Business

North Carolina-headquartered Barings named in Climate Action 100+ probe

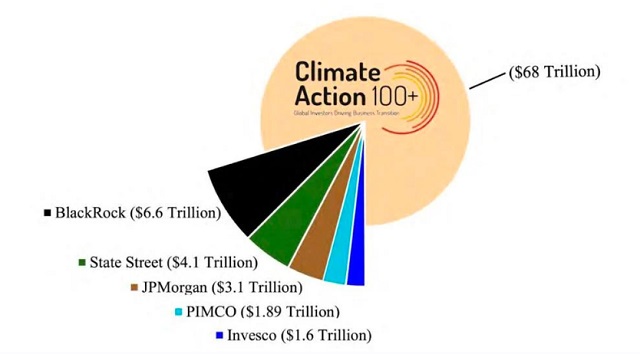

The Judiciary Committee of the U.S. House of Representatives, in a report, says its probe has led to a loss of $17 trillion worth of assets under management by the Climate Action 100+. That includes $6.6 trillion from BlackRock, $4.1 trillion by State Street, $3.1 trillion by JPMorgan, $1.89 trillion by PIMCO, and $1.6 trillion by Invesco.

From The Center Square

By Alan Wooten

An interim report by the Judiciary – Climate Control: Exposing the Decarbonization Collusion in Environmental, Social and Governance (ESG) Investing – labels the initiative a “climate cartel,” one which is involved in collusion and has not been investigated by the Biden administration.

One North Carolina company is among more than 130 in the United States being asked by a congressional committee about involvement with environmental, social and governance initiative Climate Action 100+.

U.S. Reps. Deborah Ross and Dan Bishop, a Democrat and Republican respectively from North Carolina, are among the 42 members of the Judiciary Committee in the House of Representatives seeking answers. In addition to the letter sent to Charlotte-headquartered Barings, the probe also seeks answers on involvement by retirement systems and government pension programs.

The probe and letters dated last Tuesday to Climate Action 100+ is trying to find answers to how the companies are operating with tactics, requests and actions; and garner documentations. A noon Aug. 13 deadline is set for responses.

Antitrust law, and the possible breach of it, is cited in each letter. Antitrust laws, the Department of Justice says, “prohibit anticompetitive conduct and mergers that deprive American consumers, taxpayers, and workers of the benefits of competition.”

An interim report by the Judiciary – Climate Control: Exposing the Decarbonization Collusion in Environmental, Social and Governance (ESG) Investing – labels the initiative a “climate cartel,” one which is involved in collusion and has not been investigated by the Biden administration.

“The climate cartel has declared war on our way of life, escalating its attacks on free markets and demanding that companies slash output of the critical products and services that allow Americans to drive, fly, and eat,” the report says. “The Biden administration has failed to act upon the climate cartel’s apparent violations of longstanding U.S. antitrust law. The committee, in contrast, is actively investigating their anticompetitive behavior.”

The report says with launch of the probe came withdrawals from the effort by BlackRock, State Street and JPAM, “three of the world’s largest asset managers.” Asset managers BlackRock, State Street and Vanguard own 21.9% of shares, and vote 24.9% of the shares, within the Standard and Poor’s (S&P) 500.

More than 272,000 documents and 2.5 million pages of nonpublic information were reviewed, the Judiciary says.

Most of the letters went to addresses in New York, Massachusetts and California.

Barings, according to its website, “is a global asset management firm which seeks to deliver excess returns across public and private markets in fixed income, real assets and capital solutions.”

In general, ESG investing – an acronym used in conjunction with environmental, social, and governance policies in investments – measures company policy. These policies typically align with progressive, or left, thoughts when it comes to politics.

Other names of description are sustainability, such as treatment of natural resources, gas emissions and climate regulations. A company’s policies for profits shared in the community, and how health and safety are impacted, relates to the social aspect. Governance usually aligns not only with integrity of accountability toward shareholders, but also diversity in leadership.

Issues in a company’s industry and the principles of ESG often shape policy.

Bishop is a member of the Subcommittee on the Administrative State, Regulatory Reform, and Antitrust within the Judiciary Committee. The 26-member subcommittee is chaired by Rep. Thomas Massie, R-Ky.

Managing Editor

Alberta

Pierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

From Pierre Poilievre

Business

Why it’s time to repeal the oil tanker ban on B.C.’s north coast

The Port of Prince Rupert on the north coast of British Columbia. Photo courtesy Prince Rupert Port Authority

From the Canadian Energy Centre

By Will Gibson

Moratorium does little to improve marine safety while sending the wrong message to energy investors

In 2019, Martha Hall Findlay, then-CEO of the Canada West Foundation, penned a strongly worded op-ed in the Globe and Mail calling the federal ban of oil tankers on B.C.’s northern coast “un-Canadian.”

