Uncategorized

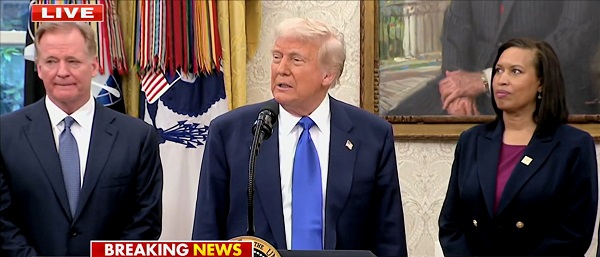

Officials say Trump overstated Kim’s demand on sanctions

HANOI, Vietnam — President Donald Trump said he walked away from his second summit with North Korean leader Kim Jong Un because Kim demanded the U.S. lift all of its sanctions, a claim that North Korea’s delegation called a rare news conference in the middle of the night to deny.

So who’s telling the truth? In this case, it seems that the North Koreans are. And it’s a demand they have been pushing for weeks in lower-level talks.

Trump’s much-anticipated meeting with Kim, held in the Vietnamese capital Wednesday and Thursday, ended abruptly and without the two leaders signing any agreements. Trump spoke with reporters soon after the talks broke down and said the dispute over sanctions was the deal breaker.

“Basically, they wanted the sanctions lifted in their entirety, and we couldn’t do that,” he said. “We had to walk away from that.”

Hours later, two senior members of the North’s delegation told reporters that was not what Kim had demanded. They insisted Kim had asked only for partial sanctions relief in exchange for shutting down the North’s main nuclear complex. Foreign Minister Ri Yong Ho said the North was also ready to offer in writing a permanent halt of the country’s nuclear and intercontinental ballistic missile tests.

Vice Foreign Minister Choe Sun Hui said Trump’s reaction puzzled Kim and added that Kim “may have lost his will (to continue) North Korea-U.S. dealings.”

The State Department then clarified the U.S. position.

According to a senior official who briefed the media on condition he not be named because he was not authorized to discuss the negotiations publicly, the North Koreans “basically asked for the lifting of all sanctions.”

But he acknowledged the North’s demand was only for Washington to back the lifting of United Nations Security Council sanctions imposed since March 2016 and didn’t include the other resolutions going back a decade more.

What Pyongyang was seeking, he said, was the lifting of sanctions that impede the civilian economy and the people’s livelihood — as Ri had claimed.

The U.N. Security Council has imposed nearly a dozen resolutions targeting North Korea, making it one of the most heavily sanctioned countries in the world. So Kim was indeed seeking a lot of relief — including the lifting of bans on everything from trade in metals, raw materials, luxury goods, seafood, coal exports, refined petroleum imports, raw petroleum imports.

But Kim wasn’t looking for the lifting of sanctions on armaments. Those were imposed earlier, from 2006, when the North conducted its first nuclear test.

For Pyongyang, that’s a key difference.

While it claims that its nuclear weapons are needed for self-

The State Department official said Trump and his negotiators deemed that to be a bridge too far because they had already determined that lifting the post-2016 sanctions would be worth “many, many billions of dollars” for the North and could essentially be used to fund their continued nuclear and missile programs.

So it was definitely a robust demand. But it wasn’t, as Trump claimed, all the sanctions.

It also didn’t come as a surprise. He said the North had been pushing that demand for weeks in lower-level talks.

Even so, both sides seemed determined to put a good face on the summit, which Trump said was generally friendly and constructive.

In a much softer tone than the officials at the late-night news conference, the North’s state-run media made no mention of Trump’s decision to walk away without any agreements and indicated that the North was looking ahead to more talks.

“The top leaders of the two countries appreciated that the second meeting in Hanoi offered an important occasion for deepening mutual respect and trust and putting the relations between the two countries on a new stage,” it said. “They agreed to keep in close touch with each other for the denuclearization of the Korean Peninsula and the epochal development of the DPRK-U.S. relations in the future.”

