Energy

One (Megawatt) is the loneliest number, but hundreds of batteries are absurd

From the Frontier Centre for Public Policy

That comes out to $104,000,000,000, in batteries, alone, to cover those 18 hours on Feb. 8. To make it easier on you, $104 billion. If you use Smith’s numbers, it’s $80.6 billion. Even if I’m out by a factor of two, it’s an obscene amount of money.

SaskPower Minister Dustin Duncan recently told me I watch electricity markets like some people watch fantasy football. I would agree with him, if I knew anything about fantasy football.

I had some time to kill around noon on Feb. 8, and I checked out the minute-by-minute updates from the Alberta Electric System Operator. What I saw for wind power production was jaw-dropping to say the least. Alberta has built 45 wind farms with hundreds of wind turbines totalling an installed capacity of 4,481 megawatts.

My usual threshold for writing a story about this is output falling to less than one per cent – 45 megawatts. Its output at 11:07 a.m., Alberta time, in megawatts?

“1”

Ten minutes later:

“1”

30 minutes later:

“1”

How long can this last? Is there a fault with the website? There doesn’t seem to be.

12:07 p.m.

“1”

Strains of “One is the loneliest number” flow through my head.

I’ve seen it hit one before briefly. Even zero for a minute or two. But this keeps going. And going. I keep taking screenshots. How long will this last?

1:07 p.m.

“1”

1:29 p.m.

“1”

Finally, there’s a big change at 2:38. The output has doubled.

“2.”

That’s 2.5 hours at one. How long will two last?

3:45 p.m.

“2”

4:10 p.m. – output quadruples – to a whopping eight megawatts.

It ever-so-slowly crept up from there. Ten hours after I started keeping track, total wind output had risen to 39 megawatts – still not even one per cent of rated output. Ten hours.

It turns out that wind fell below one per cent around 5 a.m., and stayed under that for 18 hours.

Building lots of turbines doesn’t work

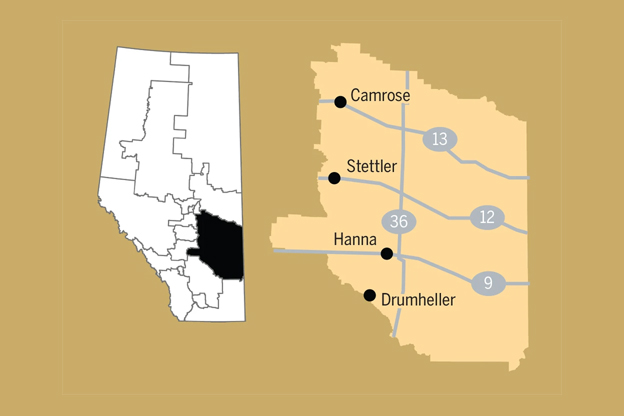

The argument has long been if it’s not blowing here, it’s blowing somewhere. Build enough turbines, spread them all over, and you should always have at least some wind power. But Alberta’s wind turbines are spread over an area larger than the Benelux countries, and they still had essentially zero wind for 18 hours. Shouldn’t 45 wind farms be enough geographic distribution?

The other argument is to build lots and lots of batteries. Use surplus renewable power to charge them, and then when the wind isn’t blowing (or sun isn’t shining), draw power from the batteries.

Alberta has already built 10 grid-scale batteries. Nine of those are the eReserve fleet, each 20 megawatt Tesla systems. I haven’t been able to find the price of those, but SaskPower is building a 20 megawatt Tesla system on the east side of Regina, and its price is $26 million.

From over a year’s frequent observation, it’s apparent that the eReserve batteries only put out a maximum of 20 megawatts for about an hour before they’re depleted. They can run longer at lower outputs, but I haven’t seen anything to show they could get two or five hours out of the battery at full power. And SaskPower’s press release explains its 20 megawatt Tesla system has about 20 megawatts-hours of power. This corresponds very closely to remarks made by Alberta Premier Danielle Smith, along with the price of about $1 million per megawatt hour for grid-scale battery capacity.

