Economy

ON LOW NATURAL GAS PRICES…

From the Frontier Centre for Public Policy

By Terry Etam

To say that “natural gas is a dying commodity” takes either some world-class mental dishonesty, disturbingly blind faith in policy over reality, or some kind of “clouds hate me” philosophical stance on life.

Is there any critical industrial material as bizarre as natural gas?

The stuff holds almost zero interest for the general public, for the same reason no one is interested in the sound of a washing machine. Both boring. Both ubiquitous. Natural gas isn’t even sold on Amazon. But forty-six percent of American homes use natural gas for heat, and surely more in Canada.

But consider the storm below the surface. Traders love it, because it is one of the most volatile commodities in existence, and volatility means trading profits. The volatility, at the slightest provocation, is almost unbelievable at times. The weather pattern shifts for three weeks out over a portion of the US and boom – the entire forward 18 months of prices can collapse or soar.

In the bigger picture though, natural gas today in North America trades at close to the same price it did a quarter century ago – not inflation adjusted, just the same old nominal dollar value, which is astonishing since global gas demand has increased by 60 percent in that time.

Natural gas is a critical fuel for much of the world, and usage is growing, particularly the relatively new field of LNG. According to the Global Gas Infrastructure Tracker website, which doesn’t even like the stuff, there are a total of 2,449 significant pipeline projects underway in the world for a total of 1.2 million kilometers (and that’s the big pipe, not the little straws that go to your house). There are 238 LNG import terminals and 189 export trains in development globally. One hundred and thirty countries either have natural gas systems or are constructing them.

Traders, consumers and businesses love the stuff even if they don’t say it often enough, while others loathe it because it is a ‘fossil fuel’. Natural gas is caught in an existential war whereby said opponents will do everything in their power to just make it go away (they really think they can). The Toronto Globe and Mail, “Canada’s news paper” (note to self: develop ethnocentric balloon head emoji, make millions), recently ran a pricelessly ludicrous opinion piece entitled ‘Natural gas is a dying commodity, and Canada needs to stop supporting it’. The article was written by one of those think tanks (International Institute for Sustainable Development) that produces nothing but ideological amplification, safely distanced from people that actually do stuff, and a mountain of impressive T4 income tax slips (latest fiscal year personnel/consultant expense: $33 million). There is no surprise that their team of political scientists would attack natural gas; their latest financials show that the Government of Canada granted them $40 million, a third of which is from climate activist/federal minister Guilbeault’s office. There’ll be no biting that little hand.

Many climate leadership icons of the world, the US, Canada, Western Europe, Japan… pretty much anyone that can, is building natural gas (LNG or non) infrastructure as fast as they can. Germany, home to the world’s most advanced green energy demolition derby, built an LNG import terminal in an astounding 5 months. Many that want to import LNG but weren’t able to last year because Europe hoovered up every molecule on the market are simply doing what it takes to attain energy security, and that can mean, lord tunderin’, coal. Pakistan is the most notable example – the country plans to quadruple coal fired power output and move away from gas only because it could not obtain it: “A shortage of natural gas, which accounts for over a third of the country’s power output, plunged large areas into hours of darkness last year.” The country’s energy minister went on, “We have some of the world’s most efficient regasified LNG-based power plants. But we don’t have the gas to run them.”

For those fortunate enough to line up LNG supplies, the ante is normally a 15-20 year contract.

To say that “natural gas is a dying commodity” takes either some world-class mental dishonesty, disturbingly blind faith in policy over reality, or some kind of “clouds hate me” philosophical stance on life.

Beyond the silly messaging looking to undermine natural gas though are some very powerful undercurrents that are shaping the world in ways most don’t consider, but they should.

Thanks to the shale revolution in the US and Canada, native natural gas production exploded onto a scene that couldn’t handle the excess, leading to persistently low prices. North America is turning into an LNG export powerhouse, but until that export capacity outpaces productive capability, natural gas prices in North America look set to remain far below global prices.

