Uncategorized

NZ leader vows to deny accused mosque gunman notoriety

CHRISTCHURCH, New Zealand — New Zealand’s prime minister declared Tuesday she would do everything in her power to deny the accused mosque gunman a platform for elevating his white supremacist views, after the man dismissed his lawyer and opted to represent himself at his trial in the killings of 50 people.

“I agree that it is absolutely something that we need to acknowledge, and do what we can to prevent the notoriety that this individual seeks,” Prime Minister Jacinda Ardern told reporters. “He obviously had a range of reasons for committing this atrocious terrorist attack. Lifting his profile was one of them. And that’s something that we can absolutely deny him.”

She demurred about whether she wanted the trial to occur behind closed doors, saying that was not her decision to make.

“One thing I can assure you — you won’t hear me speak his name,” she said.

Later, in a passionate speech to Parliament, she urged the public to follow her lead and to avoid giving the gunman the fame he so obviously craves.

“I implore you: Speak the names of those who were lost, rather than the name of the man who took them,” she said. “He may have sought notoriety, but we in New Zealand will give him nothing, not even his name.”

The shooter’s desire for attention was made clear in a manifesto sent to Ardern’s office and others before Friday’s massacre and by his livestreamed footage of his attack on the Al Noor mosque.

The video prompted widespread revulsion and condemnation. Facebook said it removed 1.5 million versions of the video during the first 24 hours, but Ardern expressed frustration that the footage remained online, four days later.

“We have been in contact with Facebook; they have given us updates on their efforts to have it removed, but as I say, it’s our view that it cannot — should not — be distributed, available, able to be viewed,” she said. “It is horrendous and while they’ve given us those assurances, ultimately the responsibility does sit with them.”

Arden said she had received “some communication” from Facebook’s Chief Operating Officer Sheryl Sandberg on the issue. The prime minister has also spoken with British Prime Minister Theresa May about the importance of a global effort to clamp down on the distribution of such material.

Australian Prime Minister Scott Morrison also urged world leaders to crack down on social media companies that broadcast terrorist attacks. Morrison said he had written to G-20 chairman Japanese Prime Minister Shinzo Abe calling for agreement on “clear consequences” for companies whose platforms are used to facilitate and normalize horrific acts.

Lawyer Richard Peters, who was assigned to represent Brenton Harrison Tarrant at his initial court appearance on Saturday, told the New Zealand Herald that Tarrant dismissed him that day.

A judge ordered Tarrant to return to New Zealand’s High Court on April 5 for his next hearing on one count of murder, though he is expected to face additional charges. The 28-year-old Australian is being held in isolation in a Christchurch jail.

“He seemed quite clear and lucid, whereas this may seem like very irrational

Peters did not return a call from The Associated Press on Tuesday.

Peters told the paper that Tarrant didn’t tell him why he wanted to represent himself. He said a judge could order a lawyer to assist Tarrant at a trial, but that Tarrant would likely be unsuccessful in trying to use it as a platform to put forward any extremist views.

Under New Zealand law, a trial is “to determine innocence or guilt,” Peters said. “The court is not going to be very sympathetic to him if he wants to use the trial to express his own views.”

Ardern previously has said her Cabinet had agreed in principle on tightening gun restrictions in New Zealand and those reforms would be announced next week. She also had announced an inquiry into the intelligence and security services’ failures to detect the risk from the attacker or his plans. There have been concerns intelligence agencies were overly focused on the Muslim community in detecting and preventing security risks.

New Zealand’s international spy agency, the Government Communications Security Bureau, confirmed it had not received any relevant information or intelligence ahead of the shootings.

In Parliament on Tuesday, Ardern said there are justified questions and anger about how the attack could have happened in a place that prides itself on being open, peaceful and diverse.

“There are many questions that need to be answered and the assurance that I give you is that they will be,” she said. “We will examine what we did know, could have known or should have known. We cannot allow this to happen again.”

Meanwhile, Christchurch was beginning to return to a semblance of normalcy Tuesday. Streets near the hospital that had been closed for four days reopened to traffic as relatives and friends of the victims continued to stream in from around the world.

Thirty people were still being treated at the Christchurch hospital, nine of them in critical condition, said David Meates, CEO of the Canterbury District Health Board. A 4-year-old girl was transferred to a hospital in Auckland and is in critical condition. Her father is at the same hospital in stable condition.

Relatives of the dead were anxiously waiting for word on when they can bury their loved ones.

Police said they have completed autopsies on all 50 bodies and have formally identified 12 of them. Six of the identified victims have been returned to their families.

Islamic tradition calls for bodies to be cleansed and buried as soon as possible. Ardern has said authorities hope to release all the bodies by Wednesday.

Sheik Taj El-Din Hilaly, of Sydney,

Grieving residents of this close-knit city have created makeshift memorials near the mosques the killer targeted and at the botanical gardens, where a mountain of flowers has grown by the day.

Janna Ezat, whose son, Hussein Al-Umari, was killed in the Al Noor mosque, visited the memorial at the gardens and became overwhelmed by the outpouring of love.

She knelt amid the flowers and wept, grabbing at daisies and lilies as though she might find her boy in them.