She said in late October, “I want to talk about batteries for a minute, because I know that everybody thinks that this economy is going to be operated on wind and solar and battery power — and it cannot. There is no industrialized economy in the world operating that way, because they need baseload. And, I’ll tell you what I know about batteries, because I talked to somebody thinking of investing in it on a 200-megawatt plant. One million dollars to be able to get each megawatt stored: that’s 200 million dollars for his plant alone, and he would get one hour of storage. So if you want me to have 12 thousand megawatts of storage, that’s 12 billion dollars for one hour of storage, 24 billion dollars for two hours of storage, 36 billion dollars for three hours of storage, and there are long stretches in winter, where we can go weeks without wind or solar. That is the reason why we need legitimate, real solutions that rely on baseload power rather than fantasy thinking.”

So let’s do some math to see if the premier is on the money.

If you wanted enough batteries to output the equivalent of the 4,481 megawatts of wind for one hour (minus the 1 megawatt it was producing), that’s 4480 megawatts / 20 megawatts per battery = 224 batteries like those in the eReserve fleet. But remember, they can only output their full power for about an hour. So the next hour, you need another 224, and so on. For 18 hours, you need 4032 batteries. Let’s be generous and subtract the miniscule wind production over that time, and round it to 4,000 batteries, at $26 million a pop. (Does Tesla offer bulk discounts?)

That comes out to $104,000,000,000, in batteries, alone, to cover those 18 hours on Feb. 8. To make it easier on you, $104 billion. If you use Smith’s numbers, it’s $80.6 billion. Even if I’m out by a factor of two, it’s an obscene amount of money.

But wait, there’s more!

You would also need massive amounts of transmission infrastructure to power and tie in those batteries. I’m not even going to count the dollars for that.

But you also need the surplus power to charge all those batteries. The Alberta grid, like most grids, runs with a four per cent contingency, as regulated by NERC. Surplus power is often sold to neighbours. And there’s been times, like mid-January, where that was violated, resulting in a series of grid alerts.

At times when there’s lots of wind and solar on the grid, there’s up to around 900 megawatts being sold to B.C and other neighbours. But for 18 hours (not days, but hours), you need 4,000 batteries * 20 megawatt-hours per battery = 80,000 megawatt hours. Assuming 100 per cent efficiency in charging (which is against the laws of physics, but work with me here), if you had a consistent 900 megawatts of surplus power, it would take 89 hours to charge them (if they could charge that fast, which is unlikely).

That’s surplus power you are not selling to an external client, meaning you’re not taking in any extra revenue, and they might not be getting the power they need. And having 900 megawatts is the exception here. It’s much more like 300 megawatts surplus. So your perfect 89 hours to charge becomes 267 hours (11.1 days), all to backfill 18 hours of essentially no wind power.

This all assumes at you’ve had sufficient surplus power to charge your batteries, that days or weeks of low wind and/or solar don’t deplete your reserves, and the length of time they are needed does not exceed your battery capacity.

Nor does it figure in how many years life are you going to get out of those batteries in the first place? How many charge cycles before you have to recapitalize the whole fleet?

For the dollars we’re talking here, you’re easily better off to four (or more) Westinghouse AP-1000 reactors, with 1,100 megawatts capacity each. Their uptime should be somewhere around 90 per cent.

Or maybe coal could be renewed – built with the most modern technology like high efficiency, low emissions (HELE), with integrated carbon capture from Day 1. How many HELE coal-fired power plants, with carbon capture and storage, could you build for either $80 billion or $104 billion? Certainly more than 4,481 megawatts worth.

Building either nuclear or HELE coal gives you solid, consistent baseload power, without the worry of the entire fleet going down, like wind did in Alberta on Feb. 8, as well as Feb. 4, 5, 6, and 7.

Indeed, according to X bot account @ReliableAB, which does hourly tracking of the Alberta grid, from Feb. 5 to 11:15 a.m., Feb. 9, Alberta wind output averaged 3.45 per cent of capacity. So now instead of 18 hours, we’re talking 108 hours needing 96+ per cent to be backfilled. I don’t have enough brain power to figure it out.

You can argue we only need to backfill X amount of wind, maybe 25 per cent, since you can’t count on wind to ever produce 100 per cent of its nameplate across the fleet. But Alberta has thousands more megawatts of wind on tap to be built as soon as the province lifts is pause on approvals. If they build all of it, maybe the numbers I provide will indeed be that 25 per cent. Who knows? The point is all of this is ludicrous.

Just build reliable, baseload power, with peaking capacity. And end this foolishness.

Brian Zinchuk is editor and owner of Pipeline Online, and occasional contributor to the Frontier Centre for Public Policy. He can be reached at [email protected].

