Alberta

Ottawa’s oil and gas emissions cap will hit Alberta with a wallop

From the Fraser Institute

Even if Canada eliminated all its GHG emissions expected in 2030 due to the federal cap, the emission reduction would equal only four-tenths of one per cent of global emissions—a reduction unlikely to have any impact on the trajectory of the climate in any detectable manner or produce any related environmental, health or safety benefits.

After considerable waiting, the Trudeau government released on Monday draft regulations to cap greenhouse gas (GHG) emissions from Canada’s oil and gas producers.

The proposed regulations would set a cap on GHG emissions equivalent to 35 per cent of the emissions produced in 2019 and create a GHG emissions “cap and trade” system to enable oil and gas producers (who cannot reduce emissions enough to avoid the cap) to buy credits from other producers able to meet the cap. Producers unable to meet the cap will also be able to obtain emission credits (of up to 20 per cent of their needed emission reductions) by investing in decarbonization programs or by buying emission “offsets” in Canada’s carbon markets.

According to the government, the cap will “cap pollution, drive innovation, and create jobs in the oil and gas industry.” But in reality, while the cap may well cap pollution and drive some innovation, according to several recent analyses it won’t create jobs in the oil and gas industry and will in fact kill many jobs.

For example, the Conference Board of Canada think-tank estimates that the cap would reduce Canada’s GDP by up to $1 trillion between 2030 and 2040, kill up to 151,300 jobs across Canada by 2030, and national economic growth from 2023 to 2030 would slow from 15.3 per cent to 14.3 per cent.

Not surprisingly, Alberta would be hardest hit. According to the Board, from 2023 to 2030, the province’s economic growth would fall from an estimated 17.8 per cent to 13.3 per cent and employment growth would fall from 15.8 per cent to 13.6 per cent over the same period. Alberta government revenues from the sector would decline by 4.5 per cent in 2030 compared to a scenario without the cap. As a result, Alberta government revenues would be $4.5 billion lower in nominal terms in fiscal year 2030/31. And between 54,000 to 91,500 of Canada’s job losses would occur in Alberta.

Another study by Deloitte estimates that, due to the federal cap, Alberta will see 3.6 per cent less investment, almost 70,000 fewer jobs, and a 4.5 per cent decrease in the province’s economic output (i.e. GDP) by 2040. Ontario would lose more than 15,000 jobs and $2.3 billion from its economy by 2040. And Quebec would lose more than 3,000 jobs and $0.4 billion from its economy during the same period.

Overall, according to Deloitte, Canada would experience an economic loss equivalent to 1.0 per cent of GDP, translating into lower wages, the loss of nearly 113,000 jobs and a 1.3 per cent reduction in government tax revenues. (For context, Canada’s economic growth in 2023 was only 1.1 per cent.)

And what will Canadians get for all that economic pain?

In my study published last year by the Fraser Institute, I found that, even if Canada eliminated all its GHG emissions expected in 2030 due to the federal cap, the emission reduction would equal only four-tenths of one per cent of global emissions—a reduction unlikely to have any impact on the trajectory of the climate in any detectable manner or produce any related environmental, health or safety benefits.

Clearly, the Trudeau government’s new proposed emissions cap on the oil and gas sector will impose significant harms on Canada’s economy, Canadian workers and our quality of life—and hit Alberta with a wallop. And yet, as a measure intended to avert harmful climate change, it’s purely performative (like many of the government’s other GHG regulations) and will generate too little emission reductions to have any meaningful impact on the climate.

In a world of rational policy development, where the benefits of government regulations are supposed to exceed their costs, policymakers would never consider this proposed cap. The Trudeau government will submit the plan to Parliament, and if the cap becomes law, it will await some other future government to undo the damage inflicted on Canadians and their families.

Author:

Agriculture

Lacombe meat processor scores $1.2 million dollar provincial tax credit to help expansion

Alberta’s government continues to attract investment and grow the provincial economy.

The province’s inviting and tax-friendly business environment, and abundant agricultural resources, make it one of North America’s best places to do business. In addition, the Agri-Processing Investment Tax Credit helps attract investment that will further diversify Alberta’s agriculture industry.

Beretta Farms is the most recent company to qualify for the tax credit by expanding its existing facility with the potential to significantly increase production capacity. It invested more than $10.9 million in the project that is expected to increase the plant’s processing capacity from 29,583 to 44,688 head of cattle per year. Eleven new employees were hired after the expansion and the company plans to hire ten more. Through the Agri-Processing Investment Tax Credit, Alberta’s government has issued Beretta Farms a tax credit of $1,228,735.

“The Agri-Processing Investment Tax Credit is building on Alberta’s existing competitive advantages for agri-food companies and the primary producers that supply them. This facility expansion will allow Beretta Farms to increase production capacity, which means more Alberta beef across the country, and around the world.”

“This expansion by Beretta Farms is great news for Lacombe and central Alberta. It not only supports local job creation and economic growth but also strengthens Alberta’s global reputation for producing high-quality meat products. I’m proud to see our government supporting agricultural innovation and investment right here in our community.”

