Uncategorized

Paris building fire claims 10 lives; arson suspected

Paris’ deadliest fire in over a decade claimed 10 lives Tuesday, sending fleeing residents to the roof as flames engulfed their apartment building before dawn.

A 40-year-old female resident of the building, said to have a history of psychiatric problems, was arrested as police opened an investigation into voluntary arson resulting in death. French officials said she was drunk when she was apprehended on the street near the eight-story building in the quiet

It is the deadliest fire in Paris since the April 2005 hotel fire near the capital’s famed Opera that killed 24 people.

Interior Minister Christophe Castaner was on the scene Tuesday morning, as plumes of smoke speckled the sky.

“I want to salute the huge mobilization of the Paris firefighters,” he said. “More than 250 people arrived immediately and, throughout the night, saved over 50 people in truly exceptional conditions.”

Firefighters rescued some people from the roof as well as others who had clambered out of windows to escape the flames.

Castaner said the blaze that started on the second floor had been extinguished, and that more than 30 people were being treated for “relatively” light injuries.

“I heard a woman screaming in the street, crying and screaming for help,” said witness Jacqueline Ravier, who lives across the street. She saw a young man blackened by smoke and a woman motionless on the ground. She said flames were shooting out for hours from the top of the building and smoke-covered victims were fleeing.

She said shaken residents were brought to her building and the one next door while firefighters continued to fight the flames.

City fire service spokesman Clement Cognon told The Associated Press that firefighters went door-to-door to ensure there are no more victims and to prevent residual fires.

“The situation was already dramatic when the firefighters arrived,” Cognon said.

Emergency workers are also seeking to shore up the building that was badly damaged after flames shot out of windows stretching across the upper floors, in images of the operation released by the fire service.

Castaner told reporters at the scene that authorities suspect the blaze was criminal in nature and that the detained female resident had “a history of psychiatric problems.”

A judicial official, who spoke on condition of anonymity as an investigation was ongoing, told AP that the suspect was drunk at the moment of her pre-dawn arrest. She is currently in police custody.

Among the injured were at least eight firefighters, according to the Paris firefighters.

The building is on rue Erlanger in the 16th arrondissement, one of the calmest and priciest districts of Paris. It is close to the popular Bois de Boulogne park and about a

Paris police said the street was blocked off and

French President Emmanuel Macron took to Twitter to express that “France wakes up with emotion after the fire in rue Erlanger in Paris last night.”

The fire comes a month after a deadly explosion and blaze linked to a gas leak in a Paris bakery.

In September 2015, there was a fire in a northern Parisian

___

Nicolas Garriga and Lori Hinnant in Paris contributed.

Thomas Adamson And Angela Charlton, The Associated Press

Uncategorized

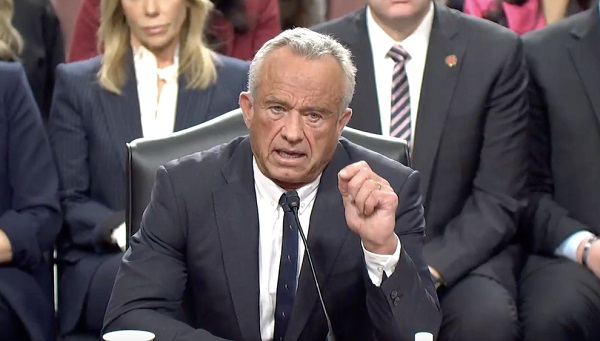

Poilievre on 2025 Election Interference – Carney sill hasn’t fired Liberal MP in Chinese election interference scandal

From Conservative Party Communications

“Yes. He must be disqualified. I find it incredible that Mark Carney would allow someone to run for his party that called for a Canadian citizen to be handed over to a foreign government on a bounty, a foreign government that would almost certainly execute that Canadian citizen.

“Think about that for a second. We have a Liberal MP saying that a Canadian citizen should be handed over to a foreign dictatorship to get a bounty so that that citizen could be murdered. And Mark Carney says he should stay on as a candidate. What does that say about whether Mark Carney would protect Canadians?

“Mark Carney is deeply conflicted. Just in November, he went to Beijing and secured a quarter-billion-dollar loan for his company from a state-owned Chinese bank. He’s deeply compromised, and he will never stand up for Canada against any foreign regime. It is another reason why Mr. Carney must show us all his assets, all the money he owes, all the money that his companies owe to foreign hostile regimes. And this story might not be entirely the story of the bounty, and a Liberal MP calling for a Canadian to be handed over for execution to a foreign government might not be something that the everyday Canadian can relate to because it’s so outrageous. But I ask you this, if Mark Carney would allow his Liberal MP to make a comment like this, when would he ever protect Canada or Canadians against foreign hostility?

“He has never put Canada first, and that’s why we cannot have a fourth Liberal term. After the Lost Liberal Decade, our country is a playground for foreign interference. Our economy is weaker than ever before. Our people more divided. We need a change to put Canada first with a new government that will stand up for the security and economy of our citizens and take back control of our destiny. Let’s bring it home.”

Uncategorized

Canada Needs A Real Plan To Compete Globally

From the Frontier Centre for Public Policy

Ottawa’s ideological policies have left Canada vulnerable. Strategic action is needed now

As Canada navigates an increasingly complex geopolitical landscape, the next federal government must move beyond reflexive anti—Americanism regardless of its political leanings. Instead, Canada should prioritize national interests while avoiding unnecessary conflict and subservience.