Energy

Ontario Leads the G7 by Building First Small Modular Reactor

A concept image of a GE Hitachi BWRX-300 small modular reactor (SMR), the nuclear technology Ontario Power Generation is using for its new project adjacent to the existing Darlington nuclear plant. (GE-Hitachi)

From Energy Now

Construction will create 18,000 Canadian jobs, add up to $500 million annually to Ontario’s economy and help secure clean, reliable energy

With electricity demand in Ontario set to soar by at least 75 per cent by 2050, the Ontario government has approved Ontario Power Generation’s (OPG) plan to begin construction on the first of four small modular reactors (SMRs) at the Darlington nuclear site. Once complete, this SMR will be the first of its kind in the G7, producing enough reliable, affordable and clean electricity to power the equivalent of 300,000 homes, supporting thousands of good-paying jobs across the province and helping secure Ontario’s energy supply for decades to come.

The construction of the four units will support the government’s plan to protect Ontario’s workers and economy by creating up to 18,000 Canadian jobs and injecting $500 million on average annually into Ontario’s economy. The construction, operation and maintenance of the four units will add $38.5 billion to Canada’s GDP over the next 65 years. The government has worked with OPG to ensure that 80 per cent of project spending goes to Ontario companies and that construction and operations will protect Ontario workers and jobs by sustaining an estimated 3,700 highly-skilled, good-paying jobs for the next 65 years.

“This is a historic day for Canada as we start construction on the first small modular reactor in the G7, creating 18,000 jobs for Canadians,” said Stephen Lecce, Minister of Energy and Mines. “This nation-building project being built right here in Ontario will be led by Canadian workers using Canadian steel, concrete and materials to help deliver the extraordinary amount of reliable and clean power we will need to deliver on our ambitious plan to protect Ontario and unleash our economy.”

The BWRX-300 is a small-scale nuclear reactor that uses commercially available uranium to generate power. The four SMRs will be vital to powering new homes, historic investments to build Ontario and fuel a thriving economy. Once complete, they will produce 1,200 megawatts (MW) of electricity, enough to power the equivalent of 1.2 million homes, to help bridge a power gap that could emerge in the early 2030s in the absence of net-new baseload power sources added to the grid.

More than eighty Ontario companies have already signed agreements with OPG to deliver this first-of-a-kind project, establishing themselves as leaders in the growing domestic and global markets for new nuclear technologies. The government has also negotiated additional commitments from GE Hitachi that will create jobs in Ontario, that will soon be unveiled.

Ontario’s Independent Electricity System Operator (IESO) concluded that the Darlington New Nuclear Project is the best option to meet growing demand in terms of costs and risks, when compared against non-emitting generation alternatives. This, combined with OPG’s outstanding track-record on the Darlington Refurbishment Project, factored into the government’s decision to support the Darlington New Nuclear Project.

Within Canada, the Ontario government and OPG are collaborating with power companies in Alberta, Saskatchewan and New Brunswick as they work towards the deployment of SMRs in their jurisdictions. Around the world, the government has helped secure job-creating agreements that deploy Made-In-Ontario components to build SMR’s for the world.

Advancing construction on the Darlington New Nuclear Project SMRs is just one part of Ontario’s Affordable Energy Future, the government’s vision as it plans for rising energy demand.

Quick Facts

- The government is supporting OPG’s $20.9 billion budget for the Darlington New Nuclear Project, which includes site preparation, engineering and design work to date, as well as the construction of all four small modular reactors.

- During project development OPG will continue to build respectful, collaborative relationships with the communities of the Williams Treaties First Nations, while pursuing potential opportunities for their equity partnership in the project. This would be a first-of-its-kind partnership in Canada for nuclear energy generation, reflecting the government and OPG’s commitment to ensure local First Nations benefit from new projects in their territories.

- Once complete, the Darlington New Nuclear Projects four SMRs will produce 1,200 megawatts (MW) of electricity, enough to power 1.2 million homes.

- According to the IESO, the province would need to build up to 8,900 MW of wind and solar paired with battery storage to replace the output of four SMRs. The IESO also concluded this alternative approach would carry significant risks including significant land requirements and the need for large scale transmission build out.

- The first SMR will cost $6.1 billion, along with costs for systems and services common to all four SMRs of $1.6 billion. Costs are expected to decline with each subsequent unit as efficiencies are gained, similar to the Darlington Refurbishment Project.