It said Kim expressed his thanks to Trump for making positive efforts for the successful meeting and talks “while making a long journey and said goodbye, promising the next meeting.”

___

Talmadge is the AP’s Pyongyang bureau chief. Follow him on Twitter and Instagram: @EricTalmadge

___

Follow all of AP’s summit coverage: https://apnews.com/Trump-KimSummit

Eric Talmadge, The Associated Press

Uncategorized

CNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

From the Daily Caller News Foundation

As the Trump administration and Republican-controlled Congress move aggressively to roll back the climate alarm-driven energy policies of the Biden presidency, proponents of climate change theory have ramped up their scare tactics in hopes of shifting public opinion in their favor.

But CNN’s energetic polling analyst, the irrepressible Harry Enten, says those tactics aren’t working. Indeed, Enten points out the climate alarm messaging which has permeated every nook and cranny of American society for at least 25 years now has failed to move the public opinion needle even a smidgen since 2000.

Appearing on the cable channel’s “CNN News Central” program with host John Berman Thursday, Enten cited polling data showing that just 40% of U.S. citizens are “afraid” of climate change. That is the same percentage who gave a similar answer in 2000.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Enten’s own report is an example of this fealty. Saying the findings “kind of boggles the mind,” Enten emphasized the fact that, despite all the media hysteria that takes place in the wake of any weather disaster or wildfire, an even lower percentage of Americans are concerned such events might impact them personally.

“In 2006, it was 38%,” Enten says of the percentage who are even “sometimes worried” about being hit by a natural disaster, and adds, “Look at where we are now in 2025. It’s 32%, 38% to 32%. The number’s actually gone down.”

In terms of all adults who worry that a major disaster might hit their own hometown, Enten notes that just 17% admit to such a concern. Even among Democrats, whose party has been the major proponent of climate alarm theory in the U.S., the percentage is a paltry 27%.

While Enten and Berman both appear to be shocked by these findings, they really aren’t surprising. Enten himself notes that climate concerns have never been a driving issue in electoral politics in his conclusion, when Berman points out, “People might think it’s an issue, but clearly not a driving issue when people go to the polls.”

“That’s exactly right,” Enten says, adding, “They may worry about in the abstract, but when it comes to their own lives, they don’t worry.”

This reality of public opinion is a major reason why President Donald Trump and his key cabinet officials have felt free to mount their aggressive push to end any remaining notion that a government-subsidized ‘energy transition’ from oil, gas, and coal to renewables and electric vehicles is happening in the U.S. It is also a big reason why congressional Republicans included language in the One Big Beautiful Bill Act to phase out subsidies for those alternative energy technologies.

It is key to understand that the administration’s reprioritization of energy and climate policies goes well beyond just rolling back the Biden policies. EPA Administrator Lee Zeldin is working on plans to revoke the 2010 endangerment finding related to greenhouse gases which served as the foundation for most of the Obama climate agenda as well.

If that plan can survive the inevitable court challenges, then Trump’s ambitions will only accelerate. Last year’s elimination of the Chevron Deference by the Supreme Court increases the chances of that happening. Ultimately, by the end of 2028, it will be almost as if the Obama and Biden presidencies never happened.

The reality here is that, with such a low percentage of voters expressing concerns about any of this, Trump and congressional Republicans will pay little or no political price for moving in this direction. Thus, unless the polls change radically, the policy direction will remain the same.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Uncategorized

Kananaskis G7 meeting the right setting for U.S. and Canada to reassert energy ties

Energy security, resilience and affordability have long been protected by a continentally integrated energy sector.

The G7 summit in Kananaskis, Alberta, offers a key platform to reassert how North American energy cooperation has made the U.S. and Canada stronger, according to a joint statement from The Heritage Foundation, the foremost American conservative think tank, and MEI, a pan-Canadian research and educational policy organization.