Six years later, her opinion hasn’t changed.

“It was bad legislation and the government should get rid of it,” said Hall Findlay, now director of the University of Calgary’s School of Public Policy.

The moratorium, known as Bill C-48, banned vessels carrying more than 12,500 tonnes of oil from accessing northern B.C. ports.

Targeting products from one sector in one area does little to achieve the goal of overall improved marine transport safety, she said.

“There are risks associated with any kind of transportation with any goods, and not all of them are with oil tankers. All that singling out one part of one coast did was prevent more oil and gas from being produced that could be shipped off that coast,” she said.

Hall Findlay is a former Liberal MP who served as Suncor Energy’s chief sustainability officer before taking on her role at the University of Calgary.

She sees an opportunity to remove the tanker moratorium in light of changing attitudes about resource development across Canada and a new federal government that has publicly committed to delivering nation-building energy projects.

“There’s a greater recognition in large portions of the public across the country, not just Alberta and Saskatchewan, that Canada is too dependent on the United States as the only customer for our energy products,” she said.

“There are better alternatives to C-48, such as setting aside what are called Particularly Sensitive Sea Areas, which have been established in areas such as the Great Barrier Reef and the Galapagos Islands.”

The Business Council of British Columbia, which represents more than 200 companies, post-secondary institutions and industry associations, echoes Hall Findlay’s call for the tanker ban to be repealed.

“Comparable shipments face no such restrictions on the East Coast,” said Denise Mullen, the council’s director of environment, sustainability and Indigenous relations.

“This unfair treatment reinforces Canada’s over-reliance on the U.S. market, where Canadian oil is sold at a discount, by restricting access to Asia-Pacific markets.

“This results in billions in lost government revenues and reduced private investment at a time when our economy can least afford it.”

The ban on tanker traffic specifically in northern B.C. doesn’t make sense given Canada already has strong marine safety regulations in place, Mullen said.

Notably, completion of the Trans Mountain Pipeline expansion in 2024 also doubled marine spill response capacity on Canada’s West Coast. A $170 million investment added new equipment, personnel and response bases in the Salish Sea.

“The [C-48] moratorium adds little real protection while sending a damaging message to global investors,” she said.

“This undermines the confidence needed for long-term investment in critical trade-enabling infrastructure.”

Indigenous Resource Network executive director John Desjarlais senses there’s an openness to revisiting the issue for Indigenous communities.

“Sentiment has changed and evolved in the past six years,” he said.

“There are still concerns and trust that needs to be built. But there’s also a recognition that in addition to environmental impacts, [there are] consequences of not doing it in terms of an economic impact as well as the cascading socio-economic impacts.”

The ban effectively killed the proposed $16-billion Eagle Spirit project, an Indigenous-led pipeline that would have shipped oil from northern Alberta to a tidewater export terminal at Prince Rupert, B.C.

“When you have Indigenous participants who want to advance these projects, the moratorium needs to be revisited,” Desjarlais said.

He notes that in the six years since the tanker ban went into effect, there are growing partnerships between B.C. First Nations and the energy industry, including the Haisla Nation’s Cedar LNG project and the Nisga’a Nation’s Ksi Lisims LNG project.

This has deepened the trust that projects can mitigate risks while providing economic reconciliation and benefits to communities, Dejarlais said.

“Industry has come leaps and bounds in terms of working with First Nations,” he said.

“They are treating the rights of the communities they work with appropriately in terms of project risk and returns.”

Hall Findlay is cautiously optimistic that the tanker ban will be replaced by more appropriate legislation.

“I’m hoping that we see the revival of a federal government that brings pragmatism to governing the country,” she said.

“Repealing C-48 would be a sign of that happening.”

-

Crime2 days ago

Crime2 days agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Health2 days ago

Health2 days agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Business1 day ago

Business1 day agoElon Musk slams Trump’s ‘Big Beautiful Bill,’ calls for new political party

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoGlobal media alliance colluded with foreign nations to crush free speech in America: House report

-

International21 hours ago

International21 hours agoCBS settles with Trump over doctored 60 Minutes Harris interview

-

Business13 hours ago

Business13 hours agoLatest shakedown attempt by Canada Post underscores need for privatization

-

Business13 hours ago

Business13 hours agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

Crime10 hours ago

Crime10 hours agoBryan Kohberger avoids death penalty in brutal killing of four Idaho students