It is worth remembering how significant this scenario is for North America. Cheap natural gas is an industrial godsend, enabling many strata of industries and enterprises that simply would not exist without. In May of 2022, the head of the Western Equipment Dealers Association, said that the previous winter’s high natural gas prices were unsustainable for businesses that had to heat 30-40,000 square-foot shops. The 2021-22 winter of which he was discontented saw Henry Hub prices average $4.56/mmbtu – about a third of global prices, and a fraction of what the world was to face later that year.

The same article pointed out how the Industrial Energy Consumers of America, a trade group whose members include smelters, plastics and paper-goods makers, wanted the US to stop permitting new LNG export terminals because “The manufacturing sector cannot invest and create jobs without assurances that our natural gas and electricity prices will not be imperiled by excessive LNG exports.”

Those guys aren’t crazy. The US gas market is balanced on a knife edge. A change in next month’s forecast can create havoc in forward prices even up to several years out.

The rise of LNG is making things even more unstable. The Freeport LNG terminal had an 8 month outage due to an accident, removing 2 bcf/d of demand from the market (in a 100 bcf/d market); this single event caused a storage surplus in the US that has depressed natural gas prices ever since. All else being equal, the US natural gas storage scene would be in a deficit to the five year average as opposed to today’s surplus if Freeport had not gone down, and both spot and futures prices would most likely be significantly higher. The Freeport outage probably knocked US natural gas prices down by at least $1/mmbtu for a period of 8 months, and actually probably much more. But even at that level, in a 100 bcf/d market, where 1 bcf is equal to 1 million mmbtus, the cost savings to US consumers totaled $100 million per day. (Of course, had the price stayed higher, we might have seen far more drilling, which may have caused a collapse as well, just a bit further down the road.)

That $100 million per day cost saving came out of the hide of North American natural gas producers selling into that market, and you’d think they wouldn’t like that one little bit. And they don’t. But gas producers have their own realities and game plans which don’t generally involve sacrificing any of their sales for the good of all other producers, as economically sensible as that strategy may be.

US producers find themselves in an odd situation. Every one of the large producers knows that they could cut production by 5 percent and double their profits; the market is that tightly balanced. Doing so would single handedly drive up NG prices substantially – just observe how the gas market goes ape over a change in weather forecast.

But driving up prices, even if it is in their own self interest, will mean a spike in production, because at sustained $4 US gas, the market becomes flooded. EQT president Toby Rice, the largest US gas producer (EQT, not Toby), says at a sustained $4/mmbtu natural gas price, the US could export 60 bcf/d of natural gas. Keep in mind that $4 gas is a fraction, anywhere from a third to ten percent of global LNG prices.

Mr. Rice may very well be correct, but glosses over the reality of natural gas prices: we will never see a sensible sustained price like $4, even though we may average it – we will see 2 and 8 and 3 and 9 and so on and so on.

On top of this, solution gas from oil plays like Permian is providing massive amounts of gas in itself. The Permian, primarily an oil field, produces more solution gas than the entire country of Canada. Permian solution gas, if a stand alone country, would be one of the world’s top five largest producers.

So who cares? Well, you all do. We all do. The goofballs that wrote the Globe & Mail article do, though they either won’t admit it or simply refuse to understand.

Natural gas is the bedrock of most economies, and cheap natural gas is a special elixir to North America. It is absolutely crucial to the level of industrial activity we enjoy. There is no substitute for the clean burning capability of the stuff. Wander into a typical big box store or more crucially try to wander into an industrial building that you won’t be allowed to because it is unsafe… drive around an industrial park and look at all the magnificent industrial activity that gives us the life we live. Now imagine those being heated by wood stoves. Or solar panels in dead of winter. Geothermal? Sure, if you plan on drilling into the earth’s mantle. And if you live on an appropriate acreage. And have enough money. I guess there’s always coal.