The tax credit provides a 12 per cent non-refundable, non-transferable tax credit when businesses invest $10 million or more in a project to build or expand a value-added agri-processing facility in Alberta. The program is open to any food manufacturers and bio processors that add value to commodities like grains or meat or turn agricultural byproducts into new consumer or industrial goods.

Beretta Farms’ facility in Lacombe is a federally registered, European Union-approved harvesting and meat processing facility specializing in the slaughter, processing, packaging and distribution of Canadian and United States cattle and bison meat products to 87 countries worldwide.

“Our recent plant expansion project at our facility in Lacombe has allowed us to increase our processing capacities and add more job opportunities in the central Alberta area. With the support and recognition from the Government of Alberta’s tax credit program, we feel we are in a better position to continue our success and have the confidence to grow our meat brands into the future.”

Alberta’s agri-processing sector is the second-largest manufacturing industry in the province and meat processing plays an important role in the sector, generating millions in annual economic impact and creating thousands of jobs. Alberta continues to be an attractive place for agricultural investment due to its agricultural resources, one of the lowest tax rates in North America, a business-friendly environment and a robust transportation network to connect with international markets.

Quick facts

- Since 2023, there are 16 applicants to the Agri-Processing Investment Tax Credit for projects worth about $1.6 billion total in new investment in Alberta’s agri-processing sector.

- To date, 13 projects have received conditional approval under the program.

- Each applicant must submit progress reports, then apply for a tax credit certificate when the project is complete.

- Beretta Farms has expanded the Lacombe facility by 10,000 square feet to include new warehousing, cooler space and an office building.

- This project has the potential to increase production capacity by 50 per cent, thereby facilitating entry into more European markets.

Related information

Alberta

Alberta Next: Alberta Pension Plan

From Premier Danielle Smith and Alberta.ca/Next

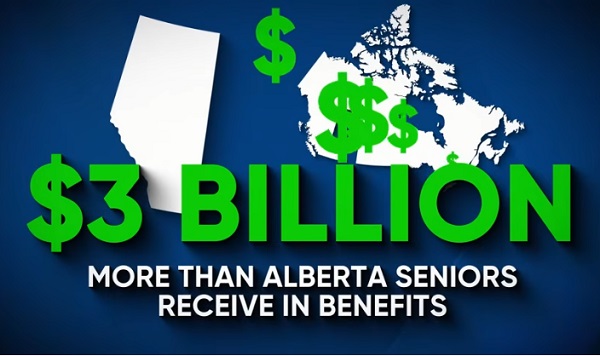

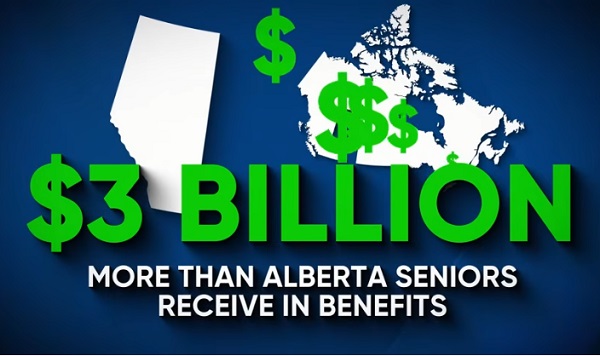

Let’s talk about an Alberta Pension Plan for a minute.

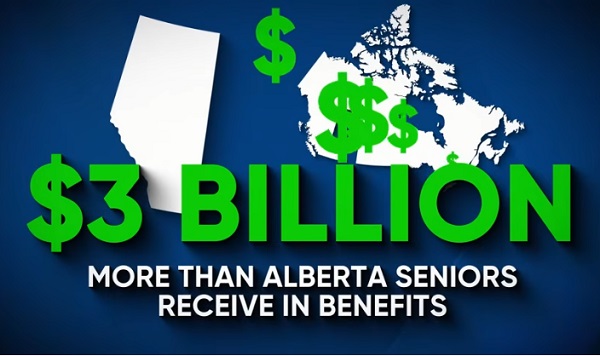

With our young Alberta workforce paying billions more into the CPP each year than our seniors get back in benefits, it’s time to ask whether we stay with the status quo or create our own Alberta Pension Plan that would guarantee as good or better benefits for seniors and lower premiums for workers.

I want to hear your perspective on this idea and please check out the video. Get the facts. Join the conversation.

Visit Alberta.ca/next

-

armed forces1 day ago

armed forces1 day agoCanada’s Military Can’t Be Fixed With Cash Alone

-

Alberta1 day ago

Alberta1 day agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

International1 day ago

International1 day agoTrump transportation secretary tells governors to remove ‘rainbow crosswalks’

-

Business1 day ago

Business1 day agoCanada’s loyalty to globalism is bleeding our economy dry

-

Alberta1 day ago

Alberta1 day agoAlberta Next: Alberta Pension Plan

-

Business1 day ago

Business1 day agoCarney’s spending makes Trudeau look like a cheapskate

-

Crime2 days ago

Crime2 days agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel

-

C2C Journal23 hours ago

C2C Journal23 hours agoCanada Desperately Needs a Baby Bump