- OPG began site preparation for the first SMR in December 2022. Ontario announced that OPG would begin planning and licensing for three additional SMRs, for a total of four SMRs at the Darlington nuclear site in July 2023. OPG obtained a Licence to Construct (LTC) for Unit 1 from the Canadian Nuclear Safety Commission (CNSC) in April 2025.

- To reduce costs the Government of Ontario is exploring potential financial instruments that would benefit ratepayers, and in parallel, OPG continues to explore other optimal financing arrangements.

Quotes

“This is a proud achievement for Ontario – this small modular reactor project is not only powering our future, it is driving real results for our economy. With thousands of good-paying jobs, billions in economic impact, and made-in-Ontario expertise leading the way, we are showing the world what our workers and industries can achieve.”

– Peter Bethlenfalvy

MPP, Pickering-Uxbridge

“The launch of Canada’s first grid-scale small modular reactor at Darlington marks a major milestone for our Province—powering growth, creating jobs, and securing a clean energy future right here in Durham Region. This transformative project will strengthen our Region’s economy, provide long-term careers, and reinforce Durham’s role as a leader in clean nuclear innovation.”

– Lorne Coe

MPP, Whitby, Parliamentary Assistant to the Minister of Children, Community and Social Services, and Parliamentary Assistant to the Minister of Colleges, Universities, Research Excellence, and Security

“Today’s announcement is the next step to strengthening Ontario and Canada’s energy security while supporting thousands of good-paying jobs for workers in the region. Once complete, this SMR will be the first of its kind in the G7, delivering clean reliable and affordable electricity to homes and businesses.”

– Todd McCarthy

MPP, Durham

“As the first mover on SMRs, this made-in-Ontario project will create jobs for the province’s workers, contracts for Ontario’s booming supply chain, and showcase our capabilities and expertise to the world to further grow our domestic industry while strengthening Canada’s energy security. As we saw through the refurbishment project, building a fleet of SMRs with the support of Ontario’s strong nuclear supply chain will provide further opportunities to learn, identify efficiencies, and expand the supply chain. All of this invaluable, irreplaceable experience will prepare us to take on the next large nuclear project.”

– Nicolle Butcher

President and Chief Executive Officer, OPG

“This is a proud moment for GE Vernova Hitachi and Ontario as we move from vision to reality with construction of the G7’s first SMR, the BWRX-300. With dozens of Ontario-based suppliers contributing to this project, we’re not just building a reactor—we’re generating thousands of good-paying jobs, driving investment into communities across the province, and reinforcing Ontario’s global leadership in clean energy technology. That leadership is already opening doors to international export opportunities for Ontario companies, helping position our province as a global hub for next-generation nuclear innovation. GE has been part of Canada’s nuclear story from the very beginning, and we’re honoured to carry that legacy forward by delivering a made-in-Ontario solution that strengthens our economy and powers our future.”

– Lisa McBride

Country Leader, GE Vernova Hitachi SMR Canada

“Clarington is excited to team up with the Ontario Government and OPG to advance new nuclear technology. As we host the first SMR in the G7, we’re paving the way for clean energy that will benefit everyone. Our leadership in this global nuclear renaissance is thrilling. The Darlington SMR project promises thousands of jobs during construction and hundreds more during operations, boosting economic growth and job creation in Clarington now and in the future.”

– Adrian Foster

Mayor, Clarington

“The Ontario Government’s approval of OPG’s small modular reactor project at Darlington represents a major milestone in the province’s clean energy strategy. This project will deliver long-term economic and environmental benefits across Ontario, including thousands of skilled jobs and a reliable, low-carbon power supply. We commend the Province for its continued commitment to investing in innovative and future-focused energy solutions.”

– Olena Hankivsky

Mayor, Municipality of Port Hope

“I am excited to be part of this historic announcement. Haldimand County looks forward to working with Minister Lecce on bringing clean energy to Ontario, thousands of jobs and millions of dollars annually into Ontario’s Economy.”

– Shelley Ann Bentley

Mayor, Haldimand County

“The Township of St. Clair recognizes the very real impacts the projected shortage of power will have not only in our municipality, but also province-wide. That is why the Ontario Government’s announcement today authorizing the construction of the first of four small modular reactors at the Darlington nuclear site is very exciting.”

– Jeff Agar

Mayor, Township of St. Clair

“The Government of Ontario’s approval for OPG to begin construction on its trailblazing Darlington New Nuclear Project is leading the way in delivering the next generation of nuclear plants across North America and internationally. Aecon is proud to bring its diverse nuclear expertise and multidisciplinary capabilities to play a prominent role in safely executing this exciting project to meet the energy demands of future generations in Ontario.”