And that sums up a lot of the world’s population’s situation: If countries aren’t building LNG, it’s likely because they are building coal, as in the countries that Europe outbid for LNG last winter in a shocking me-first display of hydrocarbon-swilling (accompanied by fossil-fuel-subsidizing self-loathing?) hypocrisy.

There are storm clouds on the horizon. The drilling efficiency that these companies boast about relentlessly in IR presentations and every 90 days in conference calls consists to a large degree on drilling longer horizontal wells. Do the math on that one. Reservoirs are finite in size. If you increase the length of wells by another mile or two, you’re just draining the reservoir faster. One day we will see true sweet spot exhaustion, which is not a laughing matter when one considers that three fields – Appalachia, Haynesville and Permian – account for more than 70 percent of US gas production, and about a fifth of global production.

But for now, North America reigns supreme with respect to the world’s most coveted heating and industrial fuel. The US, Canada and Mexico remain more or less isolated from global natural gas prices for now, which brings incalculable benefits to North American businesses and citizens, a benefit that shouldn’t be taken for granted.

Terry Etam is a columnist with the BOE Report, a leading energy industry newsletter based in Calgary. He is the author of The End of Fossil Fuel Insanity. You can watch his Policy on the Frontier session from May 5, 2022 here.

Business

Ottawa foresees a future of despair for Canadians. And shrugs

This article supplied by Troy Media.

By Lee Harding

By Lee Harding

A government report envisions Canadians foraging for food by 2040. Ottawa offers no solutions, just management of national decline

An obscure but disturbing federal report suggests Canadians could be foraging for food on public lands by 2040.

Policy Horizons Canada released the dire forecast on Jan. 7, 2025, in a report entitled Future Lives: Social Mobility in Question. It went largely unnoticed at the time, but its contents remain deeply concerning and worth closer examination.

Policy Horizons Canada is a little-known federal think-tank within the public service that produces long-term strategic foresight to guide government decision-making. Though not a household name, its projections can quietly shape policies at the highest levels. It describes itself as the government’s “centre of excellence in foresight,” designed to “empower the Government of Canada with a future-oriented mindset and outlook to strengthen decision making.” Its current head is Kristel Van der Elst, former head of strategic foresight at the World Economic Forum.

The report warns that the “powerful promise” that anyone can get an education, work hard, buy property and climb the social and economic ladder is slipping away. Instead of a temporary setback, the authors argue, downward mobility could become the norm. They liken Canada’s future to a board game with “more snakes than ladders.”

“In 2040, upward social mobility is almost unheard of in Canada,” the report states. “Hardly anyone believes that they can build a better life for themselves, or their children, through their own efforts. However, many worry about sliding down the social order.”

While these scenarios aren’t firm predictions, foresight reports like this are intended to outline plausible futures. The fact that federal bureaucrats see this as realistic is revealing—and troubling.

Post-secondary education, the report suggests, will lose its appeal. Rising costs, slow adaptation to labour market needs, long program durations and poor job prospects will push many away. It predicts that people will attend university more to join the “elite” than to find employment.

Home ownership will be out of reach for most, and inequality between those who own property and those who don’t will drive “social, economic, and political conflict.” Inheritance becomes the only reliable path to prosperity, while a new aristocracy begins to look down on the rest.

The gap between what youth are told to want and what they can realistically expect will widen, fuelling frustration and apathy. As automation and artificial intelligence expand, many traditional white-collar jobs will be replaced by machines or software. “Most people (will) rely on gig work and side hustles to meet their basic needs,” the report warns.

This leads to one of the darkest predictions: “People may start to hunt, fish, and forage on public lands and waterways without reference to regulations. Small scale agriculture could increase.”

The authors don’t propose solutions. Instead, they ask: “What actions could be taken now to maximize opportunities and lessen the challenges related to reduced and/or downward social mobility in the future?”

That question should concern us. Policymakers aren’t being asked how to prevent the collapse of social and economic mobility but how to manage its

fallout. Are those envisioning Canada’s future more interested in engineering a controlled implosion than fostering hope and opportunity?