“Energy cooperation between Canada, Mexico and the United States is vital for the Western World’s energy security,” says Diana Furchtgott-Roth, director of the Center for Energy, Climate and Environment and the Herbert and Joyce Morgan Fellow at the Heritage Foundation, and one of America’s most prominent energy experts. “Both President Trump and Prime Minister Carney share energy as a key priority for their respective administrations.

She added, “The G7 should embrace energy abundance by cooperating and committing to a rapid expansion of energy infrastructure. Members should commit to streamlined permitting, including a one-stop shop permitting and environmental review process, to unleash the capital investment necessary to make energy abundance a reality.”

North America’s energy industry is continentally integrated, benefitting from a blend of U.S. light crude oil and Mexican and Canadian heavy crude oil that keeps the continent’s refineries running smoothly.

Each day, Canada exports 2.8 million barrels of oil to the United States.

These get refined into gasoline, diesel and other higher value-added products that furnish the U.S. market with reliable and affordable energy, as well as exported to other countries, including some 780,000 barrels per day of finished products that get exported to Canada and 1.08 million barrels per day to Mexico.

A similar situation occurs with natural gas, where Canada ships 8.7 billion cubic feet of natural gas per day to the United States through a continental network of pipelines.

This gets consumed by U.S. households, as well as transformed into liquefied natural gas products, of which the United States exports 11.5 billion cubic feet per day, mostly from ports in Louisiana, Texas and Maryland.

“The abundance and complementarity of Canada and the United States’ energy resources have made both nations more prosperous and more secure in their supply,” says Daniel Dufort, president and CEO of the MEI. “Both countries stand to reduce dependence on Chinese and Russian energy by expanding their pipeline networks – the United States to the East and Canada to the West – to supply their European and Asian allies in an increasingly turbulent world.”

Under this scenario, Europe would buy more high-value light oil from the U.S., whose domestic needs would be back-stopped by lower-priced heavy oil imports from Canada, whereas Asia would consume more LNG from Canada, diminishing China and Russia’s economic and strategic leverage over it.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

As the nation’s largest, most broadly supported conservative research and educational institution, The Heritage Foundation has been leading the American conservative movement since our founding in 1973. The Heritage Foundation reaches more than 10 million members, advocates, and concerned Americans every day with information on critical issues facing America.

-

illegal immigration2 days ago

illegal immigration2 days agoICE raids California pot farm, uncovers illegal aliens and child labor

-

Uncategorized14 hours ago

Uncategorized14 hours agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

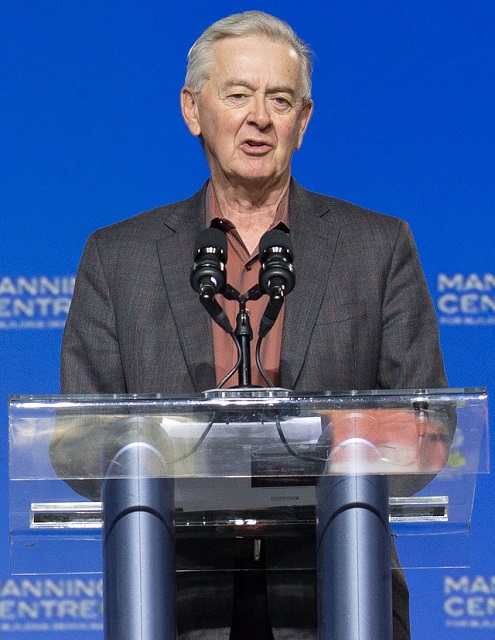

Opinion7 hours ago

Opinion7 hours agoPreston Manning: Three Wise Men from the East, Again

-

Addictions6 hours ago

Addictions6 hours agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Business4 hours ago

Business4 hours agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Business1 day ago

Business1 day agoTrump to impose 30% tariff on EU, Mexico

-

Energy1 day ago

Energy1 day agoLNG Export Marks Beginning Of Canadian Energy Independence

-

Business1 day ago

Business1 day agoCarney government should apply lessons from 1990s in spending review