– Jean-Louis Servranckx

President and Chief Executive Officer, Aecon Group Inc.

“This is an exciting day for Clarington, Durham Region, and Canada. Being home to the first site globally to start construction on SMRs demonstrates the leadership role that our region plays in the new nuclear sector. This is a monumental step forward by the Ontario Government for energy security and availability in Canada. Congratulations to OPG on this milestone.”

– John Henry

Regional Chair and Chief Executive Officer, Regional Municipality of Durham

“Ontario’s SMR project builds on Ontario’s clean energy advantage by putting Ontario at the forefront of clean energy knowledge and technology that can be exported around the world. The OEA supports the Ontario Government’s plan to make the Province a world leader in nuclear energy and maintain nuclear power as a core element of Ontario’s clean affordable energy sector.”

– Vince Brescia

President and Chief Executive Officer, Ontario Energy Association

“Today’s announcement by the Government of Ontario turns vision into reality for the Province’s clean energy future. The construction of the Darlington New Nuclear Project will deliver clean, reliable power that our economy needs to thrive, while driving innovation, investment, and good-paying jobs across the province. By deploying the first grid-scale SMR in the G7, Ontario is cementing its place as a global nuclear leader and an emerging energy superpower.”

– Giles Gherson

President and Chief Executive Officer, Toronto Region Board of Trade

“The start of construction on this SMR is a meaningful step forward for Ontario and for Canada. It reflects what can be accomplished through strong leadership, technical excellence, and a clear vision for the future. It also carries real opportunity—for Indigenous-owned businesses to be part of critical infrastructure projects in ways that create long-term impact. We’re proud to support OPG in this work and to stand alongside other supply chain partners helping to drive this project forward.”

– Clint Keeler

President, Voyageur Services Limited

“This historic milestone by the Government of Ontario is not only a bold step forward in clean energy innovation, but a powerful demonstration of how local businesses can directly contribute to—and benefit from—nation-leading projects. We are proud to see so many Clarington businesses directly support the construction of the first SMR. We commend OPG and the Provincial Government for their commitment to local economic development and for working with Ontario-based suppliers. Their leadership sets the tone for what’s possible when industry and community work together to power our future.”

– Bonnie Wrightman

Executive Director, Clarington Board of Trade

“Ontario’s historic investment in small modular reactors is a powerful statement of confidence in our province’s skilled workforce and energy future. The Darlington SMR project not only secures clean, reliable power for generations, it creates thousands of good-paying jobs and reinforces our position as a global leader in nuclear innovation. LiUNA members are proud to be at the forefront of this transformative project, building the infrastructure that powers our economy, strengthens our communities, and ensures prosperity for working families across Ontario.”

– Joseph Mancinelli

International Vice President, Canadian Director, Labourers’ International Union of North America (LiUNA)

“The Ontario Building Trades and Helmets to Hardhats Canada proudly support the Ontario Government’s development of Small Modular Reactors (SMRs) as a key part of Canada’s clean energy future. The construction of SMRs offers prosperous careers for Building Trades workers including Canada’s veterans transitioning to civilian life. We stand ready to help build this next generation of nuclear technology safely, efficiently, and with the highest standards of craftsmanship.”

– James Hogarth

President, Provincial Building and Construction Trades Council of Ontario

“To begin construction on the SMR’s at Darlington amidst significant global uncertainty makes it crystal clear that Ontario is not about to hit the pause button or sit on the sidelines and wait. Rather at this pivotal time OPG and the Province are showing their commitment to ensuring that Ontario remains a front runner in clean, reliable baseload power production. At a time when we need to invest in our own energy security, and in the very men and women who power our great province… the government is doing just that in creating jobs, creating clean power, and creating the supply chain that will position us to showcase our world leading nuclear expertise. The International Brotherhood of Boilermakers congratulates OPG, the vendor partners, and the Ontario Government on their announcement to begin the construction phase of North America’s first grid-sized SMR.”

– Jonathan White

Director, International Brotherhood of Boilermakers

“The power sector labour market partners have negotiated a 5-year agreement that will provide the labour relations stability to make this historic project by the Ontario Government and OPG a success.”