Yes, artificial intelligence will bring challenges and change. But there is no excuse for despair in a country as rich in natural resources as Canada. Besides, the 2021 income data used in the report predates even the release of the first version of ChatGPT.

If policymakers are serious about restoring upward mobility, they must prioritize Canada’s resource economy. Ports, pipelines, oil and gas development, and mining are essential infrastructure for prosperity. When these sectors are strangled by overregulation, investment dries up—and so do jobs. The oil patch remains one of the fastest paths from poverty to wealth. Entry-level jobs in the field require training and safety courses, not four-year degrees.

Similarly, post-secondary education doesn’t need to be as expensive or time consuming as it is now. We should return to models where nurses could earn certification in two years instead of being funnelled into extended university programs. And if governments required universities to wind down defined benefit pension plans, tuition would fall fast.

Unfortunately, there’s a real risk that policymakers will use reports like this to justify more wealth-killing socialism. A home equity tax, for example, might be pitched to avoid future tensions between renters and homeowners. Such a tax would require Canadians to pay an annual levy based on the increased value of their home even if they haven’t sold it. These policies don’t build wealth—they punish it, offering temporary relief in place of lasting progress.

Unless we choose a more sensible path, the controlled demolition of Canada will continue.

Lee Harding is a research fellow for the Frontier Centre for Public Policy.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

Economy

Canada’s Energy Wealth Is Bleeding South

From the Frontier Centre for Public Policy

Without infrastructure, Canada is losing billions while the U.S. cashes in on our oil and gas

Canada’s energy wealth is stuck in traffic, and our American neighbours are cashing in. It’s worse than that. Canada is bleeding millions of dollars daily because it lacks the infrastructure to export its natural resources efficiently.

While our oil and gas continue to flow—mainly to the United States—provinces like Alberta and British Columbia are forced to sell at steep discounts. This isn’t just an economic inefficiency; it’s a structural failure of national policy. The beneficiaries? American businesses and their governments which pocket the profits and tax revenues that should be circulating through the Canadian economy. This is no way to achieve economic sovereignty for Canada.

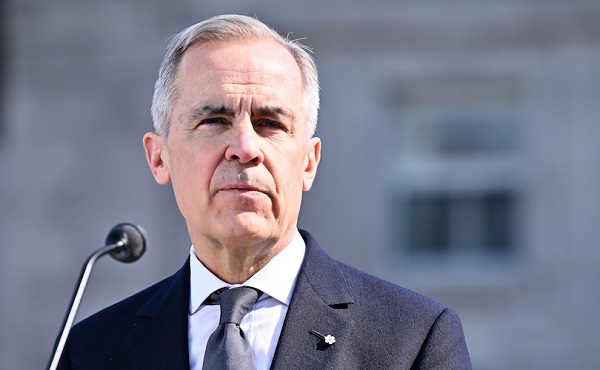

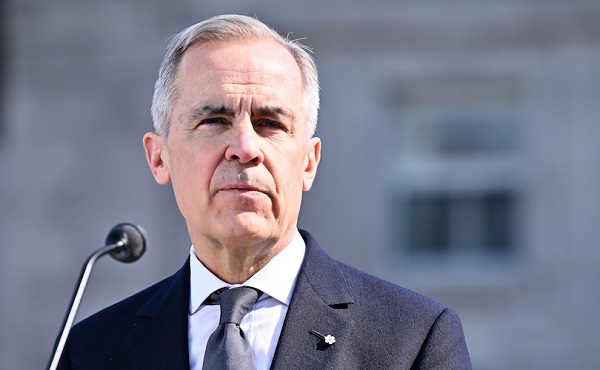

With U.S. interests reaping the rewards, this should have been a central talking point when Prime Minister Carney met with President Trump earlier this month.

Ottawa often offers the recent completion of the Trans Mountain Expansion (TMX) pipeline as an example of federal support for the energy sector. But such claims are misleading. Kinder Morgan, a private enterprise, had initially planned to build the extension without a penny from taxpayers. It withdrew only after being crippled by federal regulatory delays and political uncertainty.