The notion that Canada can stand alone is as misguided as the idea that it is only an economic appendage of the United States. Both perspectives have influenced policy in Ottawa at different times, leading to mistakes.

Rather than engaging in futile name-calling or trade disputes, Canada must take strategic steps to reinforce its autonomy. This approach requires a pragmatic view rooted in Realpolitik—recognizing global realities, mitigating risks, governing for the whole country, and seizing opportunities while abandoning failed ideologies.

However, if Washington continues to pursue protectionist measures, Canada must find effective ways to counteract the weakened position Ottawa has placed the country in over the past decade.

One key strategy is diversifying trade relationships, notably by expanding economic ties with emerging markets such as India and Southeast Asia. This will require repairing Canada’s strained relationship with India and regaining political respect in China.

Unlike past Liberal trade missions, which often prioritized ideological talking points over substance, Canada must negotiate deals that protect domestic industries rather than turning summits into platforms for moral posturing.

A more effective approach would be strengthening partnerships with countries that value Canadian resources instead of vilifying them under misguided environmental policies. Expand LNG exports to Europe and Asia and leverage Canada’s critical minerals sector to establish reciprocal supply chains with non-Western economies, reducing economic reliance on the U.S.

Decades of complacency have left Canada vulnerable to American influence over its resource sector. Foreign-funded environmental groups have weakened domestic energy production, handing U.S. industries a strategic advantage. Ottawa must counter this by ensuring Canadian energy is developed at home rather than allowing suppressed domestic production to benefit foreign competitors.

Likewise, a robust industrial policy—prioritizing mining, manufacturing, and agricultural resilience—could reduce dependence on U.S. and Chinese imports. This does not mean adopting European-style subsidies but rather eliminating excessive regulations that make Canadian businesses uncompetitive, including costly domestic carbon tariffs.

Another key vulnerability is Canada’s growing military dependence on the U.S. through NORAD and NATO. While alliances are essential, decades of underfunding and neglect have turned the Canadian Armed Forces into little more than a symbolic force. Canada must learn self-reliance and commit to serious investment in defence.

Increasing defence spending—not to meet NATO targets but to build deterrence—is essential. Ottawa must reform its outdated procurement processes and develop a domestic defence manufacturing base, reducing reliance on foreign arms deals.

Canada’s vast Arctic is also at risk. Without continued investment in northern sovereignty, Ottawa may find itself locked out of its own backyard by more assertive global powers.

For too long, Canada has relied on an economic model that prioritizes federal redistribution over wealth creation and productivity. A competitive tax regime—one that attracts investment instead of punishing success—is essential.

A capital gains tax hike might satisfy activists in Toronto, but it does little to attract investments and encourage economic growth. Likewise, Ottawa must abandon ideological green policies that threaten agri-food production, whether by overregulating farmers or ranchers. At the same time, it must address inefficiencies in supply management once and for all. Canada must be able to feed a growing world without unnecessary bureaucratic obstacles.

Ottawa must also create an environment where businesses can innovate and grow without excessive regulatory burdens. This includes eliminating interprovincial trade barriers that stifle commerce.

Similarly, Canada’s tech sector, long hindered by predatory regulations, should be freed from excessive government interference. Instead of suffocating innovation with compliance mandates, Ottawa should focus on deregulation while implementing stronger security measures for foreign tech firms operating in Canada.

Perhaps Ottawa’s greatest mistake is its knee-jerk reactions to American policies, made without a coherent long-term strategy. Performative trade disputes with Washington and symbolic grandstanding in multilateral organizations do little to advance Canada’s interests.

Instead of reacting emotionally, Canada must take proactive steps to secure its economic, resource, and defence future. That is the role of a responsible government.

History’s best strategists understood that one should never fight an opponent’s war but instead dictate the terms of engagement. Canada’s future does not depend on reacting to Washington’s policies—these are calculated strategies, not whims. Instead, Canada’s success will be determined by its ability to act in the interests of citizens in all regions of the country, and seeing the world as it is rather than how ideological narratives wish it to be.

Marco Navarro-Génie is the vice president of research at the Frontier Centre for Public Policy. With Barry Cooper, he is co-author of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

-

Alberta22 hours ago

Alberta22 hours agoGovernments in Alberta should spur homebuilding amid population explosion

-

armed forces1 day ago

armed forces1 day agoYet another struggling soldier says Veteran Affairs Canada offered him euthanasia

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAs PM Poilievre would cancel summer holidays for MP’s so Ottawa can finally get back to work

-

conflict1 day ago

conflict1 day agoWhy are the globalists so opposed to Trump’s efforts to make peace in Ukraine?

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCarney’s budget is worse than Trudeau’s

-

International21 hours ago

International21 hours agoHistory in the making? Trump, Zelensky hold meeting about Ukraine war in Vatican ahead of Francis’ funeral

-

Alberta21 hours ago

Alberta21 hours agoLow oil prices could have big consequences for Alberta’s finances

-

Business21 hours ago

Business21 hours agoIt Took Trump To Get Canada Serious About Free Trade With Itself