– Alex Lolua

General Manager, Electrical Power Systems Construction Association

“As the union representing the professionals who operate Ontario’s nuclear facilities, the Society of United Professionals is glad to see the Government of Ontario’s approval for the construction of the Darlington Small Modular Reactor. Projects like this will mean more good quality, union jobs that you can raise a family on and support our communities. To electrify our economy, meet our long-term clean energy needs, and achieve Canada’s energy independence we will need SMRs to complement our large-scale CANDU nuclear facilities to power our future.”

– Rebecca Caron

President, Society of United Professionals

“Today marks a major step forward for Canada’s clean energy future. The start of construction on the first grid-scale small modular reactor in the G7 is a clear signal that Ontario is serious about decarbonization, energy security, economic growth and international opportunities. With a strong domestic supply chain and world-class expertise, our industry is ready to deliver, bringing clean, reliable power to more Canadians while supporting good jobs and local communities.”

– George Christidis

Interim President and Chief Executive Officer, Canadian Nuclear Association

“Salit Steel is proud to play a role in this landmark clean energy project. As a Canadian, family-owned company with over 120 years of experience in the steel industry, we are deeply committed to supporting nation-building infrastructure. We’re honoured to contribute our reinforcing steel expertise to a made-in-Ontario solution that will power homes, create good-paying local jobs, and position Canada as a global leader in nuclear innovation. This project by the Ontario Government and OPG is a pivotal step toward a cleaner, more sustainable energy future, and we’re proud to help build its foundation.”

– Steven Cohen

Owner, Salit Steel

“Small modular reactors are pivotal to Ontario’s clean energy and economic future. Ontario Tech University is pleased to see the commencement of construction on the first of four SMRs begin at Darlington. As the home of Canada’s only accredited undergraduate nuclear engineering program, we are dedicated to training the next generation of nuclear industry talent from entry to expert. Our students are uniquely positioned to support these investments and will drive innovation and lead the future of clean energy right here in Durham Region.”

– Dr. Steven Murphy

President and Vice-Chancellor, Ontario Tech University

“The Ontario Chamber has long advocated for investments in diverse forms of clean energy — including SMRs — to help meet electricity demand for a growing economy. Today’s announcement – and its exciting opportunities for Ontario companies – supports our businesses and workers, positions Ontario as a global nuclear innovation leader, and helps ensure clean, reliable and affordable energy to power our future.”

– Daniel Tisch

President and Chief Executive Officer, Ontario Chamber of Commerce

“The IBEW Local Union 353 appreciates all the continued hard work and support by the Ontario Government – we maintain the growth in developing education programs that support our members in preserving the quality of work that our customers expect. The experience with our members and contractors that we have gained over the last 10 years together has helped us to build valued partnerships and expand community outreach programs that are building our province.”

– Salvatore Maltese

Business Rep, IBEW Local Union 353

“BWXT applauds the leadership shown by the Ontario government and OPG to secure the economic and environmental future of Ontario through this historic nuclear energy project. Our team is now manufacturing the first reactor pressure vessel for Darlington and we proudly embrace our role as a key partner to the Canadian nuclear industry.”

– John MacQuarrie

President, Commercial Operations, BWXT

Economy

Canada’s Energy Wealth Is Bleeding South

From the Frontier Centre for Public Policy

Without infrastructure, Canada is losing billions while the U.S. cashes in on our oil and gas

Canada’s energy wealth is stuck in traffic, and our American neighbours are cashing in. It’s worse than that. Canada is bleeding millions of dollars daily because it lacks the infrastructure to export its natural resources efficiently.

While our oil and gas continue to flow—mainly to the United States—provinces like Alberta and British Columbia are forced to sell at steep discounts. This isn’t just an economic inefficiency; it’s a structural failure of national policy. The beneficiaries? American businesses and their governments which pocket the profits and tax revenues that should be circulating through the Canadian economy. This is no way to achieve economic sovereignty for Canada.

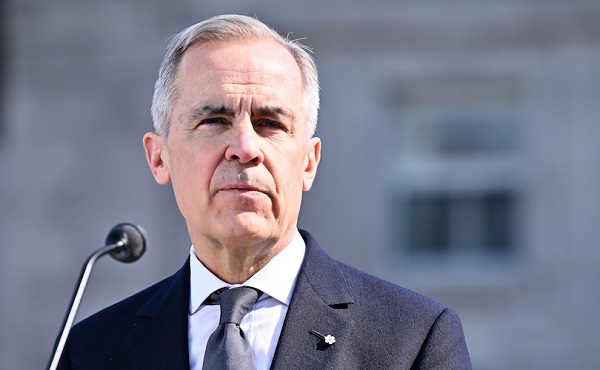

With U.S. interests reaping the rewards, this should have been a central talking point when Prime Minister Carney met with President Trump earlier this month.

