muhammad Shahzeb Khan from Pakistan, accused of plotting a massive attack against Jews in New York last October. When this news broke Canada was still reeling from the embarrassment of having just granted Canadian citizenship to Ahmed Fouad Mostafa Eldidi. Along with his son, Mostafa Eldidi, he was arrested in July last year as the pair was accused of being in the advanced stages of planning a violent attack on behalf of ISIS in Toronto. Apparently, Ahmed appears in a 2015 video dismembering an ISIS prisoner with a sword.

All prospective immigrants to Canada are subject to checks for past criminal activity. However, sometimes an immigration officer might flag an applicant for a security screening by the Canadian Security Intelligence Service (CSIS) to determine if a visa applicant has ties to terrorist groups, espionage, war crimes, crimes against humanity, etc.

In order to protect Canada, immigration officers in the field should have the unfettered discretion to refer any non-Canadian for a CSIS security background check. The referral is not a denial of entry into Canada. Applicants are just being asked to wait a little longer until we’re satisfied about their background. Immigration officers should not be second-guessing themselves about this discretion for fear of a human rights complaint.

Now is the time for Canada to set its priorities right. Our national security must be paramount and should not be hamstrung by unrealistic idealism.

David Thomas, a senior fellow at the Macdonald-Laurier Institute, is a lawyer and mediator in British Columbia. From 2014 to 2021, he was the chairperson of the Canadian Human Rights Tribunal.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoResearchers Link China’s Intelligence and Elite Influence Arms to B.C. Government, Liberal Party, and Trudeau-Appointed Senator

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP memo warns of Chinese interference on Canadian university campuses to affect election

-

COVID-191 day ago

COVID-191 day agoFauci, top COVID officials have criminal referral requests filed against them in 7 states

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe status quo in Canadian politics isn’t sustainable for national unity

-

Censorship Industrial Complex20 hours ago

Censorship Industrial Complex20 hours agoFormer residential school student refutes ‘genocide’ claims, recalls positive experience

-

COVID-1914 hours ago

COVID-1914 hours agoCDC Vaccine Safety Director May Have Destroyed Records, Says Sen. Ron Johnson

-

Bjorn Lomborg1 day ago

Bjorn Lomborg1 day agoThe stupidity of Net Zero | Bjorn Lomborg on how climate alarmism leads to economic crisis

-

2025 Federal Election7 hours ago

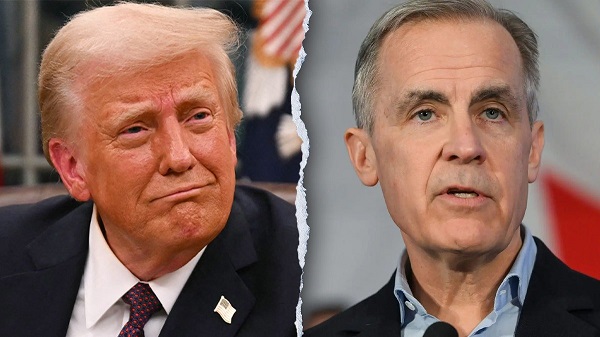

2025 Federal Election7 hours agoWhat Trump Says About Modern U.S. And What Carney Is Hiding About Canada