Ottawa stepped in not as a benevolent saviour to help Albertans, but to prevent lawsuits and save face—ultimately overpaying for the pipeline and watching construction costs balloon to nearly six times the original estimate.

To now declare this bungled project a “gift” to Alberta, as a recent op-ed in the Toronto Star did, is not only tone-deaf: it’s an insult. It ignores the fact that Alberta’s taxpayers helped finance the very project Ottawa botched. It also reveals an astonishing lack of understanding of the historical, economic and political dynamics at play between Ottawa and Western Canada.

The tragedy is that TMX, despite its importance, is insufficient. Our infrastructure bottlenecks remain. With each passing day, Canada forfeits wealth that could fund essential improvements in health care, education and national defence.

According to the Frontier Centre for Public Policy, which has developed a real-time tracker to monitor these losses, the price differential between what we could earn on global markets versus what we settle for domestically adds up to $26.5 billion annually.

Ottawa’s reluctance to greenlight new infrastructure is a primary cause of this problem. Ironically, the losses from this reluctance in a single year would be enough to pay for another TMX, mismanaged or not. The solution lies in a national commitment to building utility corridors: designated routes that facilitate the movement of energy, goods and services unhindered across provincial boundaries.

Carney’s recent promise to remove all interprovincial trade barriers by July 1 is a nice soundbite. But unless it includes meaningful infrastructure commitments, it is bound to fail like every other rhetorical flourish before it.

Canadians should be rightly skeptical. After all, what Ottawa has failed to achieve in the 157 years since Confederation is unlikely to be accomplished in the next 60 days.

The political math doesn’t help either. The Bloc Québécois holds the balance of power in the 45th Parliament, and its obstructionist stance on national pipeline development ensures the advent of more gridlock, not less. The federal government continues to uphold Bill C-69—dubbed the “no-pipelines bill”—further entrenching the status quo.

Meanwhile, Canada remains in the absurd position of relying on U.S. infrastructure to transport oil from the West to Ontario and Quebec. This undermines our economic independence, energy security and national sovereignty. No amount of “elbows up” will correct this enormous gap.

If the prime minister is serious about transforming Canada’s economic landscape and making the country strong, he must bypass the Bloc by cooperating with the Official Opposition. A grand bargain focused on utility corridors, interprovincial infrastructure and national trade efficiency would serve Alberta, Saskatchewan, and every Canadian who depends on a strong and self-reliant economy.

The stakes are high. We need a more productive country to face challenges within Canada and from abroad. Billions in lost revenue could fund new hospitals, more schools and better military readiness.

Instead, along with the limited exports of oil and gas, we’re exporting great opportunities to middlemen—and greater economic strength—south of the border.

The path forward is clear. A strong, self-reliant Canada needs infrastructure. It needs corridors. It needs leadership.

Marco Navarro-Genie is the vice president of research at the Frontier Centre for Public Policy. He is coauthor, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

-

Daily Caller2 days ago

Daily Caller2 days agoMisguided Climate Policies Create ‘Real Energy Emergency’ And Permit China To Dominate US

-

Business2 days ago

Business2 days agoAfter successful anti-American election campaign, Carney pivots to embrace US: Hails Trump as a “transformational president”

-

Alberta2 days ago

Alberta2 days agoBonnyville RCMP targeted by suspect driving a trackhoe – Update

-

Business2 days ago

Business2 days agoReality check—Canadians are not getting an income tax cut

-

COVID-191 day ago

COVID-191 day agoStudy finds nearly half of ‘COVID deaths’ had no link to virus

-

Alberta1 day ago

Alberta1 day agoEnergy projects occupy less than three per cent of Alberta’s oil sands region, report says

-

Alberta1 day ago

Alberta1 day agoCharges laid in record cocaine seizure

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCarney says Liberals won’t make voting pact with NDP