Ottawa often offers the recent completion of the Trans Mountain Expansion (TMX) pipeline as an example of federal support for the energy sector. But such claims are misleading. Kinder Morgan, a private enterprise, had initially planned to build the extension without a penny from taxpayers. It withdrew only after being crippled by federal regulatory delays and political uncertainty.

Ottawa stepped in not as a benevolent saviour to help Albertans, but to prevent lawsuits and save face—ultimately overpaying for the pipeline and watching construction costs balloon to nearly six times the original estimate.

To now declare this bungled project a “gift” to Alberta, as a recent op-ed in the Toronto Star did, is not only tone-deaf: it’s an insult. It ignores the fact that Alberta’s taxpayers helped finance the very project Ottawa botched. It also reveals an astonishing lack of understanding of the historical, economic and political dynamics at play between Ottawa and Western Canada.

The tragedy is that TMX, despite its importance, is insufficient. Our infrastructure bottlenecks remain. With each passing day, Canada forfeits wealth that could fund essential improvements in health care, education and national defence.

According to the Frontier Centre for Public Policy, which has developed a real-time tracker to monitor these losses, the price differential between what we could earn on global markets versus what we settle for domestically adds up to $26.5 billion annually.

Ottawa’s reluctance to greenlight new infrastructure is a primary cause of this problem. Ironically, the losses from this reluctance in a single year would be enough to pay for another TMX, mismanaged or not. The solution lies in a national commitment to building utility corridors: designated routes that facilitate the movement of energy, goods and services unhindered across provincial boundaries.

Carney’s recent promise to remove all interprovincial trade barriers by July 1 is a nice soundbite. But unless it includes meaningful infrastructure commitments, it is bound to fail like every other rhetorical flourish before it.

Canadians should be rightly skeptical. After all, what Ottawa has failed to achieve in the 157 years since Confederation is unlikely to be accomplished in the next 60 days.

The political math doesn’t help either. The Bloc Québécois holds the balance of power in the 45th Parliament, and its obstructionist stance on national pipeline development ensures the advent of more gridlock, not less. The federal government continues to uphold Bill C-69—dubbed the “no-pipelines bill”—further entrenching the status quo.

Meanwhile, Canada remains in the absurd position of relying on U.S. infrastructure to transport oil from the West to Ontario and Quebec. This undermines our economic independence, energy security and national sovereignty. No amount of “elbows up” will correct this enormous gap.

If the prime minister is serious about transforming Canada’s economic landscape and making the country strong, he must bypass the Bloc by cooperating with the Official Opposition. A grand bargain focused on utility corridors, interprovincial infrastructure and national trade efficiency would serve Alberta, Saskatchewan, and every Canadian who depends on a strong and self-reliant economy.

The stakes are high. We need a more productive country to face challenges within Canada and from abroad. Billions in lost revenue could fund new hospitals, more schools and better military readiness.

Instead, along with the limited exports of oil and gas, we’re exporting great opportunities to middlemen—and greater economic strength—south of the border.

The path forward is clear. A strong, self-reliant Canada needs infrastructure. It needs corridors. It needs leadership.

Marco Navarro-Genie is the vice president of research at the Frontier Centre for Public Policy. He is coauthor, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

-

COVID-192 days ago

COVID-192 days agoStudy finds nearly half of ‘COVID deaths’ had no link to virus

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCarney says Liberals won’t make voting pact with NDP

-

Autism1 day ago

Autism1 day agoNIH, CMS partner on autism research

-

Alberta2 days ago

Alberta2 days agoEnergy projects occupy less than three per cent of Alberta’s oil sands region, report says

-

Energy2 days ago

Energy2 days agoOil tankers in Vancouver are loading plenty, but they can load even more

-

Alberta2 days ago

Alberta2 days agoCharges laid in record cocaine seizure

-

Business1 day ago

Business1 day agoInnovative Solutions Like This Plan To Provide Power For Data Centres Will Drive Natural Gas Demand For Decades

-

Energy2 days ago

Energy2 days agoCarney’s energy superpower rhetoric falls flat without policy certainty