Ezat is comforted by reports that Hussein confronted the killer, charging at him after surviving the first spray of bullets.

“I’m very happy. I’m wearing white. We normally wear black,” she said. “But he is a hero and I am proud of him.”

___

Associated Press writers Stephen Wright and Steve McMorran contributed to this report.

Kristen Gelineau And Juliet Williams, The Associated Press

Uncategorized

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

Uncategorized

New report warns WHO health rules erode Canada’s democracy and Charter rights

The Justice Centre for Constitutional Freedoms has released a new report titled Canada’s Surrender of Sovereignty: New WHO health regulations undermine Canadian democracy and Charter freedoms. Authored by Nigel Hannaford, a veteran journalist and researcher, the report warns that Canada’s acceptance of the World Health Organization’s (WHO) revised International Health Regulations (IHR) represents a serious erosion of national independence and democratic accountability.

The IHR amendments, which took effect on September 19, 2025, authorize the WHO Director-General to declare global “health emergencies” that could require Canada to follow directives from bureaucrats in Geneva, bypassing the House of Commons and the will of Canadian voters.

The WHO regards these regulations as “binding,” despite having no ability or legal authority to impose such regulations. Even so, Canada is opting to accept the regulations as binding.

By accepting the WHO’s revised IHR, the report explains, Canada has relinquished its own control over future health crises and instead has agreed to let the WHO determine when a “pandemic emergency” exists and what Canada must do to respond to it, after which Canada must report back to the WHO.

In fact, under these International Health Regulations, the WHO could demand countries like Canada impose stringent freedom-violating health policies, such as lockdowns, vaccine mandates, or travel restrictions without debate, evidence review, or public accountability, the report explains.

Once the WHO declares a “Pandemic Emergency,” member states are obligated to implement such emergency measures “without delay” for a minimum of three months.

Importantly, following these WHO directives would undermine government accountability as politicians may hide behind international “commitments” to justify their actions as “simply following international rules,” the report warns.

Canada should instead withdraw from the revised IHR, following the example of countries like Germany, Austria, Italy, Czech Republic, and the United States. The report recommends continued international cooperation without surrendering control over domestic health policies.

Constitutional lawyer Allison Pejovic said, “[b]y treating WHO edicts as binding, the federal government has effectively placed Canadian sovereignty on loan to an unelected international body.”

“Such directives, if enforced, would likely violate Canadians’ Charter rights and freedoms,” she added.

Mr. Hannaford agreed, saying, “Canada’s health policies must be made in Canada. No free and democratic nation should outsource its emergency powers to unelected bureaucrats in Geneva.”

The Justice Centre urges Canadians to contact their Members of Parliament and demand they support withdrawing from the revised IHR to restore Canadian sovereignty and reject blind compliance with WHO directives.

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoRichmond Mayor Warns Property Owners That The Cowichan Case Puts Their Titles At Risk

-

Business2 days ago

Business2 days agoSluggish homebuilding will have far-reaching effects on Canada’s economy

-

Business2 days ago

Business2 days agoMark Carney Seeks to Replace Fiscal Watchdog with Loyal Lapdog

-

International1 day ago

International1 day agoUS announces Operation Southern Spear, targeting narco-terrorists

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoEU’s “Democracy Shield” Centralizes Control Over Online Speech

-

Business2 days ago

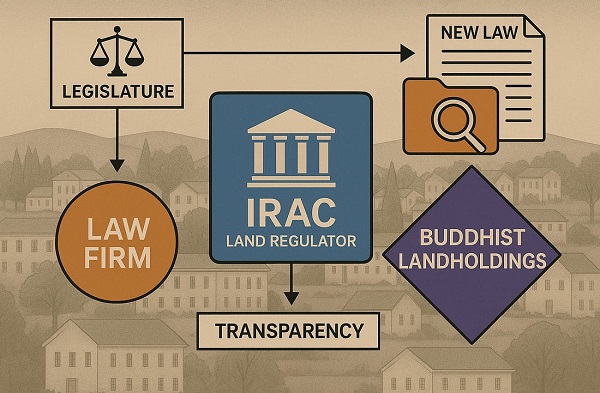

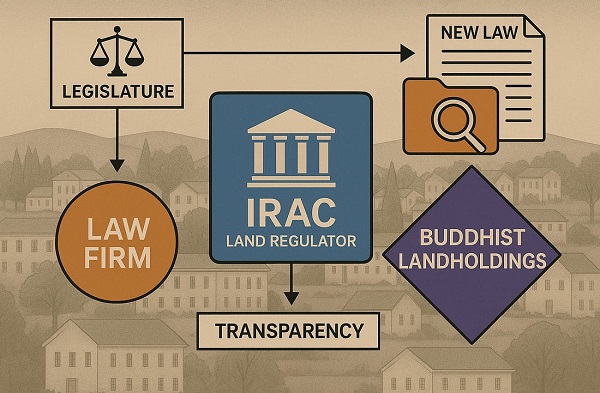

Business2 days agoP.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation

-

COVID-192 days ago

COVID-192 days agoMajor new studies link COVID shots to kidney disease, respiratory problems

-

Addictions13 hours ago

Addictions13 hours agoCanadian gov’t not stopping drug injection sites from being set up near schools, daycares